Norway

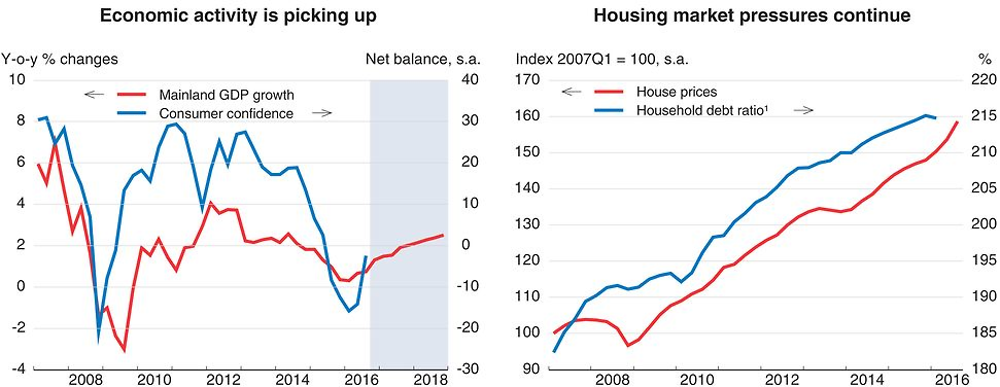

Economic growth will strengthen gradually until 2018 supported by higher private consumption and a rebound in non-oil investment, helped by better global prospects and a weaker currency. The pace of decline in petroleum investment is set to slow. The unemployment rate should peak in 2016, whereas inflation will edge down as the impact of the exchange rate depreciation abates and economic slack continues.

Monetary policy has been very accommodative and fiscal policy expansionary, which has supported activity. However, sustained low interest rates have fuelled a protracted housing boom. Additional fiscal stimulus, rather than a further easing of monetary policy, should be used to support activity as long as slack remains in the economy. Reforms to improve the business environment, to strengthen competition and to enhance skills and education outcomes are key for raising growth potential and maintaining inclusiveness.

Norway is using its fiscal space to assist the economic recovery. Recent tax reductions, including in corporate taxation, will improve competitiveness. Additional public investment should be considered, even though it must be made judiciously as in some areas, such as in education, ensuring spending efficiency and high social returns has proved challenging.

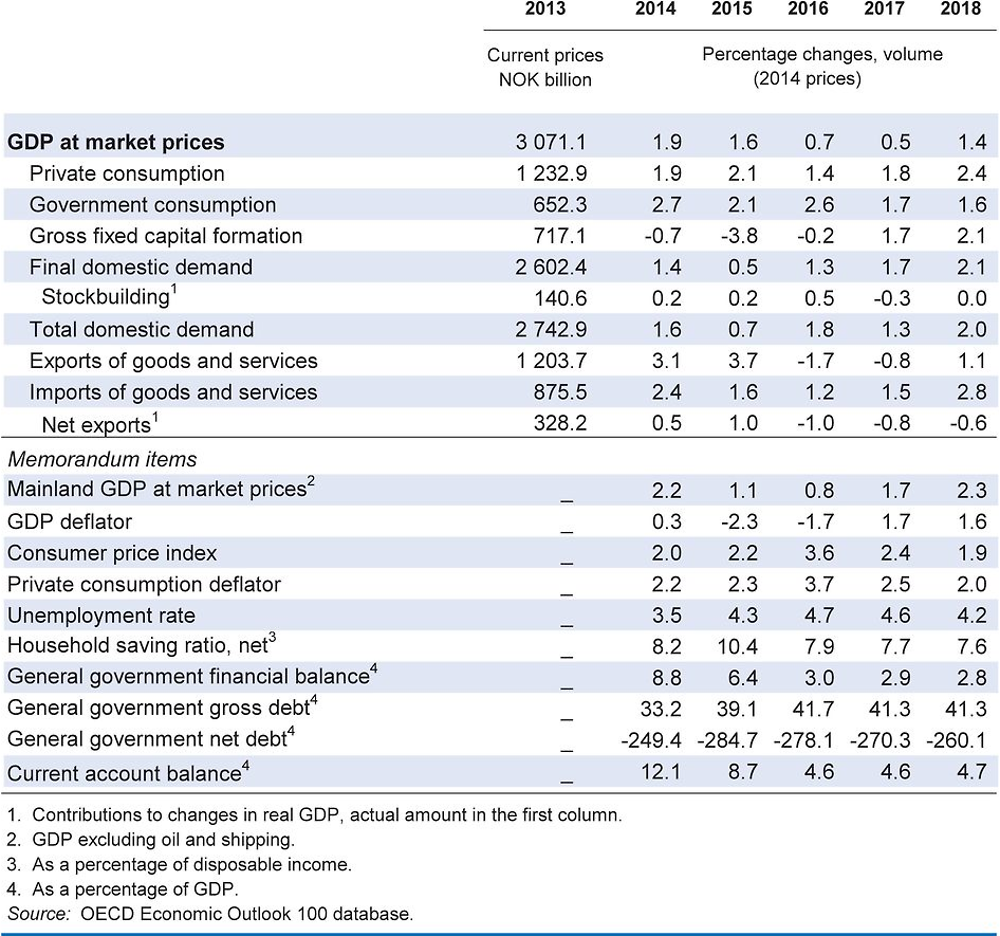

Economic activity is picking up

Mainland output growth has strengthened somewhat from recent lows. Declining petroleum investment has continued to affect oil-related industries, with the unemployment rate edging up. However, supportive fiscal and monetary policies and rising housing wealth are sustaining household spending, while a weaker currency and moderate wage growth are helping non-oil exports. The inflationary effects of currency depreciation are waning, but house prices, especially in some regions, continue to rise and household debt remains high relative to income.

1. Ratio to disposable income.

Source: OECD Economic Outlook 100 database; Thomson Reuters; Norges Bank.

Policies should support recovery and promote broad-based growth

The central bank reduced the policy rate in early 2016 to 0.50%. The impact of the exchange rate depreciation on domestic prices was stronger than expected, but inflation expectations appear well anchored. Sustained low interest rates have fuelled a long housing boom, and a correction could significantly hurt economic growth. Further tightening of mortgage-lending rules may help, but the reliance on very low interest rates to support growth should be reconsidered.

The 2017 budget provides a fiscal stimulus of 0.4 percentage point of mainland GDP. Budget measures include further cuts in the corporate tax rate along with increased spending on infrastructure, regional support and the integration of refugees. Norway has considerable fiscal space due to its oil fund (Government Pension Fund Global). Additional fiscal stimulus, rather than a further easing of monetary policy, should be used to support activity as long as slack remains in the economy. The prospect of lower returns from the oil fund may require a tighter stance in the medium term in order to adhere to the Norwegian fiscal framework.

A successful structural adjustment towards broader-based growth hinges on policies that boost productivity and combat exclusion. Recent initiatives are welcome, including further cuts in the corporate tax rate and simplification of reporting requirements and regulations for businesses. The government’s focus on improving the quality of education outcomes is also appropriate. Proposals for stricter requirements for teacher qualifications go in the right direction. Completion rates of secondary and tertiary education need to increase further. Tertiary-education reform should address the incentives that drive student decisions on the choice of courses and the pace of study. Further reforms to sickness and disability support should encourage participation in the labour force and potentially boost inclusiveness and well-being.

Output growth is projected to strengthen

Economic activity is projected to firm up gradually over the period to 2018, underpinned by low interest rates and fiscal support. Better global prospects and improved competitiveness will help non-oil exports and non-oil investment. The decline in petroleum investment is expected to slow as new projects commence, reducing the drag on activity. The unemployment rate will peak in 2016 at around 4¾ per cent of the labour force. Inflation will edge down, as the impact of the exchange rate depreciation abates and economic slack continues.

Oil-sector developments, as always, remain a key uncertainty. Developments in Europe, through export demand, will also influence the pace of the recovery. Uncertainties following the Brexit vote add to risks, given that the United Kingdom is an important trading partner. Domestically, the high level of household debt remains a source of real-side and financial risk. However, improvements in international competitiveness could boost growth more than projected.