Finland

Output growth is projected to remain healthy, albeit moderating after the vigorous 2016-18 upturn. Exports will continue to benefit from expanding external demand and regained competitiveness. Private consumption will be supported by rising wages and improved employment. Inflation will pick up gradually as the economy nears full capacity.

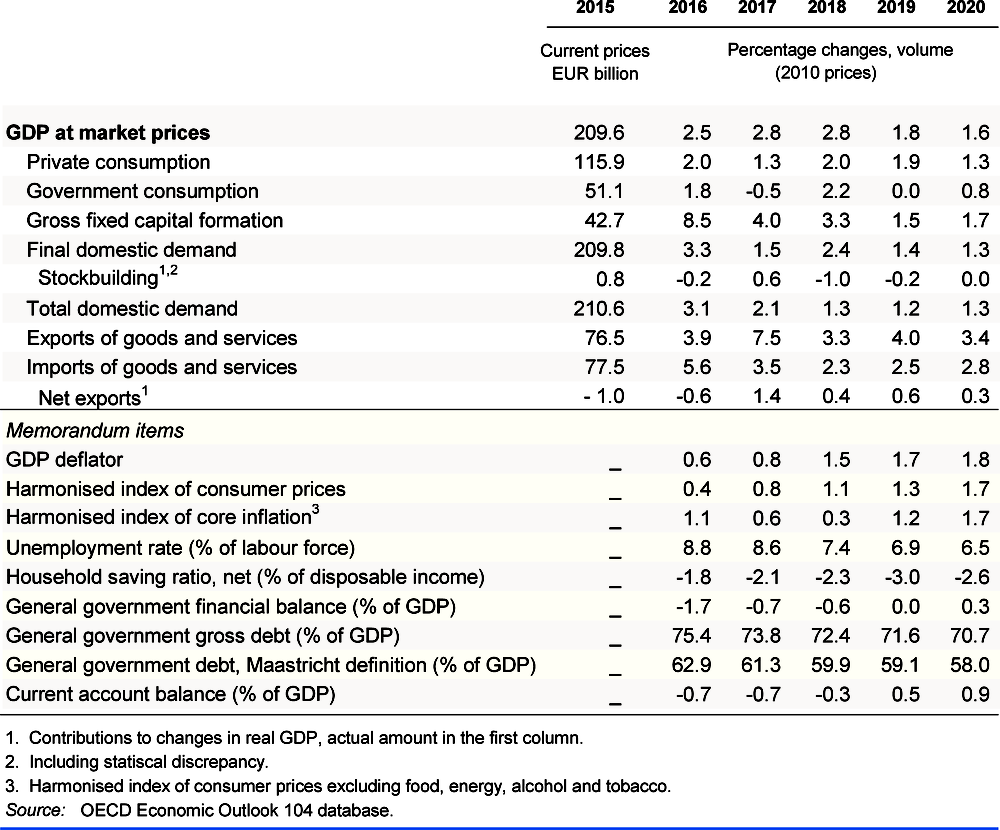

The economic recovery and fiscal consolidation measures are stabilising government debt. Nevertheless, rising ageing-related costs pose a longer-term challenge to fiscal sustainability. Recent pension and labour market reforms strengthen public finances, but enhanced work incentives are needed to lift employment further. Efficiency gains are also key to continue providing high-quality public services in a sustainable way.

Growth has been strong and broad-based

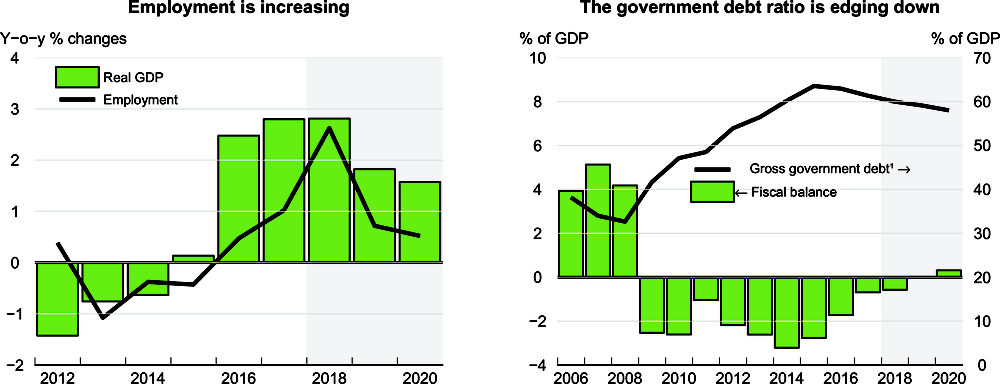

Following several years of subdued growth, the economy has been expanding strongly over the past three years on the back of robust domestic and foreign demand. Private consumption has been buoyed by earnings and employment gains. Residential investment has risen to an exceptionally high level, thanks to low interest rates and strong income growth. Business investment is being boosted by high capacity utilisation and strong export demand. Employment has risen substantially and the employment rate is now approaching the 72% target set by the government for 2019. The unemployment rate has fallen markedly but remains relatively high, partly due to labour market mismatches. Headline inflation has picked up as energy prices soared, but core inflation remains very muted. However, wage growth is starting to gather speed as productivity picks up and the labour market tightens.

Raising employment further is key for sustainable public finances

The fiscal position of general government has improved on the back of increased tax revenues and consolidation measures. Nevertheless, reducing public debt further is challenging as population ageing pushes up social spending and shrinks the working-age population. Public spending growth needs to be contained through efficiency gains in public services, notably health and elderly care, and lifting employment further is necessary to increase tax revenue. A range of policy reforms have been implemented. Pension reform entered into force in 2017, a health care and social services reform is set to be implemented in January 2021, taxes on health and environmentally harmful consumption have been raised and measures to contain public expenditure growth have been taken.

Raising employment is key to address long-term fiscal challenges. The employment rate is still lower than in any other Nordic country and structural unemployment remains relatively high. To increase work incentives, the duration of the earnings-related unemployment insurance benefit has been shortened. At the start of 2018, a revised labour activation model, with stricter conditionality, entered into force and early childhood education fees were lowered for low and middle-income families, which should increase opportunities for more women to work in paid employment. However, boosting employment further will require welfare reform, as high tax rates upon return to work and complex benefit rules still undermine work incentives.

Economic growth will slow amid growing uncertainty

Economic growth is expected to slow as the economy approaches full capacity and as uncertainty weakens business and consumer confidence. Private consumption growth will subside somewhat, as rising inflation weighs on household real income. A declining number of building permits suggests residential investment will decelerate. Non-residential investment, however, will be strong in 2020 due to several planned major projects, notably in the forest industry. Exports will continue to grow, with a strong contribution from the forest and shipping industries, while import growth will be supported by the pick-up in non-residential investment. Employment growth will be moderate as the working-age population continues to shrink. The main downside risk to the outlook is a slowdown in external demand. On the upside, private consumption and investment could prove stronger than projected if the external risks recede.