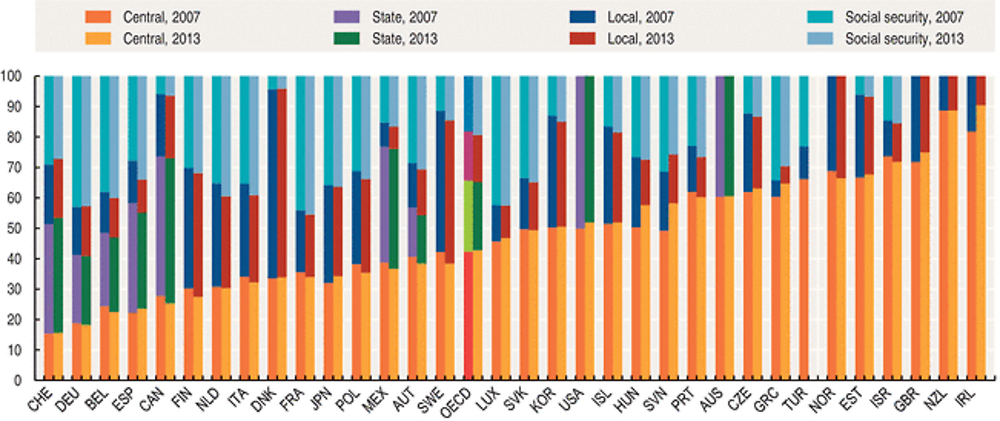

Expenditures across levels of government

The responsibility for the provision of public goods and services and redistribution of income is divided between different levels of government. In some countries, local and regional governments play a larger role in delivering services, such as providing public housing or running schools. Data on the distribution of government spending by both level and function can provide an indication of the extent to which key government activities are decentralised to sub-national governments.

Definition

Data on government expenditures are derived from the OECD Annual National Accounts, which are based on the System of National Accounts (SNA), a set of internationally agreed concepts, definitions, classifications and rules for national accounting. The general government sector consists of central, state and local governments and the social security funds controlled by these units. Data on the distribution of general government expenditures across levels of government exclude transfers between levels of government and thus provide a rough proxy of the overall responsibility for providing goods and services borne by each level of government. For the central level of government, data on expenditures are shown here according to the Classification of the Functions of Government. Data on central government expenditures by function include transfers between the different levels of government.

Comparability

Data for Australia, Korea, Japan and Turkey on the distribution of general government expenditures across levels of government include transfers between levels of government. The state government category is only applicable to the nine OECD countries that are federal states: Australia, Austria, Belgium, Canada, Germany, Mexico, Spain (considered a quasi-federal country), Switzerland and the United States. Local government is included in state government for Australia and the United States.

Social security funds are included in central government in Ireland, New Zealand, Norway, the United Kingdom and the United States. Australia does not operate government social insurance schemes. The OECD average does not include Chile and Turkey for general government expenditures across levels of government and does not include Canada, Chile, Mexico, New Zealand and Turkey for central government expenditures by function. Data for Australia refer to 2012 rather than 2013 for government expenditures across levels of government and data for Iceland refer to 2012 rather than 2013 for central government expenditures by function.

Across the OECD, in 2013, 42.8% of general government expenditures were undertaken by central government. Sub-central governments (state and local) covered 37.8% and social security funds accounted for the remaining 19.4%. However, the level of fiscal decentralisation varies considerably across countries. In Ireland, for example, 90.4% of total expenditure is carried out by central government, representing an increase of 8.4 percentage points from 2007, by contrast, state and local governments in Belgium, Canada, Germany, Spain, Switzerland and Mexico (federal or quasi-federal states) account for a larger share of public expenditures than the central government.

In general, central governments spend a relatively larger proportion of their budgets on social protection (e.g. pensions and unemployment benefits), general public services (e.g. executive and legislative organs, public debt transactions) and defence than state and local governments. In half of OECD countries, expenditures on social protection represent the largest share of central government budgets. In Belgium and Spain, central governments allocate over 60% of their budgets to general public services.

Sources

-

OECD (2015), Government at a Glance, OECD Publishing.

Further information

Analytical publications

-

OECD (2013), Value for Money in Government, OECD Publishing.

Statistical publications

-

OECD (2015), National Accounts of OECD Countries, OECD Publishing.

-

OECD (2014), National Accounts at a Glance, OECD Publishing.

-

OECD (2014), Quarterly National Accounts, OECD Publishing.

Online databases

-

“General Government Accounts: Government expenditure by function”, OECD National Accounts Statistics.

-

“National Accounts at a Glance”, OECD National Accounts Statistics.

Websites

-

Government at a Glance (supplementary material), www.oecd.org/gov/govataglance.htm.