Ireland

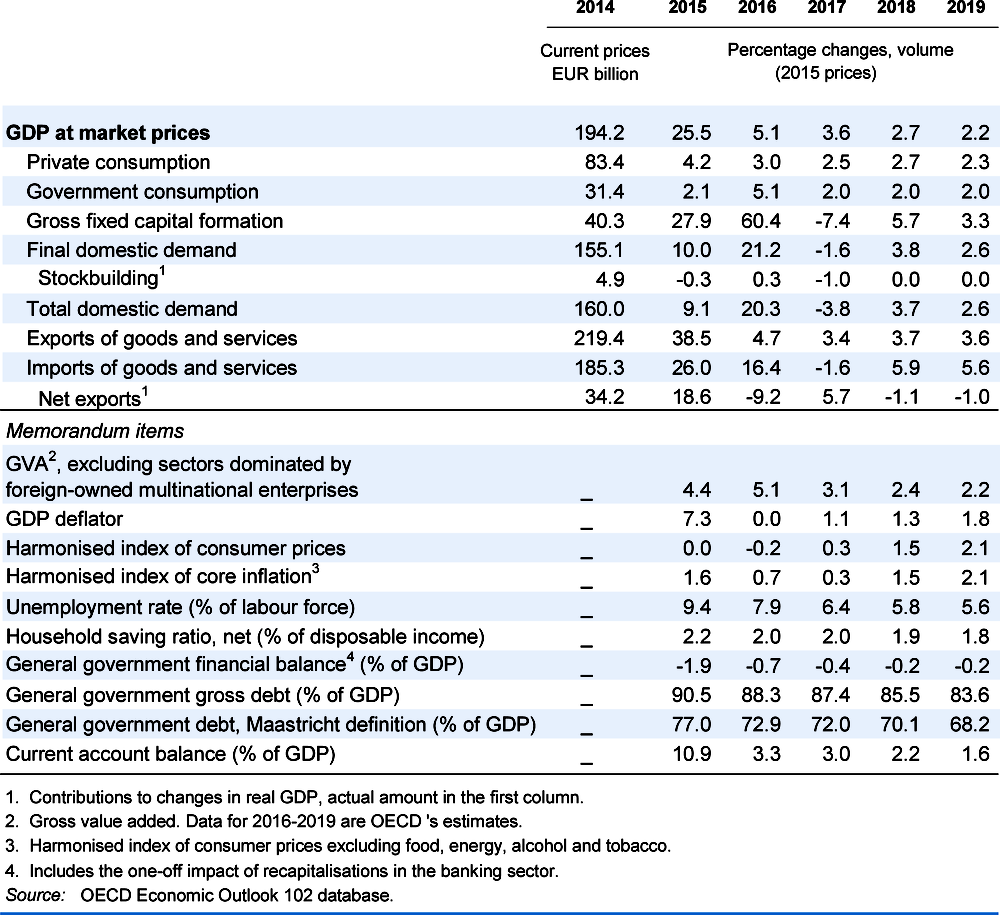

The economy is projected to keep growing robustly, as domestic demand is set to remain solid. As the labour market tightens, wage pressures will continue to be strong and are projected to feed into higher inflation. Output is expected to expand at a slower pace than in past years due to already high labour costs and high external uncertainty, including about the final outcome of the Brexit negotiations.

The government should ensure that its medium-term goal of balancing the budget is met. It leaves room to use fiscal policy to support growth if needed, while avoiding over-heating pressures in the economy. Structural policy should prioritise getting more people back into work by enhancing government programmes that improve the skills of the long-term unemployed.

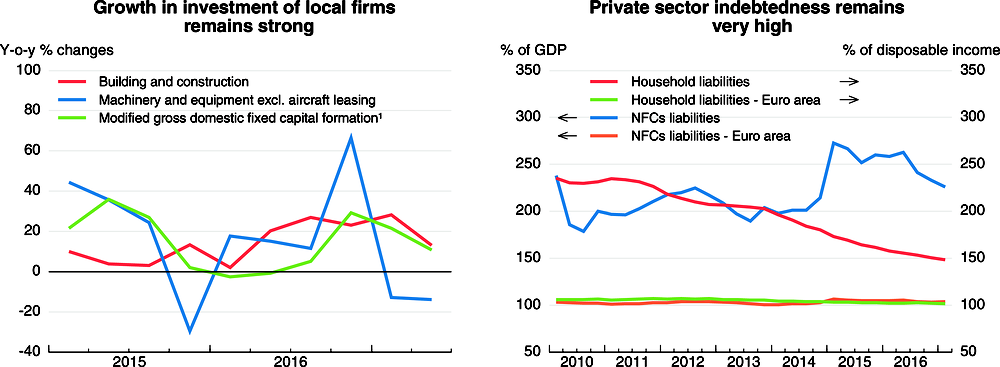

Private sector debt remains high, as some households and corporations are heavily indebted with poor prospects of debt repayment. As a consequence, the stock of non-performing loans (NPLs) remains stubbornly high, while banks often extend forbearance, which impairs the Irish banking system. The authorities should address high indebtedness by strengthening insolvency regimes and support a further resolution of NPLs by ensuring collateral enforcement and NPL write-offs.

The recovery is maturing

GDP continues to grow strongly. Abstracting from volatile activities of multinational enterprises (MNEs), domestic demand remains solid. The headline number for investment has been strongly affected by MNEs, but business investment by local Irish firms continues to recover strongly, particularly in the construction sector. The unemployment rate continues to decline rapidly. As the labour market is increasingly tight, wages are rising rapidly. Even so, inflation is subdued, notably because prices of goods imported from the United Kingdom have been declining due to the depreciation of sterling. With rising real wages, household consumption has grown steadily over the past years.

1. Modified Gross Fixed Capital Formation (GFCF*), as calculated by the Central Statistics Office (CSO) of Ireland, excludes R&D-related imported intellectual property assets and aircrafts related to leasing, both attributed essentially to multinational enterprises.

Source: Central Statistics Office, Ireland; and Eurostat.

Property prices continue to rise rapidly due to a shortage of housing supply. Property-related loans are increasing fast, driving the recent recovery in new lending. Activity in the construction sector is gaining momentum, boosting job creation, but housing supply is expected to fall short of demand for some time. The authorities should encourage more construction by greater liberalisation of planning requirements. The sharp rise in prices and lending raises concerns that another property bubble may be forming, and the authorities should stand ready to tighten prudential regulations if needed.

Policies should lay the ground for sustainable growth

While private sector debt remains high, the banking system is still impaired due to a stubbornly high stock of NPLs. NPLs still account for around 13% of total outstanding loans, while banks have often extended forbearance and circumvented write-offs over the past years. Reflecting high default rates and difficulties in collateral enforcement, bank lending rates for SMEs remain very high, despite the accommodative euro area monetary policy. The authorities should address high indebtedness by strengthening insolvency regimes and support a further resolution of NPLs by ensuring collateral enforcement and NPL write-offs, which would enable the banking sector to regain its normal functioning, and strengthen credit supply.

Due to past fiscal efforts, the budget deficit has diminished sharply and public debt, although high, is on a downward path. The fiscal stance is projected to be less contractionary in 2018 and 2019 than in past years. Public investment will reverse its past declines. The government should not spend more than planned currently to avoid overheating pressures. It should instead ensure that its medium-term goal of balancing the budget is met, while leaving as much room as possible for fiscal support in the event of future shocks from Brexit or other sources.

Growth will fall toward moderate rates

The economy is projected to expand robustly, but growth will fall toward more moderate rates, as productivity gains in the domestic sector remain limited and equipment investment will weaken, with the prospects of Brexit damping confidence even if an agreement on a transition period is concluded. Employment will also grow at a slower pace, but the labour market will increasingly tighten, feeding further wage pressures. Inflation will gain traction, gradually aligning to rising labour costs. Weaker real disposable income growth will result in some easing in household consumption growth. Construction investment will keep its momentum, contributing increasingly to overall growth.

Economic prospects are surrounded by more risk and uncertainty than usual, including notably the final outcome of the Brexit negotiations. The high level of private indebtedness leaves Ireland sensitive to a rise in interest rates, which would weigh on private spending and further raise NPLs. Property prices may increase more strongly than projected, which would support construction activity in the near term, though this would come at the cost of raising private indebtedness to even higher levels.