Austria

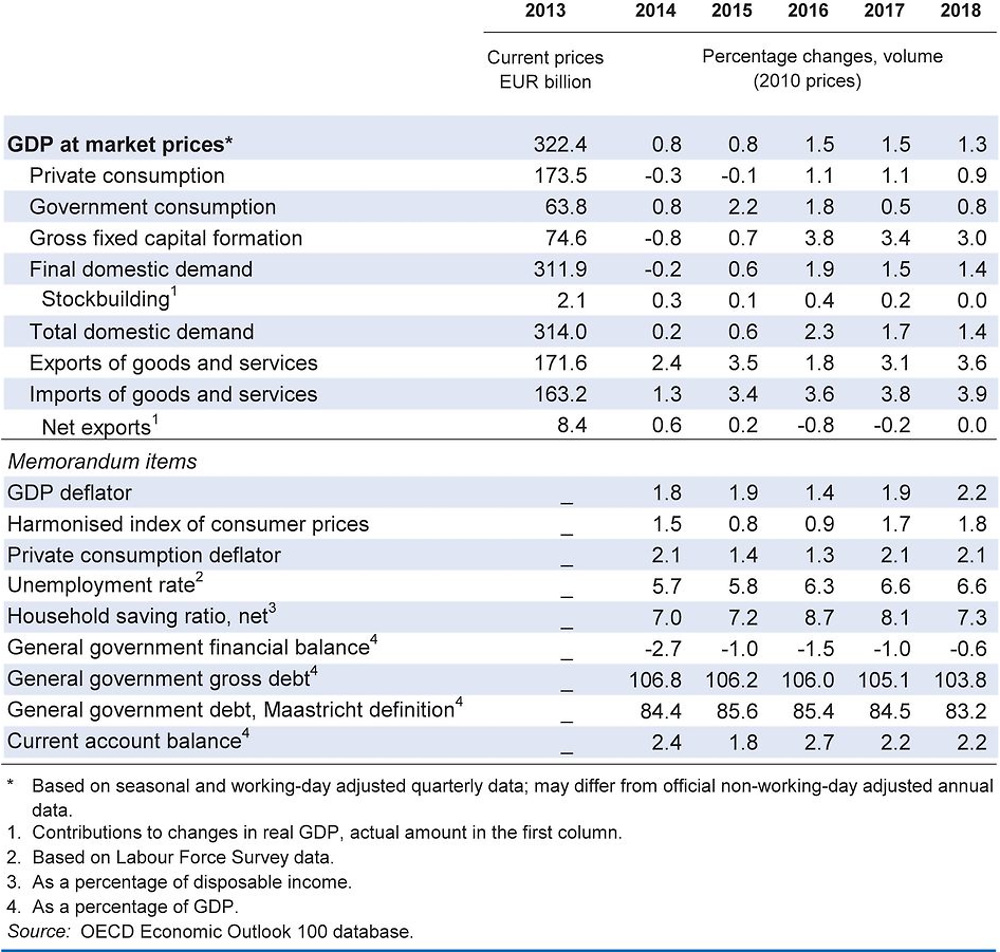

After four years of disappointing growth, economic activity picked up in 2016. It has been supported by a fiscal reform that boosted household disposable income, a catch-up of investment and solid job creation, especially among elderly, women and immigrants. These factors will continue to support growth in 2017 and, to a lesser extent, in 2018.

Easing restrictive entry regulations in retail trade and liberal professions would improve labour market prospects, including for migrants, and intensify competition, innovation and growth. Further consolidation of banks would improve cost efficiency, but care would have to be taken to avoid reductions in competition and the creation of institutions that are too big to fail.

The fiscal stance is expansionary in 2016 owing to the tax reform and migrant-related spending, and is projected to be broadly neutral in 2017 and 2018. Past support for the banking sector has pushed up public debt and population ageing will entail fiscal costs. Nevertheless, the current low interest rate environment provides fiscal space that should be used to increase public expenditure on early child care and broadband infrastructure to better prepare Austria for the future.

Growth is underpinned by domestic demand

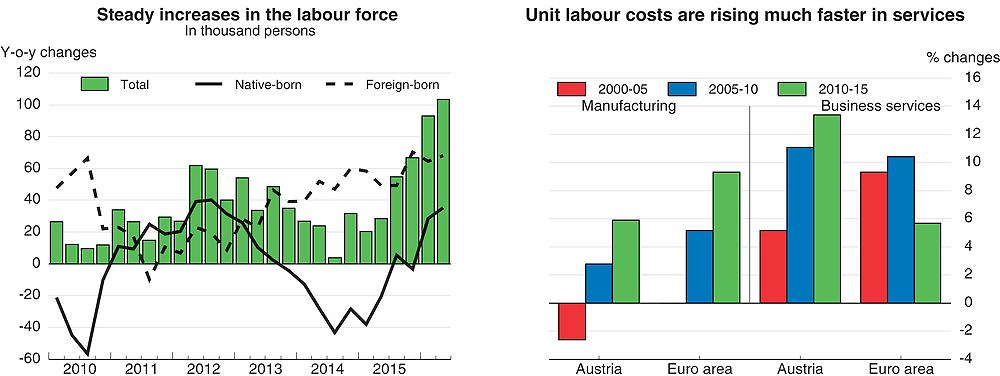

The recovery gained pace in 2016 owing to stimulus from the tax reform and a long-awaited rebound of fixed investment. About half of the increase in disposable income provided by the tax reform has been saved so far, and some spending may therefore still be in the pipeline. Fixed investment is back to its pre-crisis level, but remains lower as a fraction of GDP. Support has been provided by rising labour supply, reflecting immigration and more women and the elderly taking jobs. Manufacturing firms remain competitive, but the service sector has long suffered from weak productivity. The resulting rise in unit labour costs in services increases the cost of those services to manufacturers, weakening their international competitiveness and reducing Austria’s export performance.

Source: Statistics Austria and OECD Productivity database.

There is a need to push ahead with structural reform and public investment

Notwithstanding progress in the recognition of foreign professional qualifications, regulations in many professional services and in the retail sector are still relatively stringent. Reducing entry barriers would not only spur competition and boost productivity, but also increase the absorption of new immigrants. The restructuring of the banking sector is still ongoing. Priority should be given to cost-efficiency improvements, including by addressing issues of over-banking and supporting consolidation among banks.

The public finances have been weighed down by the still incomplete winding-down of failed banks and costs of the recent tax reform and the influx of immigrants. At the same time, historically low interest rates have created fiscal space. This fiscal room should be used for public investment that boosts growth potential and promotes social inclusion. Candidates are infrastructure investments in early childcare institutions and high-speed broadband internet coverage. Such investments would enhance equality of opportunities and thereby foster inclusiveness across genders and regions. Furthermore, a tax-and-benefit system that encourages a more balanced distribution of work, as well as more family-friendly workplaces and working-time models, would promote a more gender-equal society.

Additional room could be gained by revisiting the public expenditure mix, for instance, by shifting spending from passive towards active labour market policies or by replacing long-term care cash benefits, which are often poorly targeted, by means-tested benefits based on a transparent assessment of actual needs. A comprehensive spending review may help. Further savings could be expected from a bolder reform of the intergovernmental framework. In this regard, recent efforts to reduce misalignment between spending and financing responsibilities across levels of government should be stepped up.

Growth is set to remain modest

Domestic demand is projected to sustain the pace of growth at close to 1½ per cent per annum. Economic activity could be stronger if export performance recovers from its recent slump or if the recent tax reform were to spur consumption more than projected. Second-round effects of the tax reform on employment and investment may also be stronger than anticipated. On the other hand, the projected rebound of investment could be hampered by weaker-than-expected growth in the euro area and emerging markets or by substantial increases in oil prices. Growth would also come in weaker than projected if the decline in export performance continues, if world trade growth does not pick up as projected or if the increase in the household saving rate were to persist. Finally, political uncertainties may affect investors and consumer confidence.