Mexico

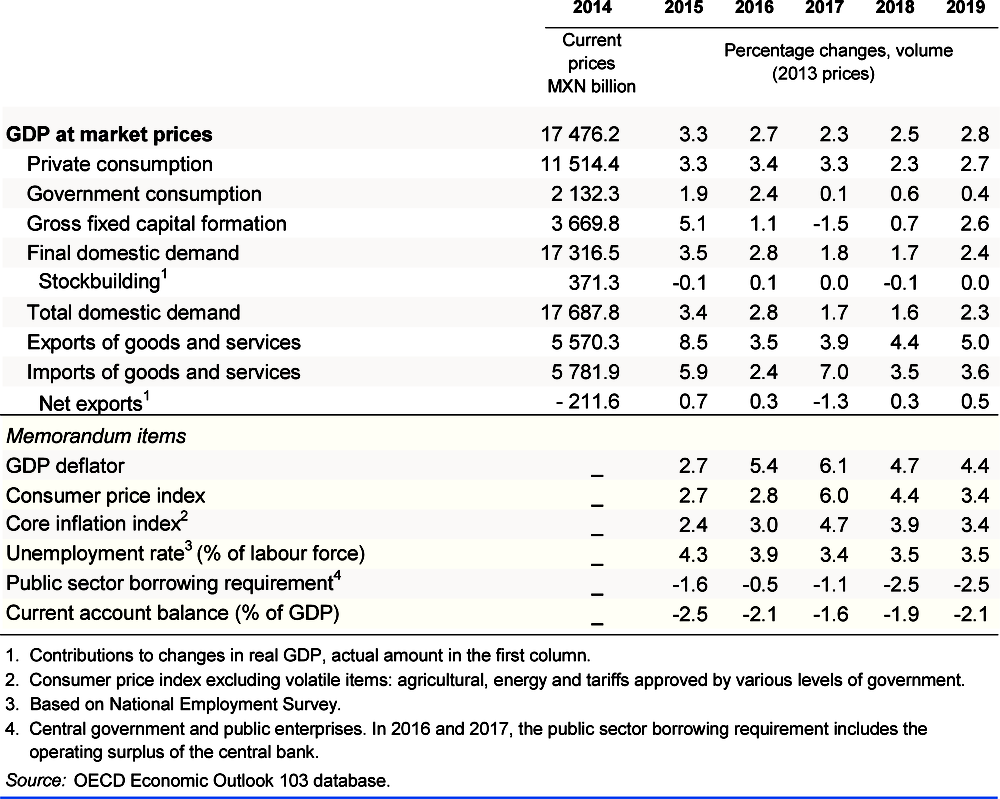

Growth is set to pick up, underpinned by private consumption and exports. Uncertainty will continue to restrain private investment, although earthquake-related reconstruction activities are expected to take place in 2018. However, private investment could accelerate if the NAFTA negotiations end favourably. Public investment will remain subdued. Unemployment is projected to remain at historic low levels. Inflation will continue to decline from its high level to closer to the central bank’s target.

Structural reforms have already visible effects but challenges persist, including high levels of violence and corruption, poverty, inequality, informality and slow productivity growth. Reaping the full benefits of structural reforms will require keeping the momentum for successful implementation nationwide, complemented by a new wave of reforms to strengthen the rule of law and improve institutional quality.

Private consumption and manufacturing exports are underpinning growth

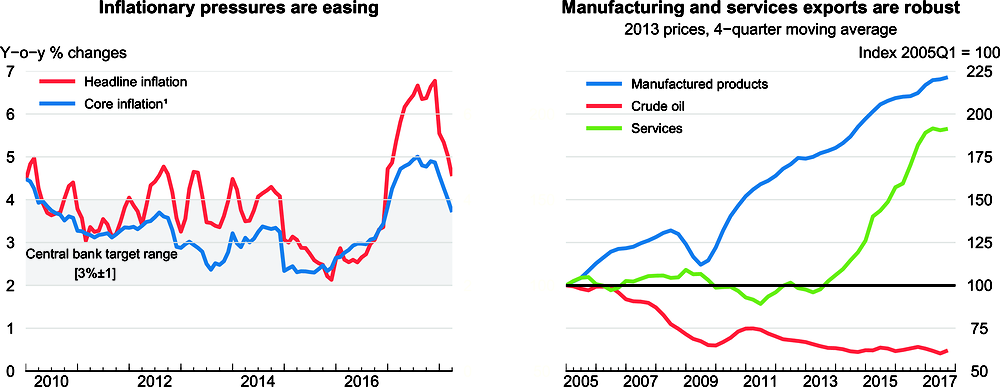

Growth has been resilient, in spite of the several idiosyncratic shocks that have hit the Mexican economy. Private consumption has supported growth, even though inflation eroded real wages in 2017. Household income has benefitted from strong remittances, job formalisation and credit expansion. More robust external demand and currency depreciation have led to an acceleration of manufacturing exports and to a non-oil trade surplus. Investment continued to be constrained by high uncertainty about the outcome of ongoing NAFTA negotiations and the government’s fiscal consolidation.

1. Consumer price index excluding volatile items: agricultural, energy and tariffs approved by various levels of government.

Source: OECD Economic Outlook 103 database; and Thomson Reuters.

Inflation has receded from its high level, as the effects of temporary domestic shocks have started to wane. The labour market continues to be buoyant as job formalisation remains robust and the unemployment rate at historically low levels. However, wage pressures are absent.

Successful reform implementation is key to raising medium-term growth

The government has implemented a fiscal consolidation plan which has led to a primary surplus for the first time since 2008, and to a decline in the public debt-to-GDP ratio. Fiscal consolidation is projected to continue, albeit at a slower pace, which will allow for a mild recovery in public investment. While satisfying public investment and social spending needs, fiscal discipline should continue to lower the public debt-to-GDP ratio. There is room to increase tax revenue by reducing tax exemptions, notably on VAT and income taxes. In addition, revenue could be enhanced by improving tax collection, raising property and green taxes, and introducing an inheritance tax. Higher taxes revenues from these sources could also allow a cut to the corporate income tax rate, which is amongst the highest in the OECD, thus moving to a more growth-friendly tax mix. Coordinating the collection of income taxes and social security contributions would reduce tax evasion.

Heightened uncertainty is delaying private investment and the effects of recent structural reforms from materialising fully. Given the current path of inflation and barring any additional shocks, and while staying vigilant regarding inflation path, inflation determinants and expectations, monetary policy should have room to reduce its high policy rate, thus contributing to more favourable credit and investment conditions.

Although some recent structural reforms, such as those in the telecommunication sector, are already contributing to growth, accelerating implementation across the country in key areas, such as judicial reform, is crucial to reap the full benefits. Raising women’s participation in the labour market, improving access to good quality education, reducing informality and alleviating poverty are key to lift employment and productivity growth as well as well-being.

Growth is projected to pick up

Growth is projected to pick up owing to continued resilient consumption and a favourable external environment, but the economy continues to be highly exposed to external shocks. Once uncertainty regarding the outcome of NAFTA negotiations dissipates, investment will also add to growth. Financial market turbulence associated with prospective changes in monetary policy in the United States or an uncertain business environment, including delayed ratification of NAFTA negotiations, could however lead to exchange rate volatility, tighter financial conditions and capital outflows. On the other hand, further reforms to improve the rule of law and the quality of institutions would boost productive investment, reduce pervasive informality and put the Mexican economy on a stronger growth path.