Netherlands

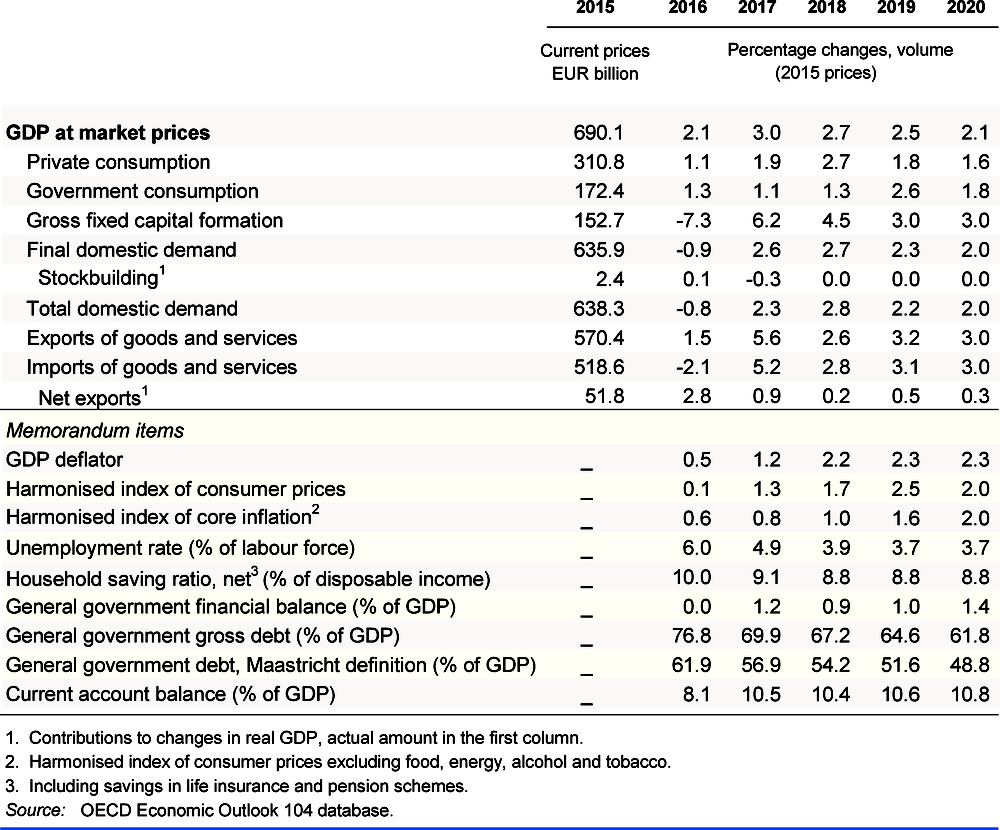

GDP growth is projected to moderate from around 2¾ per cent in 2018 to just above 2% by 2020, reflecting slowing private consumption and investment. Wage growth and inflation will increase steadily as a result of the tight labour market. The large current account surplus is projected to increase further.

Fiscal spending should focus on measures to stimulate long-term growth. Potential reforms to the occupational pension system should focus on improving the transparency of the system. Labour market reforms, such as expanding supplementary social security coverage for the self-employed, should be implemented to improve inclusiveness, particularly the opportunities for the vulnerable.

Growth is moderating but still robust

Economic growth has moderated somewhat but still remains robust. Private consumption is strong and residential investment remains very dynamic. Favourable financial conditions have supported both consumption and business investment growth. Low unemployment and increasing labour market shortages are putting upward pressure on labour costs and contributing to the ongoing shift towards hiring more workers on permanent contracts, reversing the trend towards self-employment in recent years. The inflation rate has picked up, but is still low.

Policies should address financial vulnerabilities and improve inclusiveness

The current expansionary fiscal stance remains appropriate, given the widening headline surplus and favourable debt trajectory. However, the strong fiscal position could be further utilised to mitigate the projected slowdown in growth and boost potential output, consequently reducing the largest current account surplus as a share of GDP in the OECD. The structure of tax and spending should continue to be adjusted to improve long-run growth.

Low interest rates continue to support rapid house price growth. High levels of household debt and high exposure to mortgages hamper the ability of banks to raise external funding and contribute to vulnerabilities in the financial system. The accelerated phase-out of mortgage interest rate deductibility should be complemented with a further tightening of the loan-to-value ratio for new mortgages to reduce these vulnerabilities.

Tax incentives for self-employment should be reduced and minimum sickness and disability insurance coverage introduced for the self-employed. Employment support should be targeted at vulnerable groups and a more coordinated approach to implementing activation polices would improve inter-regional labour mobility. Paid paternity leave should be expanded further to improve the participation of fathers in early childhood care and address the gender disparity in part-time work.

Growth is projected to moderate further

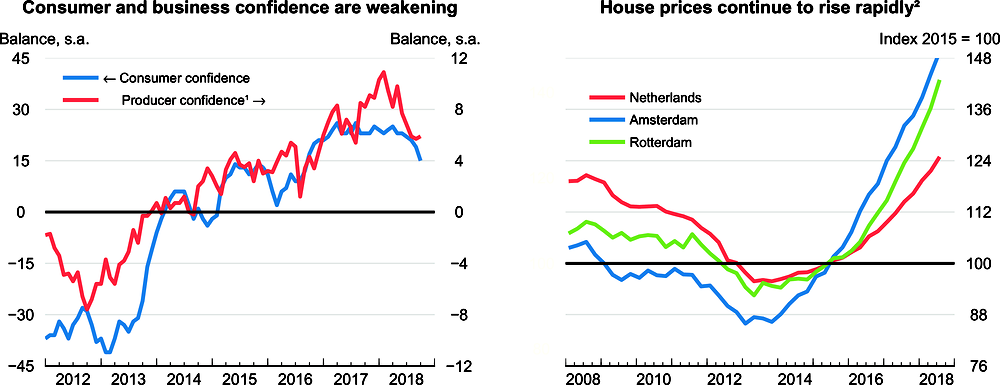

Growth is projected to moderate, reflecting weakening consumer and business confidence and the impact of increased uncertainties. The pace of investment growth is projected to soften, reflecting rising trade-related uncertainty and the impact of deteriorating business confidence. Projected weaker consumption growth reflects increasing inflation, partly related to the increase of the lower VAT rate in 2019, and the easing momentum in the labour market due to the weaker domestic demand outlook. An intensification of global trade tensions and a disorderly outcome of the Brexit negotiations between the United Kingdom and the European Union represent sizeable downside risks to the projections. Overheating in the housing market is a risk to financial and economic stability.