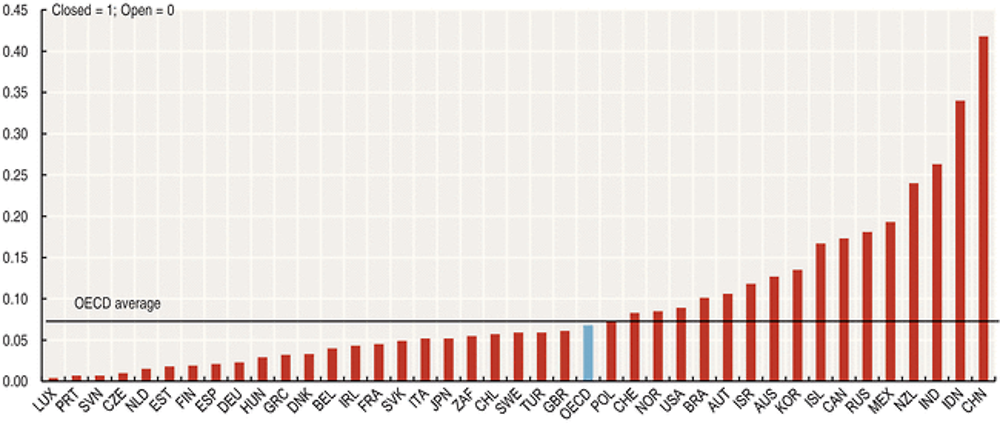

FDI regulatory restrictiveness index

Foreign direct investment (FDI) is a key element in international economic integration. FDI creates direct, stable and long-lasting links between economies. It encourages the transfer of technology and know-how between countries, and allows the host economy to promote its products more widely in international markets. FDI is also an additional source of funding for investment and, under the right policy environment, it can be an important vehicle for development.

Definition

The OECD FDI Regulatory Restrictiveness Index gauges the restrictiveness of a country’s FDI rules through four types of restrictions: foreign equity restrictions; screening or approval mechanisms; restrictions on key foreign employment; and operational restrictions.

Comparability

The OECD FDI Regulatory Restrictiveness Index covers statutory restrictions in 22 sectors. The Index is currently available for 8 years: 1997, 2003, 2006, 2010-14. Restrictions are scored on a range from 0 (open) to 1 (closed). Absence of scores refers to the absence of restrictions. Implementation issues are not addressed and factors such as the degree of transparency or discretion in granting approvals are not taken into account.

For OECD and non-OECD countries adherents to the OECD Declaration on International Investment and Multinational Enterprises, the measures taken into account by the index are limited to statutory regulatory restrictions on FDI as reflected in countries’ lists of exceptions to national treatment and measures notified for transparency under OECD instruments without assessing their actual enforcement. For the non-OECD countries, information is collected through Investment Policy Reviews. Information is updated on a yearly basis following the OECD Freedom of Investment monitoring of investment measures, and ad-hoc legal and regulatory documental research for the countries not covered.

The OECD FDI Regulatory Restrictiveness Index shows that there still remains significant variation across countries in terms of statutory restrictions on foreign direct investment. Countries in Asia and those with significant raw materials tend to be more restrictive. When used in combination with indicators measuring other aspects of the FDI climate, the Index can help to account for variations in countries’ success in attracting FDI.

Seen from a broad perspective, countries continue to liberalise their requirements on international investment over time, albeit with occasional relapses. But worldwide, many service sectors remain partly off limits to foreign investors, holding back potential economy-wide productivity gains. Even within OECD countries, restrictions on foreign investment remain in key network sectors such as energy and transport. A key risk is that FDI restrictions limiting competition in service sectors end-up raising service input costs for other economic sectors and constraining productivity growth in the more dynamic downstream ones.

Sources

-

OECD (2015), “OECD FDI regulatory restrictiveness index”, OECD International Direct Investment Statistics (Database).

Further information

Analytical publications

-

Nicolas, F., S. Thomsen and M. Bang (2013), “Lessons from Investment Policy Reform in Korea”, OECD Working Papers on International Investment, No. 2013/02, OECD Publishing.

-

OECD (2015), OECD Investment Policy Reviews, OECD Publishing.

-

OECD (2014), Southeast Asia Investment Policy Perspectives, Paris.

Methodological publications

-

Kalinova, B., A. Palerm and S. Thomsen (2010), “OECD’s FDI Restrictiveness Index: 2010 Update”, OECD Working Papers on International Investment, 2010/03, OECD Publishing.

Websites

-

Monitoring investment and trade measures, www.oecd.org/investment/g20.htm.

-

National Treatment for Foreign-Controlled Enterprises, www.oecd.org/daf/inv/investment-policy/nationaltreatmentinstrument.htm.

-

OECD Codes of Liberalisation of Capital Movements and of Current Invisible Operations,www.oecd.org/daf/fin/insurance/codes.htm.