Japan

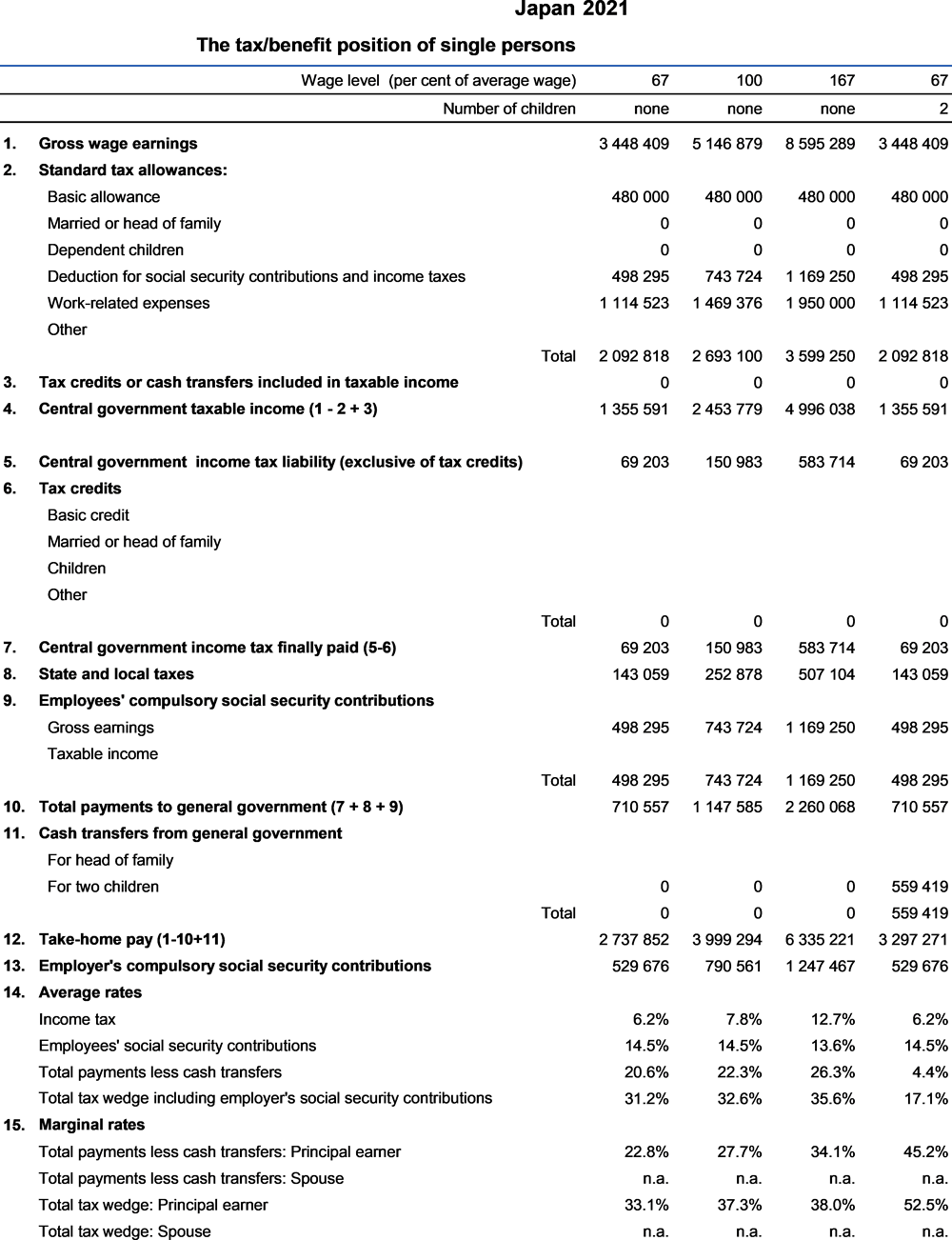

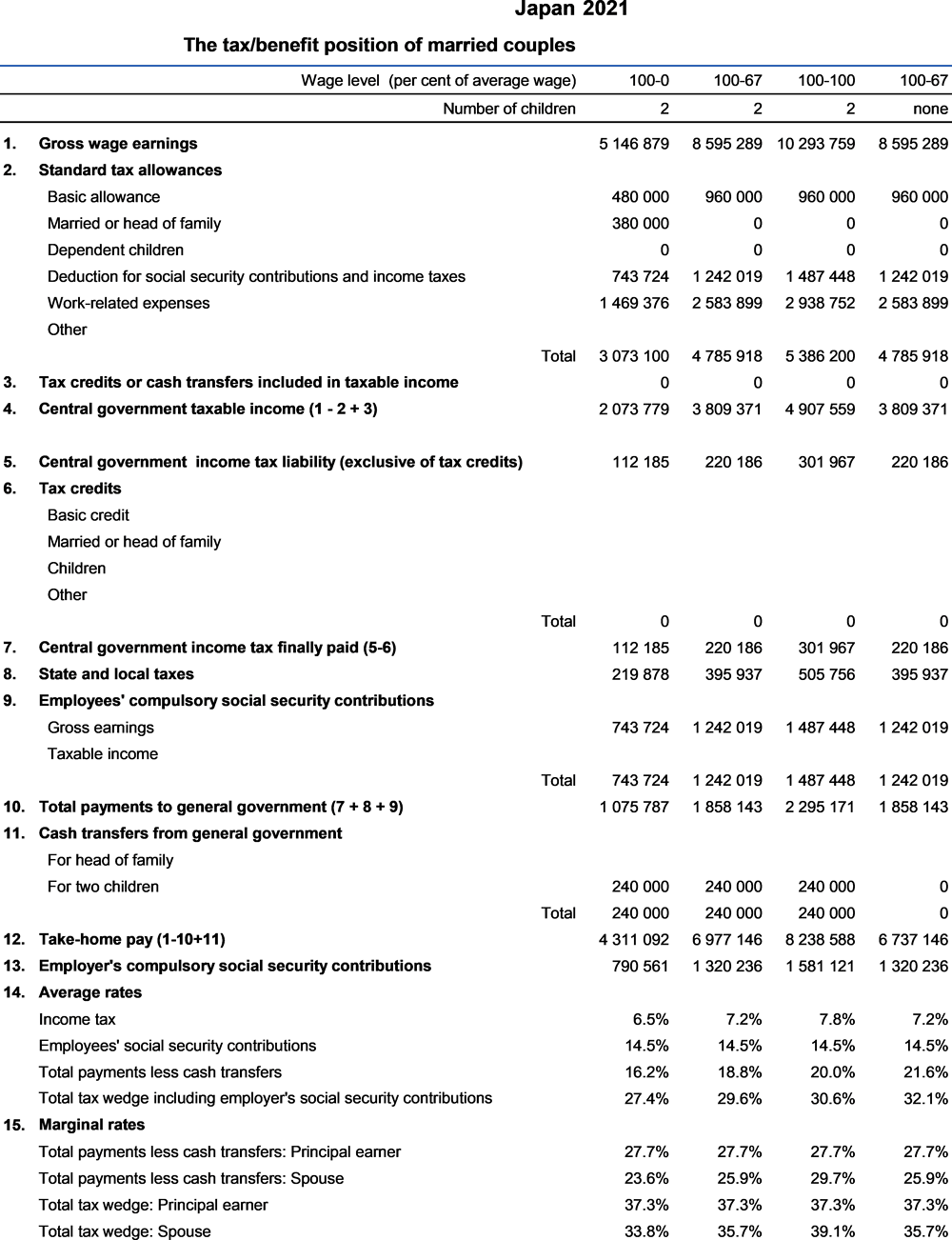

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The national currency is the Yen (JPY). In 2021, JPY 109.7 were equal to USD 1. In that year, the average worker is assumed to earn JPY 5 146 879 (Secretariat estimate). In Japan, the central government income tax year is a calendar year and the local government income tax year is from April to March. The calculations in this report are based on the tax rules and rates, which are applicable the April 1st.

1.1. Central government income tax

1.1.2. Allowances and tax credits

1.1.2.1. Standard reliefs

Employment income deduction: first, the following amounts may be deducted from gross employment income:

If gross employment income does not exceed JPY 1 800 000, the deduction is 40 per cent of gross employment income less JPY 100 000. The minimum amount deductible is JPY 550 000, even if the amount of income is very small.

If gross employment income exceeds JPY 1 800 000, but not JPY 3 600 000, the deduction is JPY 80 000 plus 30 per cent of gross employment income.

If gross employment income exceeds JPY 3 600 000, but not JPY 6 600 000, the deduction is JPY 440 000 plus 20 per cent of gross employment income.

If gross employment income exceeds JPY 6 600 000, but not JPY 8 500 000, the deduction is JPY 1 100 000 plus 10 per cent of gross employment income.

As of 2020, if gross employment income exceeds JPY 8 500 000, the deduction is fixed at JPY 1 950 000. However, in consideration of child-care and long-term care, measures will be taken to avoid increase in tax burden for taxpayers on care,1 households with a dependent relative(s) under 23 years of age and households with a member(s) dependent on care.

Second step deductions are calculated using as a “reference income” the earnings from employment less the employment income deductions described above. The second step deductions are:

Basic allowance (Personal deduction): allowance up to JPY 480 000 is given to a resident taxpayer whose reference income does not exceed JPY 25 000 000. The amount of tax allowance gradually decreases once the income exceeds JPY 24 000 000. Specifically, the allowance is JPY 320 000 for a taxpayer with income from JPY 24 000 001 to JPY 24 500 000, JP 160 000 for those from JPY 24 500 001 to JPY 25 000 000, and zero for those above JPY 25 000 000.

Allowance for spouse(*): a tax allowance up to JPY 380 000 is given to a resident taxpayer whose reference income does not exceed JPY10 000 000 and who lives with a spouse whose reference income does not exceed JPY 480 000.

Allowance for elderly spouse(*): a tax allowance up to JPY 480 000 is given to a resident taxpayer:

Special allowance for spouse(*): a tax allowance up to the amount shown in the following table is given to a resident taxpayer whose reference income does not exceed JPY 10 000 000 and who lives with a spouse whose reference income exceeds JPY 480 000 but does not exceed JPY 1 330 000:

(*) The amounts of the Allowance for spouse, of the allowance for elderly spouse, and of the Special allowance for spouse, decrease gradually when the reference income (as defined above) of the taxpayer is from JPY 9 000 001 to JPY 10 000 000, then they become zero. Specifically, the amounts of the allowances is as follows:

Reference income from JPY 9 000 001 to JPY 9 500 000: full amount*2/3;

Reference income from JPY 9 500 001 to JPY 10 000 000: full amount*1/3

Allowance amounts are rounded up to the closest multiple of JPY 10 000. For instance, an amount of JPY 73 333 is rounded to JPY 80 000.

Allowance for dependents: if a resident taxpayer has dependent children or other dependent relatives who are aged 16 o r older, whose reference income does not exceed JPY 480 000, a tax allowance of JPY 380 000 per each is given for each dependent. Two taxpayers cannot receive the allowance for the same dependent.

Special allowance for dependents: if a resident taxpayer has dependents whose reference income does not exceed JPY 480 000 and who are aged 19 to 22, an allowance of JPY 630 000 is given for each dependent, instead of the allowances for dependents mentioned above. Two taxpayers cannot receive the allowance for the same dependent.

Allowance for elderly dependent: if a resident taxpayer has dependents who are aged 70 or older whose reference income does not exceed JPY 480 000, there is a tax allowance of JPY 480 000 per each dependent, instead of the allowances for dependents mentioned above. If the dependents are direct ascendants of the taxpayer or their spouse and permanently live with the taxpayer or their spouse, a tax allowance of JPY 580 000 per each dependent is given to the taxpayer.

Deduction for social insurance contributions: the amount of social insurance contributions for a resident taxpayer or their dependents are deducted from their income without any limit.

1.1.2.2. Main non-standard tax reliefs applicable to an AW

Deduction for life insurance premiums: If a resident taxpayer pays insurance premiums on life insurance contracts and the beneficiary is the taxpayer, his/her spouse or other relatives, the portion of these insurance premiums which does not exceed the limit described below, is deductible from ordinary income, retirement income or timber income.

In addition, if a resident taxpayer pays insurance premiums for “qualified private pension plan (insurance type)”, and the recipient of the pension payment is the taxpayer or his/her spouse or relatives living with the taxpayer, the portion of such premiums which does not exceed the limit described below, is deductible from ordinary income, retirement income, or timber income.

Furthermore, if a resident taxpayer pays insurance premiums on nursing and medical insurance contacts and part of the nursing/medical care which the taxpayer receives is financed by the insurance, the portion of such premiums which does not exceed the limit described below, is deductible from ordinary income, retirement income, or timber income.

Deduction for medical expenses: If a resident taxpayer pays bills for medical or dental care for himself/herself or for his/her dependent spouse or other dependent relatives living with him/her and the amount of such expenses (excluding those covered by insurance) exceeds JPY 100 000 or 5% of the total of his/her ordinary income, retirement income, timber income and so on, the excess amount is deductible from his/her ordinary income, retirement income or timber income. The maximum deduction is JPY 2 million.

Deduction for earthquake insurance premiums: Earthquake insurance premiums up to JPY 50 000 can be deducted from income. Although the income deduction for casualty insurance premiums are basically abolished, the deduction for long-term casualty insurance premiums remains available if contracted before 31 December, 2006. The maximum deduction for long-term casualty insurance premiums is JPY 15 000. If an individual applies for a deduction for both earthquake insurance premiums and long-term casualty premiums, the maximum deductible amount is JPY 50 000 in total.

Taxpayers can also apply other tax reliefs established by Act on Special Measures Concerning Taxation (such as self-medication taxation system and credit for housing loans).

1.1.3. Tax schedule

Tax liability is obtained by multiplying the taxable income by tax rate (A) and deducting the amount (B). For example, income tax due on taxable income of JPY 7 million is:

7 000 000 x 0.23 (A) - 636 000 (B) = JPY 974 000.

Finally, the tax amount is increased by 2.1%. This provision will apply in each year from 2013 until 2037.

1.2. Local taxes (personal inhabitant’s taxes)

1.2.1. General description of the system

Local taxes in Japan (personal inhabitant’s taxes) consist of prefectural inhabitant's tax levied by prefectures and municipal inhabitant’s tax levied by cities, towns and villages. The prefectural inhabitant’s tax is collected together with the municipal inhabitant’s tax by cities, towns and villages.

1.2.2. Tax base

Basically, personal inhabitant’s taxes (prefectural and municipal inhabitant’s taxes) consist of two parts; one is income based tax and the other is a fixed per capita amount. The taxable income of personal inhabitant’s taxes is computed on the basis of the previous year's income. The main difference from state tax (income tax) is the amount of income reliefs (tax deductions). For example, the amount of personal deduction is JPY 430 000, tax deduction for dependents is JPY 330 000, and tax allowance for spouse is up to JPY 330 000, the amount of specified allowance for dependents is JPY 450 000, etc.

1.2.3. Tax rate

The standard fixed (annual) per-capita amount of Prefectural inhabitant’s tax is JPY 1 500;

The standard fixed (annual) per-capita amount of Municipal inhabitant’s tax is JPY 3 500;

The standard rate of the income based tax is 10% (Prefectural inhabitant’s tax: 4%, Municipal inhabitant’s tax: 6%, for ordinance-designated cities, Prefectural inhabitant’s tax: 2%, for Municipal inhabitant’s tax: 8%).

The personal inhabitant’s taxes rate and the income tax rate were changed in the FY 2006 tax reform. Adjusted credit (a form of tax credit) was introduced in order to alleviate the tax burden increase arising from the changes in the tax rates and from the difference between the personal allowances (basic tax allowance, tax allowance for spouse, tax allowance for dependents, special tax allowance for dependents, etc.) for national income tax purposes and for inhabitant tax purposes.

Adjusted credit is applied if the total amount of income is JPY 25 000 000 or less. Amounts of the credit are as follows:

2.1. Employees’ contributions

2.1.1. Pension

9.15% of total remuneration (standard remuneration and bonuses). The insurable ceiling of the monthly amount of pensionable remuneration is JPY 650 000 and the insurable ceiling of the standard amount of bonus is JPY 1 500 000.

2.1.2. Sickness

As from April 2012 about 5.00%, (about 4.75% before March 2012), of total remuneration, (standard remuneration and bonuses). The insurable ceiling of the monthly amount of standard remuneration is JPY 1 390 000 and the insurable ceiling of the yearly amount of standard bonus is JPY 5 730 000.

2.2. Employers’ contributions

2.2.1. Pensions

9.15% of total remuneration (standard remuneration and bonuses). The insurable ceiling of the monthly amount of pensionable remuneration is JPY 650 000 and the insurable ceiling of the standard amount of bonus is JPY 1 500 000.

2.2.2. Sickness

As from April 2012, about 5.00% (about 4.75% before March 2012) of total remuneration. The insurable ceiling of the monthly amount of standard remuneration is JPY 1 390 000 and the insurable ceiling of the yearly amount of standard bonus is JPY 5 730 000.

2.2.3. Unemployment

0.6% of total remuneration for Commerce and industry in general except for Business of agriculture, forestry and fisheries, and the rice wine brewing business, and Construction business. It is 0.7% for Business of agriculture, forestry and fisheries, and the rice wine brewing business, and 0.8% for Construction business.

3.2. Benefits for dependent children

From April 2012 (Income caps are applied beginning from June 2012 payments):

a) For persons earning incomes below the income cap

JPY 15 000 (per month) is paid to parents/guardians for each child who is under 3 years old or for the third or subsequent child from 3 years old until he/she graduates from elementary school.

JPY 10 000 (per month) is paid to parents/guardians for each child who is for the first or second child from 3 years old until he/she graduates from elementary school or who is a junior high school student.

The income cap is set at JPY 6 220 000 (the principal’s gross earnings net of certain deductions (a casualty loss deduction , a medical expenses deduction, deduction for small enterprise-based mutual aid premiums and similar payments, disability deduction, widow (or widower) deduction and working student deduction), plus JPY 380 000 per dependent).

3.3. Child rearing allowance

The benefit is available to single mothers who take care of and provide protection to a child. The benefit is available also to single fathers who take care of and provides living expenses, supervision and protection to the child.

It is available until March 31 after the child’s 18th birthday or until age 20 for those with specific disabilities. The benefit is not taxable.

Claimants can receive either a full benefit or a partial benefit depending on their income. Amounts for the full benefit over time are as follows:

The rates and withdrawal rates for the partial payment over time are as follows:

Those with incomes above the threshold for the full benefit receive a partial benefit, and those with incomes above the threshold for the partial benefit receive nothing.

The income measure used is gross annual income minus the employment income deduction minus JPY 80 000 - the amount paid towards public and private insurance premiums.

Income thresholds are based on the number of dependents (see the following table):

The amount of partial benefit is calculated as follows:

Benefit amount = 43 160-{(Amount of income - “Income–tested threshold of full benefit”) ×0.0230559 +10}

The additional amount for the second child is calculated as follows:

Benefit amount = 10 190-{Amount of income - “Income–tested threshold of full benefit”) ×0.0035524 +10}

And the additional amount for the third and subsequent children as follows:

As part of the Fiscal Year 1999 tax reform, the highest marginal rate of the personal income tax imposed by the central government was reduced from 50% to 37%. The top rate of the local inhabitant’s tax was reduced from 15% to 13%. A proportional tax reduction was granted with respect to the national income tax and the local inhabitant’s tax. The amount is equal to the lesser of 20% (local inhabitant’s tax: 15%) of the amount of tax before reduction or JPY 250 000 (local inhabitant’s tax: JPY 40 000).

As part of the FY 2005 tax reform, the rate of proportional tax reduction was reduced from 20% to 10% (local inhabitant’s tax: from 15% to 7.5%) and the ceiling was reduced from JPY 250 000 to JPY 125 000 (local inhabitant’s tax from JPY 40 000 to JPY 20 000) as from 2006 (local inhabitant’s tax: FY 2006). In the FY 2006 tax reform, the proportional tax reduction was abolished as from 2007 (local inhabitant’s tax: FY 2007).

As part of the FY 2006 tax reform, the progressive rate structure of national income tax was reformed into a 6 brackets structure with tax rates ranging from 5% to 40%, and the rate of local inhabitant’s tax became proportional at a single rate of 10%.

As part of the FY 2012 tax reform, the upper limit on employment income deduction (JPY 2 450 000) was set for those who earn employment income of more than JPY 15 000 000 as from 2013 (personal inhabitant’s tax: FY 2014).

As part of the FY 2013 tax reform, the tax rate of 45% was set for the income beyond JPY 40 000 000 from 2015 creating a 7 brackets structure.

As part of the FY 2014 tax reform, the upper limit on employment income deduction was determined to be gradually reduced. In 2016 (as for personal inhabitant’s taxes, in FY2017), the limit became JPY 2 300 000 for salary income more than JPY 12 000 000. Moreover, in 2017 (as for personal inhabitant’s taxes, in FY2018), the limit became JPY 2 200 000 for salary income more than JPY 10 000 000.

As part of the FY 2017 tax reform, as regards allowance for spouse and special allowance for spouse, the maximum spousal income qualifying for the tax allowance (maximum JPY 380 000) were raised from JPY 380 000 to JPY 850 000. At the same time, an upper income limit was introduced as a requirement for taxpayers to qualify for allowance for spouse and special allowance for spouse. The reform goes into effect in 2018. (As for personal inhabitant’s taxes, allowance for spouse and special allowance for spouse will be revised similarly. This reform will go into effect in FY2019.)

As part of the FY 2018 tax reform, following tax systems will be revised. The reform will go into effect in 2020 (as for personal inhabitant’s taxes, in FY2021):

The amount of employment income deduction and pension income deduction will be reduced uniformly by JPY 100 000 while the amount of personal deduction will be raised uniformly by JPY 100 000.

The amount of employment income deduction from income exceeding JPY 8 500 000 will be reduced to JPY 1 950 000. However, in consideration of child care and long-term care, measures will be taken to avoid increase in burden on households with a dependent relative(s) under 23 years of age and households with a member(s) dependent on care (*).

* Relatives receiving “special deduction for persons with disabilities”

A cap of JPY 1 955 000 will be put on pension income deduction for pension income exceeding JPY 10 000 000. The deduction will be reduced for pensioners with income other than pension exceeding JPY 10 000 000 after deductions.

Personal deduction will be diminished for people with total income exceeding JPY 24 000 000 after deductions, and the amount will be further reduced gradually to zero when total income exceeds JPY 25 000 000.

Eligible age for cash benefits for dependent children was raised from three to six as from 1 June 2000, from six to nine as from 1 April 2004 and from nine to twelve as from 1 April 2006. Benefit amount has been doubled to JPY 10 000 for the first and second child under the age of three as from 1 April, 2007.

As from 2010, JPY 13 000 per month is paid to parents/guardians regardless of their income for each child until he/she graduates from junior high school.

As from April 2012 (Income caps are applied beginning from June 2012 payments):

a) For persons earning incomes below the income cap

‒ JPY 15 000 (per month) is paid to parents/guardians for each child who is under 3 years old or for the third or subsequent child from 3 years old until he/she graduates from elementary school.

‒ JPY 10 000 (per month) is paid to parents/guardians for each child who is for the first or second child from 3 years old until he/she graduates from elementary school or who is a junior high school student.

‒ JPY 5 000 (per month) is paid to parents/guardians for each child until he/she graduates from junior high school as the Special Interim Allowances.

4.1. Changes to labour taxation due to the COVID pandemic in 2020 and 2021

4.1.1. Non-taxable benefit payments

No income tax shall be imposed on the following benefits provided by a municipality or special ward, and the right to receive such benefits may not be seized by disposition of the national tax delinquency;

4.1.2. Special provision for deferral of tax payment

If a taxpayer has a considerable decrease in business income due to the impact of COVID-19 and is deemed to have difficulties to pay tax (only the state tax for which payment is due from 1 February 2020 to 1 February 2021), the tax payment may be deferred for one year without collateral or delinquency tax. Similar special provision is also established for individual inhabitant tax which enables to defer tax collection.

4.1.3. Special provision of deduction for charitable contribution by individuals in relation to the cancellation of cultural, arts or sports events cancelled because of the COVID-19 pandemic.

If individuals waive the right to claim a refund of the amount paid for admissions to cultural, arts or sports events cancelled because of the government's request in order to prevent the spread of COVID-19, the deduction for charitable contribution (income or tax deduction) shall be applied for the waived amount (up to JPY 200 000).

Similar special provision is also established for individual inhabitant tax.

4.1.4. Flexible treatment of the requirements for application of the special tax deduction available for housing loans

If individuals cannot start to use the house by 31 December 2020 or by 6 month after the day of purchase due to the delay in housing construction caused by COVID-19, and if they use the house by 31 December 2021, under certain conditions, more flexibility is added to the application requirements of the tax deduction for housing loan so that they can be entitled to the deduction for 13 years.

The application requirements are also made more flexible for individual inhabitant tax.

5.1. Average gross annual wage earnings calculation

The source of calculation is the Basic Survey on Wage Structure, published by the Ministry of Health, Labour and Welfare. This survey covers establishments with ten or more regular employees over the whole country, and contains statistical figures for monthly contractual cash earnings in June and annual special cash earnings (such as bonuses) received by various categories of workers. Male and female workers in manufacturing, mining and quarrying, construction, wholesale and retail trade, transportation and storage, accommodation and food service activities, information and communication, financial and insurance activities, real estate activities, professional, scientific and technical activities are surveyed in the statistics. Their gross annual earnings are calculated by multiplying monthly contractual cash earnings by 12 and adding any annual special cash earnings. In the Basic Survey, various allowances such as overtime, sickness and leave allowances are included in cash earnings.

The survey covers the whole country, and no special assumption is made regarding the place of residence of the workers surveyed. The calculation method has been changed to adjust weighs taking into account the response rate since 2020.

5.2. Employer contributions to private pension and health schemes

DB: JPY 2 836 billion (FY 2018)

Employees’ Pension Funds (EPFs): JPY 87 billion (FY 2019)

DC: JPY 1 096 billion (FY2019)

Data of DB and EPFs are the total amount of employers’ contribution and employees’ one and there is no data of those which indicates only employers’ contribution. Under DC schemes, as from January 2012, matching contribution which enables employee to pay additional contribution to employer's one became available. The amount of DC does not include the amount of matching contribution. It is regulated by law that employers’ contribution must be higher than employees’ one.

The equations for the Japanese system are mostly on an individual basis. But the tax allowances for the spouse and for children are relevant only to the calculation for the principal earner. This is shown by the Range indicator in the table below.

The functions which are used in the equations (Taper, MIN, Tax etc) are described in the technical note about tax equations. Variable names are defined in the table of parameters above, within the equations table, or are the standard variables “married” and “children”. A reference to a variable with the affix “_total” indicates the sum of the relevant variable values for the principal and spouse. And the affixes “_princ” and “_spouse” indicate the value for the principal and spouse, respectively. Equations for a single person are as shown for the principal, with “_spouse” values taken as 0.

Note

← 1. Relatives receiving “special deduction for persons with disabilities”.