Chapter 1. Boosting investment performance1

Non-residential investment has fallen over the past 20 years as a share of GDP and is now lower than in several other high-income OECD countries. Business investment growth has been weak since the outbreak of the global financial and economic crisis. Government investment has been low, especially at municipal level. Investment in knowledge-based capital (KBC), which is closely related to long-term productivity performance, has been subdued. Weak growth prospects in the euro area have weighed on business investment and an increasing share of firms invests in distant, more dynamic markets. Policies that strengthen stability and growth prospects in the euro area would raise the attractiveness of Germany as a location to invest, notably steps to strengthen the single market and cross-border infrastructure, and complete the banking union. Steps to liberalise regulation of services, in particular knowledge-intensive professional services, would raise investment and productivity. Policies that encourage the reallocation of resources would also increase investment in KBC. Poor municipalities invest relatively little and there is scope to lower the cost of public investment projects. Better use of e-governance and more performance-oriented budgeting could improve the efficiency and effectiveness of public investment.

Policies to strengthen business and public investment can boost productivity and wellbeing

Business investment and public investment have weakened over time and this chapter analyses some driving forces. Investment is a key determinant of productivity, growth and well-being, but the challenges in sustaining momentum have increased in recent years. Policies to eliminate barriers to the development of knowledge-intensive services and the reallocation of resources would foster the transition to a more dynamic economy. Stronger growth prospects in the euro area would also have benefits for investment activity in Germany. As a key player in the euro area, Germany’s support for collective action to strengthen confidence in euro area growth is needed. Steps to identify and address public investment priorities in Germany would also improve conditions for further business investment, and can make growth more socially inclusive.

Non-residential investment has weakened

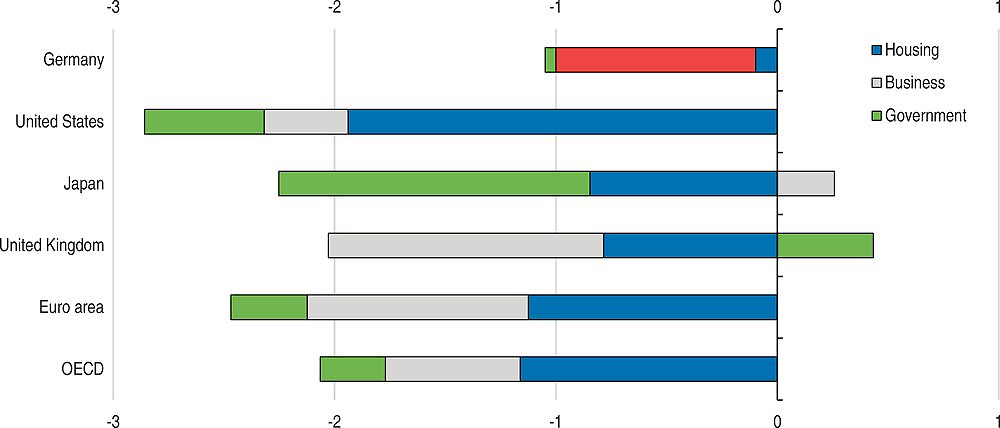

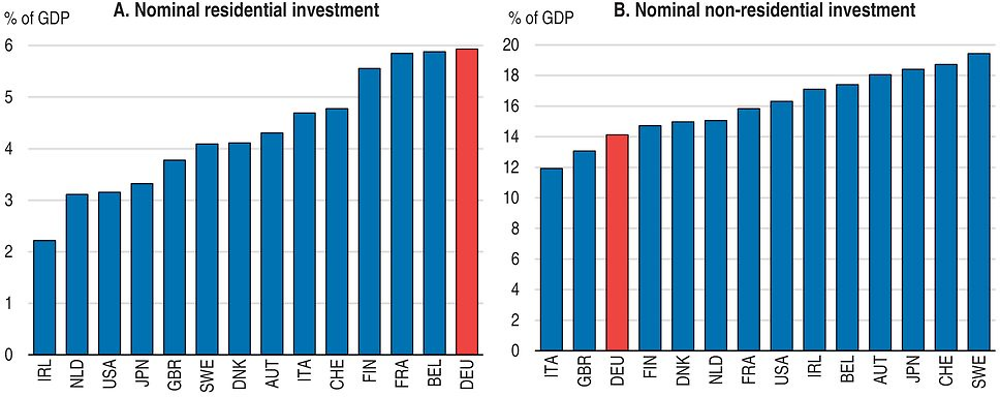

The global financial and economic crisis depressed non-residential investment as it did in the euro area or the United Kingdom (Figure 1.1). But in Germany, this has occurred despite a stronger macroeconomic and financial recovery, high business profitability, strong balance sheets and higher rates of capacity utilisation. Non-residential investment spending as a share of GDP is modest in international comparison (Figure 1.2).

← 1. Average of investment shares in GDP from 1996 to 2007.

Source: OECD (2015), OECD Economic Outlook 97 Database and Eurostat.

Note: 2013 for Japan and Switzerland.

Source: OECD (2015), OECD National Accounts Database.

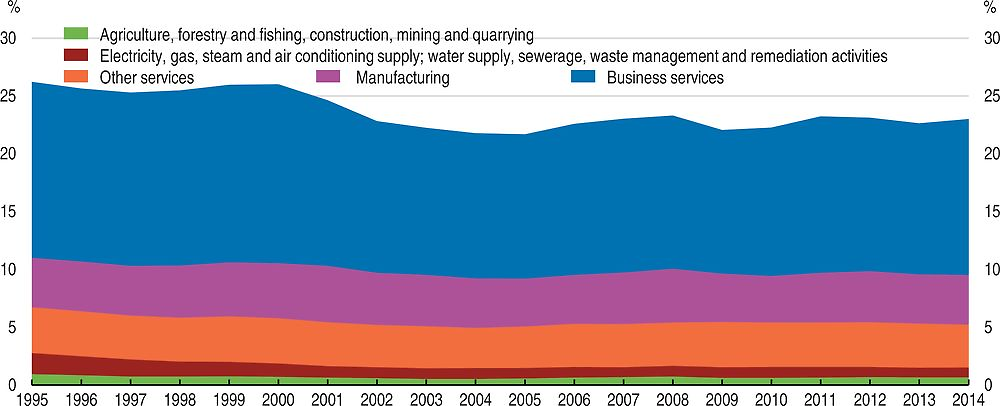

The share of business investment in value-added has fallen the most in business services, which accounts for most of business investment (Figure 1.3). German manufacturing firms have renewed their capital stock more slowly than manufacturing firms in the UK and the US. This observation applies to a broad range of subsectors (Gornig and Schiersch, 2015).

Note: Investment includes only new fixed capital goods. It excludes adjustment for net sales of used capital goods.

Source: OECD (2015), OECD National Accounts Database.

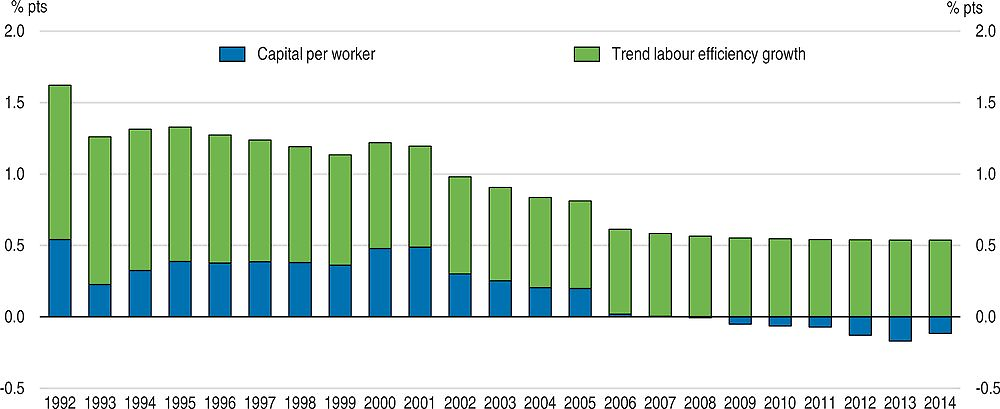

Lower spending on non-residential investment, in international comparison or over time, does not necessarily imply less growth of the capital stock, as investment goods prices and depreciation rates of installed capital may vary across countries and over time. In particular, prices for capital goods have fallen markedly over the past 30 years. ICT investment has become more important and comprises hardware and software that require frequent updating and replacement. In Germany, the contribution of the accumulation of net non-residential fixed capital to productivity growth has diminished over the past 10 years (Figure 1.4). Among OECD economies, Germany is one of few where the growth contribution of non-residential investment to productivity growth has been negative (OECD, 2015a). Non-residential construction capital and information and communication (ICT) capital growth, notably in software and databases, have been particularly weak in international comparison (Table 1.1).

Source: OECD (2015), OECD Economic Outlook 98 Database.

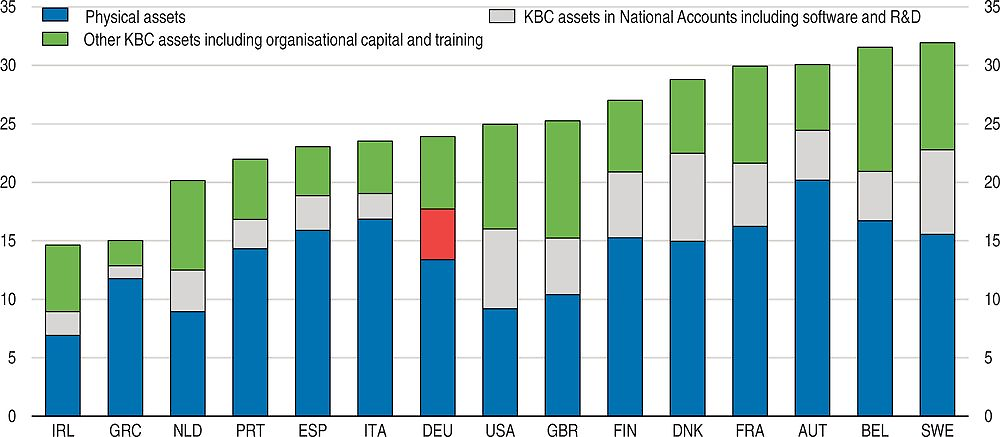

Weak non-residential investment could reflect substitution from traditional physical capital to intangible forms of capital (“knowledge-based capital”, KBC; Box 1.1). In many OECD countries, investment in KBC has risen more strongly than investment in physical capital (Andrews and Criscuolo, 2013). While business expenditure in R&D in Germany is relatively high compared to other OECD countries, investment in KBC, which also includes spending on other intangible assets, is lower than in leading high-income OECD economies and has grown little over time (Figure 1.5). Spending is low on ICT-related KBC (software, databases), intellectual property, organisational capital and training.

Knowledge-based capital (KBC) encompasses all assets that lack physical substance but, like physical capital, generate economic benefits that can be retained by firms at least to some extent, for a period that exceeds one year (OECD 2015h).

KBC is classified into the following three main categories, following Corrado et al. (2009):

-

Computerised information includes software and databases. This is already recorded as investment in the national accounts as a part of gross fixed capital formation.

-

Innovative property comprises research and development (R&D) which is recorded in the national accounts definition of investment, mineral exploration and artistic originals, new architectural and engineering designs and new product development in financial services. Spending on the latter is estimated from the compensation of high-skilled workers in the financial sector industry.

-

Economic competencies comprise firms’ human and structural resources such as firm-specific training, brand equity, and organisational capital. Investment in firm-specific human capital is estimated from firms’ expenditure on training and education. Investment in brand equity is estimated from spending on advertising and market research. Finally, organisational capital is estimated from managers’ compensation and the gross output of the business and management consultancy industry. The estimation of organisational capital involves particular uncertainty given that countries differ substantially in managers’ compensation systems and the extent to which firms rely on external consultancy in their management decision.

Some KBC assets are included in the national accounts definition of investment, notably R&D, software and databases. Components of KBC that are not recorded in national accounts include investment in design, new financial products, advertising, market research, training and organisational capital.

Source: OECD (2015), OECD Science, Technology and Industry Scoreboard 2015: Innovation for growth and society.

KBC is an important determinant of long-term productivity growth. It has been estimated to account for one-fifth to one-third of labour productivity growth in the market sector of the US and EU economies (Andrews and Criscuolo, 2013; Corrado et al., 2013). Investment in knowledge capital boosts productivity especially strongly in countries closer to the technology frontier, such as Germany. For example, manufacturing firms that exhibit a higher level of software investment generate more patents per R&D dollar, and their investment in R&D is more highly valued by equity markets (Branstetter et al., 2015). These also generate global productivity spillovers (Dabla-Norris et al., 2015). Investment in several KBC components, notably business processes or organisational structure (“organisational capital”), are particularly important sources of productivity growth in many services (Dabla-Norris et al., 2015). Investments in KBC, notably in organisational capital also tend to boost the productivity of physical assets, notably in ICT goods, thereby encouraging investment in such physical assets (Andrews and Criscuolo, 2013; Chen et al., 2014).

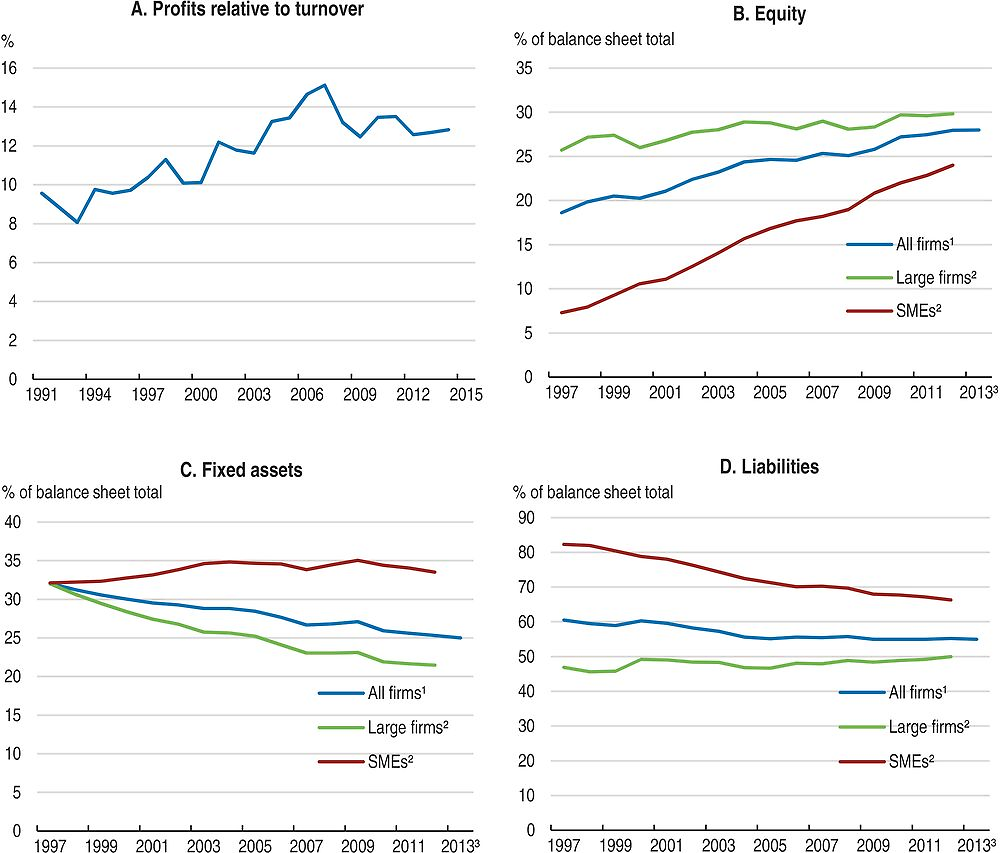

Weaker demand is the main explanation of weaker business investment

Funding conditions are favourable for business investment. Indeed, profitability is historically high. The retention of profits has resulted in continuously rising equity buffers (Figure 1.6). High levels of retained profits are typically a strong boost to investment (Schiantarelli, 1996). The outbreak of the euro area sovereign debt crisis in 2010 turned Germany into a safe haven, driving long-term real interest rates to historically low levels, below those in other euro area countries. The share of firms reporting limitations in access to external funding remains historically low. The tax-induced cost of capital fell significantly as corporate tax burdens were reduced in 2001 and 2008 (Spengel et al., 2014). So it would appear there’s not a lack of funds, but rather a lack of appetite to commit these funds to investment projects.

1. Large firms are defined as having sales of EUR 50 million or more. Small and medium-sized enterprises (SMEs) are defined as having sales below EUR 50 million.

2. Estimate in 2013 for all firms.

Source: Deutsche Bundesbank, National Account Statistics for Panel A and “Extrapolated results from financial statements of German enterprises from 1997 to 2013”, Corporate Financial Statements Tables for Panels B-D.

Weak demand growth can explain to a large extent why business investment has been weak following the outbreak of the global financial and economic crisis, including in Germany (OECD, 2015a). This weakness could have a lasting effect on the capital stock. Indeed, episodes of marked demand weakness can have lasting effects on the capital stock when investment decisions are costly to reverse. For example, firms may not reverse decisions to abandon markets after a period of weak demand (e.g. Dixit, 1992). Weak demand conditions in geographically close export markets, notably in the euro area, are particularly important for domestic investment as these markets can best be served with domestic production. This is confirmed by gravity models, which highlight the importance of geographic proximity for trade (e.g. Boulhol and de Serres, 2008). In addition, the long lasting reduction of economic activity in European emerging markets weighs on investment intentions of German export oriented companies.

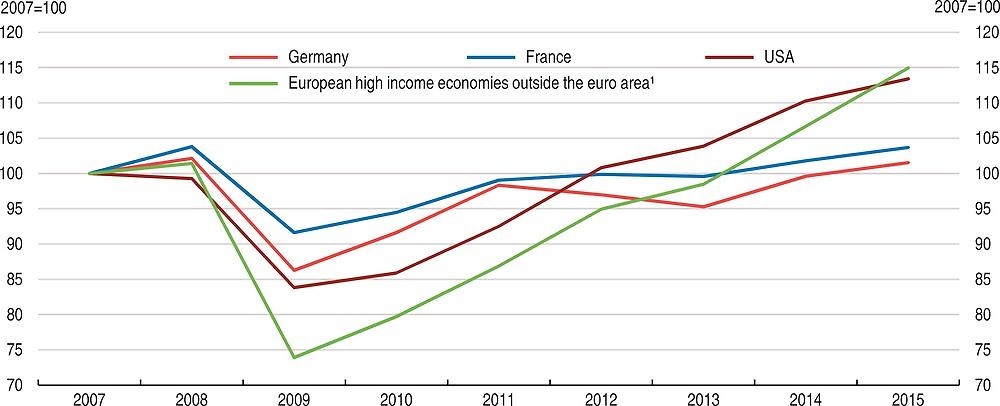

The shift in demand to more distant markets appears to have attracted investment by German firms in these markets. According to a survey of German business leaders (DIHK, 2015), the share of German industrial businesses intending to invest abroad has risen from 42 to 47% since 2008, especially in East Asia and the United States, and they have raised the volume of their fixed investment abroad. Most firms invest abroad to serve foreign demand better, and this share has increased considerably. According to the same survey only 23% of firms invest abroad to benefit from lower costs. This share remains close to historic lows. Weak investment in other euro area countries may also have weighed on investment in Germany because of the geographic integration of value-added chains within the euro and the common exploitation of the knowledge-based assets. Indeed, investment in multinational firms which integrated through value-added chains makes investment across countries complementary to each other (OECD, 2015a). Business investment has been particularly weak in euro area countries, including Germany, since 2011, contrasting with the United States and European economies outside the euro area (Figure 1.7).

1. Includes Denmark, Sweden, Switzerland and the United Kingdom. They are weighted on the basis of investment spending in 2011.

Source: OECD (2016), OECD Economic Outlook: Statistics and Projections (database), and OECD calculations based on OECD Economic Outlook: Statistics and Projections (database) and on Main Economic Indicators Database.

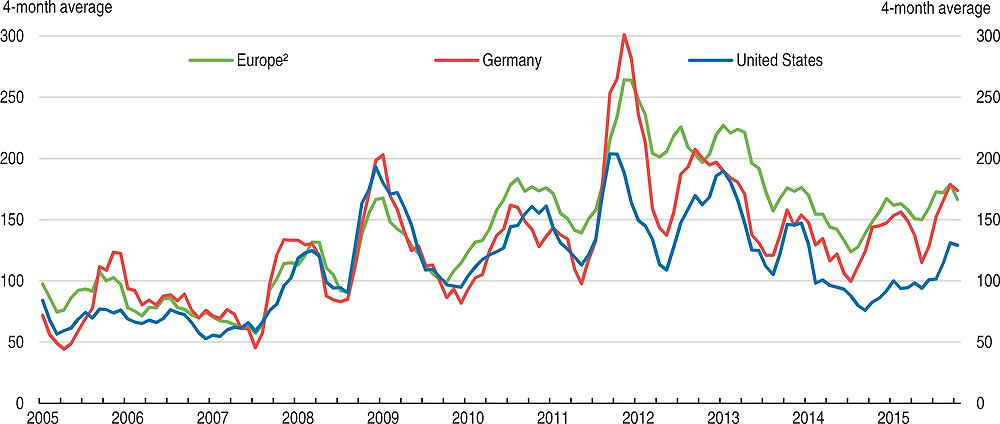

Uncertainty exacerbates the impact of weak demand on investment. It gives agents an incentive to postpone or cancel their investment decisions. In particular, new investment decisions will be the lower the stronger the downside tail risks are (OECD, 2015e, Dixit and Pindyck, 1994). A recently developed news-based index of policy-induced uncertainty rose strongly between 2010 and 2012, especially in European economies, including in Germany, with the eruption of the euro area debt crisis (Figure 1.8). This suggests that euro area developments have been an important driver of increased uncertainty. Higher uncertainty, as measured by this index, has been estimated to have lowered investment across OECD countries (OECD, 2015a), even though the index does not provide a precise measure of uncertainty. A substantial effect of policy uncertainty on investment has been estimated for Germany (Federal Ministry for Economic Affairs and Energy, 2013), even after controlling for the effect of general business confidence. Policy uncertainty in Germany can explain the weakening of investment in 2012. However, the German production of investment goods is used as a proxy for investment, which may also capture the response of foreign investment on uncertainty. A study by the association of German co-operative banks (BVDR, 2013) concludes that the increase in uncertainty in 2011 lowered equipment investment in Germany by 4-6%. Estimates by Deutsche Bundesbank, 2016) suggest that uncertainty may have lowered investment in Germany after the outbreak of the global financial and economic crisis in 2009 and after the outbreak of the euro area debt crisis in 2012 and 2013. Since 2007, German non-financial businesses have raised equity buffers, liquid financial assets and stocks, whereas they have reduced fixed assets and short-term financial liabilities (Hüther, 2014). This observed increase in liquidity raises flexibility and makes companies more resistant to shocks as well as more independent from external financing.

← 1. Index constructed by drawing on two newspapers per country through the count of articles containing the terms uncertain or uncertainty, economic or economy, and one or more policy-relevant terms.

2. Average of ten European newspapers from France, Germany, Italy, Spain and the United Kingdom.

Source: Economic Policy Uncertainty (www.policyuncertainty.com).

European-wide efforts to bolster growth would also strengthen investment in Germany

Policies that strengthen stability and growth prospects in the euro area would raise the attractiveness of Germany as a location to invest. Germany should therefore continue to support efforts to improve growth prospects in the euro area, notably steps to strengthen the single market and cross-border infrastructure, and complete the banking union. These steps will strengthen long-term growth, reduce the risk of financial crises, and strengthen crisis management. Contagion, triggered by capital outflows, played a major role in propagating uncertainty within the euro area (de Grauwe, 2013). To reduce the scope of such contagion effects, currency areas have developed institutions which provide emergency liquidity support. Germany will benefit from a further deepening of the banking union in the euro area through a reduction in uncertainty, which will help to support demand, and in particular business investment.

Weak demand growth cannot fully explain why investment spending is especially low in Germany. Recent empirical research suggests that cross-country differences in cyclical positions, as well as in structural features, including employment, demography and the sectoral structure, do not appear to explain why investment in Germany is relatively low (DIW, HRI, 2014). These findings suggest that there is scope for improved structural policies to boost investment in Germany. The following sections examine several key areas.

Econometric and case study evidence indicates that the relative utilisation of more-skilled workers is positively correlated with capital intensity and the implementation of new technologies at the firm and industry level. Such complementarity seems to be particularly marked for ICT investment and with respect to cognitive and soft skills. Increased computer intensity is associated with increased employment shares of managers, professionals and other highly educated workers (Katz and Autor, 1999). The supply of new skills through the entry of young workers to the labour market is diminishing as a result of population ageing, making life-long learning a key instrument to improve skills. This is discussed in Chapter 2.

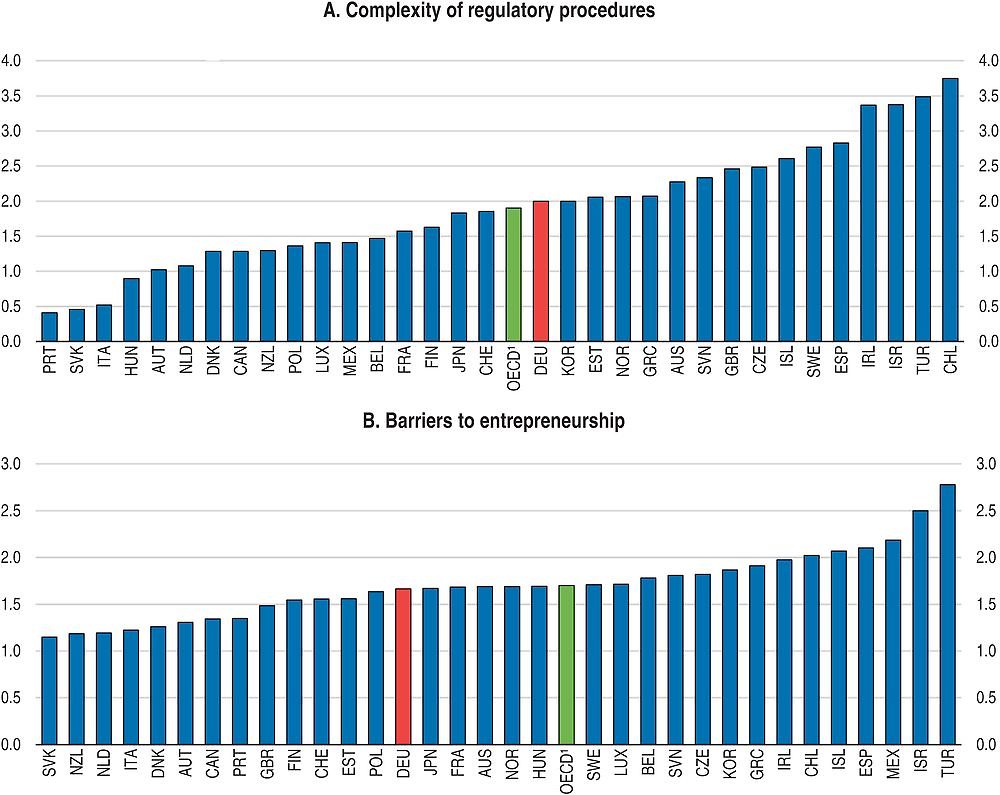

Removing barriers to competition strengthens investment

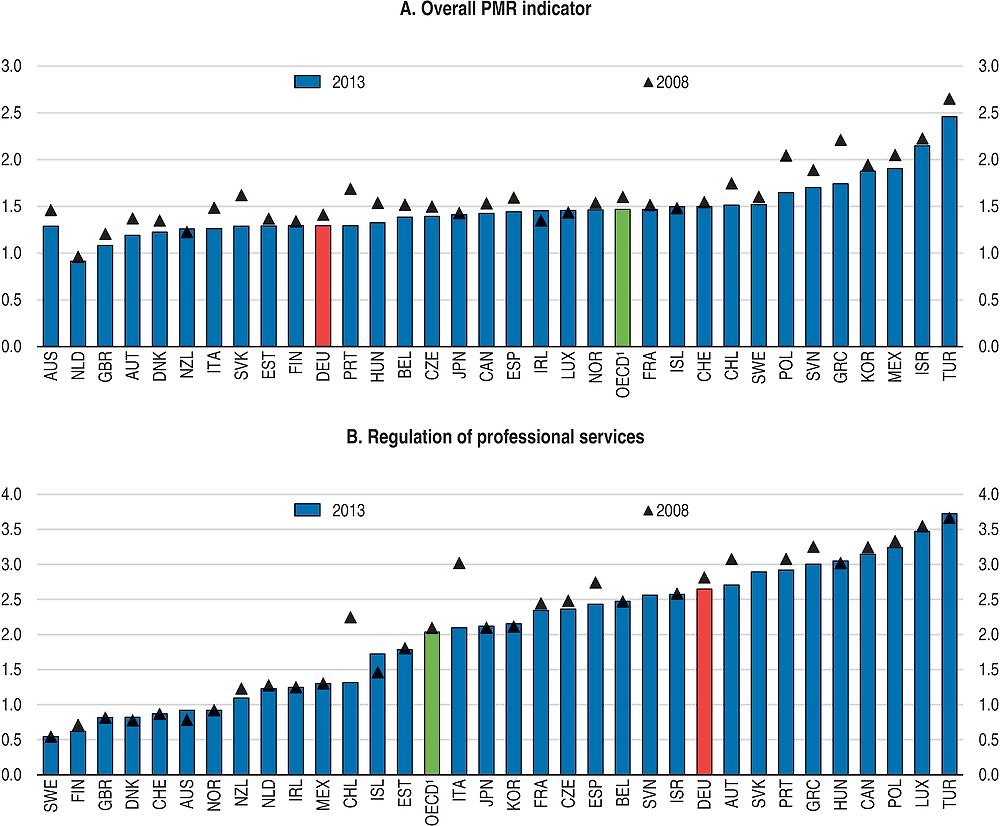

Relaxing product market regulation which harms competition or market entry stimulates business investment and innovation and thereby productivity. More intense competition encourages the adoption of improved management practices and related investment in KBC (notably organisational capital). Such improvements raise the productivity of physical capital, notably in ICT, which encourages ICT investment. The resulting productivity gains are substantial (Bloom et al., 2012). Regulation restricting entry also damps investment in physical capital (IWU, 2015; Alesina et al., 2005; Nicoletti and Scarpetta, 2005). While Germany has made much progress in reforming product market regulation in general over the past 15 years, regulation in some services remains restrictive, especially the professional services and in some network industries (Figure 1.9; see also the OECD Economic Survey of Germany 2014, OECD, 2014c). As argued below, since these services are used as intermediate services, regulatory reform in these sectors has important benefits for productivity and investment throughout the economy.

1. Average of all OECD countries excluding the United States. For Panel B, the Slovak Republic and Slovenia are also excluded to calculate the OECD average in 2008.

Source: OECD (2015), OECD Product Market Regulation Database.

Removing barriers to competition in the services

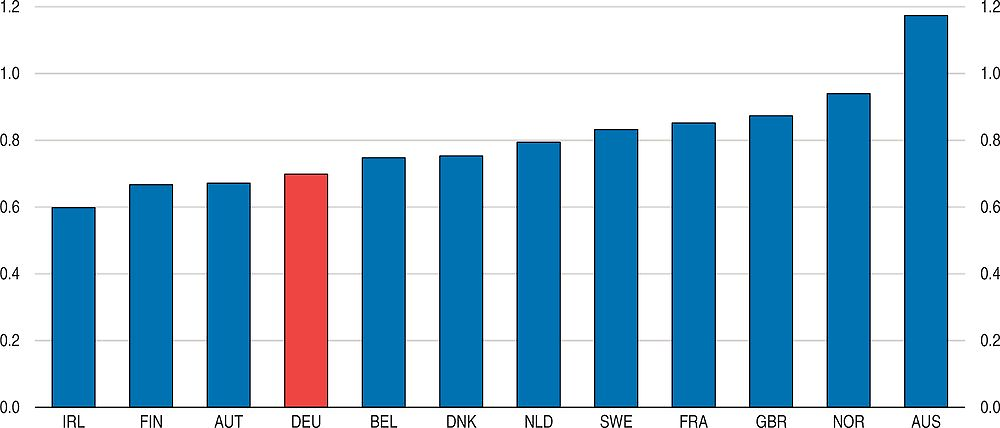

The potential for regulatory reform to raise productivity performance in the services is particularly large. While most countries have experienced substantial productivity catch-up in agriculture and manufacturing relative to the United States, productivity differences in most services across countries have remained high. Productivity gaps in the services are also particularly large at the firm level, suggesting that there is much scope to raise productivity through the diffusion of knowledge. Investment in knowledge-based capital plays a key role in the diffusion process (OECD, 2015a). In Germany, the productivity gap between manufacturing and services is particularly large (Figure 1.10). Productivity growth over the past 15 years has been low, also in international comparison (OECD Economic Survey of Germany 2014, OECD, 2014a). Investment in non-tangibles (e.g. business processes, organisational structure) are particularly important sources of productivity growth in many services (Dabla-Norris et al., 2015). In Germany in the weakness in KBC spending may be attributed to the services (Figure 1.11). In a study comparing 7 European economies, the contribution of investment in KBC to services productivity growth has been estimated to be substantially weaker in Germany than in the United Kingdom, the Netherlands, France and Austria, outperforming only Spain and Italy (Corrado et al., 2014).

← 1. 2013 for France, 2012 for Australia and the United Kingdom.

Source: OECD (2015), OECD National Accounts Database.

Source: INTAN-Invest (www.intan-invest.net).

Services contribute 70% to economy-wide value-added in Germany and are important intermediate inputs to other sectors, including for manufacturing. The domestic services content of economies’ gross exports has risen over time, underscoring the importance of open and efficient markets for services for participation in global value-added chains. Global production networks rely on business services to move goods and co-ordinate production along the value chain (Gornig and Schiersch, 2015).The purchases of intermediate services by industrial firms amount to about 12% of GDP. More productive and innovative services raise productivity in downstream sectors. In export-oriented industries, the value of services inputs relative to their value-added is particularly high. In chemicals (including pharmaceuticals), for example, it amounts to 43% (IWU, 2015). Intermediate service inputs also facilitate the diffusion of new technologies. Technology-intensive firms benefit the most from strengthening competition by reforming the regulation of business services (OECD, 2015a).

Professional services and network industry services play particularly important roles as intermediate inputs. Close to 100% of the services produced by lawyers and notaries, building engineers and architects in Germany are used in downstream sectors. In telecommunications, this share is 50%. The purchases of legal services and services of building engineers and architects by manufacturing firms amounted to close to 10% of their value added in 2010 (IWU, 2015). Past efforts to reduce barriers to competition in the professional services regulation have had important benefits for value added the economy as a whole (IWU, 2015), in particular for manufacturing. Making regulation as competition-friendly to one of the best-performing OECD country in this regard (the United Kingdom) suggests that productivity throughout the German economy could rise by 2%, and in manufacturing, by 2.3% (IWU, 2015). These productivity gains would be facilitated by stronger investment, including in KBC.

Germany ranks 25th of 33 countries in the OECD’s index of regulation in the professional services (see the 2014 Economic Survey, OECD, 2014a, for more detail). Some of the most protected professional services also report among the highest shares of profits relative to turnover, well above the economy-wide average (IWU, 2015). This reflects entry barriers and conduct regulation. The 2014 Economic Survey (OECD, 2014c) contains an extensive analysis of regulation that is harmful to competition and economic activity. In particular there are binding price regulations for notaries, architects and building engineers and lawyers (for legal representation in court). Notaries benefit from particularly extensive exclusivity rules. For example, notaries have the exclusive right for legal transactions involving the creation of a new business. This includes in particular the founding agreement. Shareholder requirements in some professional services require that the certified professionals themselves must be majority owners in their businesses. Advertising is restricted in some professional services. The limitations on shareholding and the restrictions on co-operation between different professions limit economies of scale and scope, which are a key driver for investment in KBC.

More competition-friendly regulation of the network industries would also have important benefits for productivity and investment throughout the economy. For telecommunications, the 2014 Survey pointed to the large potential for productivity gains in services and manufacturing that lies in breaking up exclusive rights of issuing SIM cards, which remains restricted to holders of mobile telephony spectrum. In postal services, incumbent and competitors need to be put on a level playing field with respect to VAT. In railway services, the implementation of an EU directive will strengthen the incumbent’s incentives to reduce infrastructure costs and broadens the range of infrastructure on which the regulator can determine access conditions. Nonetheless, limited investigative powers of the regulator, for example in market surveillance, continue to limit scope to prevent discrimination of market entrants (OECD, 2014a). Divesting government ownership in services which are subject to competition in all these industries would also boost market entry.

In 41 crafts professions, including in the construction industry (painters, plasters, bricklayers, scaffolders and installation of heating and cooling installations) and in some services (e.g. hairdressing) self-employment is restricted to holders of tertiary level vocational degrees. Alternatively, workers in these professions can open a business with a minimum work experience of six years, four of them in a managing position, in addition to the vocational education degree at the upper secondary level required to exercise the profession. These requirements raise entry barriers for self-employment. Self-regulation by sector-specific business chambers, notably in the professional services and the crafts, also risks protecting incumbents.

Fostering the reallocation of resources strengthens productivity in investment in knowledge-based capital

The gains in value that can be obtained from KBC gives rise to increasing returns to scale which makes KBC an engine of long-term growth. This is because the initial cost incurred in deploying KBC does not increase as it is combined with increasing amounts of other inputs (labour, capital) in the production of goods or services. The returns of KBC can best be exploited if other production inputs (capital, labour) are reallocated to the most productive use. For example, KBC is significantly more productive in sectors in which ICT capital is deployed intensively. Firms which invest in management (one component of KBC) also tend to undertake more physical investment (Andrews and Criscuolo, 2013; Chen et al., 2014). To exploit the potential of KBC, barriers to the reallocation of resources must be reduced. The cross-country differences in KBC reflect the fact that some countries are more successful at reallocating resources to underpin the growth of firms that invest in KBC (OECD, 2015a).

Preventing incumbent bias in policy making

Policies to avoid that incumbents’ interests disproportionately affect the design of regulation can also improve reallocation, thereby raising innovation and productivity. Germany has made significant improvements to its regulatory policy system over the last years, introducing systematic ex post evaluation of regulations in 2013. Nonetheless, the capacity of the administration should focus more strongly on the analysis of the economy-wide impacts of policies, rather than on sector-specific impacts. Germany could benefit from an independent standing capacity to regularly undertake comprehensive in-depth reviews of policy areas to inform large scale regulatory reforms (OECD, 2015j). In the Netherlands, for example, the Bureau for Economic Policy Analysis conducts analysis of economy-wide impacts of regulation for the government. In Australia, such analysis is conducted by the productivity commission.

Germany can also do more to raise transparency of lobbyists’ involvement in public decision processes. Transparency in lobbying is important to avoid partial policy decisions by forcing policy-makers to filter out self-interested arguments and allowing the public to take a well-informed view on decision-making (OECD, 2014b).

Germany discloses the contributions of lobbying in parliamentary consultations and has moved ahead of other OECD countries by creating a public list of associations representing interests vis-à-vis the federal parliament (Bundestag) or the federal government that is kept by the President of the Bundestag. This list allows stakeholders to easily access disclosed information on lobbying which also involves the executive branch of government. However, unlike other OECD countries which have created a lobbying register, the information it provides in Germany is limited. (OECD, 2014b; Transparency International, 2015). Some information, such as the lobbyist’s employer, the potential beneficiary of the lobbying activity, the government action targeted by the lobbying (such as a legislative proposal), the government department contacted by the lobbyist, government funding received or contributions made to political campaigns, is not provided. Indeed, results from the OECD 2013 Survey on lobbying showed that legislators and lobbyists across OECD countries consider such information to be important to raise transparency (OECD, 2014b). Two proven transparency tools in Germany are the Freedom of Information Act and the constitutional right of every single member of parliament to put questions to the government. More information provided by the lobbying register could be an additional tool to strengthen transparency. Steps could also be taken to improve access to information about views taken in advisory and expert groups (Transparency International, 2015). An online electronic filing system would reduce the administrative burden that would result from such steps to improve transparency and public scrutiny (OECD, 2014b).

Extensive government ownership in some business sectors risks hampering the reallocation of resources to more productive sectors or firms. For instance, publicly owned commercial banks have a market share of more than 40% in Germany. As the 2014 Economic Survey (OECD, 2014c) pointed out, the regional Landesbanken, which are mostly owned by Länder governments, have had a poor track record in the efficient allocation of credit, technical efficiency and vulnerability to solvency risk. They have provided lending to support established industries in their respective regions, which in some cases has added to financial risks and can slow the reallocation of resources to new more productive activities. Progress with privatisation is slow, as Länder governments are planning to privatise only 1 of 7 Landesbanken. Reflecting stricter risk management standards, governance has improved also in the Landesbanken, but specific governance problems for the Landesbanken resulting from regional government ownership are likely to remain (OECD Economic Survey of Germany 2014, OECD, 2014a). Further privatisation would be welcome. Steps to further improve governance might be an alternative option. Since the outbreak of the global financial crisis, the federal government has also kept a minority share in one of the large private, commercial banks.

A regional government also owns just above 20% of one of the biggest car manufacturers. Moreover, a specific law regarding Volkswagen stipulates that key business decisions require a majority of at least 80%, which effectively gives veto power to the regional government. The federal government also owns substantial shares in network industry incumbents, notably in telecommunications and postal services. Privatising these shares would help remove perceptions of conflicts of interest between the government’s role as owner of these businesses and its role as the regulator of the relevant markets, boosting market entry, competition and investment.

Fostering mobility of workers

In several ways framework conditions are supportive for geographic mobility. A well-developed private, rental housing market covering about 50% of households (one of the largest shares in the OECD) supports worker mobility (Dohmen, 2005). Rental regulation appears to strike a successful balance between the protection of tenants, owners’ rights, and responsiveness to market developments, making rented housing attractive for owners and tenants alike (de Boer and Bitetti, 2014). Residential investment is high (Figure 1.2 above) and is generally responsive to changes in demand (Andrews et al., 2011). In view of particularly strong increase in the demand for housing in the context of the refugee inflow the government is also planning to provide tax subsidies for investment in low-cost housing.

The government has recently decided to tighten rental regulation, to give powers to local authorities to limit rent increases on newly rented housing in those geographic areas where rent increases have been particularly large. This could in principle limit the supply of housing and thereby reduce mobility to regions with attractive jobs and high housing demand. However, the impact is likely to be small, provided the measures are applied to urban centers, where the supply is price-inelastic, and newly built housing is exempt from the new rules. However, generally speaking, restrictive housing regulation discourages mobility (OECD, 2015a).

High housing transaction costs raise the costs of mobility for owner-occupiers. In Germany, these transaction costs amount to around 7% of the value, more than in most OECD countries (Andrews et al., 2011), impairing mobility for owner-occupiers. Housing transaction taxes account for more than half of these costs. High costs of notary services further add to these transaction costs (see above).

Conditions are less favourable for worker mobility across jobs and firms. Stringent employment protection legislation (EPL) is associated with lower rates of job reallocation (Davis and Haltiwanger, 2014). It raises the cost of business failure, making it less attractive for firms to experiment with uncertain technologies. Seniority-based compensation for dismissal also affects voluntary job-to-job movements, as a worker who moves to another firm loses cumulated compensation rights. Compensation for unfair dismissal in Germany rises strongly with seniority, reaching 18 months of salary for a worker with 20 years of tenure compared with an OECD average of 12 months. The notice period for workers with long tenure is fairly long; for example, 7 months for workers with 20 years of tenure, compared with an OECD average of 3 months. As argued in previous Economic Surveys (OECD, 2010a) legal costs associated to employment protection legislation could be reduced by giving employers the right to choose between paying a severance payment or paying a higher unfair dismissal compensation which would replace the court route. The relatively strict stance of employment protection in Germany has a particularly strong negative impact on productivity in those sectors in which worker turnover is high (Andrews et al., 2015). However, seniority-based employment protection may be part of an institutional framework which has supported a cumulative innovation processes in manufacturing sectors (Fuentes et al., 2004), in which Germany has a long-standing comparative advantage and which have contributed to Germany’s strong export performance. The vocational education system, with its emphasis on on-the-job training and the accumulation of firm-specific skills is part of this framework. Long-term relationships between employers and workers support the accumulation of firm-specific skills. Reducing the legal costs associated to employment protection would be one way to facilitate worker mobility without undermining the institutional framework.

Fostering the reallocation of capital across firms and improving framework conditions for start-ups

Successful innovative start-ups depend on the reallocation of resources, which is key to foster KBC. Firms that drive one technological wave often fail to continue to do so in the subsequent one, as they then tend to concentrate on incremental improvements, and young firms possess a comparative advantage in commercialising radical innovations (OECD, 2015a).

Bankruptcy regulation, which limits the costs of firm closure and safeguards opportunities for a fresh start, is an important instrument to ensure reallocation of resources (OECD, 2015a). Reform of bankruptcy legislation, most recently in 2012, reduced the stay period after which bankrupt entrepreneurs are cleared from remaining debt (“fresh start”) from 6 to 3 years, if they are able to pay at least 25% of their outstanding liabilities, and to 5 years if they are able to reimburse the procedural costs. Bankruptcy procedures are shorter and appear to be more efficient than in most OECD countries (OECD, 2013a). Regulatory requirements for creating a new corporation have been lowered and one-stop shops have reduced administrative costs. Accounting and statistical requirements on small businesses have been lowered. However, restrictive regulation of notaries’ services still contributes to excessive costs for the legal transactions required to create a new firm (see above).

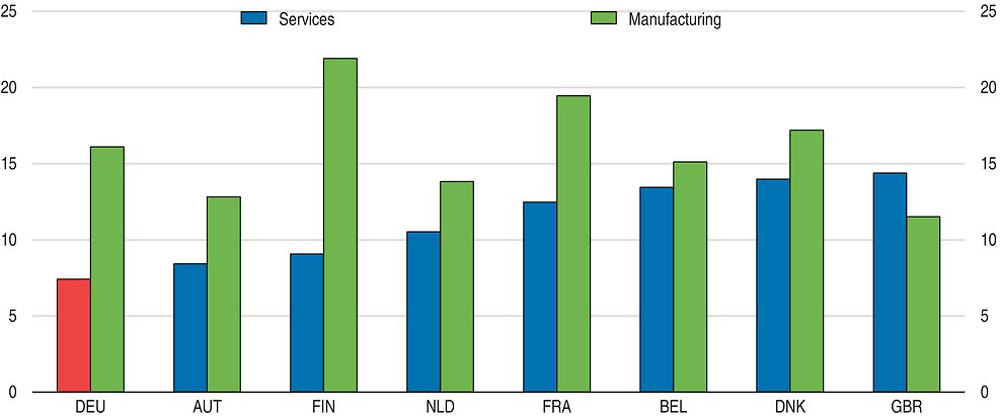

Entrepreneurship still suffers from lacking simplification of administrative procedures (Figure 1.12). The “silence is consent” principle is not generally applied in the issuance of licences. Stronger development of e-governance could also help reduce administrative costs (see below). Entrepreneurs also do not generally have access to low-cost public health insurance (OECD, 2014a), which may deter entrepreneurship, especially when income risks are substantial. Entrepreneurs may have to pay relatively high fees for private insurance, which are independent of their income level, and so may be difficult to pay for when income drops.

1. Average of all OECD countries excluding the United States.

Source: OECD (2015), OECD Product Market Regulation Database.

Initial public offerings in stock markets are key instruments to make equity capital available to start-up firms with strong growth potential. Across many OECD countries, initial public offerings have declined, notably of small firms (Isaksson and Çelik, 2013) and particularly so in Germany. This decline started before the global financial crisis. It has occurred in the context of important changes in the governance and operation of stock markets, which have become for-profit institutions, and the increasing importance of high-frequency trading in generating profits for stock market operators. While the causes for the decline in initial public offerings are not yet well-understood, declining spreads between bid and ask stock prices for small firms have reduced profit margins for market making activities, which help channel information about new firms in the stock market to market participants. Regulatory changes which have reduced the interval at which stock prices have quoted (“tick size”) appear to have played a role in reducing initial public offerings.

Tax regulation hampers the reallocation of capital to most productive use

Inheritance tax exemptions with respect to family firms lock in capital in these firms, harming reallocation. Moreover, managerial quality in these firms tends to be lower than in other firms. Reducing such exemptions could therefore raise aggregate productivity and improve intergenerational social mobility (Andrews and Westmore, 2014). Inheritance tax exemptions could also create barriers for firm growth, as capital raised through the stock market, for example, would not benefit from the exemptions. Growth of small firms with high potential is a key driver of productivity growth (OECD, 2015a). Reforms to remove these exemptions have been held back by concerns that this would raise firm liquidations. As recommended in previous Economic Surveys steps to give more time for family-owned businesses to pay inheritance tax liabilities and to treat the inheritance tax liability as subordinate debt in the balance sheet can help deal with any liquidity problems that could result from capital market frictions (OECD, 2003, 2014a). Removing inheritance tax exemptions would strengthen the inclusiveness of the German tax system, in view of the strong concentration of wealth, as argued in the 2014 Economic Survey (OECD, 2014c). The 2014 Survey also argued that the inheritance tax has particularly low economic efficiency and administrative costs. The government and parliament are considering reform of inheritance taxation.

The tax treatment of venture capital and of workers in the venture capital industry is in some respects less favourable than in other European countries (FISI, 2012). Venture capital is an important instrument to finance growth of start-up firms. Much less venture capital is made available to entrepreneurs in Germany than in leading OECD economies (OECD, 2015a). Tax provisions which reduce the carrying forward of losses when a business is sold may be particularly harmful for the provision of venture capital, as start-ups often generate losses in their early years and the sale of shares by venture capitalists to a broader set of financial investors often serves to finance the growth of start-up firms. However, the limitations to the carrying-forward of losses have been effective in limiting tax avoidance through base evasion and profit shifting of multinational enterprises.

As in many OECD countries, taxation of business profits generates a bias towards debt financing of investment because interest payments can be deducted from taxable profits. By contrast, dividends are exempt from tax. This tax advantage for debt financing of businesses is reduced by several rules. Germany limits the deductibility of interest from the corporate tax base to 30% of profits. However, amounts exceeding these limits can be carried forward, so these limits are not usually binding and are mainly targeted at reducing tax avoidance by multinational enterprises (German Council of Economic Experts, 2015). Interest expenditure is included in the base of the local business tax (Gewerbesteuer) and capital gains are subject to lower tax rates.

While equity buffers have risen strongly in the German non-financial business sector (see above) debt bias in business profit taxation could be harmful for the financing investment in KBC in particular, as typically physical assets can be used as collateral for loans, but not intangible assets. Debt bias may damp firm creation, as newly created firms need equity. Overcoming this bias could therefore help firms with growth potential to expand (OECD, 2015a). Introducing a tax allowance for the opportunity cost of equity (ACE) could be one way of further reducing the tax bias in favour of debt-financed investment. Model simulations presented by the German Council of Economic Experts suggest that a tax allowance for equity could raise the capital stock by 5.5%, even if such an allowance were introduced in revenue-neutral terms (Council of Economic Experts, 2015). However, further research on the debt-equity bias itself and on the effectiveness of an ACE in removing this bias is still needed. Several issues need to be addressed for implementing an ACE tax system, including minimising tax revenue loss and evasion including through base erosion and profit shifting of multinational firms or windfall profits (FSB, 2015).The empirical evidence on the impact of the introduction of an ACE for corporations in Belgium is conflicting (Princen, 2012, aus dem Moore, 2014).

Reductions in the taxation of business profits along the lines discussed above would have costs in terms of inclusiveness of the tax system and foregone tax revenue. These effects could be offset by including households’ interest income, dividends and capital gains in the taxation of personal income. This income is currently taxed at a flat tax rate, which is in most cases lower than the personal income tax rate. Taxing such income at the household level at a higher rate would have little impact on investment, as international capital mobility separates saving from investment decisions. Indeed the taxation of household dividend income appears not to reduce investment. It also appears not to reduce the efficiency of investment decisions. This evidence is robust (Yagan, 2015). Improved international co-operation of tax administrations also mitigates concern that the elimination of these tax exemptions could lead to tax evasion through capital flight. Eliminating such exemptions strengthens the inclusiveness of tax systems substantially, as such income concentrated in top income households (Joumard et al., 2012).

Improving the roll-out of high-speed broadband infrastructure

Fast broadband boosts productivity growth substantially (Czernich et al., 2011). For example, a 1 percentage point increase in broadband penetration raised annual per capita GDP growth by 0.9-1.5 percentage points between 1995 and 2007 including through fostering investment to exploit opportunities generated by the infrastructure, in particular, investment in ICT, such as software (Egert et al., 2009). High-speed Internet is important for spurring Internet-related services as well as for technological advances in manufacturing, notably through machine-to-machine communication (OECD, 2014c). Moreover, broadband access also improves ICT skills, and, because of the complementarity of skills and fixed assets, investment in ICT capital (Falck and Wiederhold, 2015).

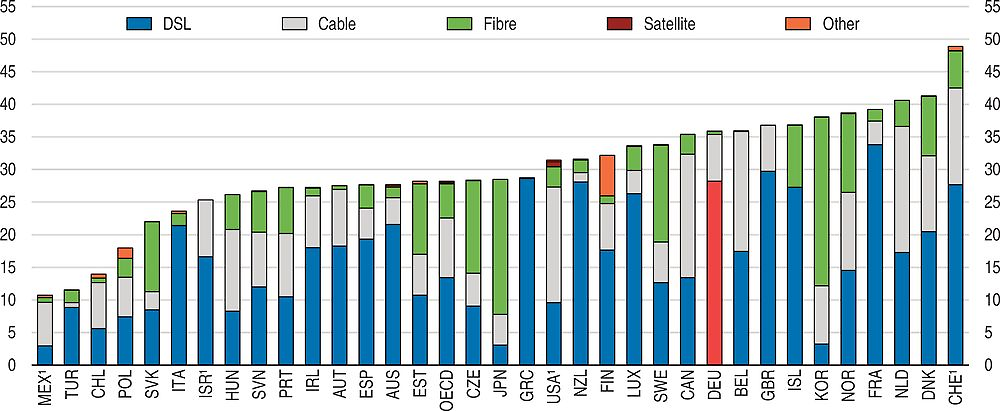

In Germany wired broadband has been rolled out less than in leading OECD economies and technologies which supply the fastest speeds, notably fibre (“fibre to the home”, FTTH), have barely been deployed (Figure 1.13). This reflects the decision of the incumbent operator not to invest in FTTH und upgrade its existing copper network instead at much lower cost, but providing lower speeds than fibre. Prices for high-speed fibre-based broadband services (100 Mbit per second or more), are high according to OECD statistics (OECD 2014c). There are scale economies in the deployment of high-speed fibre networks (OECD, 2014c). This creates a case for providing government support for the roll-out these networks.

1. Estimates for Israel, Switzerland and the United States. Preliminary data for Mexico.

Source: OECD (2015), OECD Science, Technology and Industry Scoreboard 2015: Innovation for growth and society.

The federal government plans to spend EUR 2.7 billion (0.1% of annual GDP) over three years to subsidise broadband deployment in order to ensure broadband speeds of 50 Mbit per second. These subsidies are allocated through competitive tender. However, the federal government’s support is not targeted to the roll-out fibre networks, which ensures the highest speeds. The Monopolkommission (2015), an independent expert body in charge of competition policy assessment, has voiced some concern that part of the subsidies can be taken up by the incumbent operator to modernise its copper networks. The federal government owns 32% of the incumbent operator, which may generate perceptions of conflicts of interest. Such perceptions can hold back entry of alternative operators.

Since there are scale economies in the rollout of high-speed broadband development the costs of rollout per user will be the lower the more users there are. More demand for high-speed Internet services can therefore reduce average costs, which can then further raise demand, setting in motion market dynamics which are favourable for roll-out. To strengthen demand, the government can start intensifying the use of electronic communications (see below). More effective competition policy for Internet-based services could also help. In particular, current merger control rules appear insufficiently adapted to competition issues in digital markets. In particular, to determine whether mergers should be prevented to safeguard completion, the competition authority investigates whether market share would exceed critical thresholds based on past turnover data, which must be met for the competition authority to intervene. However, such turnover data are ill-suited to capture the future potential of market dominance by Internet service providers. Broadening the criteria for the assessment of market dominance would help. For example, the competition authority could include the value of merger transactions (Monopolkommission, 2015).

Raising public investment to strengthen inclusive growth

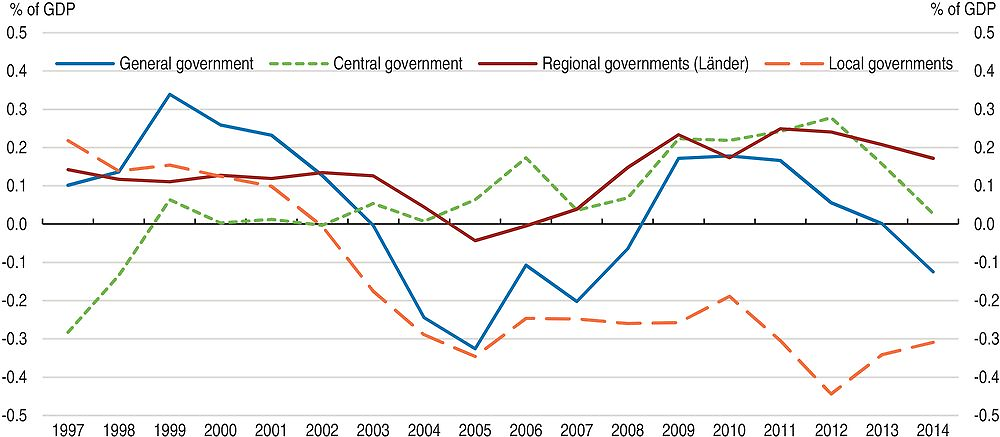

Government investment has been low in the past 10 years, often falling short of depreciation, especially in municipalities, and declined markedly at the level of the municipalities in the first half of the 2000s (Figure 1.14). As outlined below, higher public investment into fixed and human capital in selected areas would have substantial returns in terms of inclusive economic growth.

Source: OECD (2015), OECD National Accounts Database.

Population ageing is unlikely to damp government investment needs over time, despite the expected decline in population (Chapter 2). Demographic change and internal migration will have vastly differing implications for the population and its age composition across regions. Adjusting public infrastructure to population developments increases investment demand (KfW, 2015). As the share of the elderly increases, the public infrastructure needs to be adjusted accordingly. For example for investment into age-appropriate infrastructure investment needs are estimated to amount to 1.8% of GDP (Köller, 2013).

Investment in full-day care and education for children has high returns

Investments in childcare and early childhood education have long term benefits and support inclusive growth. Gaps remain in the quantity and quality of supply (OECD 2014b). The enrolment in childcare of children under the age of 3 increased strongly in recent years (Federal Statistical Office, 2015; OECD Economic Survey of Germany 2014, OECD, 2014c). Nonetheless, only 29% of children under the age of 3 were enrolled in day care in 2013 compared to 50% or more for Denmark, the Netherlands or France. Enrolment rates remain low in international comparison and access to full-day care is limited (OECD, 2014f; Kultusministerkonferenz, 2015). Also Kindergarten hours are often short or part-time and enrolment rates are below the OECD average. The quality and quantity of early child care facilities varies strongly across regions (the Länder; Bock-Famulla et al., 2015). Day-care can not only improve labour market participation of second earners, but can also improve educational outcomes and social skills of children, especially for those with weak socio-economic background (StEG, 2010). The federal government decided to support municipalities with the expansion of childcare with one billion euro per year between 2015 and 2017, following similar investment programmes between 2008 and 2014.

In 2014 only 53.3% of elementary schools offered full-day schooling, catering for 33.1% of all primary school children (KMK, 2015). In most full-day schools participation in afternoon is not mandatory (KMK, 2015). They are only required to open at minimum 3 days a week for seven hours. The afternoon hours mostly consist of care, foregoing the educational benefits full-day schooling can provide (Autorengruppe Bildungsberichterstattung, 2014; OECD, 2015). For only 6.0% of primary school children attendance in the afternoon was mandatory in 2013 (KMK, 2015). More time spent in formal teaching improves education outcomes especially for students with weak socio-economic background (OECD, 2015) and strengthens intergenerational upward mobility in terms of education and income.

The quality of transport infrastructure is high but standards are at risk

The survey based indicator (LPI) of the World Bank ranks Germany as the country with the best quality of trade and transport related infrastructure worldwide since 2010. In the same time period the (also survey based) assessment of the World Economic Forum of overall transport infrastructure fell from rank 2 to rank 8. Decreases in the rankings in all areas of transportation (roads, air, train, ship) contributed to this (World Economic Forum, 2015; International Bank for Reconstruction and Development/World Bank, 2014). Maintenance standards of federal infrastructure have fallen somewhat over the past 20 years (BMVI, 2015). However, most transport infrastructure is the responsibility of subnational governments. At the municipal level, in particular, infrastructure endowments are likely to have deteriorated more substantially.

Additional annual investment needs to maintain transport infrastructure across all levels of government are estimated to be between EUR 3.8 billion (Kunert and Link, 2013) and EUR 7.2 billion (Daehre-Kommission, 2012). The federal government has budgeted additional investment for federal transport infrastructure of EUR 5 billion spread over four years (2014-17). In 2015 the federal government announced an additional “future investment” package of EUR 10 billion which includes EUR 3.1 billion for transport infrastructure between 2016 and 2018. Additional funding for transport infrastructure will come from the extension of the highway toll for heavy goods vehicles to a broader range of roads and vehicles.

Investment gaps are increasing especially at the local level

Municipalities have reported cumulated investment needs of EUR 132 to EUR 156 billion (3-5% of GDP; KFW, 2015; BMWi, 2015). The biggest needs are seen in transport infrastructure, schools and other educational facilities. The three most important reasons for the investment gap reported by the municipalities are insufficient funding, high maintenance needs, and high social spending (Alm and Zettelmeyer, 2015; BMWi, 2015). The municipalities play a substantial role in contributing to transport infrastructure as well as in social transfer spending (Box 1.2).

The German federal system consists of broadly three government levels: central government, Länder and municipalities. Länder and municipalities are closely interlinked. The Länder have a discretionary power to delegate a range of tasks to their municipalities. Therefore the division of tasks between a Land and its municipalities varies across Länder. Municipalities are generally responsible for child care and early childhood education. Länder and municipalities share the responsibility for primary, first and secondary education while municipalities are mainly responsible for administrative tasks, buildings and equipment. Municipalities perform a large part of public social transfer spending notably in the context of social assistance, support for asylum seekers, which are regulated by federal law, and assistance for youth. In the area of infrastructure municipalities are responsible for almost 80% of German roads, for local public transport as well as sport and healthcare facilities and they are also responsible for sewage and waste.

Municipalities have three sources of funding: taxes, allocated funds from the respective Land and fees. Municipalities receive the local business tax (Gewerbesteuer) as well as the tax on land and buildings and they receive a share the joint taxes, namely of income taxes (15% of total income tax revenues) and VAT (2% or total VAT revenues). Each Land has its own system of redistributing funds among municipalities. The central government cannot make transfers to the municipalities directly, except to co-finance capital spending. The central government and the Länder can agree to increase the municipalities’ share of joint taxes (income tax or VAT). The federal government can also agree to make transfers to the Länder which they pass on to municipalities.

Generally municipalities are only allowed to use loans for investments. Cash credits are allowed for short term use only. Limits to the use of cash credits can be set by the Land.

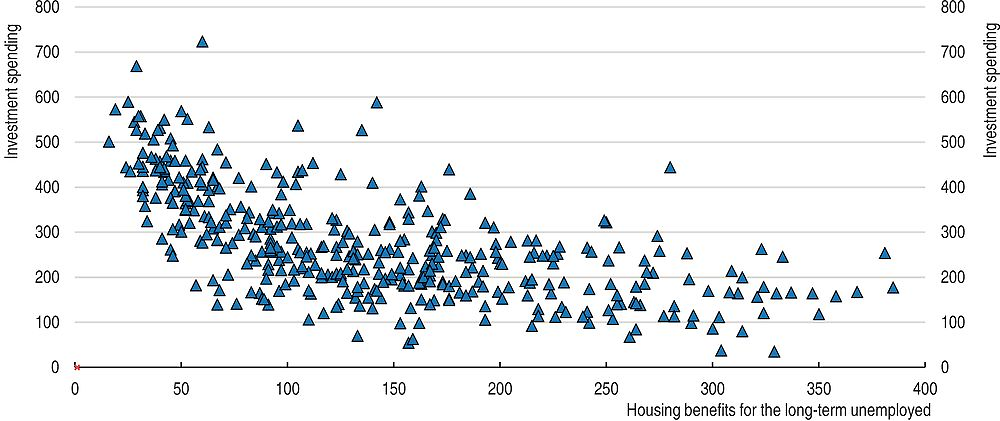

Municipalities which invest less tend to be those with weak budgetary positions, are in relatively poor regions, and have relatively high spending on social cash transfers, which are often mandated at the federal level, but are largely the responsibility of municipalities (Arnold et al., 2015a, 2015b). Since these social cash transfers are means-tested, such spending is correlated with poverty risk. Fiscal federal transfers broadly equalise tax revenues per capita across the Länder, and across municipalities within each Land, but do not take into account differences in federally mandated social cash transfer spending. This reduces budgetary space for investment spending in municipalities where such transfer spending is high. The federally-mandated social cash transfers account for 55% of their social spending (Statistisches Bundesamt, 2015). One example for such transfers are housing benefits for the long-term unemployed. For these, data are available across municipalities. As Figure 1.15 shows, municipalities with high spending on these transfers invest less. While municipalities in aggregate generated budget surpluses between 2012 and 2014, the budgetary situation is diverse across the Länder (Arnold et al., 2015b). The municipalities’ short-term borrowing more than doubled between 2004 and 2013, although it remains low on aggregate (2% of GDP, BMF 2014).

Source: Arnold, F. et al. (2015a), “Large and lasting regional disparities in municipal investments”, DIW Economic Bulletin 2015, Vol. 5, Issue 42/43, pp. 568-576.

The central government introduced a special fund in 2015 which supports financially weak municipalities with EUR 3.5 billion between 2015 and 2018. It funds up to 90% of investment projects in hospitals, noise protection, urban development, broadband infrastructure, energy efficiency, clean air and modernisation of education facilities. However, by linking transfers to outstanding debt, this scheme risks harming incentives for sound budgetary policies.

The federal government has taken over some of the federally-mandated social transfer spending from the municipalities in recent years to create budgetary leeway for higher municipal investment. It is considering to take some further steps in this direction (Bertelsmann Stiftung, 2015; BMWi, 2016). The federal government also provides financial support structurally weak regions in Eastern Germany in the context of its programme Improving the Regional Economic Structure (Gemeinschaftsaufgabe “Verbesserung der regionalen Wirtschaftsstruktur” – GRW), which supports close-to-business investments. The government is also considering to extend this programme to Germany as a whole starting in 2020 (BMWi, 2016). The new system could be broadened to include more measures which serve the higher demand for public investments in certain areas, such as transportation, child-care or education. The federal government should provide more support for investment in municipalities where federally-mandated spending on cash transfers is high. Alternatively federal government support for municipal investment could be based on income and demographic indicators, which are correlated with higher social spending needs, such as age composition or the share of the immigrant population.

The long-term benefits of local investment of Länder and municipalities in childcare, early childhood education and full-day schooling are likely to accrue nation-wide, generating positive economic externalities for other jurisdictions. Therefore there is a case for the federal government to play a role in fostering the supply of such services, in particular by contributing to their funding. Constitutional rules limit federal government funding for child care facilities to capital spending and prevent the federal government co-funding for compulsory education services. Considering the long-term and nation-wide benefits of investments into education, including investments beyond physical capital, there is a case for reviewing these barriers. As proposed in the 2014 Economic Survey (OECD, 2014c), the central government could finance vouchers which parents could use to pay for childcare in accredited childcare facilities. Such vouchers would provide incentives for the service providers to meet parental demand, for example, with respect to opening hours.

Tax autonomy gives subnational government levels leeway to fund investment projects desired by the local population. Revenue decentralisation also tends to improve GDP growth in lagging regions (OECD, forthcoming). The Länder have no significant tax-setting powers. Municipalities can set local business and real estate tax rates. However, the local business tax base is highly geographically mobile, limiting the scope to raise tax rates. Moreover these revenues are highly cyclical and volatile. Real estate tax revenues are held back by outdated valuations of real estate. In order to make room for more fiscal autonomy, Länder should be allowed to levy a surcharge on the income tax (OECD, 2006; BMF, 2015). A reform of the taxation on real estate, in which the tax base is determined according to market prices – as proposed in the OECD Economic Surveys since 2006 (see especially OECD, 2010) – could improve the financial leeway of municipalities.

More leeway could also be given to municipalities to set real estate tax rates to encourage infrastructure deployment in an environmentally-friendly way. Depending on its design, tax on land and buildings can influence urban sprawl which is a key issue on the German environmental policy agenda (European Environment Agency, 2015; BMUB, 2013). Therefore, a revised tax on land and buildings should allow for leeway to set higher rates on land than on buildings, as this sets incentives to develop relatively less land, and set higher rates for single-family houses compared to multi-family houses (OECD, 2014b; Brandt, 2014; Slack and Bird, 2014).

Making public procurement more efficient

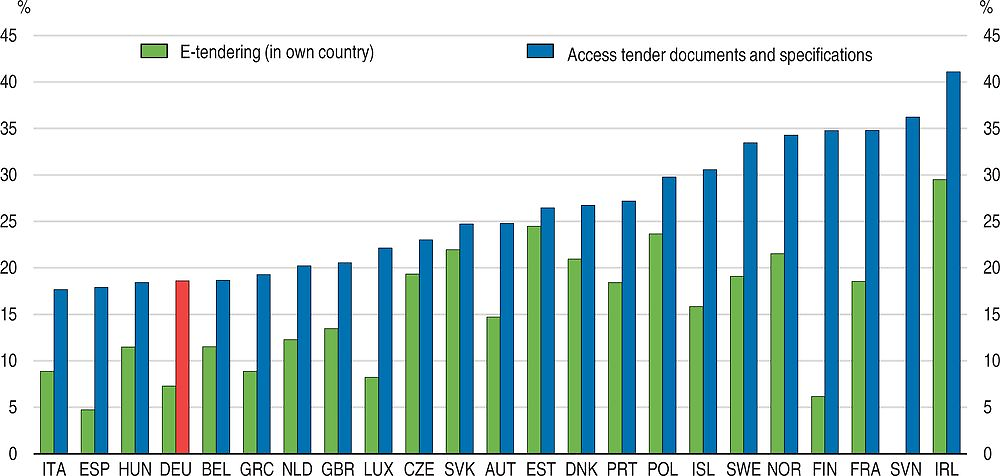

Well-designed public procurement is important for the efficient use of public money in public investment projects. Using electronic means in procurement (e-procurement) promotes the diffusion of innovation, investment in knowledge-based capital and investment in ICT, with spillovers throughout the economy (OECD, 2013b; OECD, 2015c; OECD, 2011). This is because governments can pull demand through their procurement activities because of their large purchasing power. This can help reduce costs where scale economies can be exploited, for example, in the use of electronic communication through Internet. The German public procurement legislation will be completely overhauled in 2016 in response to three new EU directives on public procurement and concessions.

Fostering e-procurement

Germany lags behind in the use of information and communication technologies in public procurement (Figure 1.16). The central government’s spending on ICT is one of the lowest among OECD countries (OECD, 2013c). The new EU public procurement directives require all member governments to start conducting procurement electronically from 2016. The government’s plans to implement a comprehensive e-procurement system (Federal Government, 2015) and to promote the smart digital interconnectedness of public services are welcome (Federal Ministry of Economic Affairs and Energy, 2015). These initiatives should also include measures to make sure that relevant infrastructure is provided.

Source: OECD (2015), Government at a Glance 2015.

E-procurement raises the skill-requirements for procurement officials, including for ICT skills. Concerns exist about a lack of ICT skills within procuring entities, especially at the local level. For instance, civil servants are not trained for data analysis and re-use (OECD, 2013b; OECD, 2015b; Wegweiser, 2009). Incentives need to be designed for procurement officials to consider strategic goals in their decision making, especially because they are operating in a risk-adverse culture. The impact of procurement policies on strategic objectives, notably innovation, is not monitored (OECD, 2015b; OECD, 2013b).

Spreading best practices within Germanys federal structure

Germany’s federal structure generates considerable diversity in the procurement and the implementation of investment projects across municipalities. This yields valuable lessons about best practices which need to be spread across all jurisdictions. The federal government should play an important role in co-ordinating this learning process in view of the substantial innovation opportunities. At present, it does not co-ordinate training for public procurement officials or establish policies for contracting authorities, unlike in many other OECD countries (OECD, 2015b). There are also concerns that the substantial decline in local public investment has resulted in a lack of expertise by municipalities to implement complex infrastructure projects or sophisticated financing arrangements. The share of government contracts acquired by SMEs is low, which argues for simplified administrative procedures (OECD, 2013c).

Support for local governments in improving procurement and implementing investment should be strengthened, as envisaged by the government. It should support municipalities in improving procurement procedures and planning and realising complex investment projects (Academic Advisory Board of the Federal Ministry for Economic Affairs and Energy, 2015). The regional consultancy units should be regarded as a two-way communication channel to spread best practices within Germany’s federal system. E-procurement can help to ensure a well-informed consultation process (see above).

Reform of budgeting can help ensure priority investment projects are carried out

Effective budgeting procedures help identify costs and benefits of public investment projects, helping to ensure appropriate budget allocation for investment and optimal choice of investment projects. Regular reviews of expenditure are being introduced to support evidence-based priority-setting. The first cycle of these spending reviews is about to finish in spring/summer 2016. This is welcome, but there is scope for improvement (OECD, 2014d):

-

The federal parliament focuses on micro-level management of budgetary allocations. The parliament’s role in monitoring the strategic orientation of budgeting and procurement procedures should be strengthened, for instance by raising its analytical capacity. The collaboration with independent research institutions could be expanded or an independent parliamentary budget office, like recently established in Austria, be created.

-

The use of performance information in budgeting processes is increasingly popular among OECD countries to promote the efficient use of public resources and improve the accountability of the government. In Germany such practices are used little. For instance, poor performance of spending programmes is made public only selectively and rarely has negative budgetary implications (OECD, 2013c). Several line ministries have started improving their evaluation methodology.

Involving the public more effectively

A key impediment for carrying out large-scale, complex public investment projects in Germany is strong resistance of the local population, which makes it unattractive for local governments to even contemplate such projects (Bertelsmann Stiftung, 2012). Resistance at a late stage of the planning phase can also result in higher costs, which can be avoided if the public is involved early in decision-making. Complex infrastructure projects often yield important benefits for society as a whole, but can also generate negative local externalities, for instance pollution or noise. Moderating such conflicts requires involvement of the public in the planning and realisation of investment projects.

There is scope to involve the public more effectively in realising complex investment projects in Germany (OECD, 2014b). Ninety-eight per cent of citizens want to be involved more in the planning of infrastructure projects (Bertelsmann Stiftung, 2015a). The recent advances in electronic media and communication technologies offer much scope to improve the way public administrations, citizens and civil society can interact. E-governance, if used as a two-way communication tool, can be particularly useful in raising citizen participation (European Institute for Public Participation, 2009; OECD, 2014b). However, currently the German government uses advanced communication tools mainly to provide information (OECD, 2013c). More efforts are needed to involve the public in planning and realising investment projects, including through advanced communication tools. Such efforts would also result in an improvement of civic engagement and public governance, which is one of the key OECD wellbeing indicators, and the only one in which Germany scores below the OECD average (OECD, 2015o).

Harnessing private funding for public infrastructure

Governments of OECD countries are increasingly considering Public-Private Partnerships (PPPs) as a means to finance and raise the quality of infrastructure in light of increasing fiscal constraints (Araujo and Sutherland, 2010). PPP arrangements can improve efficiency, but only if based on a sound analysis of their suitability and careful contract design (Box 1.3). Germany has so far engaged little in PPPs (Partnerschaften Deutschland, 2015).

Public-private partnerships (PPPs) typically constitute a specific agreement between a public entity and the private sector for the provision and operation of a public service. PPPs typically are based on a long term, risk sharing contract between public and private parties. The contract covers the bundling of design, construction, operation and/or asset maintenance, together with a major component of private finance (Kappeler, 2012).

PPPs can be a superior solution to traditional public procurement (Araujo and Sutherland, 2010). Efficiency gains arise from increased competition and innovation, more efficient risk allocations and access to private sector skills and technology transfer. The bundling of procurement and operation provides incentives for the private partner to account for life-cycle costs of the project more comprehensively. Also, the likelihood of cost overruns in the construction phase is lower for PPPs than for traditional public procurement (Blanc-Brude and Makovsek, 2013).

However PPPs can increase costs and financial risks (Araujo and Sutherland, 2010; Weichenrieder, 2014). Whether efficiency gains are fully reaped depends, for instance, on the proper allocation of risks to the party better equipped to deal with them. The option of contract-renegotiation needs to be carefully designed to allow adjustments to changing external conditions, while avoiding bargaining power is abused once the infrastructure is put in place (hold-up problem). The design of pricing policies is important to avoid overinvestment; and effective performance monitoring is needed to ensure service quality and avoid under-investment. Rapid technological change may make it more difficult to specify outputs or to quantify risks over the contract life-cycle. Moreover, the temptation to use PPPs as a means to circumvent budgetary pressures can lead to large contingent liabilities affecting long-term fiscal and macroeconomic sustainability and inter-generational equity.

The central government’s PPPs conform well with the OECD Principles on Public Governance of PPPs (OECD, 2014d). There is scope to strengthen framework conditions for PPPs, especially at subnational levels of government (OECD, 2014d; OECD, 2010). Sub-national governments are not required to disclose the long-term financial risks associated with particular PPP projects to the federal government, even though they have to prove that every PPP project improves value for money compared to other procurement methods so it is not merely used as an alternative to borrowing. Nonetheless, risks can arise for example because the Länder can give minimum revenue guarantees to the private party, unlike the federal government. Raising the transparency of the various risks associated with PPPs realised by subnational levels of government may become increasingly important in the future as the debt brake could make off-budget borrowing more attractive.

Some sector specific regulatory obstacles hold back PPPs. For instance, different municipal funding rules apply for construction, maintenance and operation of investment projects in some areas, including roads, hospitals and schools. This makes it more difficult to include all phases of infrastructure projects in a single PPP contract. (OECD, 2014c; OECD, 2010). Sector specific regulation should be reviewed to eliminate unnecessary barriers to PPPs.

Data on the performance of PPPs is limited. Sharing experience spreads best practices. It is therefore welcome that a federal and some regional PPP advisory units have been put in place (OECD, 2010b). These should cover all Länder. Germany should also promote the international exchange of experience about PPPs. Harmonizing procedures within Germany’s federal structure and among OECD and EU countries can also help strengthen competition and lower costs.

Some OECD countries explore new instruments to facilitate public-private co-operation, for instance, social impact investment in the US and the UK. Investors engage a contractual obligation to improve a social outcome. If the social outcome reaches an agreed performance threshold, investors receive a financial return. For this instrument to be successful, the social outcome needs to be measurable (OECD, 2015d). Sharing experiences with other countries is essential should this comparatively new instrument be considered.

Project bonds are another instrument increasingly used to raise private money to finance infrastructure (Della Croce and Gatti, 2014). They are issued by the private partner engaged in an infrastructure project. Project bonds are attractive to institutional investors because they can more easily be issued with long maturities, which match the long-term horizon of infrastructure projects. However, bond investors need to be sufficiently informed about the risks involved. This is especially true if project bonds are used to engage pension funds.

User fees can raise the efficiency of infrastructure

Usage-dependent charges are powerful instruments to internalise emission and non-emission costs of public infrastructure use (OECD, 2014c). Such charges contribute to an effective use of existing infrastructure and reduce congestion if differentiated by location and time. Such congestion charges can signal infrastructure needs, helping to direct investment in transport infrastructure to where it is most needed. By reducing the net budgetary cost of the infrastructure investment, they can also help overcome budgetary limitations in deploying needed infrastructure. Experience of other countries shows that user charges are more easily accepted if infrastructure is provided in collaboration with private partners (Academic Advisory Board of the Federal Ministry for Economic Affairs and Energy, 2014).

Plans to establish an independent agency in charge of the federal road infrastructure investment, which would raise revenues from road use charges, can be a useful step in this direction. This improves and the long-term sustainability of road projects (Academic Advisory Board of the Federal Ministry for Economic Affairs and Energy, 2015). Germany has extended usage-based charges for trucks to a broader range of freight transport vehicles and federal long-distance roads. However, the planned user charge for passenger cars is not usage-dependent. Germany should consider extending usage-based charges for passenger cars. Such charges could also be differentiated by location and time. The required infrastructure for usage-dependent charges is already in place to a large extent because of the existing digital toll system to operate the usage-dependent charges for trucks.

Strengthening competition in services

-

Reduce restrictive regulation in the professional services.

-

Ease requirements of a tertiary level vocational degree or job experience for self-employment in some crafts.

-

Strengthen the role of the railways regulator by improving its investigative and interventional competences.

-

Provide equal treatment in value added taxation for all postal service providers.

-

Liberalise the issuance of SIM cards.

Foster the reallocation of resources

-

Improve governance or privatise government stakes in the Landesbanken, car manufacturing, telecommunications and postal services.

-

The administration should strengthen the analysis of the economy-wide impact of regulation.

-

Strengthen transparency on the role of lobbies in the design of new legislation and regulation, for example, by providing more information in the lobbying register, such as the potential beneficiary and the targeted government action.

-

Remove exemptions for family businesses in inheritance tax.

-

Lower taxation of real estate transactions.

-

Remove limitations on the carrying forward of losses when a start-up firm is sold while taking measures to prevent tax evasion.

Strengthen local government investment

-

Provide more support for good municipal investment projects, including by strengthening administrative capacity, especially in municipalities burdened with high social spending mandates (such as cash transfers).

-

Invest more in full-day schooling, raise the supply of formal childcare and improve the quality of childcare and early childhood education. To this end, introduce vouchers for childcare and remove constitutional barriers to federal government co-funding of education expenditure by subnational governments.

-

Introduce regional advisory units in all Länder to provide technical support for local governments in carrying out investment.

Improve efficiency in public investment

-

Promote e-procurement by improving skills of procurement officials. Involve the public more effectively in investment projects through electronic communication tools.

-

Improve priority setting in budgeting, for example by enhancing the analytical capacity of parliament and by making poor performance of budget programmes public.

-

Improve assessment and disclosure of long-term financial risks of PPPs of subnational governments. Share experience across levels of government and national borders and harmonise procedures.

-

Give consideration to introducing usage-dependent and congestion-dependent road tolls for cars.

Bibliography

Academic Advisory Board of the Federal Ministry for Economic Affairs and Energy (2014), Engpassbasierte Nutzerfinanzierung und Infrastrukturinvestitionen in Netzsektoren, Berlin, 26 September.

Academic Advisory Board of the Federal Ministry for Economic Affairs and Energy (2015), Stärkung von Investitionen in Deutschland, April.

Albrizio, S., T. Koźluk and V. Zipperer (2014), “Empirical Evidence on the Effects of Environmental Policy Stringency on Productivity Growth”, OECD Economics Department Working Papers, No. 1179, OECD Publishing, Paris, https://doi.org/10.1787/5jxrjnb36b40-en.

Alesina, A. et al. (2005), “Regulation and Investment”, Journal of the European Economic Association, Vol. 3(4), June, pp. 791-825.

Alm, B. and J. Zettelmeyer (2015), “Kommunale Investitionen – Woran fehlt es?”, Wirtschaftsdienst, Vol. 95, Issue 7, Springer Berlin Heidelberg.