Balance of payments

The current account balance is the difference between current receipts from abroad and current payments to abroad. When the current account balance is positive, the country can use the surplus to repay foreign debts, to acquire foreign assets or to lend to the rest of the world. When the current account balance is negative, the deficit will be financed by borrowing from abroad or by liquidating foreign assets acquired in earlier periods.

Definition

Current account transactions consist of exports and imports of goods; exports and imports of services such as travel, international freight and passenger transport, insurance and financial services; primary income flows, consisting of compensation of employees (e.g. wages and salaries) and investment income (i.e. property income in System of National Accounts); and secondary income such as government transfers (i.e. international cooperation), worker’s remittances and other transfers such as gifts, inheritances and prizes won from lotteries.

Investment income includes retained earnings (i.e. profits not distributed as dividends to the direct investor) of foreign subsidiaries. In general, earnings of direct investment enterprises are treated as if they were remitted abroad to the direct investor, with the part that is actually retained in the country where the direct investment enterprises are located shown as direct investment income reinvested earnings in the current account and as inward direct investment in the financial account.

Comparability

The data are taken from balance of payments statistics compiled according to the International Monetary Fund (IMF) Balance of Payments Manual and International Investment Position (BPM6) which was introduced in most countries in 2014. However, data for Mexico, Brazil, China, India, Indonesia, and South Africa are still presented according to the old BPM5. The IMF, OECD and other international organisations closely monitor balance of payments statistics reported by member countries through regular meetings of balance of payments compilers. As a result, there is relatively good comparability across countries.

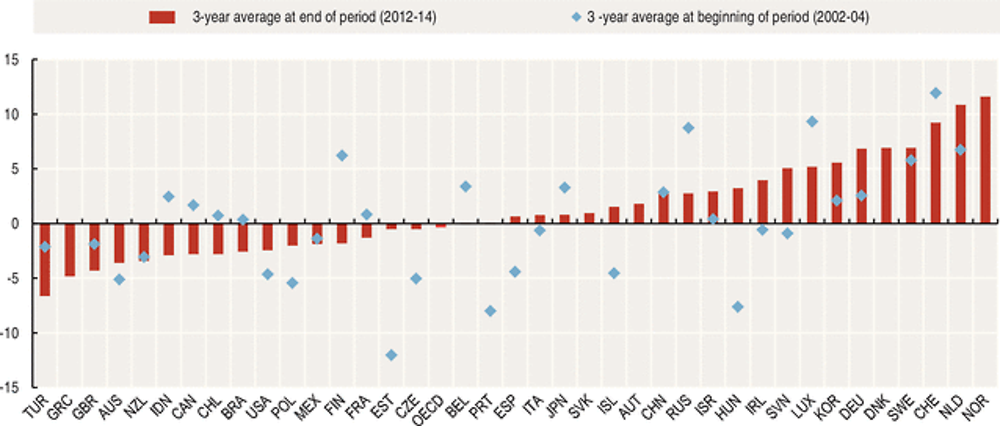

The lead up to and the aftermath of the global financial and economic crisis had a clear impact on current account balances as a percentage of GDP of for a large number of countries between 2002, 2006, 2010 and 2014. An example of this rise and fall is Iceland, which saw its current account balance as a percentage of GDP fall from 1.1% in 2002 to negative 23.2% in 2006, due to the large inflow of capital seeking high interest rates and now sits at 3.2% in 2014. A number of other countries that exhibit a similar pattern are Estonia, Ireland, Portugal, Spain and the United States.

OECD countries that have recorded current account deficits throughout the period since 2002 are: Australia, Mexico, New Zealand, Poland, Turkey, the United Kingdom and the United States. This is partly due to the way in which earnings of direct investment enterprises are treated.

Turkey is the only OECD country that recorded a current account deficit of 5% of GDP or more on average over the three years to 2014 (negative 6.6%), although Turkey’s current account deficit as a percentage of GDP has improved since 2011 when it reached negative 9.6%. Surpluses in excess of 5% of GDP were recorded by Denmark, Germany, Korea, Luxembourg, the Netherlands, Norway, Sweden, Slovenia and Switzerland.

Sources

-

OECD (2015), Main Economic Indicators, OECD Publishing.

Further information

Analytical publications

-

OECD (2008), Export Credit Financing Systems in OECD Member Countries and Non-Member Economies, OECD Publishing.

Methodological publications

-

International Monetary Fund (IMF) (2009), Balance of Payments and International Investment Position Manual, 6th edition, IMF, Washington DC.

-

OECD et al. (2010), Manual on Statistics of International Trade in Services, United Nations.

Online databases

Websites

-

Sources & Methods of the OECD Economic Outlook, www.oecd.org/economy/outlook/sources-and-methods.htm.