Portugal

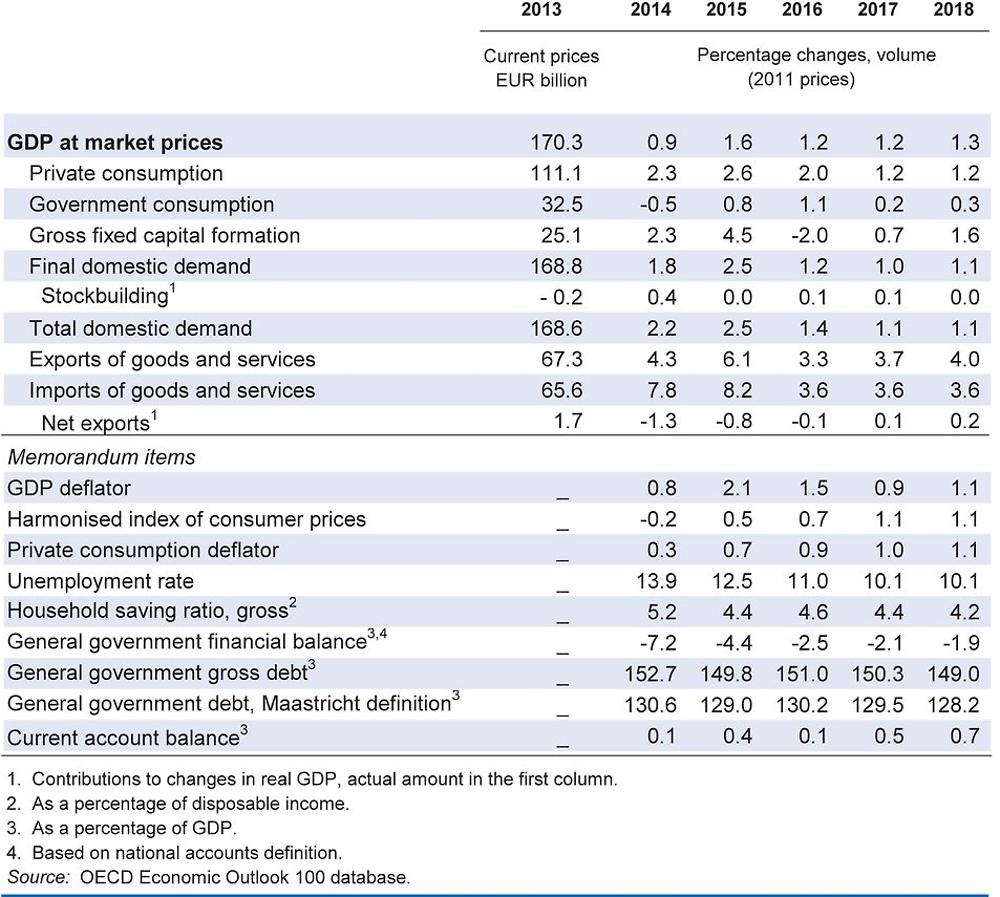

GDP growth is projected to remain subdued, at about 1¼ per cent in 2017 and 2018. High corporate leverage and a fragile banking sector will hold back private investment and still high unemployment will restrain consumption growth. As economic slack will persist, inflation will remain low.

Boosting investment and productivity are key to raise living standards and growth. Investment incentives could be strengthened through further reforms to simplify administrative procedures, including land use regulations, improvements in judicial efficiency to facilitate insolvency procedures, and easing entry barriers in professional services. Removing distressed legacy loans from bank balance sheets and opening up new sources of financing are needed to facilitate investment. Improving skills is also crucial to raise productivity, including through a continued expansion of adult education and training and more effective vocational education.

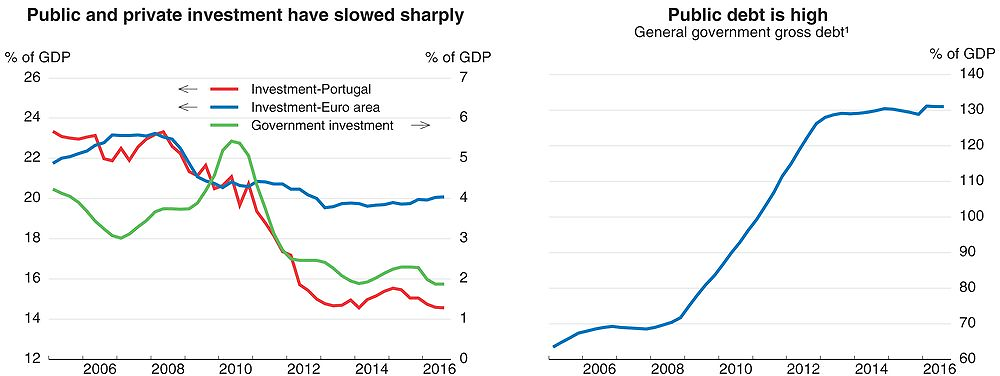

At about 130% of GDP, public debt remains very high despite significant progress achieved in fiscal consolidation, severely limiting fiscal space. The gradual consolidation in 2017 and 2018 strikes a balance between fiscal sustainability and not damaging economic prospects. Going forward, it is important to achieve a tax and spending structure reform that supports growth, including by achieving permanent cuts in current expenditures.

Low investment and unfavourable external conditions are curbing growth

Growth remains sluggish due to very weak public and private investment. The tourism sector and manufacturing production are supporting exports, but a sharp slowdown in extra-EU demand and energy exports have prevented a stronger contribution of exports to growth. The unemployment rate has declined but structural unemployment remains critically high.

1. Maastricht definition.

Source: OECD Economic Outlook 100 database.

Resuming investment is key to boost growth and living standards

Both private and public investment are historically weak. A highly leveraged corporate sector and high uncertainty are holding back business investment, which is crucial to sustain export growth. A large stock of non-performing legacy loans is crowding out investment funding from banks. The use of alternative sources of investment financing could be enhanced by reducing the tax bias towards debt financing relative to corporate equity, as currently under discussion. Revising land regulations and limiting discretionary powers of municipalities would speed up licensing procedures and reduce investment costs.

Public debt remains very high, which makes recent achievements, including reaching a primary surplus, still fragile. Consequently, fiscal space is limited and the government should focus on the composition of expenditure and taxes to support growth. Public investment has been squeezed to meet deficit targets and its planned increase in 2017 is welcome, as it can support growth without weakening the fiscal position. However, achieving permanent reductions in current expenditures, notably regarding staff spending, would free up resources for still more productive spending. Pursuing a comprehensive expenditure review could also lead to efficiency gains. On the tax side, the projected shift from income to consumption taxes is welcome as it will support production by reducing distortions. Additional revenue could be raised by reducing exemptions and limiting the use of reduced rates.

Downside risks are significant

Growth is projected to remain weak. Risks are significant and tilted to the downside. The banking sector remains highly leveraged, exposed to sovereign debt and to developments in the euro area, and could require more public support. This would further add to public debt, whose projected downward trajectory is already subject to significant risks, including potential increases in interest rate spreads. On the positive side, a stronger–than-expected recovery in Portugal’s trading partners could boost exports and trigger higher investment. Faster resolution of non-performing loans and a stronger recapitalisation of the banking system could restore confidence and boost investment financing.