Executive summary

Making growth stronger and more inclusive

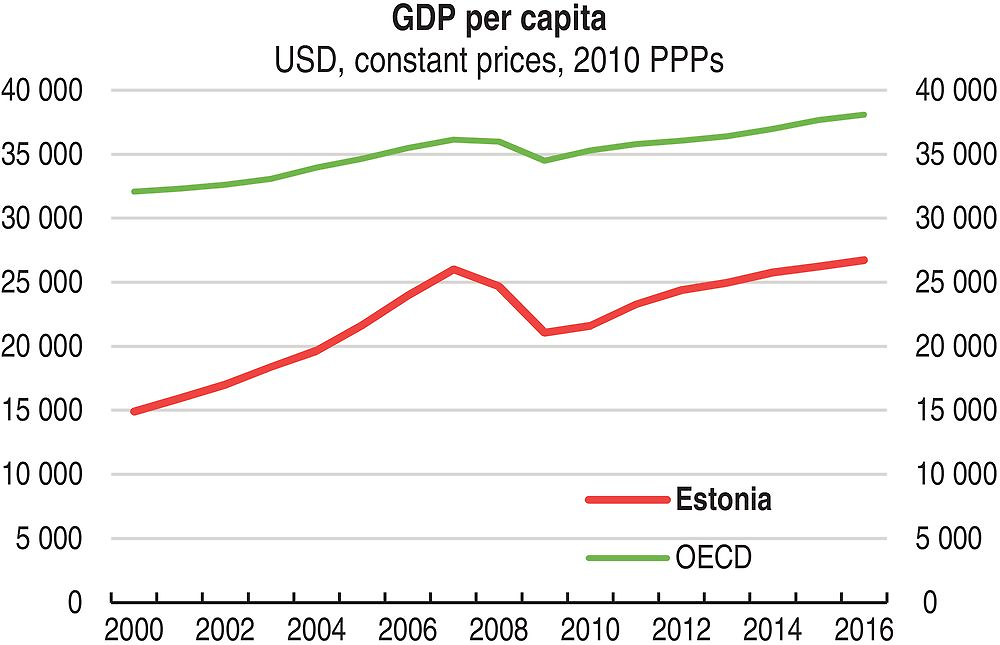

The Estonian economy displays numerous strengths, including an excellent business environment, high educational attainment, high labour market participation, an innovative ICT sector and solid public finances. Economic growth has disappointed in recent years but is now gaining momentum. Around a quarter of the population is still at risk of poverty. Fiscal room is available for measures to increase the long-term growth potential and to make growth more inclusive. Strengthening social protection and life-long education is a priority, as it will help the most vulnerable adapt to the rapid changes induced by globalisation and technological progress.

Source: OECD National Accounts Database.

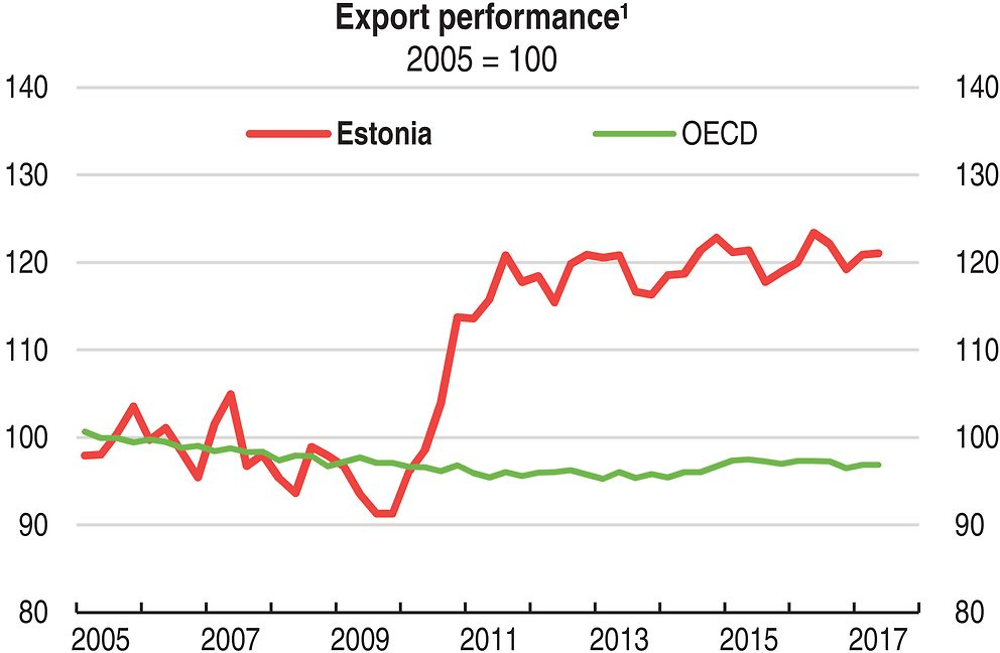

Deepening integration in global trade

Estonia is well integrated into global trade, and export performance has been resilient. Low and medium value added products still account for a large share of total exports. To increase export potential and value-added drawn from trade, innovative capacity and transfer of knowledge from highly productive firms to the rest of the economy need to improve. Efforts should concentrate on strengthening adult education, immigration of talents, and co-operation between businesses and researchers.

1. Export performance is measured as actual growth in exports relative to the growth of the country’s export market.

Source: OECD Economic Outlook 101 Database (updated with information available on 1 September 2017).

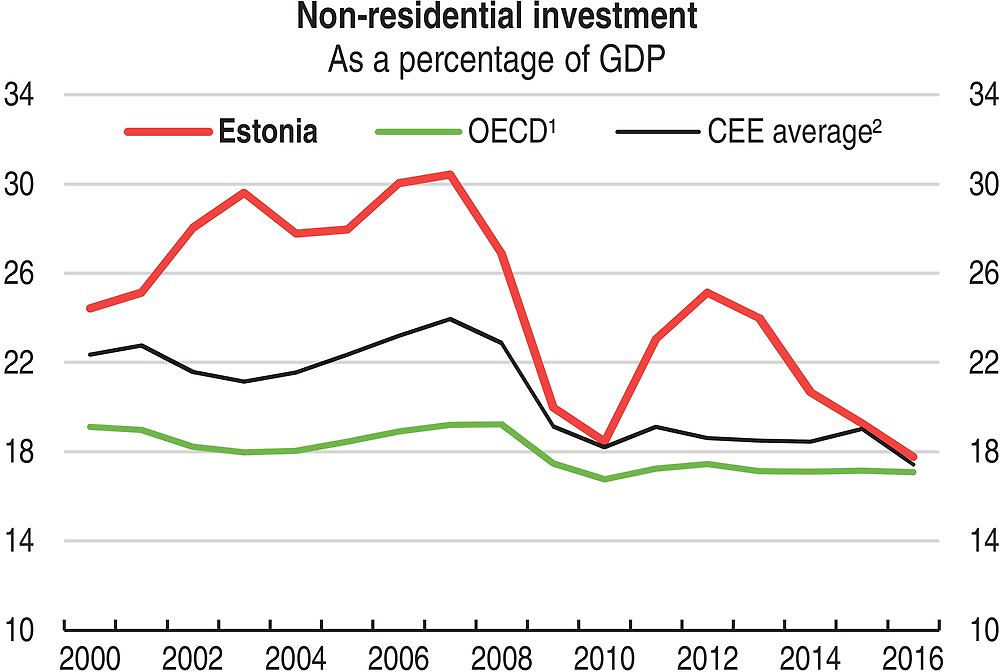

Unleashing productive investment

Investment has weakened, particularly in projects required to increase business productivity. Skill shortages prevent business expansion in some sectors and investment in knowledge-based capital. Weak credit recovery from insolvent firms can limit funding of small innovative firms. The quality of infrastructure has improved, but bottlenecks in logistics remain. Green investment is needed to reduce pollution emitted by the oil shale industry and to achieve energy efficiency gains.

1. Simple average of OECD available countries.

2. Simple average of Czech Republic, Hungary, Latvia, Lithuania, Poland, Slovak Republic and Slovenia.

Source: OECD Economic Outlook 101 Database (updated with information available on 1 September 2017).