Greece

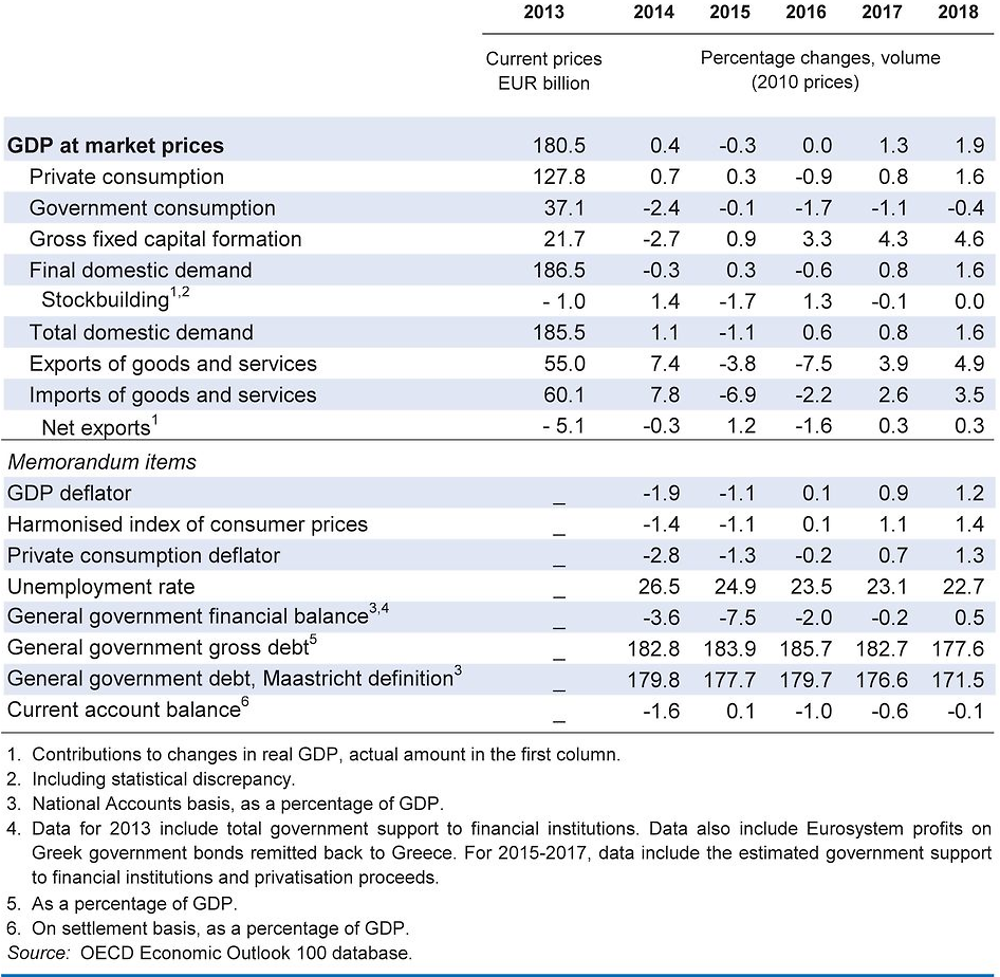

Growth has rebounded in the second half of 2016 and is projected to gain strength in 2017 and 2018 as structural reforms start to bear fruit, the conclusion of a policy review with creditors raises business and consumer confidence and the economic and political environment stabilises. Exports of services are underperforming because of structural rigidities and capital controls (which particularly affect the export revenue from the shipping industry). Employment is projected to increase but unemployment remains far too high.

The Guaranteed Minimum Income should help address rising poverty and make growth more inclusive. The implementation of key structural reforms to reduce the regulatory burden and ease regulation in the energy and transport sectors will boost productivity and growth. The high level of non-performing loans undermines credit growth, holding back investment. To deal with this, the authorities should implement already legislated incentives and performance targets for banks to monitor their progress in reducing bad debt.

The huge public debt undercuts confidence in the Greek economy, a situation that calls for additional debt relief. Even if the ambitious medium-term fiscal targets established in the 2015 agreement with creditors were met, more should be done to make public debt clearly sustainable. The implementation of structural reforms would boost growth and thereby improve debt dynamics. Broadening further the tax base and ensuring that the new independent public revenue agency improves tax compliance and collection would increase revenues.

The economy is slowly recovering

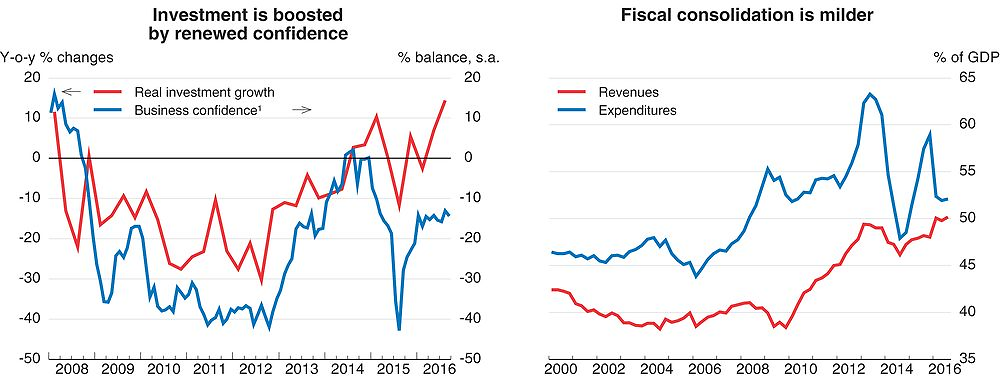

The financing programme agreed with creditors in August 2015 and the completion of the first review has spurred confidence and boosted investment and consumption. However, travel receipts declined in the first half of 2016 and the contribution of tourism to GDP growth is expected to decrease further due to the impact of Brexit and the refugee crisis. Financing conditions are still weak with the high level of non-performing loans limiting credit, despite the gradual but steady easing of the capital controls. Notwithstanding weak activity, employment has continued to increase, especially in manufacturing, but unemployment is still very high, resulting in a great deal of poverty.

1. Unweighted average of data for manufacturing industry, construction, trade and business-related services.

Source: OECD Economic Outlook 100 database; OECD, Main Economic Indicators database.

The primary budget surplus is expected to be above the target of 0.5% of GDP in 2016. The government has legislated fiscal measures to reach the primary surplus target of 1.75% of GDP for 2017 and 3.5% for 2018. These measures include broadening of the tax base as well as spending cuts at a time when social needs are important. The government is undertaking a pilot review of some spending categories and plans to extend the review to the entire public administration to identify inefficiencies. The aim will be to redirect resources towards social protection measures to combat the exclusion and poverty that arose in the wake of the crisis that began in 2009. Notwithstanding these welcome initiatives, some form of debt relief will be needed to raise growth and incomes.

The full implementation of structural reforms is needed to enhance inclusiveness

The social cost of the crisis has been severe and the poverty rate almost tripled between 2007 and 2013, when measured against pre-crisis incomes. Fully implementing social policies, such as the guaranteed minimum income, a targeted school meal and housing assistance programmes, is therefore needed. The conclusion of the pension system reform will improve fairness, as pensioners are better off than the younger generation, and free up resources for greater support for the poor and the unemployed. The modernisation of the public employment service would benefit the high number of unemployed, especially among youth and the long-term unemployed.

The implementation of structural reforms, especially the reduction of oligopoly power and regulatory burdens, has been too slow to generate sustainable growth. Further reducing administrative burdens and opening up of professions would enhance productivity and investment, particularly for SMEs. Continuing easing of regulations in energy, communications and transports would raise competitiveness and enhance exports. The acceleration of privatisations would raise competitiveness and efficiency. Further broadening the tax base and ensuring that the new independent public revenue agency improves tax compliance and collection would increase revenues and help fighting tax evasion. That revenue could be used to support social policies and to make growth more inclusive.

Growth is projected to rebound but uncertainty remains

Output growth is projected to gain strength as structural reforms boost investment and consumption. Employment will increase but unemployment will stay high, especially for youth. Inflation is projected to rebound slightly over the projection period, pushed up by stronger wage growth.

Full and swift implementation of structural reforms, faster improvement in the liquidity and financing conditions of the banking system, and some form of further debt relief would spur confidence and the recovery. Weaker global trade and growth in the European Union and China would affect Greek exports. Geopolitical tensions among Greece’s neighbours and the related refugee crisis would pose significant additional challenges.