Poland

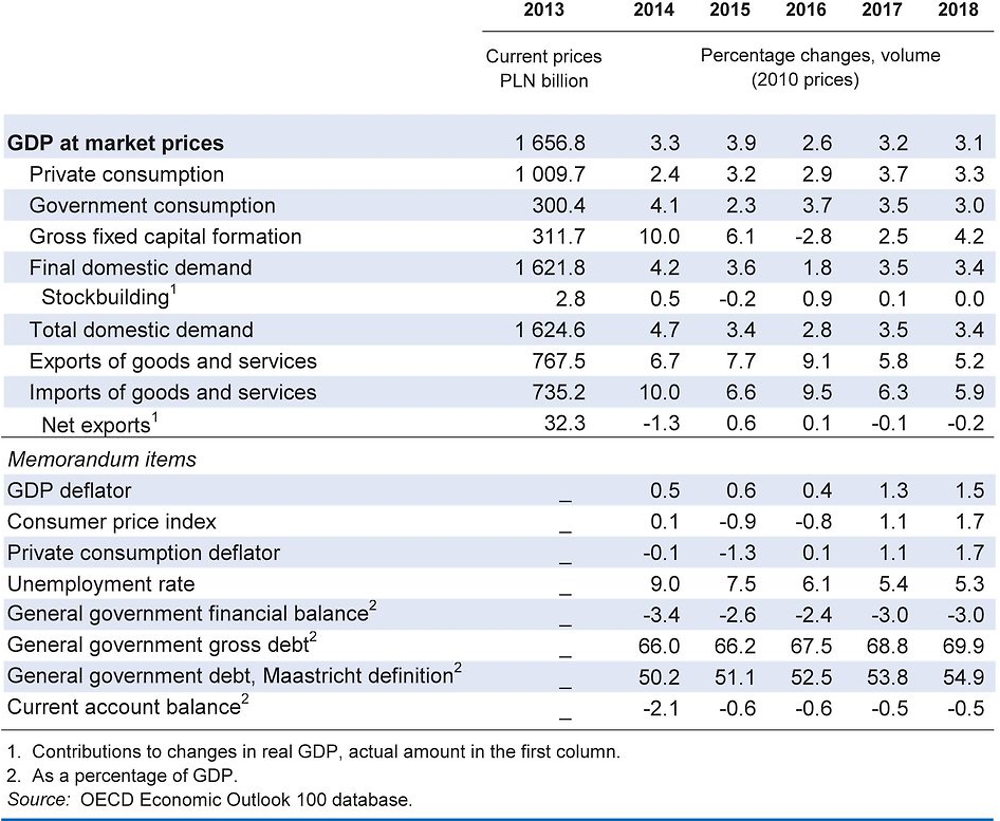

GDP growth is projected to strengthen to around 3% annually in 2017-18, thanks to higher social transfers, low interest rates and rising disbursements of EU funds. Increasing disposable income and consumption, the switchover to the new budgetary period for EU funds and diminishing spare capacity should lead to an acceleration in investment. Stronger aggregate demand is expected to underpin a return to modest inflation.

The central bank is projected to start increasing rates towards the end of 2017, as inflation picks up. New social spending was mostly financed by one-off revenues in 2016. Plans to increase tax compliance are welcome, and scaling down exemptions and special rates would improve efficiency, but lowering the retirement age would decrease potential growth and public revenues, which are already likely to be curbed by population ageing.

By 2017, interest payments on public debt will have fallen by about 1% of GDP since 2012, and this increase in fiscal space will be partly used to implement a mild current-spending-based fiscal expansion over the projection period. However, the available fiscal room could instead be used to bring forward the planned investment in infrastructure. This would strengthen productivity growth and environmental and health outcomes. Reducing taxes on low wages would also benefit low-skilled employment.

Economic growth remains robust

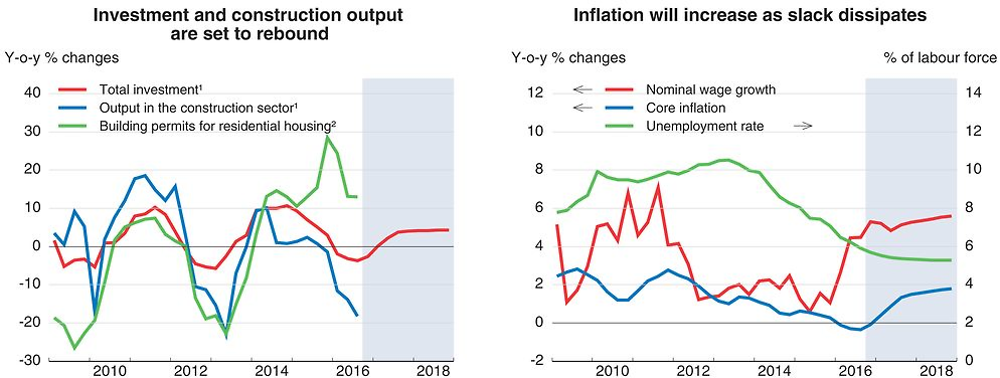

Economic growth eased in 2016. Exports are moving ahead rapidly owing to a progressive recovery in foreign markets and strong cost-competitiveness. Ongoing gains in employment and wages, higher social transfers and low energy prices are supporting private consumption and housing construction. However, infrastructure investment has fallen because of lower disbursements of EU funds, notably in network sectors. Increased uncertainty is also holding back business investment, despite easy credit conditions, rising profits and high capacity utilisation.

1. Volume.

2. Average growth over the past two quarters.

Source: OECD Economic Outlook 100 database; and GUS Macroeconomic Database.

Despite rising wage pressures, consumer prices have continued to fall, driven by declining energy prices. The steady decline in the unemployment rate, a minimum wage hike and higher social levies on some atypical labour contracts are set to increase wage growth further and shrink earnings inequality. Stabilising energy prices, rising demand pressure and the pass-through of new taxes to consumers will underpin a return to inflation closer to the target. The central bank should gradually increase its policy rate towards the end of 2017 as underlying price pressures are set to strengthen.

Efficient infrastructure investment and structural reforms would improve medium-term growth

The public costs of the introduction of a new child benefit programme have been covered by one-off revenues in 2016. Rising social spending, a rebound in public investment, and a planned reduction in the statutory retirement age could push the deficit over the Maastricht ceiling of 3% of GDP in 2018, despite additional taxes on banks and retailers. Planned tax cuts for low-income households could also increase the deficit further. Although the overall fiscal path appears broadly appropriate, ongoing reforms are not conducive to long-term growth and female labour force participation. By contrast, bringing forward and carefully selecting public infrastructure projects, and expanding childcare facilities would take full advantage of currently low financing costs.

Upgrading Poland's ageing coal-fired energy capacity and developing public transport would help secure a greener energy supply, improve workers’ mobility and reduce damage to public health from noxious emissions. This would require stable energy and climate change policies and stronger local administrative capacity to raise investment efficiency. At the same time, more lifelong training opportunities and a larger rental housing market would help reduce skill mismatches and enhance worker mobility, strengthening productivity and inclusiveness. Over the longer term, enhancing employment incentives for women and older workers, as well as increasing green taxes, would raise revenues and help finance rising health, pension and infrastructure needs, and increase growth and well-being.

Private consumption and investment are projected to strengthen

GDP growth is projected to strengthen to around 3% in 2017-18, underpinned by increasing labour incomes and higher social transfers. Falling spare capacity and good financing conditions are expected to stimulate business investment, while public investment financed by EU funds will regain momentum towards the end of 2017. A slow recovery in external demand should support export growth, allowing the current account deficit to remain broadly stable. Unemployment should continue to ease and wages and prices should pick up.

A stronger-than-expected impact of Brexit and a slowdown in emerging market economies, notably China, would hit exports. Domestic risks are also significant. The envisaged forced compensation of foreign-currency-denominated mortgage holders for the high costs charged by banks prior to 2011 could reduce banks’ capital positions and credit to the real economy. Rising uncertainty about fiscal and structural policies could negatively affect business confidence and investment. Alternatively, large income gains and an efficient implementation of the new long-term economic development plan could lead to faster private spending growth.