Investment rates

Investment, or to be more precise, gross fixed capital formation, is an important determinant of future economic growth and an essential variable in economic analyses, such as analyses of demand and productivity.

Definition

Gross fixed capital formation (GFCF) is defined in the national accounts as acquisition less disposals of produced fixed assets. The relevant assets relate to products that are intended for use in the production of other goods and services for a period of more than a year.

Acquisition includes both purchases of assets (new or second-hand) and the construction of assets by producers for their own use.

The term produced assets signifies that only those assets that come into existence as a result of a production process recognised in the national accounts are included. The national accounts also record transactions in non-produced assets such as land, oil and mineral reserves for example; which are recorded as (acquisitions less disposals of) non-produced assets in the capital account and the balance sheet.

Acquisition prices of capital goods include transport and installation charges, as well as all specific taxes associated with purchase.

Comparability

All countries compile data according to the 2008 SNA “System of National Accounts, 2008” with the exception of Chile, Japan, and Turkey, where data are compiled according to the 1993 SNA. The most important changes between the 1993 SNA and the 2008 SNA was the extension of the scope of assets to be recorded as GFCF.

According to the 2008 SNA, expenditures on research and development and military weapons (warships, submarines, military aircraft, tanks, etc.) are now included in GFCF.

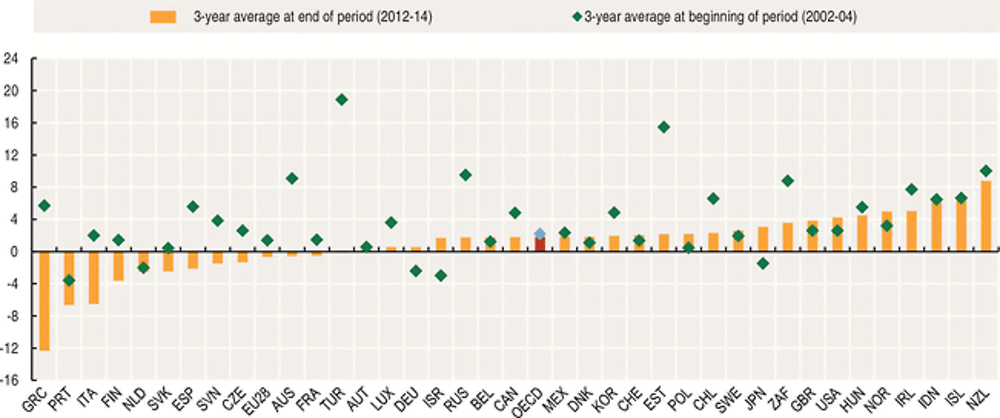

Investment grew on average by 1.8% over the period 2012-14 for the OECD as a whole, reflecting an overall improvement since the financial crisis. While the majority of the OECD countries experienced positive growth rates, ten countries recorded negative growth in 2014: Australia, Austria, Chile, Estonia, Finland, France, Greece, Israel, Italy, and Turkey. Although Greece recorded a negative average growth rate of 12.3% for the period 2012-14, the decrease was by less than 3% in 2014 improving by 6.6 percentage points compared to 2013. The growth rate of investment, on the other hand, fell by 8.2 percentage points from 2.1% in 2013 in Chile to minus 6.1% in 2014.

Belgium, Hungary, Iceland, Ireland, Luxembourg New Zealand, Poland, Sweden, and the United Kingdom all recorded growth rates of investment larger than 5%. In Hungary, Iceland, and Ireland investment grew by more than 10% in 2014, which is particularly notable for the latter two countries because investment growth rates were negative in 2013.

Sources

-

OECD (2015), National Accounts of OECD Countries, OECD Publishing.

-

For Brazil: National sources.

Further information

Analytical publications

-

OECD (2015), OECD Economic Outlook, OECD Publishing.

-

OECD (2015), OECD Investment Policy Reviews, OECD Publishing.

Statistical publications

-

OECD (2015), National Accounts at a Glance, OECD Publishing.

Methodological publications

-

Ahmad, N. (2004), “Towards More Harmonised Estimates of Investment in Software”, OECD Economic Studies, No. 37, 2003/2.

-

OECD, et al. (eds.) (2010), System of National Accounts 2008, United Nations, Geneva.

Websites

-

Sources & Methods of the OECD Economic Outlook, www.oecd.org/eco/sources-and-methods.htm.