South Africa

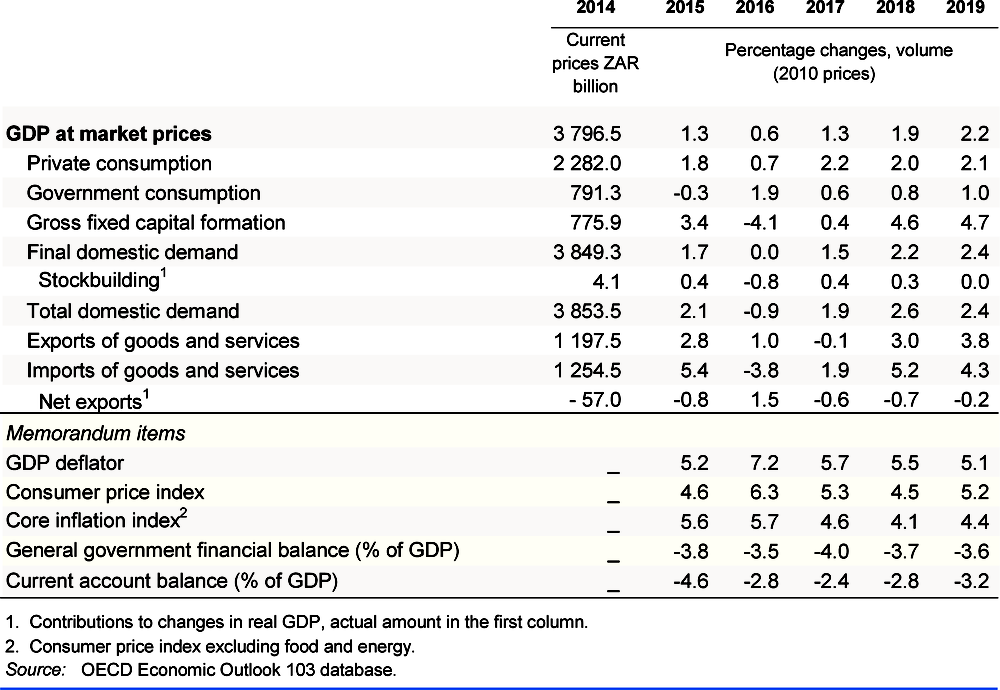

Economic growth is set to strengthen in 2018-19, driven by increased business and consumer confidence. A favourable outlook in trading partners will benefit exports. Private consumption will expand, albeit at a slightly lower rate than in 2017 due to tax increases. Employment trends remain a concern.

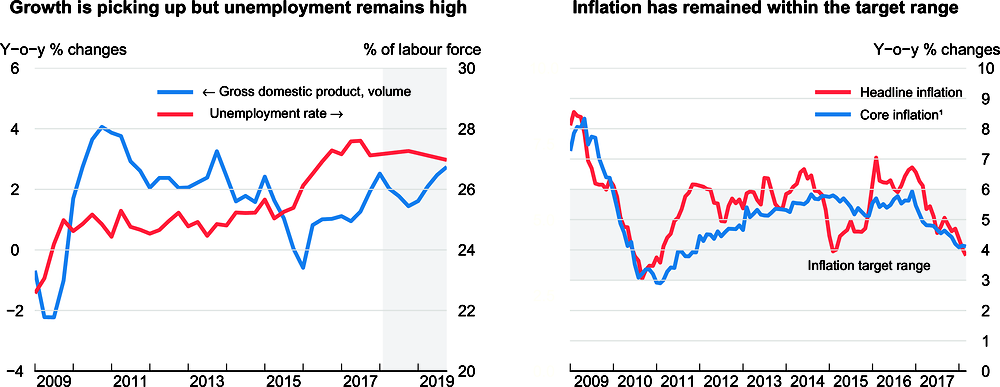

Inflation is projected to remain in the target range, reflecting an assumed stable strong exchange rate, which lessens the effect of higher international oil prices and thus the upward pressure from the VAT hike. Monetary policy is projected to be moderately expansionary, which is appropriate to support growth. The government budget for 2018-19 remains tight, but tax reforms will create some fiscal room for much needed investment in higher education and social benefits. Once the fiscal situation improves, government debt reduction needs to be advanced. Network regulation reforms aimed to broaden competition can further support growth.

Growth is improving against a more stable political environment

A change in the political environment marked a positive turning point for business and consumer confidence. Investment is picking up after three years of decline. The currency has stabilised following an initial period of strengthening after the change of power in the ruling party. In addition, the agricultural sector rebounded from the severe drought in 2016, leading to an upward revision of growth in 2017. The budget for 2018/19 reversed past fiscal slippage. Rating agencies, acknowledging the favourable political developments, have refrained from further downgrades since November 2017.

1. Consumer price index in urban areas, excluding food, non-alcoholic beverages, fuel and energy.

Source: OECD Economic Outlook 103 database; and Statistics South Africa.

Recent economic improvements have not yet translated into higher employment. Unemployment remains high at 27%, weighing on household consumption. Inequalities in income and opportunities continue to be high. Young people are especially vulnerable to unemployment, reflecting the low quality of the education system, which contributes to skill shortages and low productivity.

As fiscal policy tightens, monetary easing should support activity

The budget released in February 2018 proposes several measures to contain the deficit. The VAT rise from 14% to 15% and the partial freezing of personal income tax brackets will increase revenues. Increases in social benefit and the introduction of fee-free higher education for new students will temper the effect of the VAT increase on incomes. However, budget reallocation towards these measures may outbalance the added revenues and weigh on the public finances in the future.

Inflation fell to around 4% at the beginning of 2018 following a slowdown in price increases for food and transport. The VAT increase is likely to have only a small effect on inflation. Inflation is projected to stabilise in the middle of the 3%-6% target range, providing room for some monetary easing to support the economic rebound. In March 2018, the Reserve Bank reduced the repurchase rate from 6.75% to 6.5%. A further reduction in the policy rate is projected to follow.

Investment in infrastructure and structural reforms would support growth in the medium to long term. The budget proposes important structural reforms, including reducing barriers to competition in several network sectors. Timely implementation would sustain improved levels of business confidence and increase investment. Higher investment will be crucial for growth to translate into lower unemployment and, thereby, greater inclusiveness.

Growth is projected to stabilise but remains exposed to internal and external risks

Growth remains fragile and exposed to policy uncertainty and external risks. Investment and the service sector will be main drivers of growth. Despite the favourable political environment, policy uncertainties remain, such as the governance of state enterprises. In addition, a potential land reform allowing land expropriation without compensation raises uncertainty about property rights, which could lead to a significant decline in investment. External downside risks relate to an increase in oil prices and to foreign trade tensions, in particular on commodities. In addition, higher interest rates in Europe and the United States could affect the financial market and the exchange rate through capital outflows. On the upside, a quick implementation of proposed structural reforms could reduce remaining policy uncertainties and stimulate domestic demand through higher-than-expected investment.