Netherlands

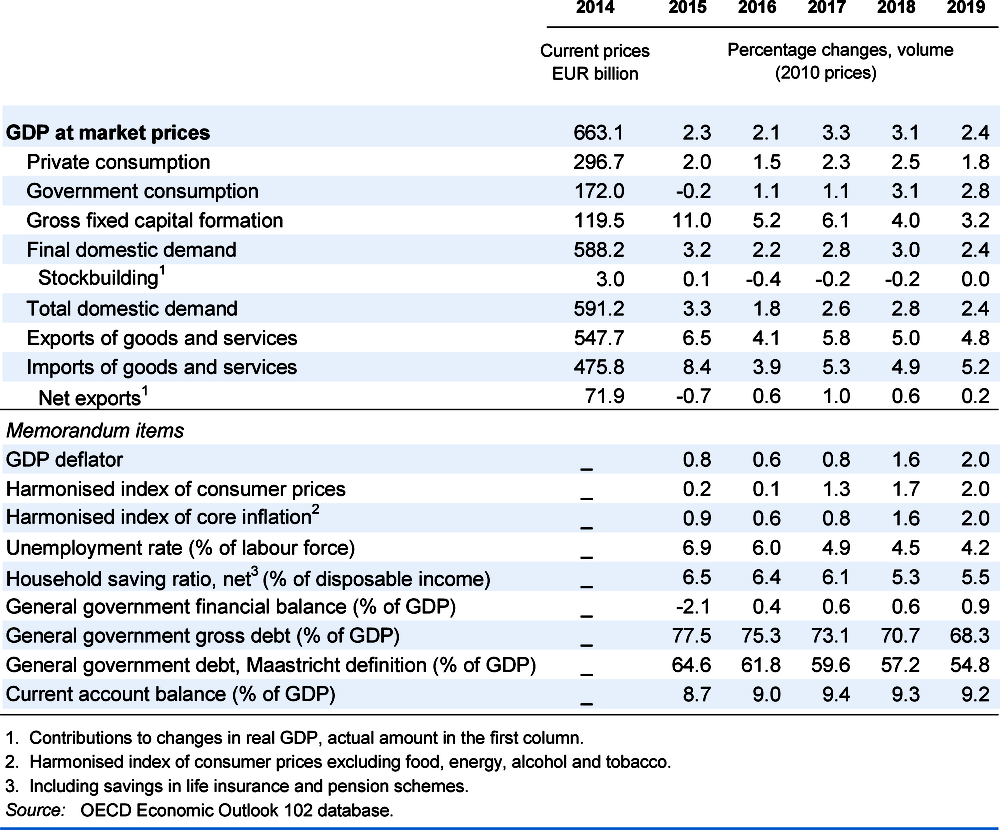

GDP growth is projected to remain strong and broad-based in 2018 and 2019. Private consumption growth will peak in 2018, reflecting a strong labour market and a looser fiscal stance, before moderating in 2019. Growth in business investment should be vibrant, driven by improved economic sentiment and solid external demand. Wage growth and inflation are projected to rise gradually. The current account surplus is set to ease gradually but remain at a high level.

Accommodative euro area monetary policy will continue to support demand. Fiscal measures outlined in the recent government coalition agreement will also be supportive, especially in 2018. To ensure more inclusive growth, labour market reforms should make it easier for workers to attain good quality jobs. Avenues to reduce reliance on non-standard jobs include lowering the cap on severance payments and ensuring that the dismissal system works more efficiently. Improving credit flow to SMEs and increasing public spending on R&D would lead to higher rates of investment and help to reduce one of the largest current account surpluses in the euro area.

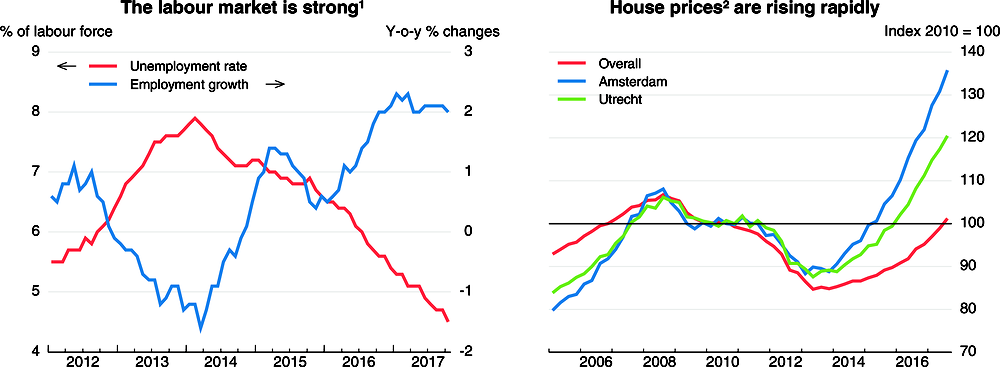

House prices have recovered and in major cities have surpassed the level reached before the global financial crisis. High levels of mortgage debt make households vulnerable to decreases in house prices. The reduction in the maximum loan-to-value ratio for new mortgages and the lowering of mortgage interest relief should proceed at a faster pace than planned to reduce fragilities. Easing the strict regulation of the private rental market would improve housing supply and damp excessive house price growth.

Strong domestic and external demand are driving growth

Economic growth continues to be firm. Robust consumption and strong business investment growth reflect high levels of consumer and business confidence. Solid external demand, particularly from other euro area countries, is driving rapid export growth. Growth in residential investment remains solid, despite softening somewhat recently. Consumer price inflation is below 2%.

1. Data are seasonally adjusted and refer to the population aged between 15 and 75.

2. Price index of existing own homes that are located on Dutch territory and sold to private individuals.

Source: Statistics Netherlands (CBS).

Labour market conditions remain strong, with the unemployment rate falling further to new lows. However, the rising share of workers on temporary contracts or who are self-employed could indicate a weakening of work quality. Reducing the cap on severance payments and ensuring the dismissal system works efficiently would help to narrow the gap between workers on permanent contracts and those on temporary ones. Further lowering the cap on unemployment benefits would enhance the job search incentives for high-skilled individuals, making the allocation of labour more efficient.

There is scope for further fiscal measures

Measures announced in the recent coalition agreement will have a positive short-term impact on activity but also on longer-term growth. Increased health-care and social expenditures will ensure an immediate stimulatory impact, while the effect of a gradual lowering of corporate income taxes will have a more lasting impact. Given healthy public finances, the structure of tax and spending measures should continue to be adjusted with a focus on improving long-run growth potential. Further lowering taxes on low-income workers and second-earners with young children would reduce inequalities and support women’s participation in paid work. More direct government funding of R&D, to complement existing tax relief for private R&D spending, would bolster the capital stock. The fiscal cost of such measures should be offset by reducing less growth-friendly expenditures or raising less distortionary taxes, such as further reducing the gap between low and high VAT rates in addition to the planned increase in the low rate in 2019.

High levels of household debt, particularly mortgage-related debt, make households particularly vulnerable to a fall in house prices. To address this challenge, the lowering of the maximum loan-to-value ratio for new mortgages should be accelerated and the pace of reduction of the tax relief for mortgage interest payments, which the new government plans to accelerate, should be increased further. In order to improve the supply of housing and slow price growth in overheating markets, strict regulations associated with the private rental market should be eased.

Growth will remain robust

Business investment growth is projected to remain healthy, reflecting low borrowing costs, strong producer confidence and robust domestic demand. Household consumption growth is projected to pick up in 2018 owing to favourable labour market conditions and steady growth in real wages, before easing in 2019 in response to a planned increase in the reduced VAT rate. Inflation is projected to rise above 2% at the end of the projection period as labour and product markets tighten. The fiscal stance is assumed to be expansionary in 2018, and broadly neutral in 2019. The current account surplus will remain large in the absence of significant changes to saving or investment.

The main downside risk is the uncertainty surrounding the negotiations and the eventual exit of the United Kingdom from the European Union. The Netherlands is more exposed than many other European countries due to its strong trade and financial linkages with the United Kingdom. The possibility of a sharp correction in house prices is another important risk to the projections, and could result in a fall in residential investment and weaker consumption growth. A downturn in the housing market could also have sizeable financial stability implications, reflecting domestic banks’ exposure to the market. On the upside, reduced levels of uncertainty could lead to stronger-than-expected growth in business investment and household consumption. Stronger global trade growth would further strengthen economic growth over the projection horizon.