Germany

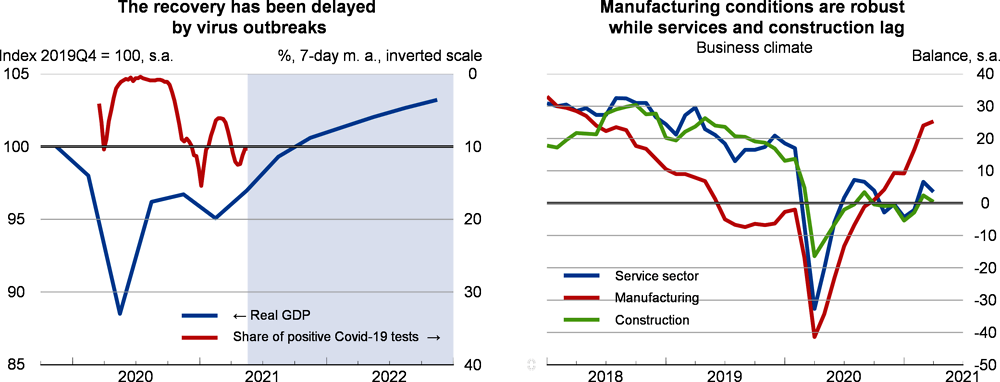

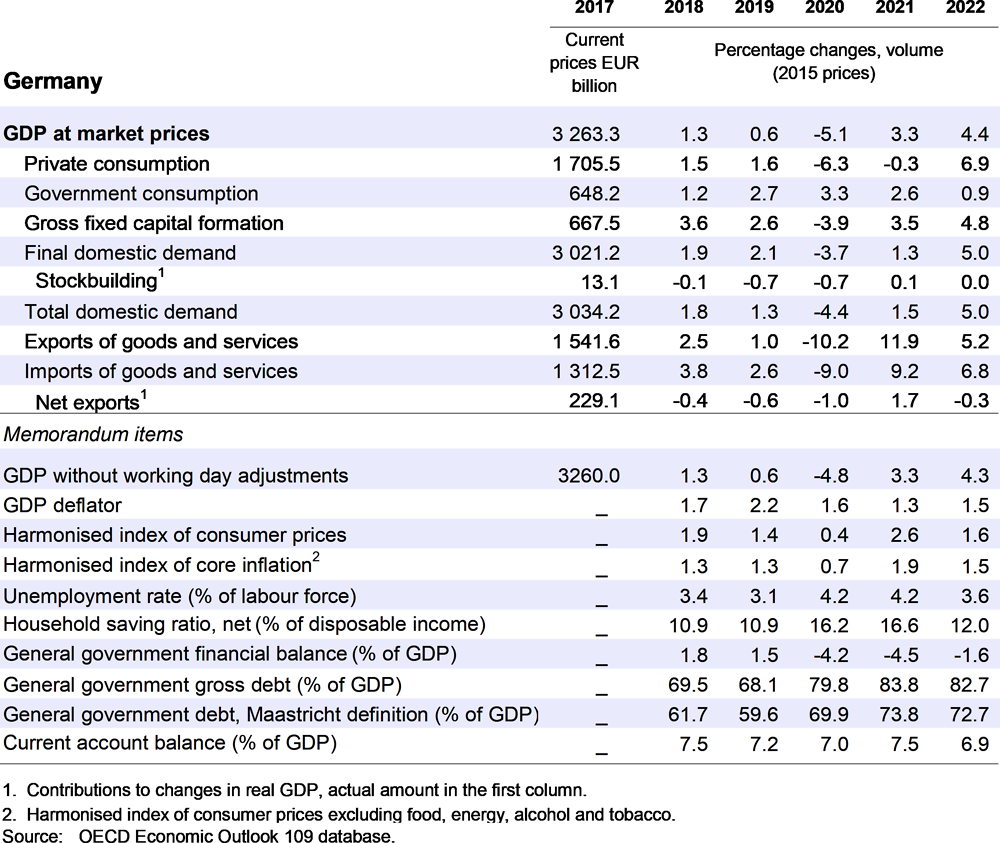

Economic growth is projected to reach 3.3% in 2021 and pick up further to 4.4% in 2022. Virus outbreaks and associated containment measures have delayed the recovery in services, while the export-focused manufacturing industry is growing strongly despite some supply-chain disruptions. Vaccination will enable a progressive reopening of the domestic economy.

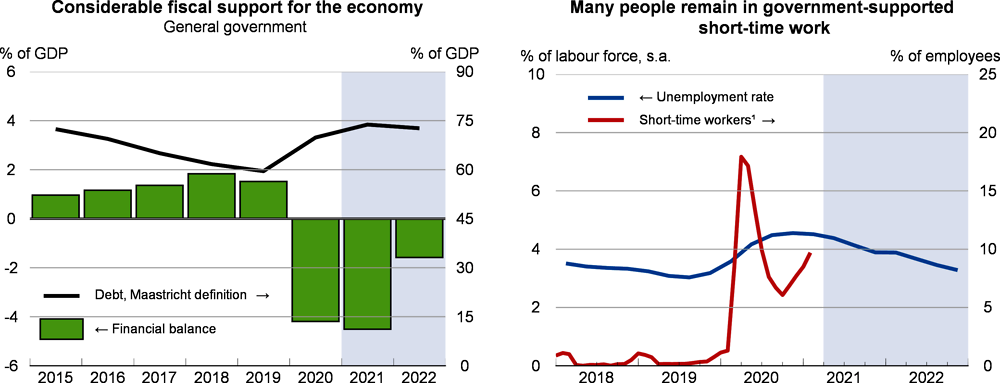

Expansionary fiscal and monetary policies are supporting growth in 2021, but a swifter implementation of government investment plans is needed to maximise the benefits. The rollout of vaccines should continue to be accelerated through coordination between federal and state authorities. Expanded short-time work moderated the increase in unemployment during the crisis, but reabsorption of those on short-time work will slow the decline in unemployment. Training will become increasingly critical as the economy recovers and structural challenges from the energy transition, digitalisation and an ageing population become more pressing.

COVID-19 outbreaks have delayed the reopening of the economy

Virus containment measures were extended over the winter due to the emergence of more contagious variants. Easing of restrictions began in some regions from mid-February, including the reopening of some schools and non-essential retail outlets, with considerable variation across states. Reopening was paused as new case numbers increased during March and April. In April, the federal government was given more power to enforce containment measures in regions where the incidence of new infections exceeds nationally determined thresholds. Progress in vaccination had lagged the European Union as a whole, but stepped up in April. Targeted vaccinations – for example for primary teachers and day-care workers – will support reopening of some critical sectors.

Manufacturing is booming while services and construction lag

The export-focused manufacturing industry has benefited from strong global demand, with export orders exceeding pre-crisis levels and industry expectations at their highest level in over a decade. Business survey data show manufacturing output increasing strongly in the first half of 2021 despite some supply-chain disruptions, notably semiconductor chip shortages affecting the automotive industry and shortages of shipping containers. The service sector is being held back by further circulation of the virus and containment measures, with quarterly average mobility reaching a new low during the first quarter of 2021 and recovering only slowly thereafter. Retail sales in January and February 2021 were even lower than in March and April 2020, but recovered by 7.7% in March. Construction activity has been held back by unfavourable weather and the expiry of the temporary VAT rate cut in early 2021, but underlying demand and capacity utilisation remain strong.

The labour market has been resilient, with unemployment basically flat over the winter. The number of people in government-supported short-time work increased to 3.27 million in February 2021, still well below the peak of 6 million in spring 2020. Just over half of short-time work notifications over the winter were in services heavily affected by containment measures: wholesale and retail trade, accommodation and food, culture, entertainment, recreation and other personal services. Wage pressures are muted across the whole economy, with negotiated wage increases falling to 1.5% on average in early 2021 after ranging between 2% and 3% over the prior decade. Consumer prices increased sharply in the first quarter of 2021 due to a number of temporary factors: supply-chain disruptions, increased commodity prices, statistical effects of changing consumption weights during the crisis, and the end of the temporary VAT rate cut.

Expansionary fiscal policy is supporting growth

Budgetary support was much smaller than planned in 2020, due to resilient revenue and less expenditure. Further stimulus is planned for 2021 through support for firms affected by containment measures, bonus payments for families, expanded short-time work until the end of 2021, a cap on social security contributions and investment in digitalisation, education, health and green infrastructure. Financing has been ensured through the approval of EUR 240 billion (6.9% of GDP) in new federal borrowing in 2021 and suspension of the debt brake rule again in 2022, with EUR 80 billion (2.3% of GDP) of new borrowing approved for that year. Much new borrowing in 2021 is unallocated and tax revenue has begun to recover, so a smaller-than-planned budget deficit is again likely. EU Recovery and Resilience grants will be used to tackle climate change, enhance digitalisation, strengthen healthcare and reduce barriers to investment. Highly accommodative monetary policy by the European Central Bank is also supporting aggregate demand.

The authorities have taken steps to sustain credit and avoid bank deleveraging through a reduction of the countercyclical capital buffer and other supervisory measures. Survey data suggest that there has nonetheless been some tightening of banks’ lending policies for SMEs. The expected increase in corporate insolvencies after policy support subsides is likely to increase pressures on Germany’s banks, which are relatively unprofitable and have medium to high leverage, though the central bank has assessed this as manageable in part due to capital buffers increasing after the global financial crisis. The German government is developing an action plan to strengthen financial regulation in the wake of two high profile insolvencies.red

A strong recovery is on its way

The key driver of economic growth will shift from external to domestic demand in the second half of 2021 as vaccination becomes widespread and the economy reopens. The combination of strong manufacturing activity and resurgent services and construction is projected to result in a strong rebound in GDP growth in the third and fourth quarters. Consumption will be supported by a reduction in currently high saving, though normalisation is expected to be gradual as additional savings have been concentrated among high-income groups with a low marginal propensity to consume. Quarterly consumer price inflation is set to ease as temporary factors dissipate, before reduction in spare capacity sees a more gradual and durable upturn during 2022. Reabsorption of short-time workers will slow the fall in unemployment, particularly in early 2022 when expanded government-supported short-time work comes to an end.

The biggest risk to the outlook is new virus variants or slow progress with vaccination, which would delay the reopening of the economy, particularly for services requiring in-person contact. Enduring supply constraints affecting manufacturing could threaten the synchronised upturn foreseen in the second half of 2021. A sharp rise in corporate insolvencies and stress in real estate and financial markets could result in banks restricting lending, delaying the economic recovery. Conversely, a more rapid normalisation of saving or full use of approved government borrowing would see faster growth.

Delivery of vaccinations and fiscal plans would support well-being

Continuing to accelerate the vaccination rollout is critical to protect against the virus and allow a return to normality. Strong coordination between federal and state authorities is needed to deliver vaccines efficiently as supply increases. Delivery of fiscal stimulus plans is important to support a sustainable recovery, particularly investment needed for digitalisation and the energy transition. Steps should be taken to ensure spending is implemented so that fiscal support is received when it is needed. For infrastructure investment, this means further steps to resolve local planning and construction industry constraints through more funding to municipalities, streamlining planning processes and cooperation between government agencies. Increasing the generosity of research and development tax relief and venture capital funding would help support the growth of innovative firms. To improve inclusion and address gender imbalances in digital environments, computational thinking should be introduced earlier and training for teachers increased to ensure effective use of digital technologies in schools.