Outlook and prospects of job creation

Key facts

-

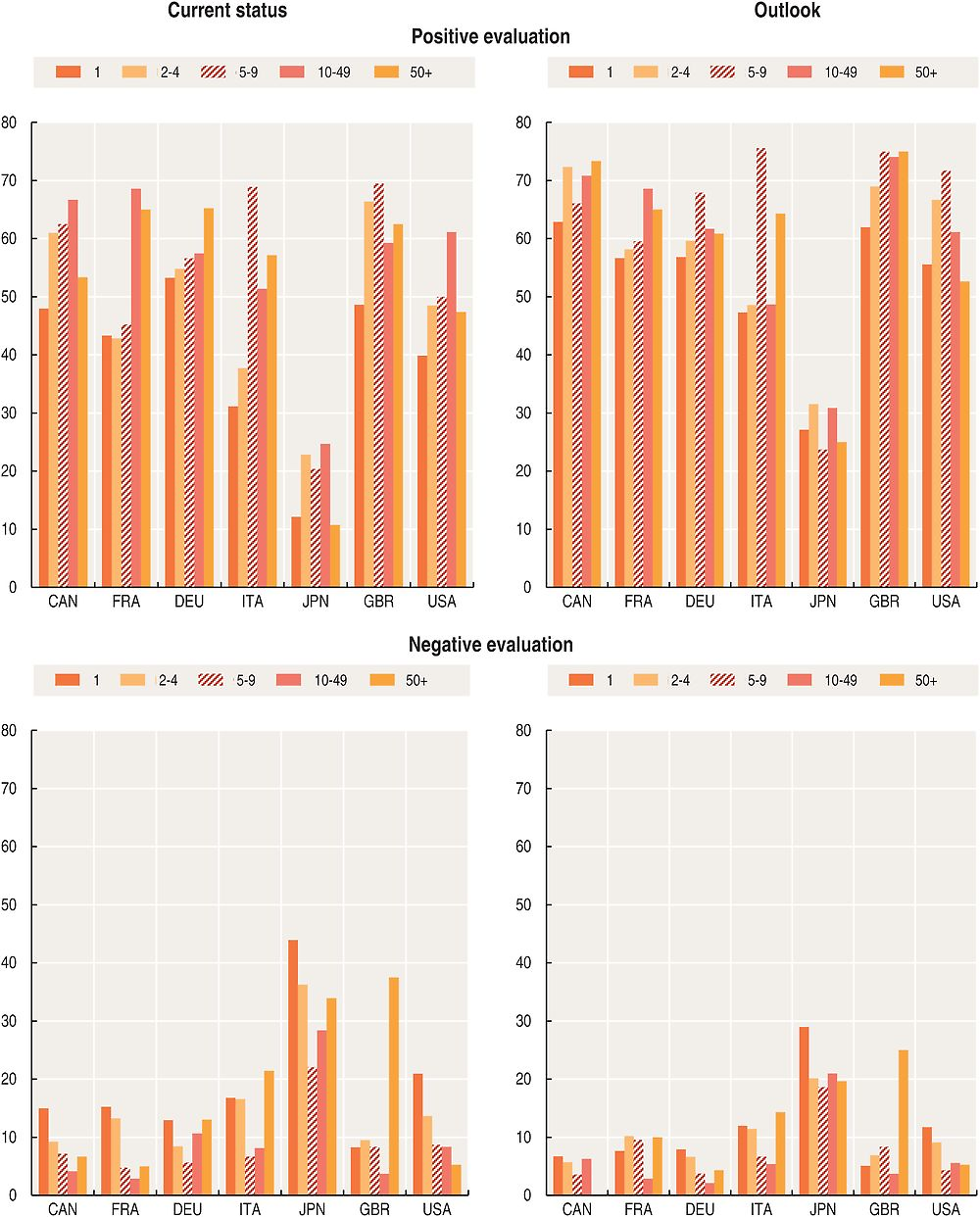

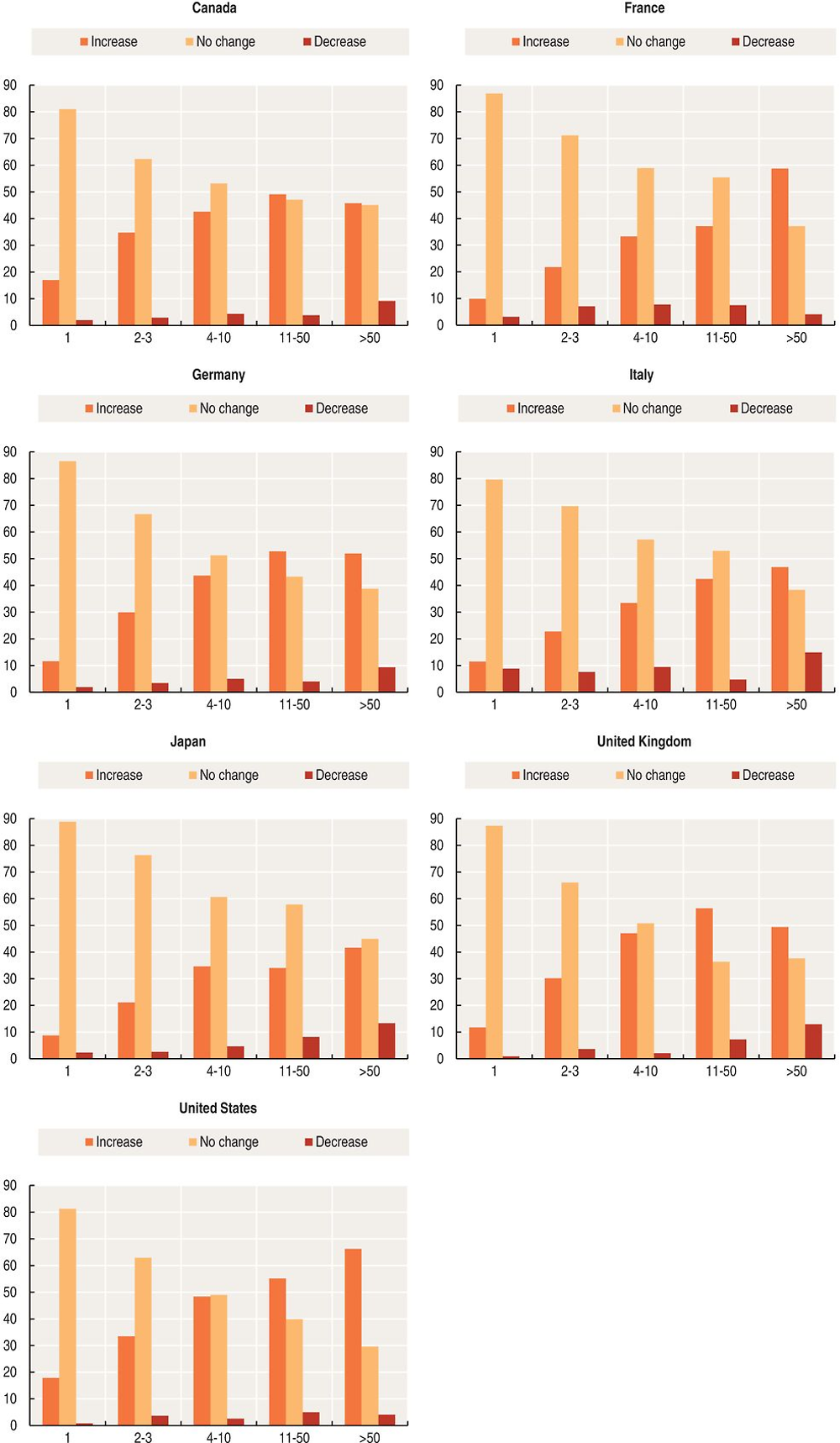

Across countries and over time, micro enterprises typically have a less positive evaluation of their current or future situation than do larger firms. Cultural as well as economic factors help to shape responses, with Japanese firms of all sizes scoring the lowest of all G7 countries in positive assessments and highest for negative assessments. Of note, given that the survey period began five months prior to the UK Referendum on European Union membership, is the significantly higher negative assessments of UK firms with 50 or more employees, than those made by smaller firms.

-

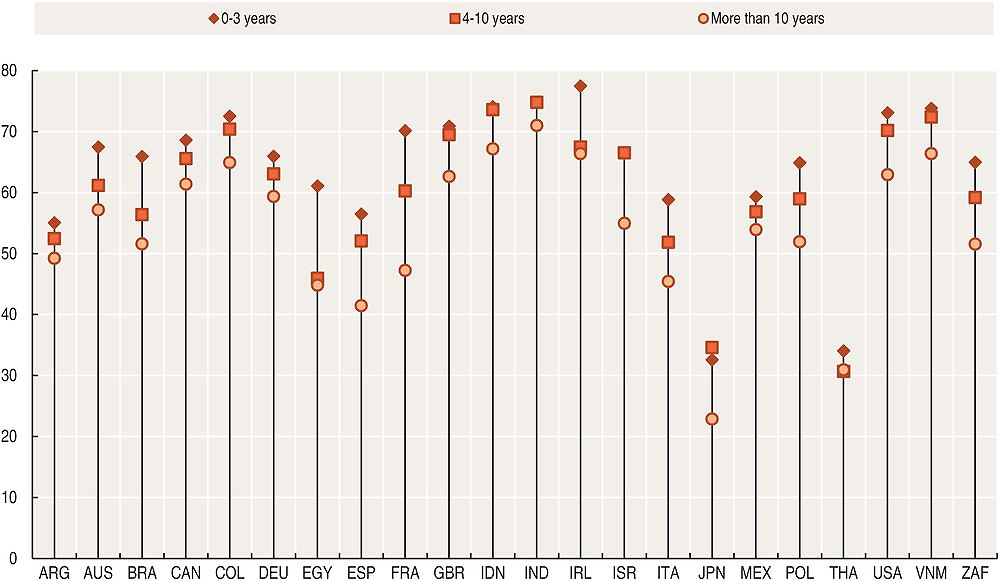

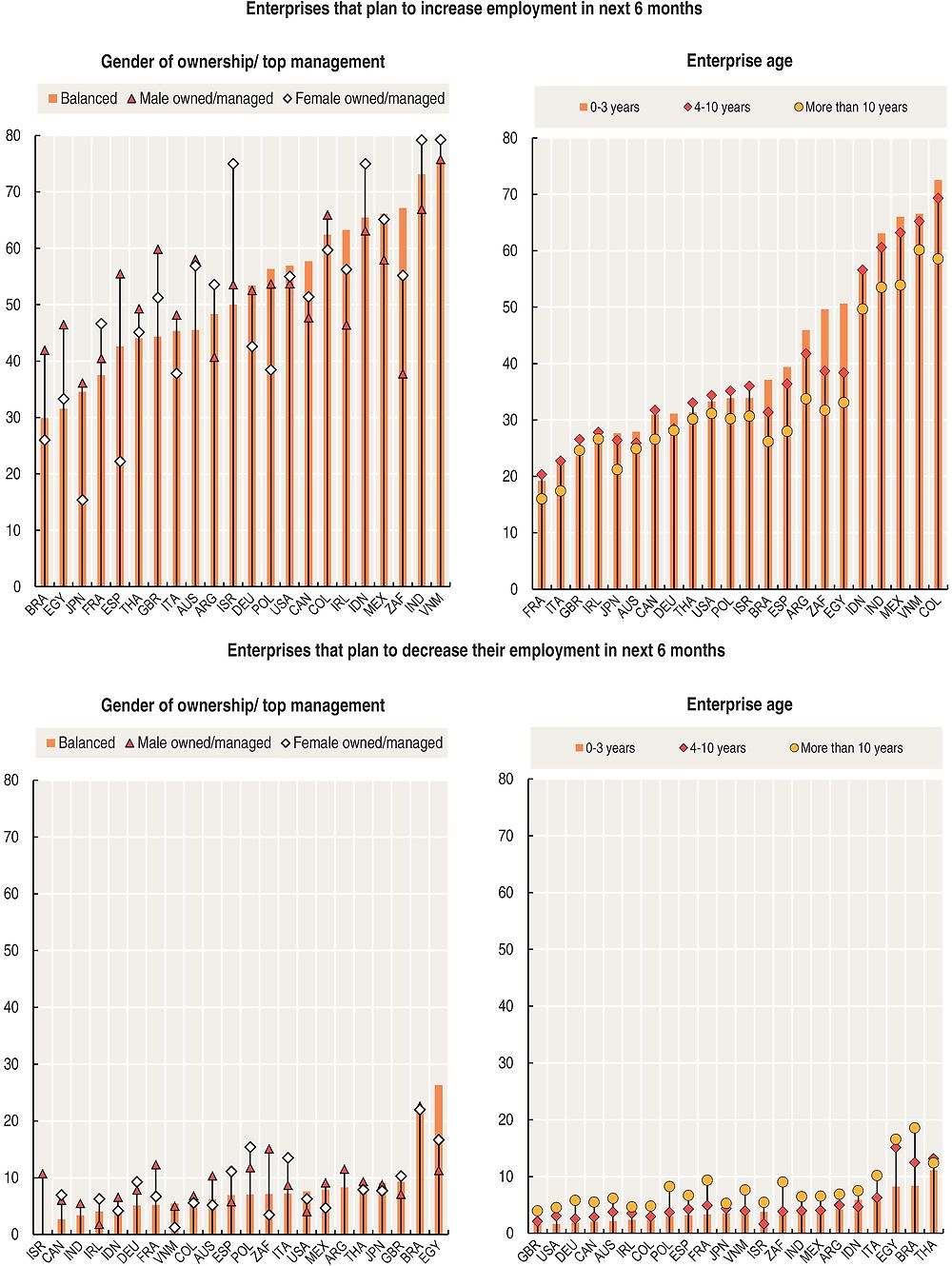

The age of a firm also has an influence on expectations. Young enterprises are significantly more positive about the short term, and have higher expectations about job growth, than do enterprises more than 10 years old, especially in emerging economies such as Colombia, India and Viet Nam.

-

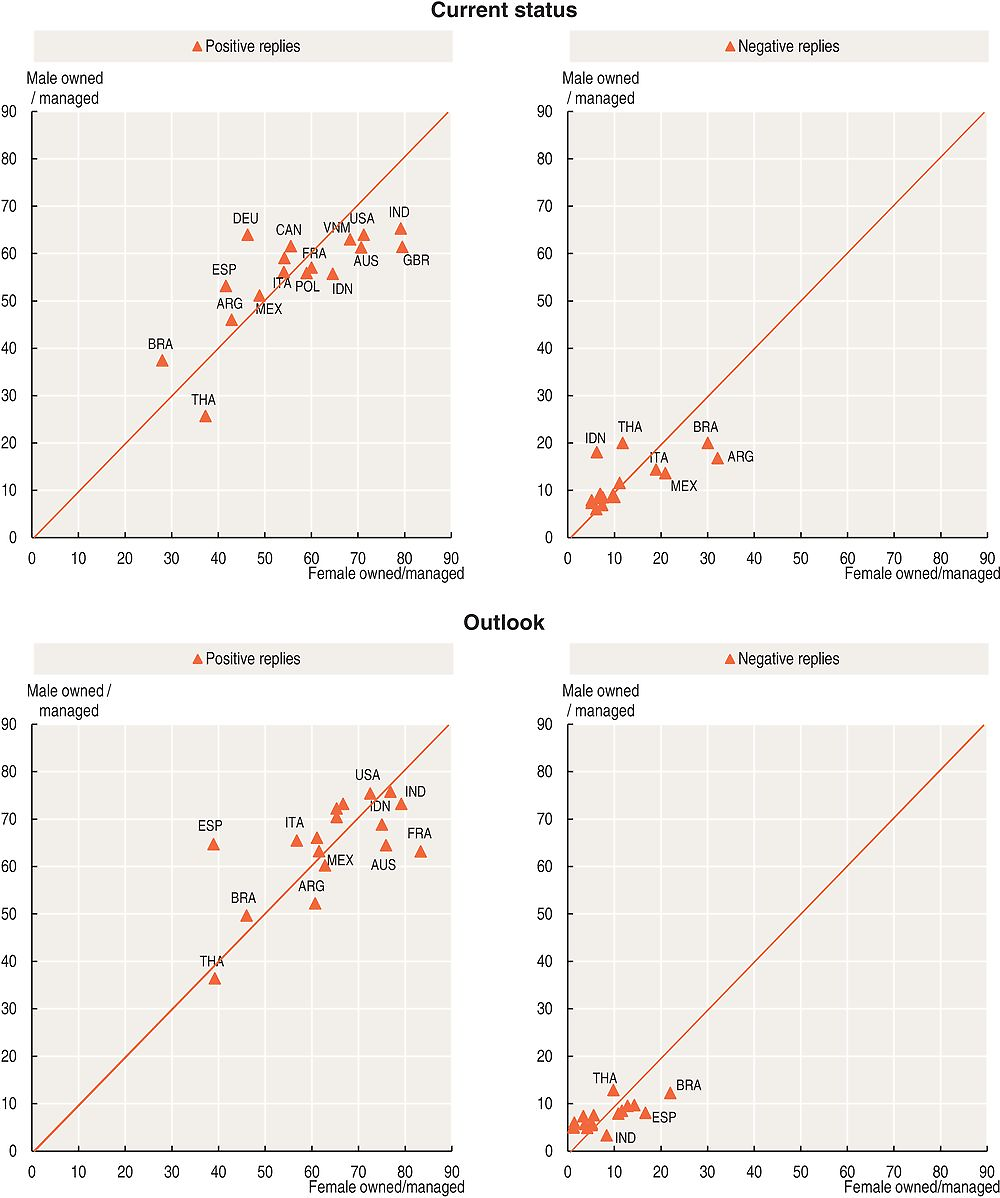

Despite the gender gap in perception of barriers in setting up a business (as seen further in Chapter 7), women feel equally confident as men about their business and its future, once it is up and running.

-

Around half of firms with 50 or more employees in G7 countries (two-thirds in the United States) expect to increase employment in the latter half of 2016, a significantly greater share than that of micro enterprises (between 10% and 20% for self-employed firms). However, in general, large firms are much more likely to shed jobs in the latter half of 2016 than smaller firms: around 15% of large firms in Italy and 10% in the United Kingdom and Canada.

-

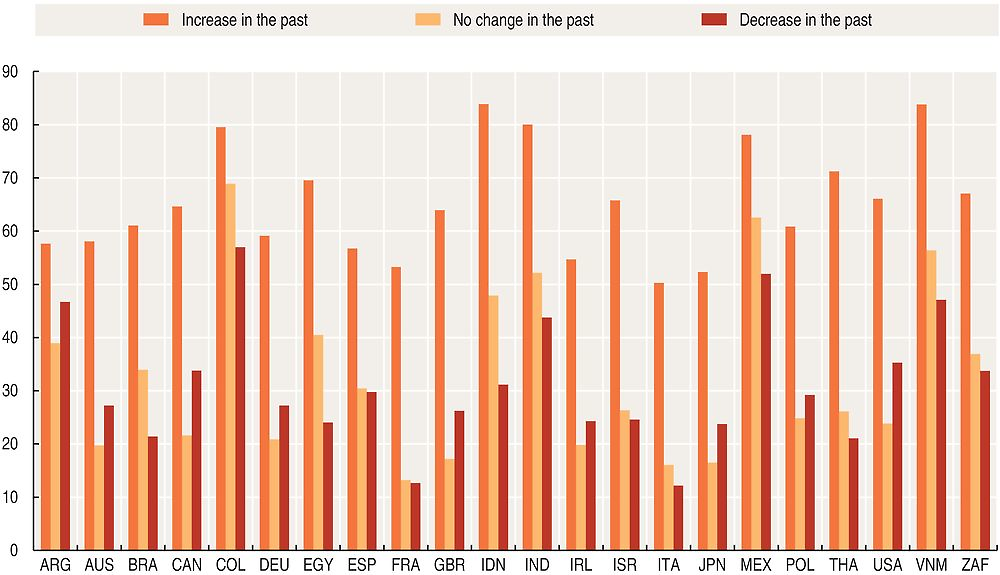

Past success is a useful indicator of future expectations. The highest shares of “positive employment outlook” in the latter half of 2016 are found among enterprises, of all sizes, that have already increased employment in the previous six months.

Current status and Outlook respectively report the reply (“Positive”, “Neutral” or “Negative”) to the questions: “How would you evaluate the current state of your business?” and “What is your outlook for the next 6 months on your business?”.

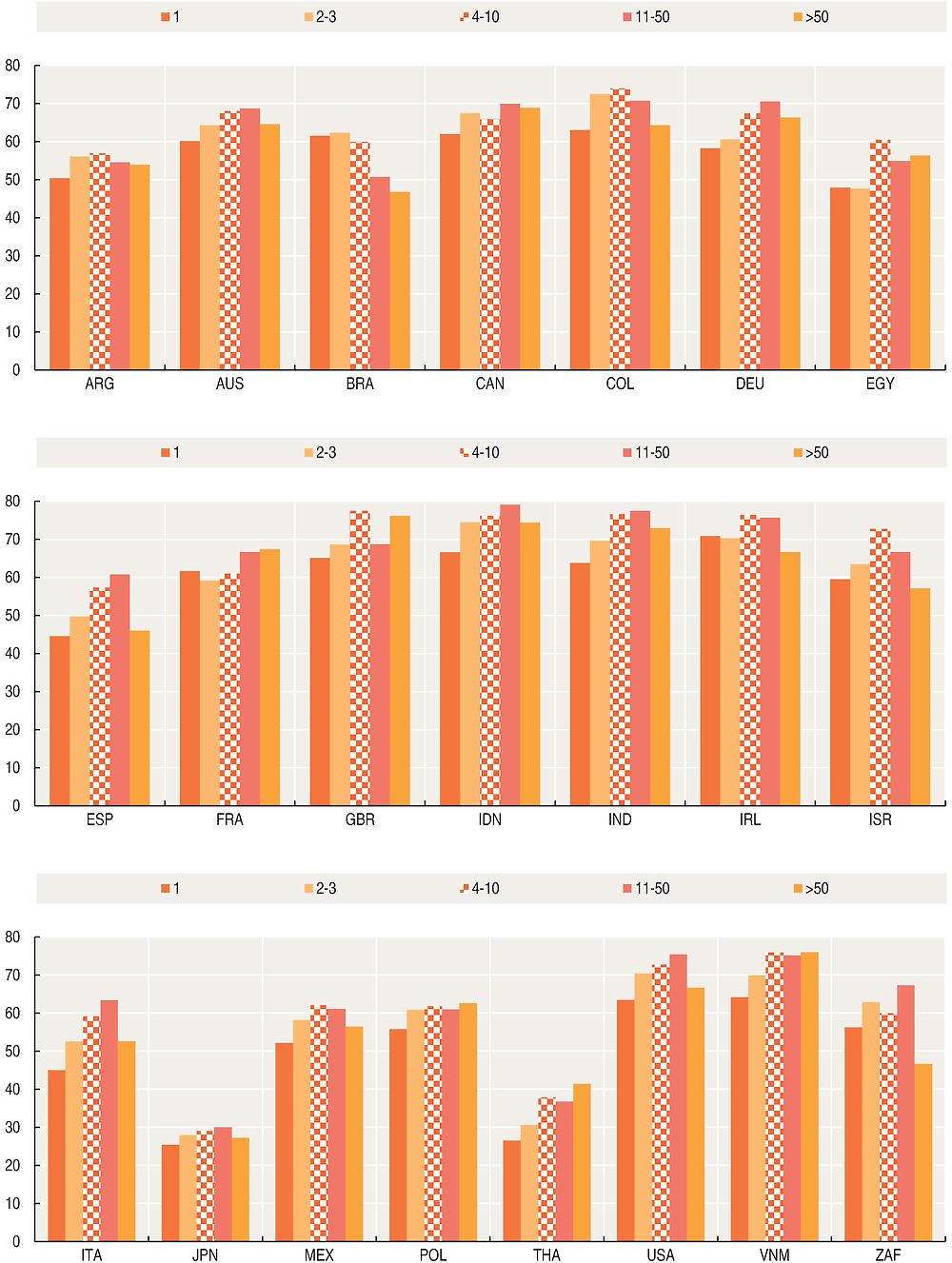

Prospects of job creation in the short-term are measured responses (“Increase”, “No change” or “Decrease”) to the question “How do you expect the number of employees in your business to change in the next six months?”.

Male (female) managed/owned enterprises are identified as enterprises having at least 65% of male (female) owners or top managers. Balanced management of an enterprise refers to firms where neither gender constitutes 65% or more of ownership or top management.

Relevance

Entrepreneurship is an important determinant for achieving sustainable and inclusive growth, and has significant potential for creating further jobs beyond self-employment. Prospects of job creation by the business sector are not only contingent on the economic cycle, but also depend on characteristics of the enterprises.

Comparability

Data are drawn from the first six waves (February to July 2016) of a new monthly survey of enterprises, the Future of Business Survey, conducted by Facebook in collaboration with the OECD and the World Bank. The survey is administrated via an online questionnaire enquiring about perceptions on the current state and future outlook of the firm, and more broadly of the economy and relevant industry; granular information on enterprise characteristics such as age, size and involvement in international trade is also collected. The survey currently covers 22 countries, where the reference population are enterprises with a Facebook account. Country samples are not stratified, and figures in this section present unweighted data with respect to enterprise size, age and economic activity of enterprises (see also Reader’s Guide). In Figures 1.6, 1.7 and 1.11, for July 2016 data, the class size 2-3 refers to 2-4; 4-10 refers to 5-9; 11-50 refers to 10-49; and more than 50 refers to 50 and more.

Source

Facebook Future of the Business Survey, www.futureofbusinesssurvey.org.

Further reading

OECD (2003), Business Tendency Surveys. A Handbook, OECD Paris Publishing, https://www.oecd.org/std/leading-indicators/31837055.pdf.