Executive summary1

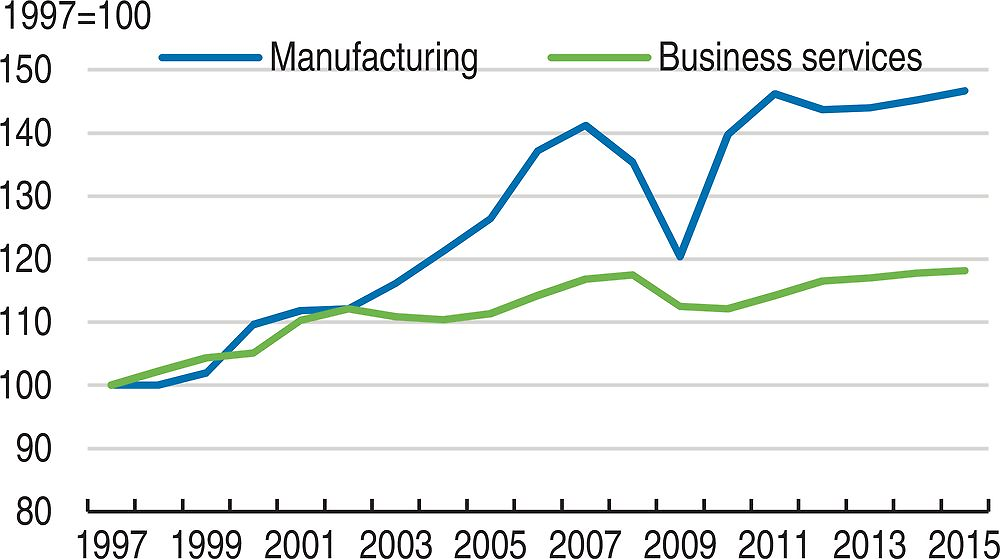

Unemployment is low but productivity growth has weakened

Source: OECD (2016), OECD Productivity Database.

The economy has steadily recovered from the 2008 global crisis and, thanks to past reforms, the labour market has proved strong. Labour productivity growth has weakened and productivity is low in services. Germany has high material living standards, low income inequality and scores well in most dimensions of well-being. Despite substantial progress, there still are gaps in childcare and full-day schooling. Disincentives to work full-time in the tax system also contribute to low earnings of women as many work part-time. In recent years many low-income households have not benefited from economic growth and investment.

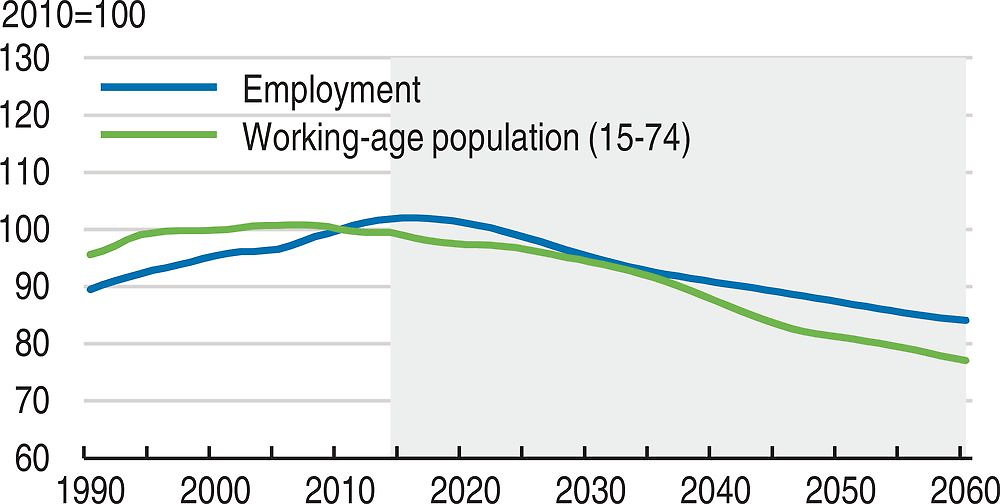

Demographic ageing and a large refugee inflow pose challenges

Labour supply is set to shrink faster than the population as a consequence of ageing. This can be offset by improving employment opportunities for women and older workers. Immigration, including the recent inflow of refugees, will also add to the labour force, but their integration requires additional efforts and spending which may exceed the currently available fiscal room. Some well-being outcomes decline with age, and therefore better prevention of health risks could raise income and well-being. Further reforms in the pension system are needed to ensure its long-term sustainability.

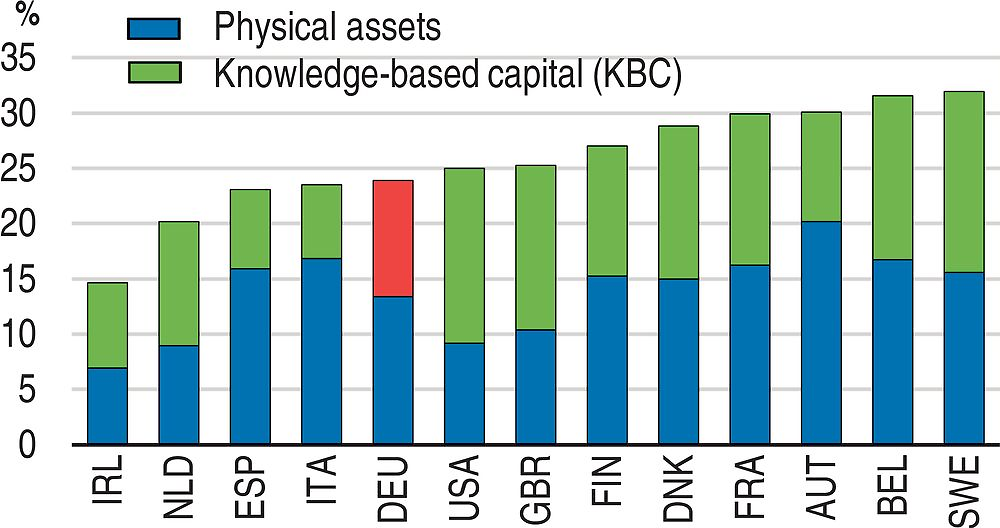

Investment is subdued and key social infrastructure needs to be developed further

Source: OECD (2015), OECD Science, Technology and Industry Scoreboard 2015.

Investment and productivity growth are held back by weak demand growth in emerging economies and also the euro area as well as restrictive regulation in services. Public investment has been low, although recently the government has provided more funds to improve maintenance of transport infrastructure. There is scope to improve efficiency in the procurement and management of public investment projects. Investment in formal childcare has increased. However, provision of childcare, early childhood education and full-day primary schooling still fall short of needs.

← 1. The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.