Portugal

Real GDP growth is projected to decline from 6.7% in 2022 to 1% in 2023 and 1.2% in 2024, as Russia’s war of aggression against Ukraine, supply-chain disruptions, elevated energy prices and rising interest rates weigh on activity. The Recovery and Resilience Plan (RRP) will boost public investment, but there are risks that implementation delays continue. Elevated energy and food prices will push headline consumer price inflation to 8.3% in 2022, before it moderates to 6.6% in 2023 and 2.4% in 2024. Wage growth will strengthen as the unemployment rate remains low, but not enough to protect households’ purchasing power.

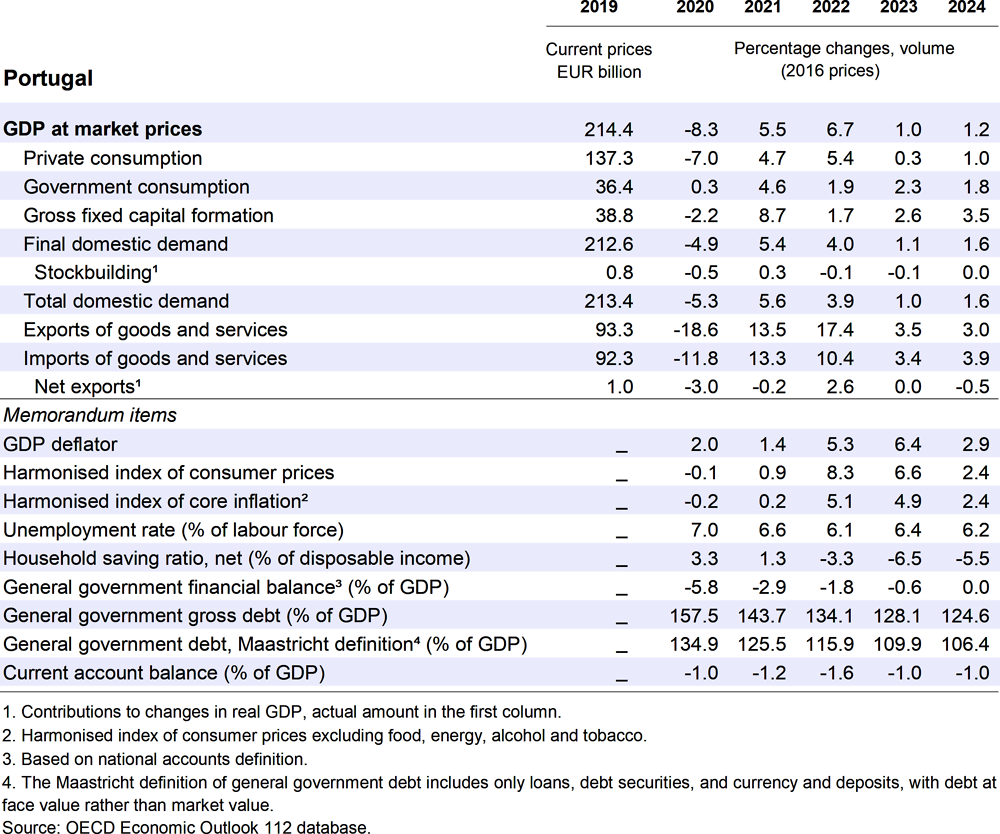

Fiscal policy will become more restrictive. Support measures, notably cash transfers, helped to smooth energy price shocks in 2022 but will be increasingly phased out in 2023. While the increase in public debt since 2019 has been moderate compared to other OECD countries, its high level and an ageing population make fiscal consolidation a priority. Ensuring an efficient and timely implementation of the RRP would boost green infrastructure, energy efficiency and the capacity to generate renewable energy, and help to offset the slowdown in 2023.

The recovery has lost steam

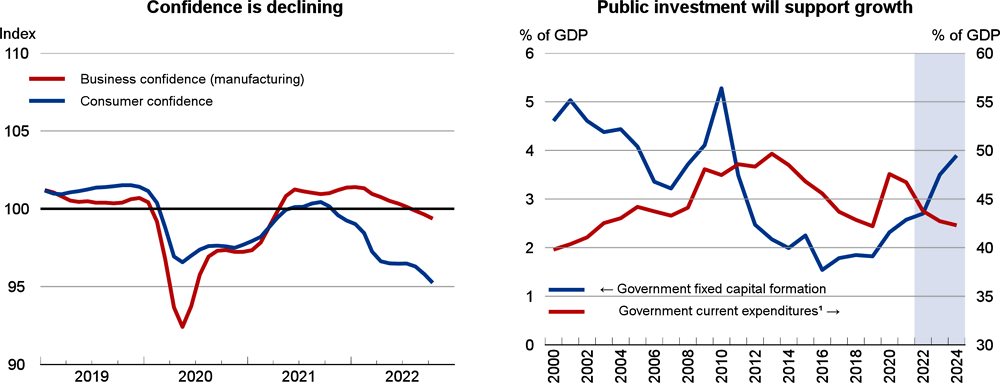

As the rebound in consumption and tourism fade, the slowing global economy, elevated energy prices, uncertainty and rising interest rates have started to weigh on activity. GDP grew by 0.4% on a quarterly basis in the third quarter of 2022. While historically-high employment rates, excess savings and government cash transfers are providing some support to households, consumer confidence has slowed, and the Bank of Portugal’s coincident private consumption indicator continued to ease in September. Strong rises in production costs and materials shortages have negatively affected business confidence, and particularly sentiment in construction and industry. Wage growth has lagged behind annual consumer price inflation, which reached 10.6% in October, reducing household purchasing power.

Elevated energy and commodity prices are raising costs for households and firms, despite energy support measures worth close to 1.6% of GDP in 2022. Monetary and financial conditions are also becoming less supportive. With almost 70% of housing loan rates fixed for only up to one year, higher interest rates will rapidly raise mortgage payments, holding back household consumption and investment. The risk of a reduction in energy supply appears contained. Portugal imports gas via ship and has the capacity to generate a notable share of electricity from renewables, reaching almost 55% of electricity generated between January and September 2022. There are limited energy connections between the Iberian Peninsula and the rest of Europe.

Policy support will ease

Fiscal policy is expected to become less supportive over 2023 and 2024. The budget deficit will narrow to 1.8% of GDP in 2022, as COVID-19-related spending is phased out and additional tax revenues due to greater-than-expected inflation help to offset the cost of energy support measures. In 2022, support totalling 1.6% of GDP includes one-off cash transfers to households (EUR 1.9 billion) and lower energy prices through reduced taxes and tariffs and public transport prices (EUR 1.7 billion). Some energy measures have been extended into 2023 (EUR 648 million), such as reduced taxes on fuels and electricity and public transport prices. The Energy Bill Support Package for Companies will lower electricity and gas costs for firms. Energy measures are assumed to have been phased out by 2024. Measures under the 2022 Medium-Term Agreement on improving incomes, wages and competitiveness will also support household income, including through the increase in the minimum wage by 8% in 2023 and fiscal incentives for firms to raise wages. The implementation of the RRP will boost investment. Spending from grants is projected to start at 0.5% of GDP in 2022, increasing to 1.5% of GDP in 2023 and 1.9% of GDP in 2024.

Growth is slowing

GDP growth is projected to moderate to 1% in 2023 and 1.2% in 2024. Consumption growth will weaken as monetary and financial conditions become less supportive, pent-up demand eases, employment growth slows and elevated inflation lowers purchasing power. However, energy support measures and rising wages will provide some offset. Export growth will ease as the rebound in tourism ends and global growth slows. Investment will be boosted by European funds. Headline consumer price inflation will moderate to 6.6% in 2023 and 2.4% in 2024 as energy prices stabilise and spare capacity rises. High nominal GDP growth will help to lower public debt (Maastricht definition) to just over 106% of GDP in 2024. If wages increase by more than projected, this would boost consumption and inflation. However, a larger-than-expected decline in the housing market would further weigh on consumer sentiment and residential investment. Additional delays in RRP spending would also constrain activity and the green transition.

Policy can support sustainable growth

Additional support measures against rising energy prices should remain temporary, become increasingly targeted on the most vulnerable households and firms and maintain incentives for energy reductions. Investments under the RRP will increase energy efficiency, green infrastructure and the capacity to generate renewable energy. Ensuring the complete implementation of the RRP in a timely manner is key to maximise the benefits. Maintaining the government’s focus on fiscal consolidation should help limit increases in borrowing costs as euro area monetary policy normalises. A clear and credible medium-term fiscal strategy would further support external credibility. While levels of education have improved drastically over the past two decades, they remain below the OECD average and participation in adult education is low. Continuing to support lifelong learning will be crucial to boost incomes and productivity.