Germany

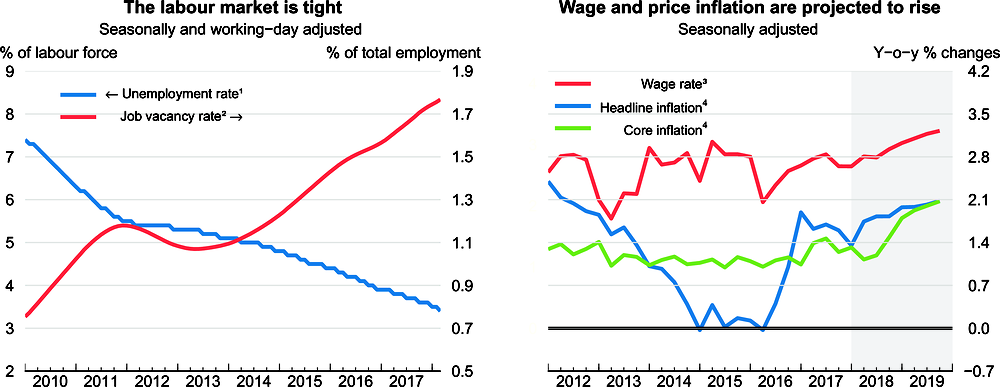

Economic growth is projected to remain solid, backed by robust world trade, investment and a booming labour market. Consumption growth has slowed somewhat, as higher inflation has curbed real wage growth. Low interest rates, high capacity utilisation and growing housing demand are supporting strong residential and business investment. The current account surplus is projected to fall somewhat on the back of strong domestic demand that fuels imports.

Fiscal policy is mildly expansionary, but strong cyclical revenue growth will keep the budget balance in surplus. Reductions in social security contributions and higher subsidies for families are expected, although their timing remains uncertain. Fiscal space is available to increase spending on education, broadband and low-emission transport infrastructure, all of which would strengthen productivity in the long run. Tax reductions for low-wage and second earners along with higher environmental and real estate taxes would promote greener and more inclusive growth.

Economic growth has been strong

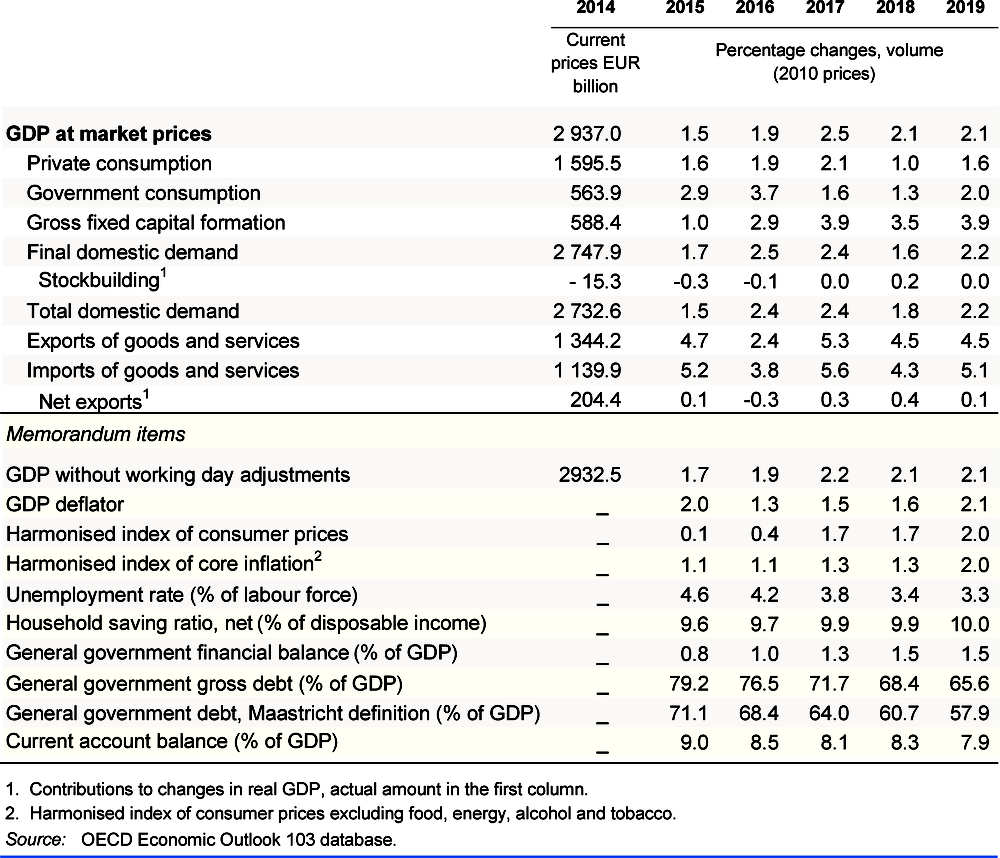

With its specialisation in capital goods, Germany has benefitted from the broad-based global upswing. In the context of high capacity utilisation and easy credit, this has promoted strong machinery and equipment investment. However, in the first quarter, strikes and an outbreak of influenza lowered manufacturing production temporarily. Government spending also slowed before the new government took office in March. Business sentiment remains high notwithstanding a recent decline related to concerns about rising protectionism. Immigration, rising household incomes and low interest rates have boosted housing demand and construction. However, the construction sector has now reached capacity constraints, limiting faster growth going forward. House prices have risen markedly, especially in urban areas, where the supply of buildable land is scarce. Access to affordable housing is increasingly difficult for lower and middle-income households. But prices are still below long-run averages and mortgage lending has been in line with income growth, suggesting that financial risks remain limited.

1. Manufacturing, construction, wholesaling and retailing.

2. The nominal house price is divided by the nominal disposable income per head. It is standardised by being divided by the long-term average as a reference value over post-1980.

Source: Ifo Business Survey, May 2018; and OECD Housing Prices database.

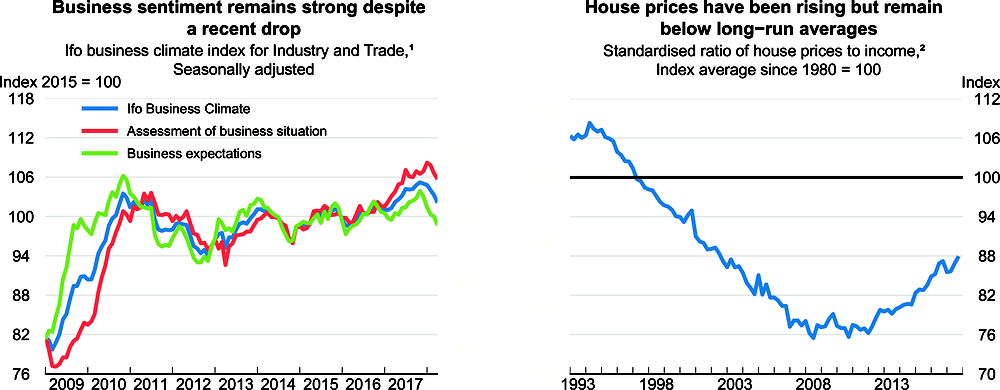

Vigorous employment gains have pushed the unemployment rate to a record low, while the number of vacant jobs has continued to rise, in particular in long-term care and construction. The booming labour market underpins consumption and helps improve job quality and equality, as the number of full-time permanent contracts is growing strongly and broad-based wage growth benefits particularly lower-income earners. Employment growth has been strongest for low-pay jobs with the lowest skill demands in recent years, mostly in health care as well as personal and administrative services, moderating aggregate wage growth. Strong immigration, mostly from other EU countries, has also kept wages from rising more vigorously. Recent collective bargaining outcomes suggest a modest increase in wage growth. Unions and employers have negotiated non-wage benefits, such as a better work-life balance through more possibilities to reduce their working time temporarily.

Fiscal policy is addressing some key structural priorities

The fiscal stance is projected to be expansionary in 2018 and 2019. The new government has announced plans to reduce unemployment insurance contributions by 0.3 percentage point and to shift about 0.5 percentage point of health insurance contributions from employees to employers. Child tax allowances and benefits will also rise. The government also plans substantial tax rebates and grants for families with children who want to buy a home. All of these measures will boost household demand. Government spending to better integrate refugees, improve childcare provision, upgrade schools’ digital equipment and spur the rollout of high-speed broadband is expected to rise. Most of these measures were announced in the government’s coalition agreement. Overall tax reductions and spending increases are projected to amount to 0.5% of GDP between 2017 and 2019. Nonetheless, strong cyclical tax revenue growth is likely to increase the government surplus to 1½ per cent of GDP by 2019.

1. Population aged 15-74 years. Based on the German labour force survey.

2. Percentage of unfilled job vacancies relative to total employment.

3. Average nominal wage per employee.

4. Harmonised consumer price index (HICP). Core HICP excludes energy, food, alcohol and tobacco. Projection from 2018Q2 for HICP and core HICP.

Source: OECD Economic Outlook 103 database; and Statistisches Bundesamt.

The fiscal stance is appropriate, as most of the envisaged fiscal measures promote long-term growth and inclusiveness, and there is little sign of overheating. However, the subsidies for owner-occupied housing could push up house prices further, given capacity constraints and overall relatively inelastic housing supply. Higher house prices risk further reducing access to affordable housing for lower-income households. Using more of the fiscal space for education and infrastructure investment would be preferable. Providing opportunities to enrol more young children from disadvantaged socio-economic backgrounds in high-quality childcare and increasing places in full-day primary schooling should be spending priorities. These steps would also make it easier to reconcile family life and full-time employment, especially for women. The new government has committed to introducing a legal guarantee of full-day primary schooling by 2025 and to develop a national life-long learning strategy with the social partners.

Growth is projected to remain robust

Economic growth is projected to slow slightly on account of decelerating external demand and capacity constraints, which together with a tight labour market will raise consumer price inflation. The current account surplus is expected to edge down, as the past euro appreciation and moderating world demand should slow export growth from an exceptionally fast pace. At the same time, strong domestic demand should continue to contribute to dynamic import growth. Rising protectionism in trade and investment could disrupt world trade and global value chains, which are key for the success of German exports. This would weigh on economic growth and employment. On the other hand, steps to implement reforms to complete the Single Market in the European Union and establish a more comprehensive banking union in the euro area could strengthen confidence and boost the attractiveness of Germany as a location to invest.