Brazil

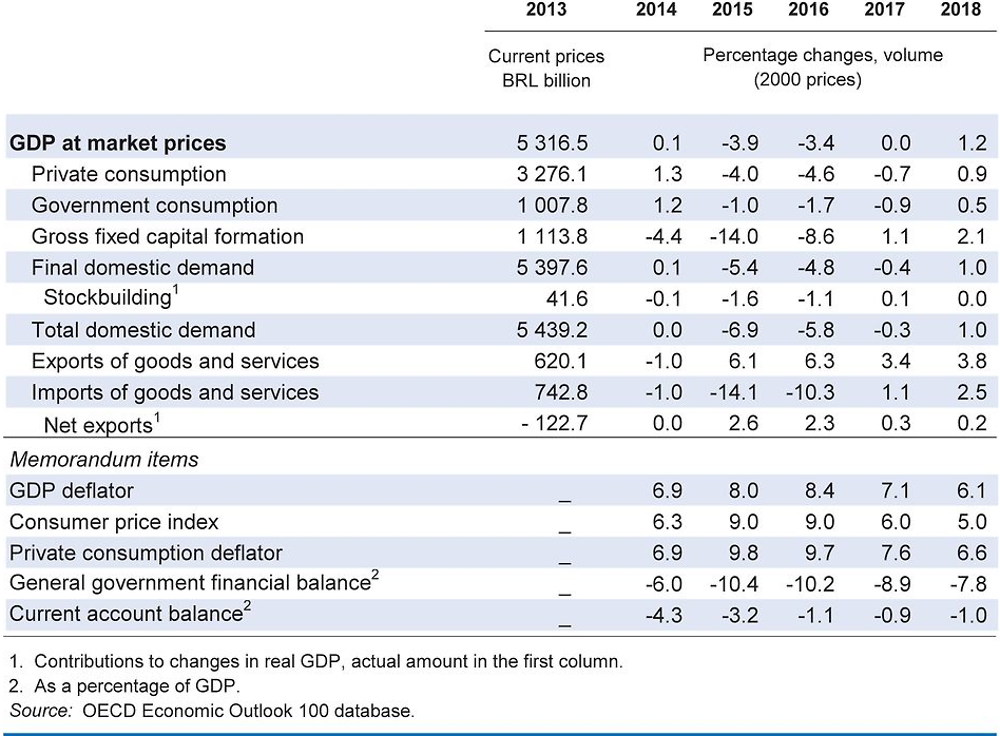

The economy is emerging from a severe and protracted recession. Political uncertainty has diminished, consumer and business confidence are rising and investment has strengthened. However, unemployment is projected to continue rising until 2017 and decline only gradually thereafter. Inflation will gradually return into the target range.

The fiscal stance is mildly contractionary over the projection period, which strikes an adequate balance between macroeconomic stability requirements and the need to restore the sustainability of public finances through a credible medium-term consolidation path. An effective fiscal adjustment would allow monetary policy to loosen further and support a recovery of investment. Raising productivity will depend on strengthening competition, including through lower trade barriers, fewer administrative burdens and improvements in infrastructure.

Public expenditures have been outgrowing GDP for many years and public debt has increased. A new fiscal rule is being implemented and, in combination with a planned reform of pensions and social benefits, it should strengthen fiscal sustainability. These reforms could simultaneously lead to stronger declines in income inequality. On the revenue side, there is substantial scope to reduce complexity and compliance costs, including by consolidating indirect taxes at the state and federal levels into one broad-based value added tax.

The economy is emerging from a severe and protracted recession

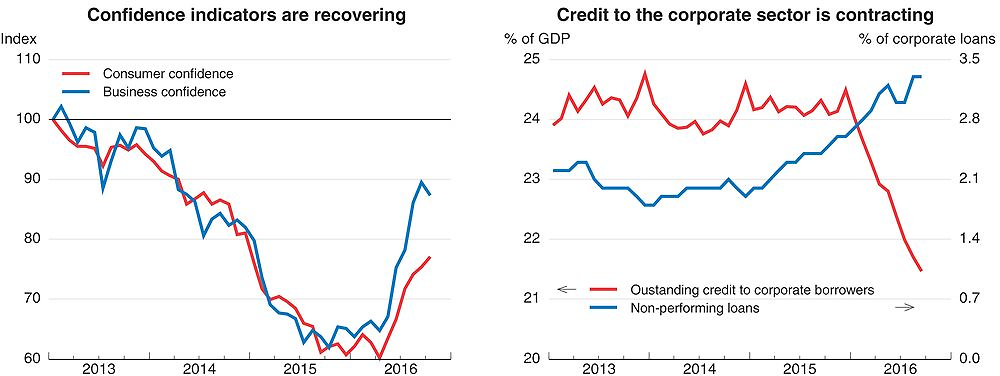

After six quarters of contracting activity, the unemployment rate has risen to 11.8% and corporate bankruptcies and debt have been rising. However, the economy seems to be now turning around. Confidence indicators have recently started to recover after a long decline, even if their level is still low. Investment growth has turned positive, while signals from industrial production have been mixed. Political uncertainty has diminished as the new government has been confirmed in power by congress until the next scheduled elections in October 2018.

Source: Fundação Getúlio Vargas; Confederação Nacional de Indústria; Central Bank of Brazil.

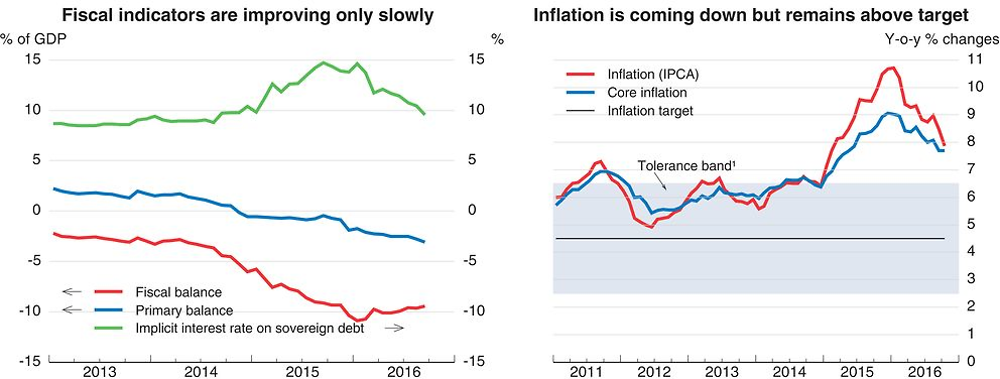

In the medium term, public expenditures will be contained through a new fiscal rule

The fiscal deficit remains high at over 9% of GDP and the primary deficit of 3% of GDP is distant from the primary surpluses required to keep public debt on a firmly declining path. Part of this deterioration is cyclical and related to weak revenues in the face of the recession, but poorly targeted tax exemptions in the past, which have yet to be completely unwound, have also played a role. Against the background of considerable slack, the fiscal stance is estimated to be only mildly contractionary. This is part of a necessary adjustment process to strengthen fiscal sustainability and correct past excesses, and strikes an appropriate balance.

Rising current expenditures in combination with projected increases in pension spending have raised concerns about longer-term fiscal sustainability. These concerns are being adequately addressed with the implementation of a new expenditure rule, in line with recommendations in previous OECD Economic Surveys. The new rule limits real increases in expenditures and reduces the rigidity of the budgeting process, except for pensions and benefits, which amount to almost half of central government spending. Implementing a separate pension reform will be crucial for turning the fiscal adjustment into a success, and could also lead to stronger declines in inequality and poverty by improving the targeting of social benefits. Scope for raising spending efficiency exists across many areas, and the new fiscal rule leaves sufficient room for attaining policy objectives.

1. The inflation target is met whenever the accumulated inflation during the period January-December of each year falls within the tolerance band.

Source: Central Bank of Brazil; and IBGE.

The credible commitment to containing public expenditures will allow further monetary easing going forward, which should give rise to stronger investment. Year-on-year inflation is coming down towards the target range as inflationary pressures from administrative prices retract and economic slack widens.

Structural reforms should support economic adjustment and inclusive growth

Structural reforms have the potential to boost growth significantly and to make it more inclusive. Reducing the compliance costs and distortions imposed by Brazil’s fragmented system of indirect taxes would provide an almost immediate cost reduction for firms, and could be achieved by consolidating indirect taxes into a single, broad-based value-added tax with full deductibility for inputs and a zero-rating for exports. In addition, reducing barriers to international trade would cut the costs of imported inputs and strengthen incentives to enhance productivity. Improvements in infrastructure could also reduce transport costs, particularly for exporters. Stronger trade integration would benefit low-income earners in particular, as an expansion of the export sector would have a larger impact on the demand for low-skilled labour. Further improvements in educational attainment would not only raise productivity, but also allow more low-income households to join Brazil’s growing middle class.

The economy is projected to embark on a slow and gradual recovery

Growth is projected to resume progressively during 2017 owing to improvements in confidence and investment. The pace of the recovery will be limited by high corporate sector debt and significant spare capacity in some sectors. Nevertheless, the implementation of structural reforms will gain momentum relative to the past, but fall short of the ambitious agenda required. Slow earnings growth and a continuing contraction in private credit will limit consumption growth initially, although lower interest rates may eventually allow the recovery of consumption to accelerate. Against the background of low international trade growth and ongoing competitiveness challenges, the external sector will not be able to provide as much support as in past years.

Inflation will continue to ease on the back of lower pressures from administrative prices and weak activity. Inflation is projected to return into the tolerance band during 2017, whose ceiling will then be at 6%. Unemployment is projected to rise further until mid-2017, before starting to decline as the economy accelerates towards its growth potential in 2018.

Stronger momentum on structural reforms is a potential upside risk to the projections as this could enhance domestic demand through a combination of lower spreads, less currency appreciation and lower real interest rates. Downside risks could come from the corporate sector, where the protracted recession is reflected in rising corporate defaults in the face of high debt levels, which could in turn weaken some parts of the financial sector. Although they have diminished, political risks remain with respect to the final implementation of the new fiscal rule.