Argentina

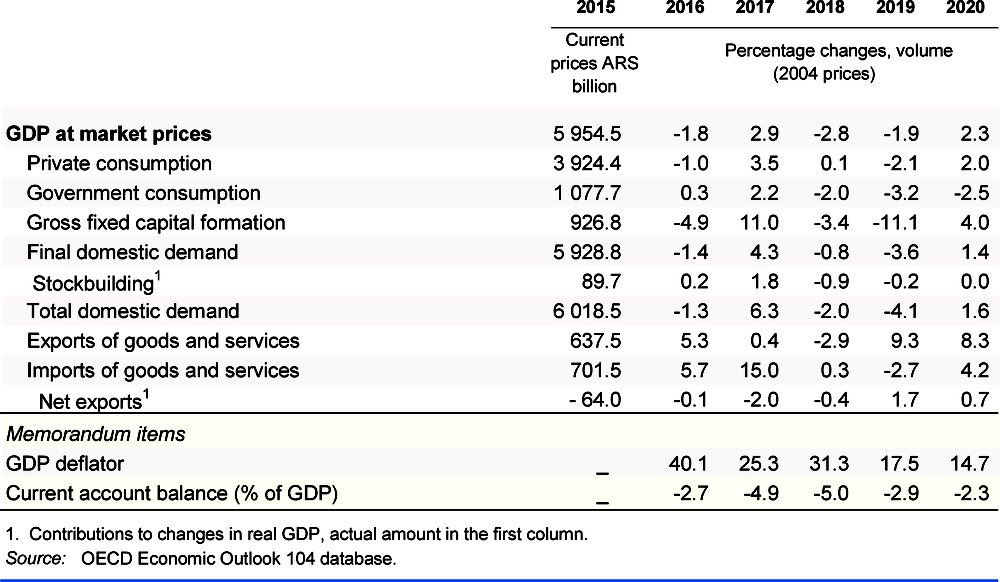

A combination of massive fiscal and monetary tightening will keep the economy in recession during 2018 and 2019. Private consumption and investment will remain depressed due to lower real incomes and high interest rates, and unemployment will rise. However, a better harvest and a lower real exchange rate will support stronger exports.

In the wake of the crisis, Argentina adopted a large IMF programme. Faster fiscal consolidation and tight monetary policy will be a drag on growth in the short run, but are needed to reduce persistent fiscal and current account imbalances. This, and the planned greater independence of the central bank, if implemented, will help to restore confidence. Envisaged increases in social transfers would cushion the social impact of the recession. In the longer term, reforms in taxes, competition and administrative procedures will strengthen productivity. Tariffs have fallen in a few sectors, but more is needed to foster integration into the global economy. Reducing barriers to entrepreneurship is also essential.

The economy is in recession

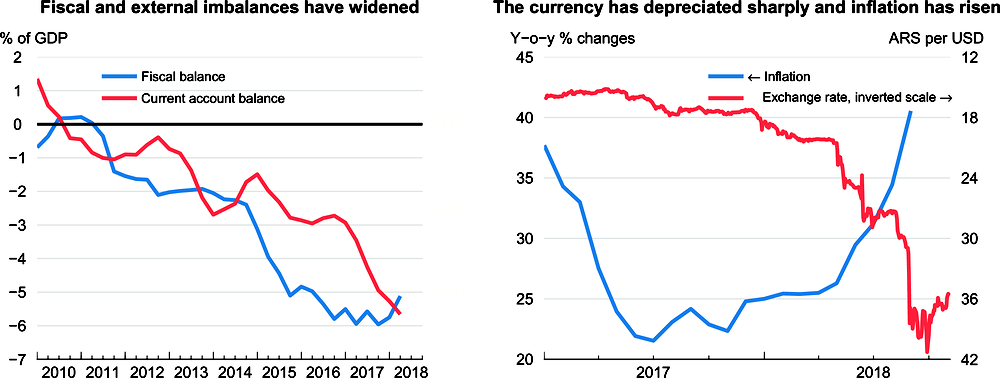

Against the background of significant vulnerabilities related to persistent imbalances and high foreign-currency debt, a capital flight and a currency run that began in April intensified during August, causing the peso to lose around half of its value this year. As risk premiums rose, financing the large twin deficits became difficult, triggering a large fiscal contraction and recourse to a large IMF programme. Rising interest rates in response to the currency run, as well as faltering confidence, have led to a contraction of investment. A spike in inflation, lower real wages and rising unemployment are depressing domestic demand and growth further. An exceptional drought in 2018 reduced exports, exacerbating the large current account deficit.

Fiscal and monetary policies are aimed at reducing imbalances and restoring confidence

To fight persistently high inflation, in September the central bank committed to cut growth of the monetary base sharply, from 44% to 0%, and to freeze the base in nominal terms until June 2019. Financing constraints and the sharp rise in the public debt burden required revised fiscal targets, which now aim at a balanced primary budget in 2019 and a primary surplus of 1% of GDP in 2020. This is equivalent to a cumulative fiscal tightening of almost 4% of GDP in 2019-2020. Tight macroeconomic policies will depress domestic demand in the short run, but are necessary to restore confidence and reduce imbalances over time. The continued commitment to a floating exchange rate, with interventions limited to cases of extreme volatility, should preserve the more competitive exchange rate and support stronger export performance.

Structural reforms are key for stronger and more inclusive growth

Significant progress has been made in undertaking structural reforms, but more is needed to improve productivity, boost exports and raise growth. Competition remains weak in many sectors, owing to domestic restrictions on firm entry and high import barriers. Lower consumer prices resulting from stronger domestic and foreign competition would improve household purchasing power, especially among low-income households. Better access to intermediate inputs would raise productivity and competitiveness, allowing firms to create better-paying jobs. Lowering barriers to entrepreneurship would also strengthen productivity and job creation. Improving access to quality education and training would help workers prepare for these new opportunities, while more effective unemployment insurance could provide income support for workers as jobs move across firms or sectors. Development of capital markets would diversify sources of funding for investment and public debt.

Emerging from the recession will take time

GDP is projected to continue to fall in 2019 and unemployment will rise until 2020. Exports will lead the recovery, but domestic demand will take longer to recover from tight monetary and fiscal policies. Using the fiscal space foreseen in the IMF agreement to spend more on well-targeted social benefits would mitigate the likely increase in unemployment and poverty. Inflation and the current account deficit are projected to decline. Once completed, the adjustment process will leave the economy with more solid macroeconomic fundamentals and reduced vulnerabilities.

The projection is subject to large downside risks. Domestic demand could contract more than projected, given the large size of the needed macroeconomic policy adjustment. Rising unemployment and a deterioration of social indicators could undermine political support for the adjustment. At the same time, fiscal slippage could cause a further loss in confidence. As 70% of public debt is denominated in foreign currency, the depreciation has raised its domestic currency value relative to GDP. While the currency has been stable in recent weeks, further depreciations cannot be ruled out and would add to public debt risks.