copy the linklink copied!Estonia

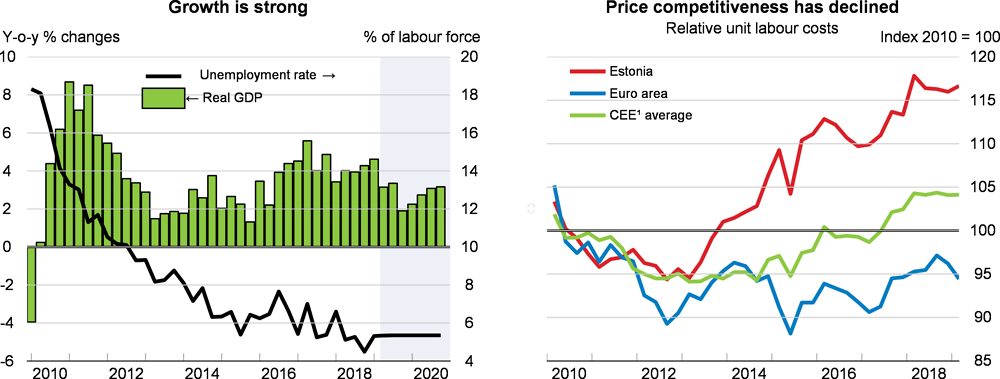

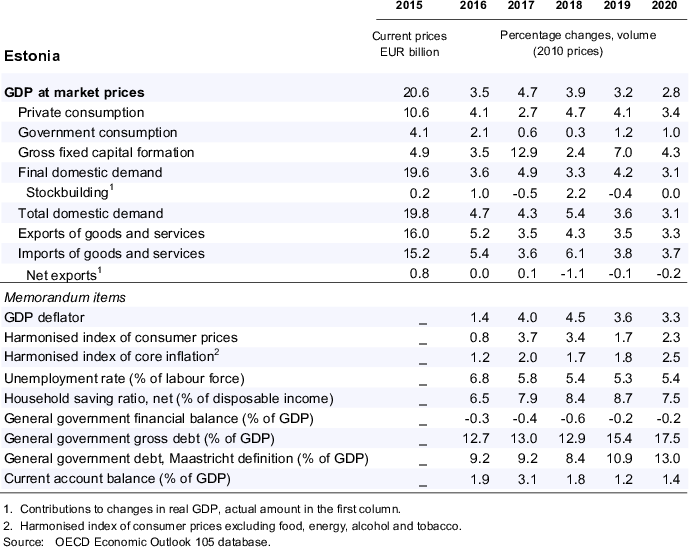

Growth is projected to slow to 3.2% in 2019 and 2.8% in 2020, as the global outlook softens and the domestic economy runs into capacity constraints. Strong growth of real wages and employment will support household consumption. Export growth will decelerate somewhat due to lower global demand and a loss of price competitiveness. Inflation will fall back as temporary factors wane.

Current budget plans include new spending on infrastructure, such as broadband Internet, as well as education, health and social welfare. A moderate fiscal consolidation in 2019 is expected, followed by a broadly neutral stance in 2020. Public debt is low, and macroprudential tools have been put in place to damp potential financial excesses. Cases of money-laundering pose risks to the banking system.

Growth is driven by domestic demand

The expansion continues, fuelled by domestic demand, as consumer confidence increases. Residential investment has picked up, after a housing downturn, and is now making a sizeable contribution to growth. Export growth has held up relatively well, despite a loss of price competitiveness, but imports have been growing faster due to a strong domestic economy and the weakening of the currencies of main trading partners. Employment has risen and unemployment fallen. Capacity constraints are increasingly becoming binding, resulting in labour shortages and strong nominal wage growth, at around 7% a year. Households have increased saving, and high wage growth has so far not been passed through to price inflation. Headline inflation has fallen back to slightly above 2%.

Productivity and skills need a boost to accelerate catch-up

Monetary policy in the euro area is expected to remain very accommodative. Further fiscal expansion in Estonia should be avoided to reduce risks of overheating, but there is fiscal space to finance productivity-enhancing investments, for example in infrastructure and skills. House prices are growing in line with incomes, and macroprudential tools have improved resilience. Subsidiaries of Nordic banks provide the bulk of banking services in the country. Several of them are being linked to on-going money-laundering investigations, calling for a strengthened legal framework with higher fines.

Export growth is still fairly solid, as rising unit labour costs are compensated by gains in non-price competitiveness and a compression of margins. Falling price competitiveness contributes to reductions in traditional manufacturing employment, with social costs that can be significant and geographically concentrated. Ensuring good access to unemployment insurance and activation policies can help to alleviate the social impact and help jobseekers return to work more rapidly. Structural policies to boost productivity and to encourage the adoption of digital technologies would help to sustain income growth.

Employment growth is strong and immigration helps to alleviate labour shortages. The work ability reform is bringing individuals with a partial ability to work out of disability insurance and into the labour force. However, some of these individuals, and workers displaced from traditional manufacturing, may struggle to find new employment, calling for renewed efforts to re-skill and up-skill. Further improving access to childcare, along with a more equal sharing of parental leave between parents, could give an additional boost to female employment and reduce the second-highest gender wage gap in the OECD.

Growth is projected to slow as the economy hits capacity constraints

The economy will slow to a more sustainable pace over the projection period. Business investment is set to recover, partly with the assistance of EU structural funds, including the construction of Rail Baltica from 2020. As the economy slows and temporary inflationary effects from higher excise duties fade, inflation will stabilise. However, supply constraints are already affecting the economy, and there is a risk of overheating, resulting in higher-than-projected wage and price inflation and a further loss of price competitiveness. This could be particularly challenging to Estonia in an environment of weakening global demand. Money laundering revelations also hold the potential to cause some volatility in the banking sector.

Metadata, Legal and Rights

https://doi.org/10.1787/b2e897b0-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.