Slovak Republic

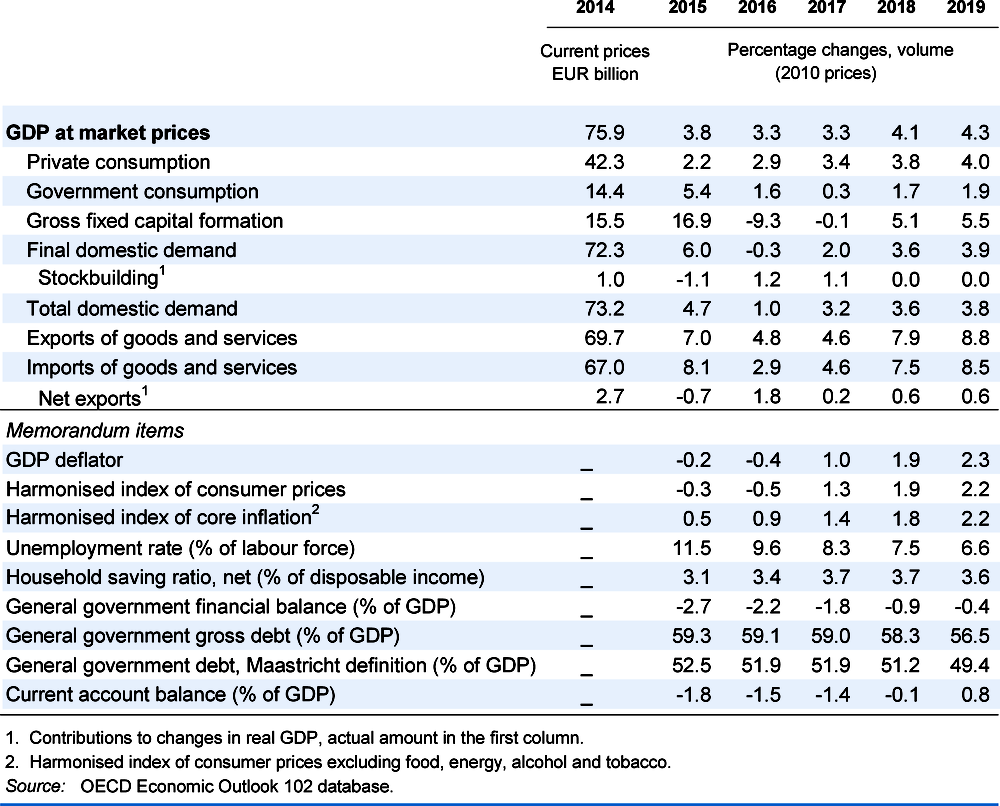

The Slovak economy is maintaining its rapid expansion and growth is projected to exceed 4% in 2018 and 2019. Low interest rates and strong labour market outcomes will fuel consumer spending. Unemployment has already fallen to record lows, and intensifying labour shortages will boost wage growth. Investment should pick up, supported by an improving business climate and new infrastructure investment. Exports will continue to benefit from the expansion in the automotive sector, allowing the current account to reach a modest surplus. Tightening labour and product markets will push consumer price inflation above 2%.

The government intends to reach a balanced budget by 2020, implying modest consolidation in 2018-19. In order to finance inclusiveness-friendly reforms, particularly in education, the government should enhance public-sector efficiency and continue to improve tax collection.

The financial sector remains stable with profitable and well-capitalised banks and relatively few non-performing loans. Household indebtedness is low, but it has been increasing sharply in recent years due to new mortgage lending. In this respect, the central bank took several pre-emptive macro-prudential measures to reduce the risks of a housing bubble and strengthen financial stability. The authorities should stand ready to strengthen these measures if systemic risks increase.

Household consumption is underpinning growth

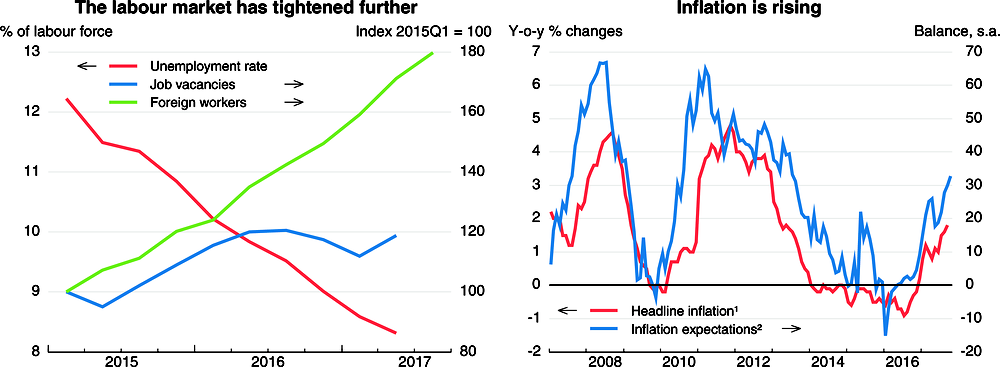

Economic growth remains strong, driven mainly by robust household spending supported by improving consumer confidence and favourable labour market developments. Wage pressures have been building as unemployment continues to fall, and the number of vacancies has reached historic highs. Persistent labour shortages are attracting growing numbers of foreign workers. However, investment activity has decreased due to a fall in public investment. Exports slowed in recent months due to temporary weakness in the automotive sector. Inflation has picked up of late, underpinned by rising demand pressures and higher food prices.

1. Headline inflation refers to the harmonised index of consumer prices (HICP).

2. Based on consumer opinion survey of future tendency.

Source: OECD Economic Outlook 102 database; OECD Main Economic Indicators database; Statistical Office of the Slovak Republic; and Centre of Labour, Social Affairs and Family.

Fiscal policy will remain prudent

The fiscal deficit in 2016 was slightly higher than planned, but the consolidation will continue with an annual structural balance adjustment of 0.5% of GDP in 2017-19. This is an important step towards reducing the risk of being forced to take pro-cyclical fiscal measures in case of any unexpected large negative shocks, and economic buoyancy provides an opportunity to strengthen public finances. In order to finance much needed reform in education and Roma integration, the government should enhance public-sector efficiency and continue to improve tax collection. Monetary policy in the euro area will remain accommodative, boosting investment and consumption through low lending rates.

Financial vulnerabilities have decreased considerably since the financial crisis, and the financial sector is now stable. The banks are well capitalised and profitable, and the share of non-performing loans is comparatively low. However, strong growth and very low interest rates have led to rapid increases in bank lending, particularly for housing. Household indebtedness has risen more sharply than elsewhere, although its level remains relatively low. In response, the National Bank of Slovakia has correctly taken pre-emptive macro-prudential measures. Now, banks must have an additional 0.5% counter-cyclical capital buffer and limit new housing loans with a loan-to-value ratio exceeding 90%. The authorities should stand ready to tighten these measures if risks to the financial system increase.

Economic activity will remain strong

Growth is projected to exceed 4% in 2018-19. Domestic demand will accelerate, while the launch of new production lines in the automotive sector will boost exports. Private consumption is projected to expand further on the back of the buoyant labour market and supportive financial conditions. Unemployment is expected to fall below 7% in 2019. As EU-funded projects take off and the government will start new infrastructure projects, investment growth will rise. Wage pressures will remain strong, fuelling higher inflation, which should exceed 2% in 2019.

Both upside and downside risks to the outlook are related to the external environment, as exports (notably of cars) will depend in large part on developments elsewhere in Europe. Increased political uncertainty in the European Union would have a negative impact on investment and economic activity, while a more robust EU recovery would boost already strong exports. At the same time, activity could be stronger if labour market tightening and high wage growth boost private consumption more than expected.