Germany

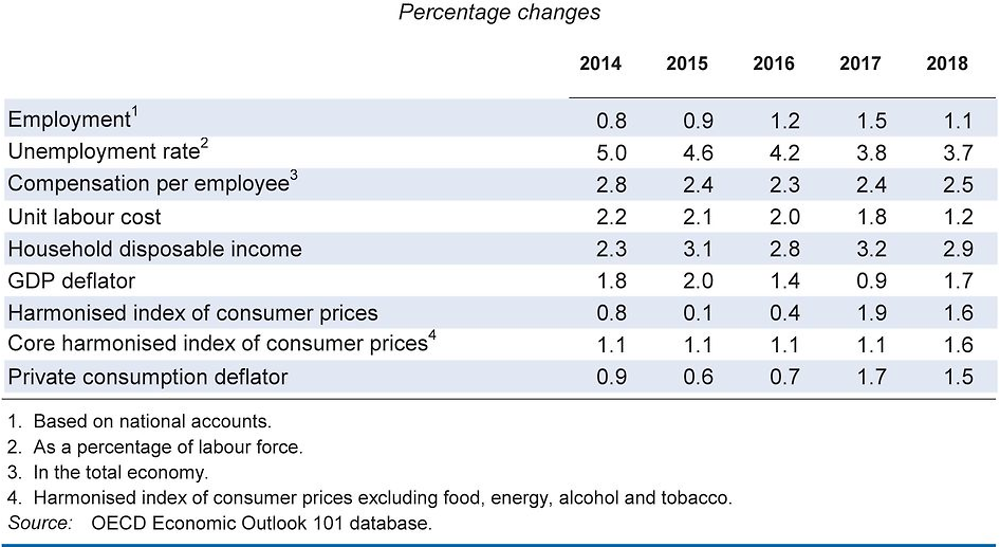

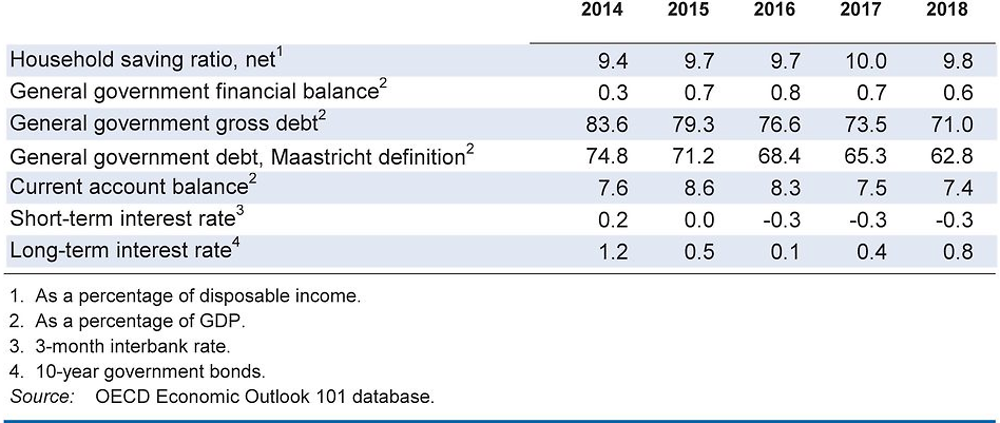

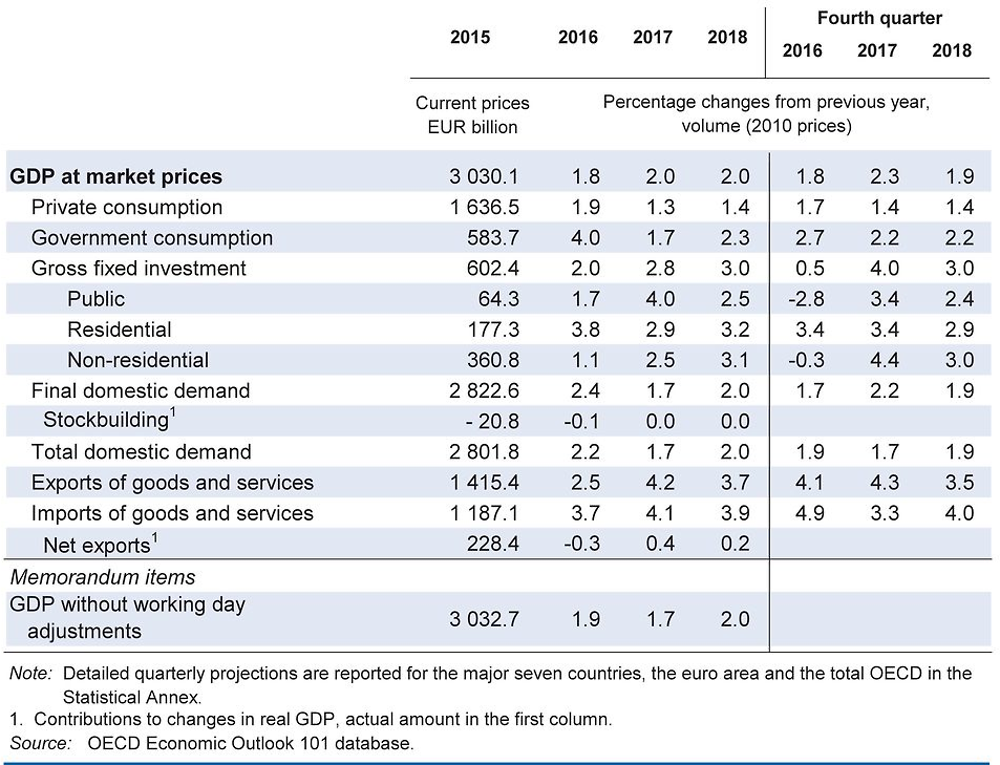

Economic growth is projected to remain solid, and the unemployment rate to fall further. Low unemployment and higher government spending will underpin private consumption. Low interest rates and immigration should sustain residential investment, but business investment is set to strengthen only gradually. Exports are benefiting from strong demand in Asia and the United States, but will weaken as the impact of past euro depreciation fades and import growth in China slows. The current account surplus will narrow somewhat, mostly as a result of higher energy prices. Strong revenue growth is projected to keep the government budget in surplus.

Fiscal policy needs to provide more support to address key structural weaknesses that are holding back inclusive growth. Extra spending should prioritise training for immigrants, improving childcare and expanding full-day primary schools. Lower taxes on second earners would reduce barriers for women’s access to more attractive jobs and careers, allowing skilled labour supply to expand in a tight labour market.

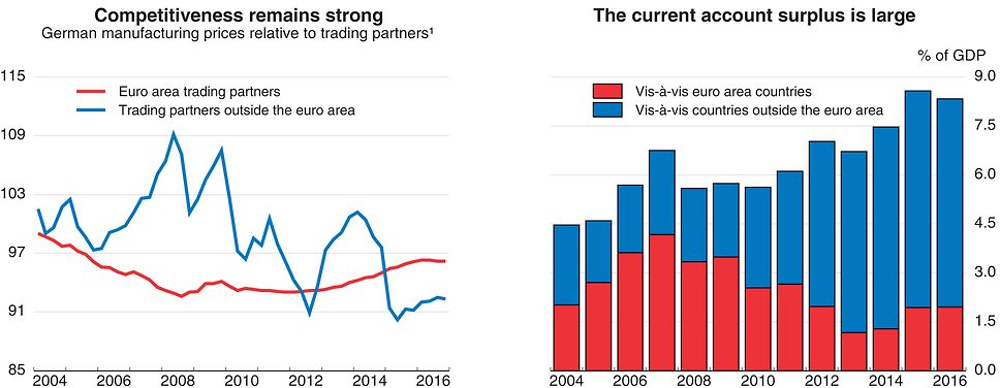

Strong integration in global value chains (including by outsourcing labour-intensive tasks, and strengthened sales in distant dynamic markets, notably Asia), depreciation of the euro and wage restraint have made Germany’s manufacturers very competitive. The number of workers on relatively low pay has risen, upward income mobility has fallen and the average duration of unemployment spells is long, although poverty remains low. High household saving, low business investment, and budget consolidation have all contributed to the large current account surplus. Reforms to remove barriers to entry in services and boost public infrastructure would strengthen investment and reduce the large current account surplus.

Growth has been vigorous and broad-based

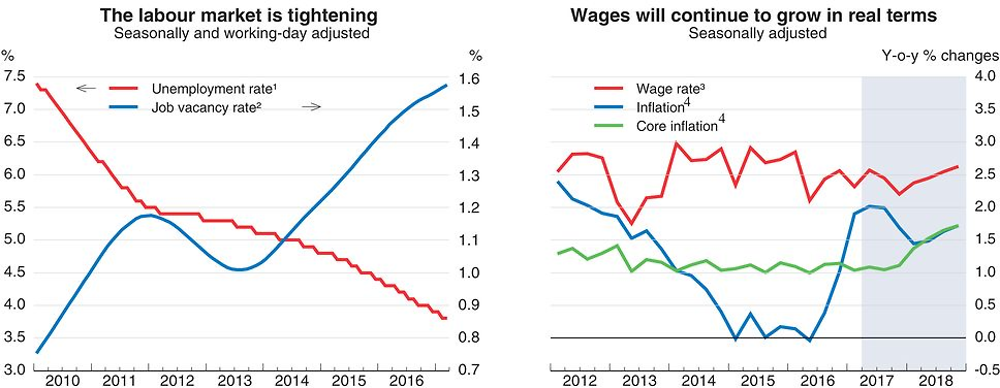

Economic activity has expanded strongly, as depreciation of the euro and strong demand from the United States and China has boosted exports. Construction activity has increased, as the housing needs of immigrants and low interest rates have boosted housing demand. House prices have risen broadly in line with rental prices and incomes. Employment has expanded, sustaining growth of household consumption. Wage growth has remained moderate recently, despite record-low unemployment and rising vacancies. This partly reflects low starting wages for immigrants and the increasing willingness of older-age workers to work at lower wages. Low interest rates and high capacity utilisation have kept firm profitability high, even though business investment has remained subdued, damping credit growth.

1. Seasonally and working day unadjusted and based on the deflators of manufacturing sales. Average since 1991 = 100.

Source: Deutsche Bundesbank.

Fiscal policy should do more to support inclusive growth

The fiscal stance is projected to be mildly expansionary in 2017 and 2018, reflecting higher spending on the integration of immigrants, long-term care benefits, as well as defence and security. The federal government has also increased transfers to fund local government investment. Pension spending is rising automatically under entitlement rules, public sector wages are rising, and family benefits and tax allowances have become more generous.

However, the strong fiscal position provides room for priority spending and tax reforms. More spending to improve full-day childcare and to introduce full-day primary schools on a broad basis would make it easier, especially for women who are most affected, to reconcile family life and full-time employment, and raise the supply of qualified workers. It would also improve education outcomes among youth with a disadvantaged socio-economic background. Government investment still falls short of depreciation of the capital stock, especially in low-income municipalities, and will need to be increased. Lower taxation of second earners would give women access to better professional careers and reduce the large gender earnings gap.

1. Population aged 15-74 years. Based on the German labour force survey.

2. Percentage of unfilled job vacancies relative to total employment.

3. Average nominal wage per employee. Projection from 2017Q1.

4. Harmonised consumer price index (HICP). Core HICP excludes energy, food, alcohol and tobacco.

Source: OECD Economic Outlook 101 database; and Statistisches Bundesamt.

Financial market conditions are supportive of economic expansion, reflecting a very accommodative euro area monetary policy and the continued attractiveness of Germany as a safe haven. Stock market prices have risen and long-term interest rates remain very low. However, large banks remain highly leveraged. Implicit government guarantees may exacerbate inequality, impair efficiency and encourage banks to assume more risk and pay higher salaries. The recent depreciation of the euro is boosting exports. However, modest and uncertain growth prospects in nearby European export markets have reinforced incentives to invest overseas.

Reforms are also needed to boost sustainable and inclusive growth and raise incomes. Lower barriers for setting up a business, for example in construction-related crafts, would open more economic opportunities for immigrants, who are particularly likely to seek self-employment and employment in the construction sector. Lowering such barriers could help ease supply bottlenecks in the construction sector and provide opportunities for upward income mobility. Lowering barriers to entry in telecommunications, postal and rail transport services, professional services and in some crafts could boost investment and thereby help reduce the current account surplus. Steps to avoid favouring incumbents in new regulation as well as the privatisation of government ownership of businesses in the car industry, telecommunications and postal services could also boost investment. Steps to implement reforms to complete the Single Market in the European Union and establish a more comprehensive banking union in the euro area could strengthen confidence in the euro and boost the attractiveness of Germany as a location to invest. Improving life-long learning opportunities would reduce skills mismatch which is also holding back investment in new technologies. It would also make it easier for workers displaced by technological advances or trade to find new jobs more quickly. Improved access to low-cost private pension systems and incentives to retire at a higher age could boost consumption and welfare, while helping reduce the current account surplus.

Domestic demand will be the main driver of growth

Economic growth is projected to remain robust in 2017 and 2018, driven by household demand and higher government spending. Falling unemployment and robust labour demand will boost wages, which are projected to grow more strongly than productivity. Consumer price inflation will rise somewhat. The current account surplus will fall, as oil prices have risen. Export growth may weaken, as the impact of past euro depreciation fades and rising wages weaken Germany’s competitiveness within the euro area. Demand from China, one of the most important export destinations, is also expected to grow less vigorously in 2018. Notwithstanding fiscal easing, strong tax revenue growth is expected to keep the government balance in surplus.

The exit of the United Kingdom from the European Union and concerns about banking sector issues in the euro area have increased uncertainty about trade and investment prospects. A sharp slowdown of activity in emerging market economies and increased trade protectionism would weaken exports and investment. On the other hand, some businesses are considering shifting investment from the United Kingdom to Germany. Effective policies to integrate immigrants would increase their incomes and well-being, raise employment and ease labour market pressures.