Belgium

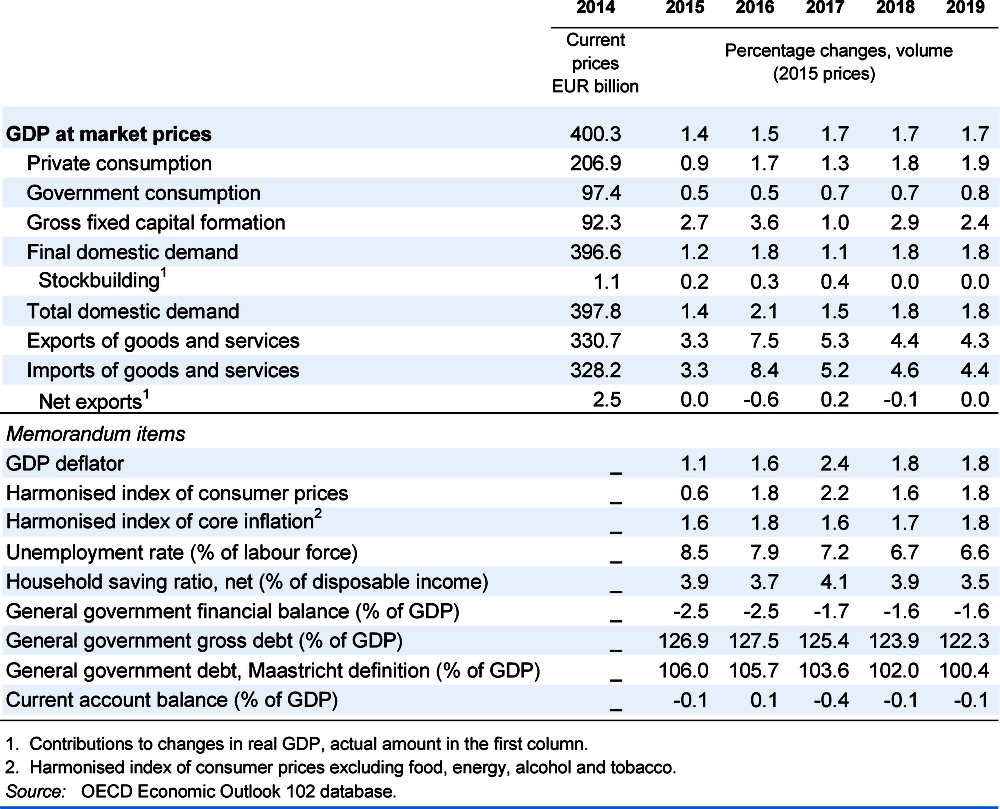

Economic growth increased in 2017 and is projected to stabilise at 1.7% in 2018 and 2019. Private consumption will be an important driver of growth. Government investment will be strong in 2018 and private investment will support growth. Inflation will increase due to tightening labour markets and higher wages.

The fiscal stance will provide modest support for growth in 2018 and 2019, due to planned reductions in labour taxation. Raising skills and work opportunities for disadvantaged groups would make growth more inclusive. Re-orientating public spending towards education and physical infrastructure investment would enhance productivity growth and inclusiveness.

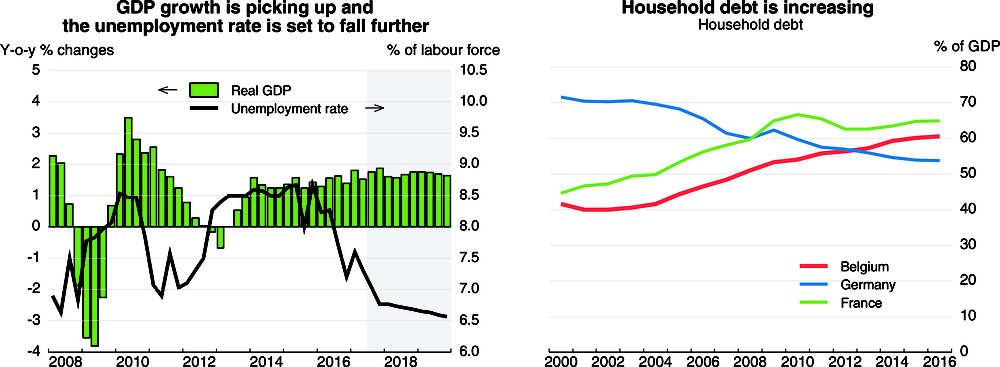

Public debt, at 105.7% of GDP in 2016, remains high. To ensure sustainability, it is important that the government sticks to its medium-term consolidation path. Financial sector vulnerabilities are limited, with stress tests indicating resilience in the banking sector. However, prolonged low interest rates could create risks. House prices and mortgage lending have already increased considerably. Further improving macro-prudential measures to mitigate risks related to the housing market would be welcome.

Growth has strengthened

Economic growth strengthened in 2017, supported by domestic demand. Business confidence has risen and business investment shows signs of strengthening. Consumer confidence has improved and household consumption has increased, with continued employment growth, supported by expanding output, labour tax cuts and past wage moderation measures. With wage moderation measures now unwound, wage growth has increased, notwithstanding the recent reform of the wage-setting system. Inflation has been higher than in neighbouring countries due, in part, to recent increases in indirect taxes.

Source: OECD Economic Outlook 102 database.

Productivity and inclusiveness could be enhanced

The budget deficit was 2.5% of GDP in 2016 and is projected to decline to around 1.6% of GDP by 2019, with the fiscal stance providing modest support to growth in 2018 and 2019. With public debt at 105.7% of GDP in 2016, it is important that the government adheres to its medium-term fiscal targets to permit a steady reduction of the debt ratio. The authorities should increase public investment, which has been low for several decades, while at the same time reduce inefficient government spending in order to boost productivity growth and ensure fiscal sustainability.

Growth could be made more inclusive by further enhancing the labour market performance of immigrant, low-skilled and older workers. Improving the capacity of the education system to provide disadvantaged students with necessary skills, on-the-job training and increased use of flexitime is particularly important. Recent pension and wage indexation reforms are also likely to have improved labour market outcomes, but should be monitored. While the shift from labour taxes to excise duties and environmental taxes will also likely improve the employment of low-skilled workers and enhance green-growth, Belgium will continue to have rates of labour taxation amongst the highest in the OECD, suggesting further reform is warranted. Recently announced reforms to the corporate tax regime, which has a relatively high statutory rate and numerous exemptions, are welcome. Further measures to broaden the capital income tax base as part of a broader reform of household savings taxation should also be considered.

Growth will remain stable

GDP growth is estimated to have risen to 1.7% in 2017 and is projected to remain at this level in 2018 and 2019. Private consumption will continue to be an important driver of growth, supported by employment growth and cuts in labour taxation in 2018 and 2019. Private investment will support growth in 2018 and 2019, thanks to favourable financial conditions. Government investment will contribute to economic activity in 2018. Export growth is projected to slow as competitiveness gains from past wage moderation measures subside. Employment growth is projected to remain solid and lead to further declines in the unemployment rate, to 6.6% in 2019. Inflation will peak at 2.2% in 2017, due to the effects of past energy prices and other measures, ease in 2018 as these factors subside, before rising again in 2019, as economic slack is eliminated.

Economic growth could be stronger if tax reductions enhance private consumption more than expected. A weaker-than-expected international environment could reduce economic growth somewhat. A fall in house prices, which have risen steadily along with household debt since 2000, would pose a moderate risk to household consumption.