Luxembourg

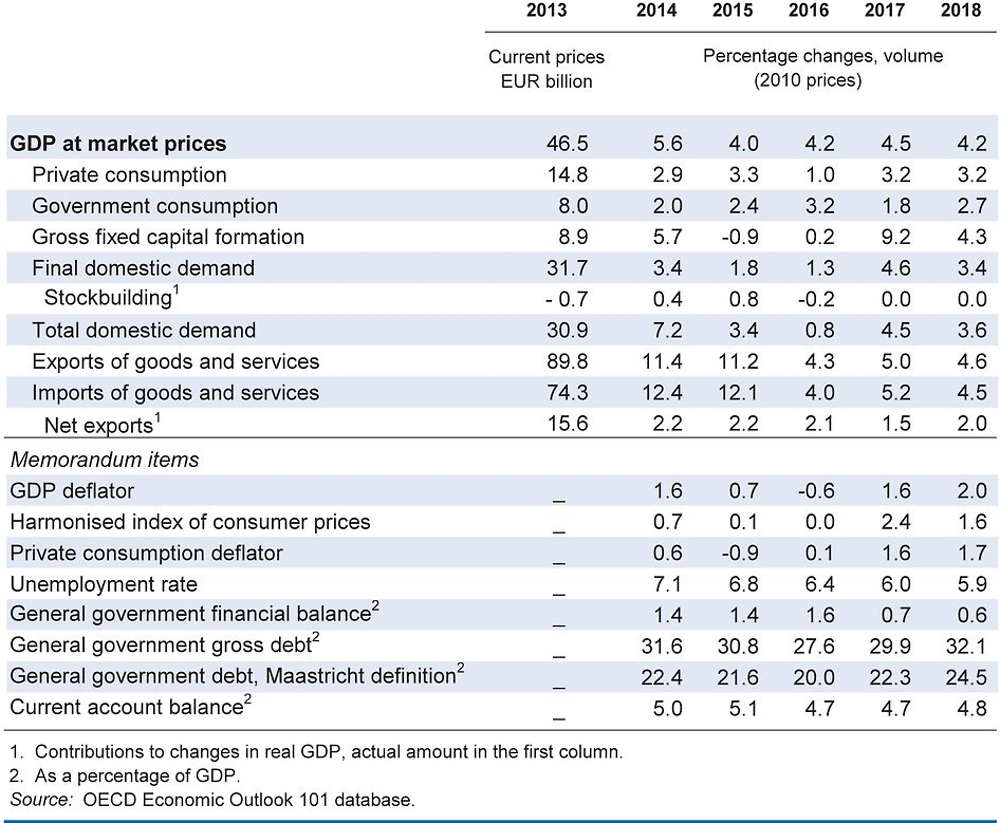

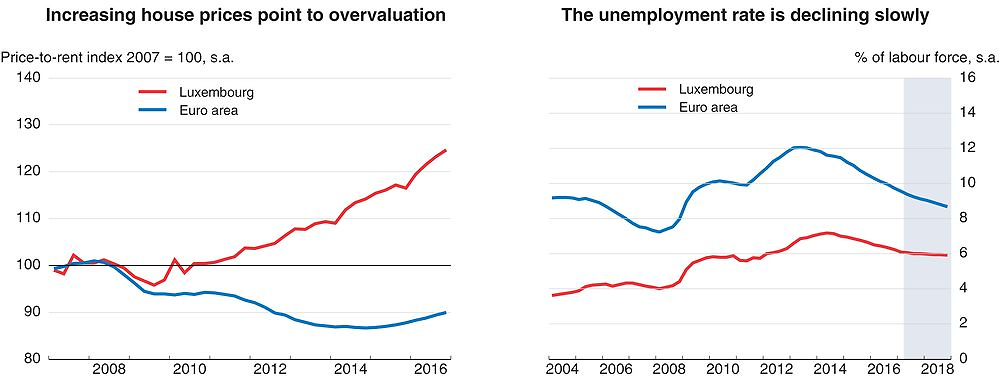

Economic growth is projected to stay robust at above 4% in 2017 and 2018, due to strong domestic demand and strengthening activity in the domestic financial sector, which will foster exports. Inflation is rising due to higher commodity prices and increasing wages, due to automatic wage indexation. Unemployment is falling, but, at 6%, the rate remains high.

Strong growth has created fiscal space, which is being used to reform and reduce corporate and personal income taxes. The reform has made the personal income tax more progressive and provided additional tax credits to single parents and low-income earners, making it easier for them to work while caring for young children. Financial and monetary conditions are accommodative, although persistently low interest rates may have contributed to large house price increases in recent years. The supervisory authorities should monitor the situation closely and implement additional macro-prudential measures, such as limits to loan-to-value or loan-to-income ratios, to decrease risks.

To reduce reliance on the financial industry and address the challenges of globalisation, the government has adopted a new long-term strategy focusing on digital technologies and renewable energy. This strategy is welcome and needs to be complemented by policy measures to enhance the supply of skills, such as improvements in the education system, in particular lifelong learning. A reorientation of labour market policies from supporting job creation towards training programmes for the unemployed would help workers who are displaced by economic changes to find new, good jobs.

Economic growth is driven by domestic demand

The economy remains strong, on the back of robust household consumption encouraged by the January tax reform and wage indexation adjustment. The financial sector, particularly investment funds, is benefitting from the favourable evolution of asset prices and accommodative monetary policies. The external position is also strong, with persistent current account surpluses and a positive net international asset position. The general government budget is in surplus, gross debt is low, at 20% of GDP, and net debt is negative, reflecting large assets held by the social security administration.

Source: OECD Economic Outlook 101 database; and OECD Analytical House Price database.

Structural reforms are needed to improve labour and housing market outcomes

Corporate income tax rates will be reduced in 2017 and 2018 as part of a multi-year tax reform to make the tax system more progressive and to take advantage of the tax base broadening resulting from European and international tax transparency initiatives. The reform will encourage business investment through higher tax credits covering spending within the European Economic Area. As a result, the fiscal surplus of the general government is projected to decline in both 2017 and 2018.

Personal income taxes have become more progressive, with an increase in the top bracket from 40% to 42% and additional tax credits to single parents and other low-income earners to meet education and child care costs. The reform is welcome, as it could improve social cohesion and labour market inclusiveness. Another welcomed purpose of the tax reform is to help women gain access to employment by introducing optional individual taxation for married or co-habiting income earners. This policy reduces the marginal tax rate applied to the earnings of second earners, potentially equalising incentives to work for both partners. Measures that could help cool down the housing market, for instance, by increasing the currently low taxation of housing, are also warranted. Also, the ceilings for mortgage interest deductions have been increased, even though a reduction would have been warranted.

The work incentives introduced by the tax reform need to be coupled by additional changes in structural policies. Active labour market policies offering individualised support and focusing on training, rather than on temporary job creation, are crucial to reduce long-term unemployment and boost inclusive growth. Rising house prices in the city of Luxembourg are likely to reflect existing supply bottlenecks that should be addressed by reformed zoning regulations, introduction of time-limited building permits and improved provision of social housing.

Growth is projected to remain strong

Growth rates are projected to stay above 4% in both 2017 and 2018. Private consumption and investment will be boosted by the reduction in private and corporate income tax rates from 2017. Activity will also be supported by accommodative monetary conditions in the euro area and robust financial services exports. A round of wage indexation that took place in January 2017 will lift both inflation and disposable incomes.

International trade, on which Luxembourg depends, would suffer from an increase in global protectionism. High cross-border financial linkages between domestic banks, their parent or other banks, possibly outside the EU regulatory and supervisory framework, and investment funds could transmit external shocks into the domestic economy. On the upside, Luxembourg’s established financial centre may become even more attractive in the wake of Brexit. Creating a more even level playing field in corporate taxation at the global level could benefit Luxembourg by emphasising its competitive advantages, such as political stability and a highly qualified labour force.