India

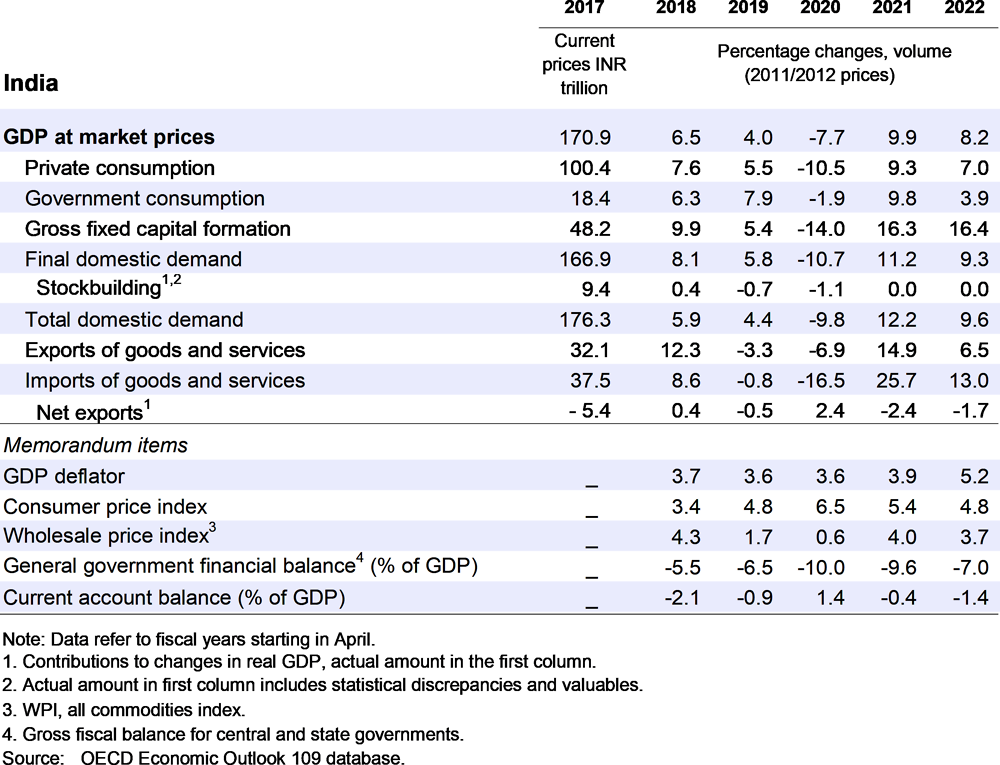

After the 2020 huge GDP contraction, economic growth is projected to bounce back in 2021, driven by pent-up demand for consumer and investment goods, before declining in 2022. The dramatic infections upsurge since February has weakened the nascent recovery and may compound financial woes of corporates and banks. As public anxiety over the virus spreads and lockdowns multiply, high-frequency indicators suggest that a marked slowdown may have taken place in the April-June quarter, although the overall annual impact is likely to be muted. Wholesale and retail inflation rates remain elevated, but within the target range of the central bank.

The damage that COVID-19 continues to inflict on the poor makes it necessary to prioritise policies that reduce scarring effects, in particular for children that have been out of school for months, and increase investment and employment opportunities. The banking sector remains fragile, although the proposal to create an asset recovery company and the planned privatisation of two public banks testify to the authorities’ commitment to reforms. The healthy foreign exchange reserves position should provide sufficient buffers to deal with any potential external shock-driven capital-stop or outflows in the period ahead.

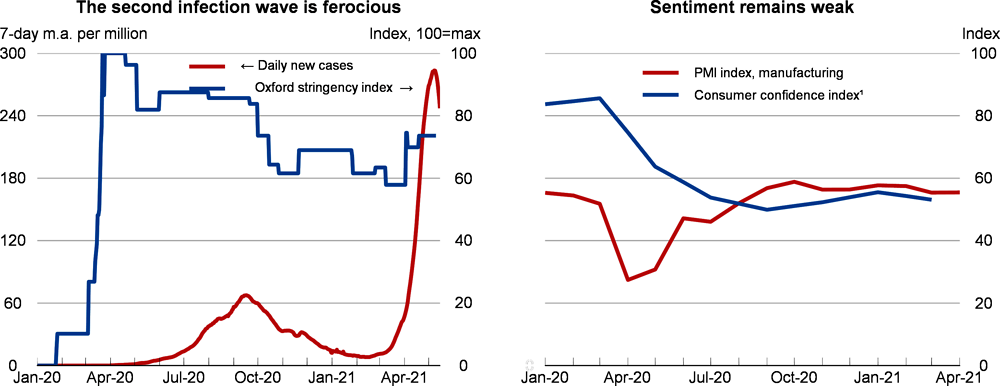

The second wave of the virus hit hard

India’s new confirmed COVID-19 virus infections have risen very rapidly, from a daily minimum of 13 000 cases in late January to more than 400 000 in early May. Although about 20% of the population is estimated to have antibodies, a rapidly transmissible strain doing the rounds, laxity in the application of social distancing and chronic underinvestment in public health make the situation calamitous. Localised containment measures have been reinstated and are impacting mobility, but a new nation-wide lockdown is unlikely. The inoculation rollout is slow, with domestic take-up far below the pace needed to meet the goal of vaccinating 300 million people by August. The National COVID-19 Vaccination Programme that has come into effect in May 2021 could help close that gap, notably by increasing vaccine supply and opening access to anybody beyond the age of 18.

The resurgence in infections is delaying the recovery

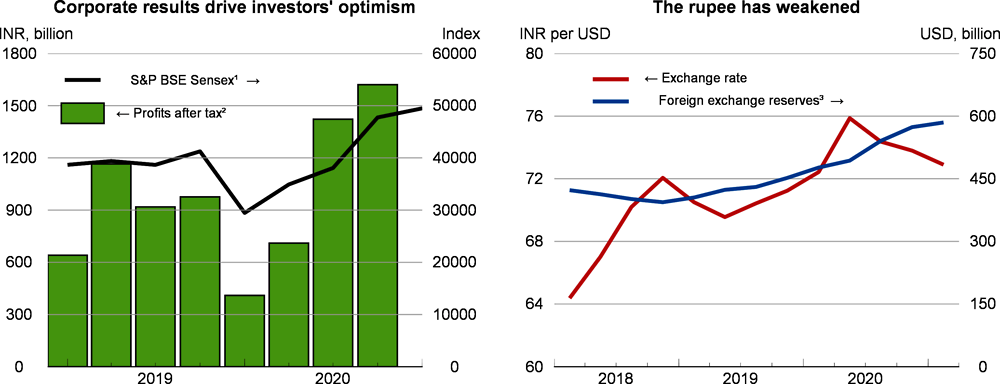

Domestic demand has been on the mend since mid-2020 and near-term prospects were improving until recently. The Purchasing Managers’ Index points to a recovery of the economy, with recent readings stable at levels above the medium-term average. Merchandise exports and imports surged to record levels in March. Financial markets have attracted considerable foreign portfolio flows, reflecting global trends and sound results, at least for large corporates. Foreign exchange reserves remain close to the all-time record level registered in January, reflecting the central bank’s strategy to build a buffer to tide over any possible impact of the unwinding of the anti-pandemic measures taken in advanced economies.

Even before the new COVID-19 flare up, some weaknesses were emerging, especially in services where demand remains well below normal. Recent mobility data, including freight rail traffic, as well as non-mobility indicators such as electricity consumption and e-way bills generation, indicate weakening recovery momentum. The unemployment rate was volatile in the six months to March 2021, before rising in April, and city lockdowns are spurring waves of return migration to rural areas. Inflation fears are mounting, stoked by prices of vegetables growing fast due to supply-chain disruptions and the firming of fuel price.

The policy mix is evolving

In 2020, monetary easing, supportive financial regulation and fiscal support were deployed to counter the recessionary effects of the lockdown. Policy fine-tuning is now underway in each area. According to the 2021 Union Budget, the central government deficit is expected to fall to 6.8% of GDP, from 9.5% in FY 2020-21, with conservative assumptions of nominal GDP growth and revenue. Most of the improvement is cyclical. Following the steep increase in FY 2020-21, the overall public debt-to-GDP ratio is set to fall marginally to 93% in FY 2021-22. So far this year, the RBI Monetary Policy Committee has kept the repo rate unchanged at 4%, while signalling its intention of maintaining an accommodative stance as long as necessary. Given risks surrounding the pace of the recovery, the central bank is projected to delay any rate increase to mid-2022. The cash reserve ratio was increased to 4%, while significant sovereign bond purchases have been announced.

Some structural reforms are envisaged. An asset reconstruction company and an asset management company will be set up to take over existing stressed debt and manage and dispose impaired assets. The privatisation programme is to be accelerated – including two public sector banks and one general insurance company – although the difficulties in concluding the long-delayed sale of Air India suggest that the goal of obtaining USD 24 billion (0.8% of GDP) this year is ambitious. The reform of agriculture markets, aimed at supporting synergies between farmers and agribusiness, has been halted as negotiations between government and farmers’ organisations remain suspended. The proposal to allow industrial conglomerates to own banks and participate in privatisation, on the other hand, should be considered with great caution.

There are various downside risks on the horizon

India is projected to be the fastest-growing G20 economy in 2021 – but also the one which is the furthest away from its pre-crisis GDP trend. Pent-up demand for consumer durables and exports of manufacturing goods and services will act favourably, but other components will be far less supportive. Notwithstanding the pressing need to upgrade physical and human infrastructure, as well as increased allocations for capital expenditure and the expansion of production-linked incentives scheme to sectors other than large-scale electronics manufacturing, weak investment is set to persist. Profit margins in the banking sector are likely to decline, in particular for state banks that may see both impaired loans and credit costs soaring, following the lifting of moratorium relief to borrowers. Input-cost pressures may push inflation outside of the policy target band.

Serious scarring risks for individuals and firms call for appropriate policy actions

In 2020, poverty and informality increased and the ranks of the middle class plummeted, in both cases undoing several years of progress. Other negative consequences of the pandemic have been the surge in the number of school dropouts, heightened child malnutrition due to the suspension of the cooked meal programme, and of the mid-day school meal scheme in particular, and more than 150 thousand estimated additional child and maternal deaths. Better targeting of energy and fertiliser subsidies, as well as an overhaul of tax expenditures, would free resources for pro-poor fiscal policies. Several states have either recently adopted or are contemplating polices to reserve private sector jobs for local residents, but absorbing more than 10 million young Indians who join the labour market each year requires first and foremost a pick-up in job-generating investments. Improving the business climate will be crucial. With the share of banking assets that are non-performing expected to shoot up well above 10%, it will be especially important to apply the 2016 bankruptcy code in a consistent, transparent and fast way.