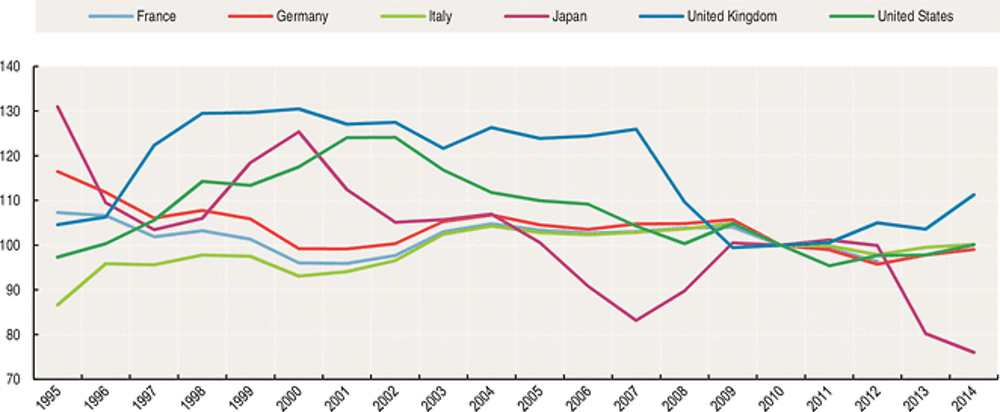

Real effective exchange rates

Effective exchange rates are a summary measure of the changes in the exchange rates of a country vis-à-vis its trading partners. They provide a broad interpretation of a country’s price competitiveness, which is, in turn, a major determinant of the success of different countries in raising exports and productivity, fostering innovation and improving living standards.

Definition

Nominal effective exchange rate indices are calculated by comparing, for each country, the change in its own exchange rate against the US dollar to a weighted average of changes in its competitors’ exchange rates, also against the US dollar. Changes in the competitor exchange rates are weighted using a matrix measuring the importance of bilateral trade flows in the current year.

The indicator of real effective exchange rates, i.e. relative consumer price indices, takes into account not only changes in market exchange rates but also variations in relative prices using consumer prices.

The change in a country’s relative consumer prices between two years is obtained by comparing the change in the country’s consumer price index converted into US dollars at market exchange rates to a weighted average of changes in its competitors’ consumer price indices, also expressed in US dollars. The weighted average of competitors’ prices is based on a matrix for the current year expressing the importance of bilateral trade.

Comparability

The index is constructed using a common procedure that assures a high degree of comparability both across countries and over time.

A rise in the index represents a deterioration in that country’s competitiveness. Real effective exchange rates are a major short-run determinant of any country’s capacity to compete. Note that the index only shows changes in the international competitiveness of each country over time. Differences between countries in the levels of the indices have no significance.

Real effective exchange rates try to eliminate the weakness in the nominal effective exchange rates - namely that potential competitiveness gains from exchange rate depreciations can be eroded by domestic inflation - by correcting effective nominal exchange rates for differences in inflation rates. Consumer prices are usually used to make the correction because they are readily available. However, this implicitly assumes that the relative price of domestic tradable goods as compared with foreign tradables evolves in parallel to the relative consumer prices, which is often not the case.

From around 2009 to 2012, France, Germany, Italy, Japan, the United Kingdom and the United States saw virtually no change in their real effective exchange rate. However since 2012, while rates for France, Germany, Italy and the United States have remained stable, Japan has seen a major gain in its international competitiveness, as measured by the drop in its real effective exchange rate, while the United Kingdom has seen its international competitiveness deteriorate.

Commodity exporting countries also saw an improvement in international competitiveness in the last few years (Australia, Canada, Chile and Norway) along with the Czech Republic, Sweden and Turkey. Iceland, Korea and New Zealand, on the other hand, all recorded drops in their international competitiveness over the last few years.

For non-OECD countries, with the exception of China, all have seen their international competitiveness improve; and in the case of Indonesia and South Africa quite substantially since 2010.

Sources

-

OECD (2015), OECD Economic Outlook, OECD Publishing.

Further information

Analytical publications

-

OECD (2015), OECD Economic Surveys, OECD Publishing.

Statistical publications

-

OECD (2015), Main Economic Indicators, OECD Publishing.

Online databases

Websites

-

Sources & Methods of the OECD Economic Outlook, www.oecd.org/eco/sources-and-methods.