Hungary

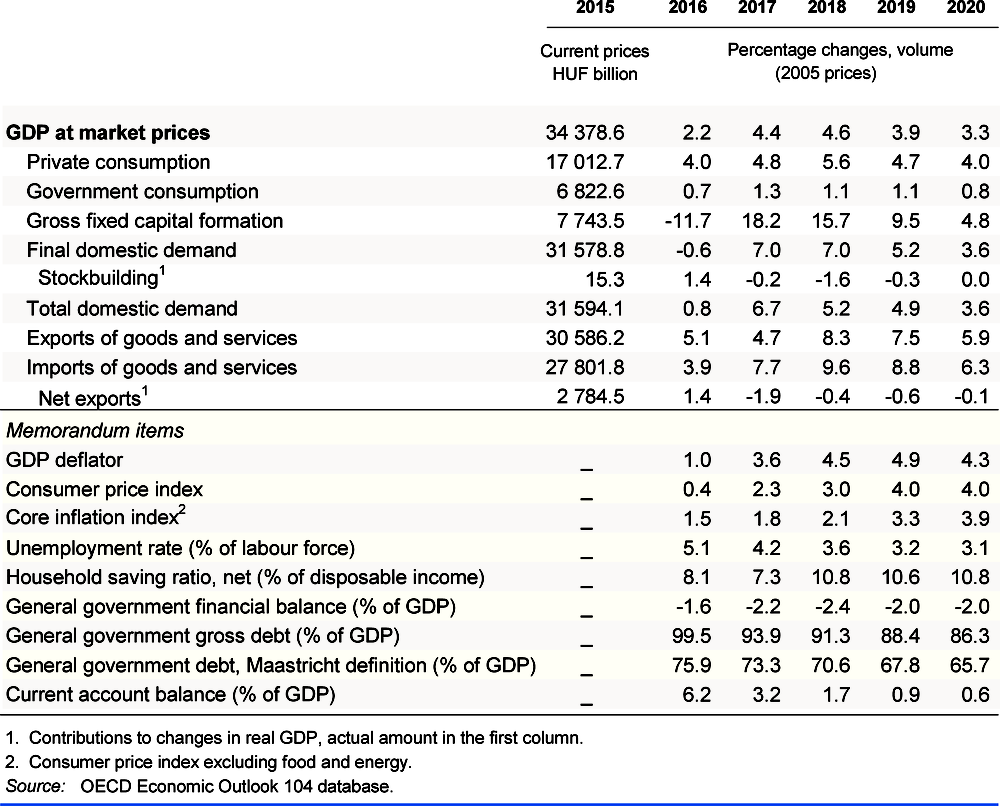

The strong economic expansion is projected to slow gradually in the next two years. Private consumption will be supported by real-wage gains and record-high employment, while investment will be boosted by housing construction and corporate activity, as well as disbursements of EU structural funds, albeit at a slower rate. Tight labour market conditions will raise inflation, projected to reach 4% in 2019. As capacity constraints bite, demand is increasingly met by imports, and growth will gradually lose momentum.

Fiscal and monetary policies are expansionary. Tax cuts and public spending increases were introduced in 2018, and further tax cuts are scheduled for 2019. The central bank has maintained policy rates on hold although headline inflation exceeds its central target of 3%. Macroeconomic policies should be tightened gradually to prevent the economy from overheating. This would also help the authorities to meet their target of reducing public debt below 50% of GDP in the medium term.

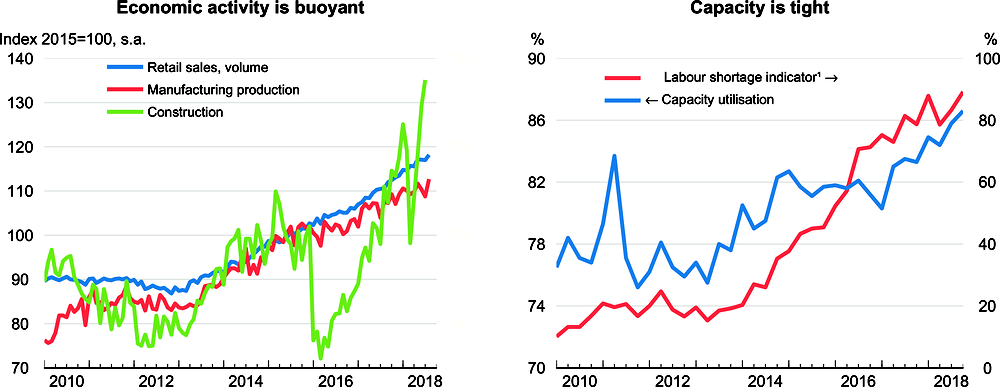

Domestic demand will remain strong

Domestic demand is driving growth, underpinned by rising real incomes, high consumer confidence, and supportive macroeconomic policies. Investment is expanding fast thanks to EU disbursements, buoyant residential construction and the need to expand capacity. Still-strong external demand is boosting exports. However, the high import-content of private consumption and manufacturing is increasing imports, reducing the current account surplus.

The unemployment rate fell to 3.6% in 2018, a historical low, and employment rose steadily. The tightening labour market, public sector wage increases and a hike in the minimum wage led to wage growth of 12% in the first eight months of 2018. Headline inflation reached 3.8% in October 2018, reflecting price increases for fuel, food, tobacco and alcohol rather than underlying wage pressures, while core inflation rose less.

A tighter policy stance is needed

The risk of overheating means that the stimulatory macro-economic policies should be tightened gradually. Monetary policy interest rates are still close to zero, but the central bank has indicated it will begin to normalise monetary policy. Rates are projected to increase in the first quarter of 2019, to help contain inflation expectations. Expansionary fiscal measures in 2019 include tax-allowances for families, cuts in social security contributions for businesses and VAT reductions. Spending will increase on wages, education, infrastructure, and subsidies for house purchases. As a result, the general government deficit will narrow only gradually, despite robust economic growth.

The period of above-trend growth provides a window of opportunity to address medium-to-long-term fiscal challenges, including increases in ageing-related spending on pensions and health care. Robust growth is expanding employment opportunities, which should enable the government to scale back public work schemes. The mainly foreign-owned export sector has been at the core of the upswing, while the domestic SME sector has low growth, productivity and propensity to innovate. Strengthening SMEs requires improving regulatory policies to improve the business environment, and better development of human capital through skills upgrading.

Growth is projected to slow but inflationary tensions will persist

Economic growth will gradually slow in the next two years as capacity constraints tighten. As a result, domestic demand will be increasingly met by imports. Private consumption will continue to benefit from surging real incomes, while business investment will expand to meet rising capacity pressures. Housing construction will slow in response to the re-introduction of VAT on new dwellings from 2019. New industrial capacity coming on-stream will support exports, but rising unit-labour costs will slow market-share gains and export market growth will slow. The projection is subject to downside risks. Higher-than-expected wage increases could de-anchor inflation expectations and require a sudden tightening of monetary policy, thus harming growth. On the other hand, a faster reduction in public work schemes could reduce wage pressures, sustaining growth. Hungary remains vulnerable to spillovers from financial turmoil in emerging-market economies, which would jeopardise financial stability. A hard Brexit would hurt Hungary’s exports and business confidence.