Finland

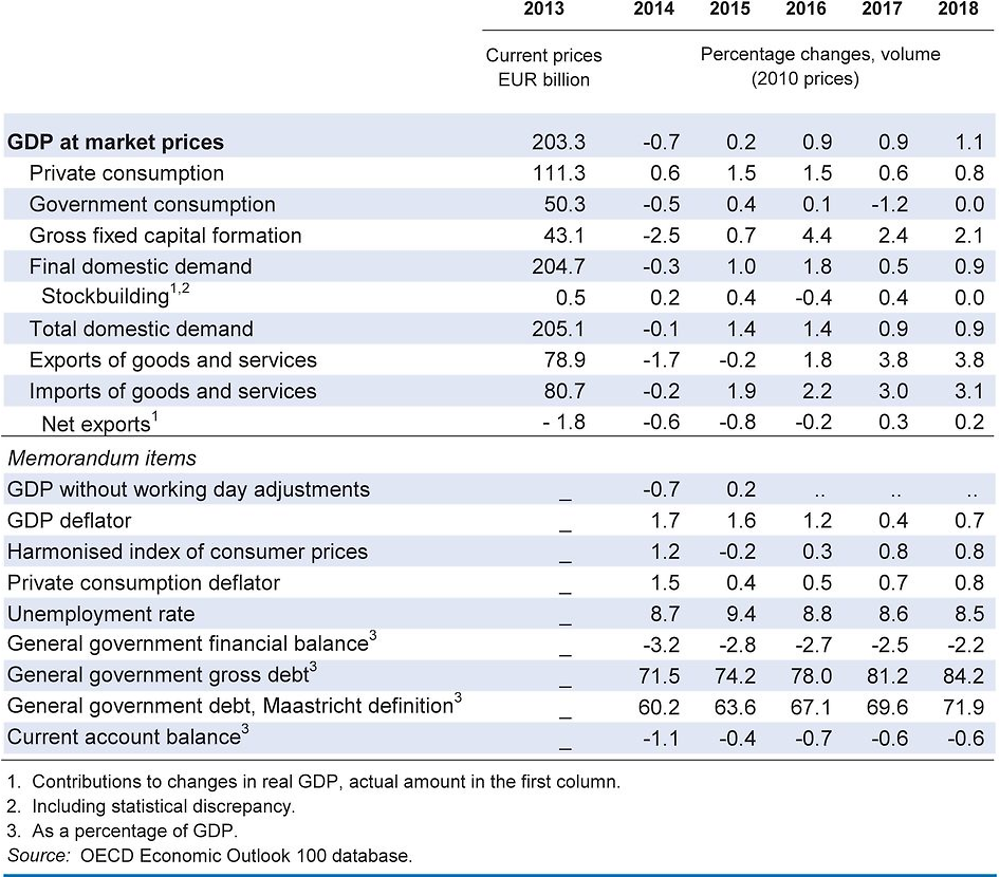

Rising private consumption and investment growth have pulled the economy out of recession. However, output growth is projected to remain sluggish over the coming years, as domestic demand growth is projected to weaken again, although export growth will rise significantly as external demand edges up and competitiveness improves. Unemployment will decline modestly and inflation will pick up only slowly.

Substantial progress has been made on implementing the government’s reform programme. The social partners have agreed on a Competitiveness Pact, which lowers labour costs in 2017, and on wage moderation over the following years. Enhancing labour market flexibility would raise the employment rate further. Health care reform is also moving forward, with the decisions to shift some responsibilities from municipalities to newly-created regional institutions in 2019 and reform funding mechanisms. After easing in 2016, the stance of fiscal policy is set to be broadly neutral in 2017-18.

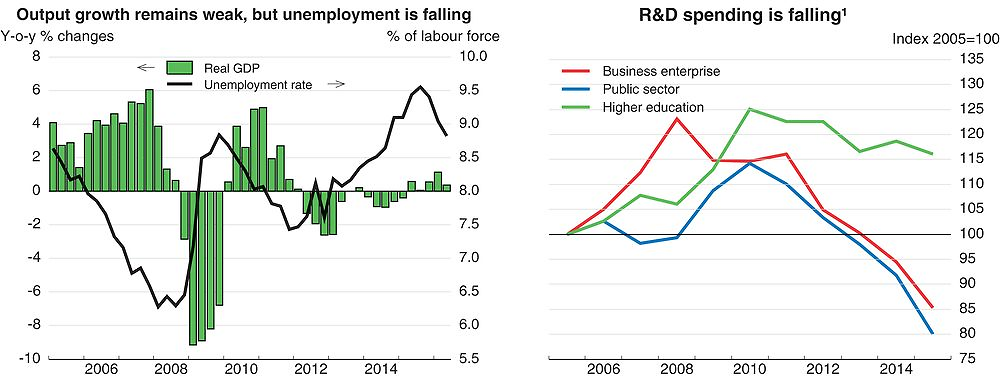

The room offered by Finland’s low government deficit and debt should be used to support the economy through the tax and social contributions cuts linked to the Competitiveness Pact and through investments in infrastructure. There is room to spend more than currently planned on tertiary education and public R&D, and to provide fiscal incentives for private investment in R&D and staff training.

Output expansion lowers unemployment

Output growth is strengthening somewhat, but is facing headwinds from weak external demand, especially for commodities and investment goods, which account for the bulk of Finnish exports. Very low wage increases, agreed by social partners to restore price competitiveness, are holding back private consumption. However, household real disposable income is rising due to low inflation. Coupled with low interest rates, this supports a rebound in investment, especially in construction. Investment in machinery and equipment, notably in large-scale forestry and energy projects, is also strong. The unemployment rate is falling thanks to job creation in services and construction, while population ageing is shrinking the labour force. The fiscal deficit remains close to 3% of GDP, as spending cuts and higher revenue are offset by increasing age-related costs.

1. Deflated by GDP prices.

Source: OECD Economic Outlook 100 database.

Major progress in structural reforms has been achieved

The social partners have agreed on a Competitiveness Pact, which will lower unit labour costs by about 4% from 2017. Employees will work 24 hours longer annually for the same wages, public sector holiday bonuses will be cut, and employer social security contributions will be reduced and partly shifted to employees. In addition, the current collective agreements freezing wages are extended to around end-2017. The pact also provides cuts in taxes and social contributions in 2017. All these measures should help to contain unit labour costs, and thereby strengthen international competitiveness and export prospects.

Additional spending on transport infrastructure maintenance over 2016-18 should further support growth. However, substantial cuts in tertiary education risk harming future growth, even though they may be partly offset by efficiency gains. Furthermore, both public and private R&D expenditures have declined over recent years. To enhance innovation, more spending on public R&D and fiscal incentives for private investment in R&D and staff training should be considered.

Long-term fiscal sustainability is set to be strengthened by the health care reform. By shifting some responsibilities from municipalities to newly-created regional institutions in 2019, and by changing funding mechanisms, this reform will generate economies of scale, while enhancing user choice and equality in access to care across the country.

Growth set to remain sluggish

Continued weak growth will be supported mainly by exports, as private consumption is constrained by low household income growth. Investment growth is broad-based, with residential and commercial real estate investment fuelled by low interest rates and high demand in the biggest cities. Shrinking spare capacity in some sectors should support modest machinery and equipment investment. Although the unemployment rate is poised to continue to come down slowly, further policy reforms to enhance labour market flexibility will be needed to significantly increase the employment rate.

As a small open economy, Finland is sensitive to global economic and world trade developments. A slowdown in other Nordic countries and Germany would hurt exports. Worsening geopolitical tensions, a further economic slowdown in China or increased volatility in emerging market economies, notably Russia, could disrupt the recovery. Conversely, a rebound in global investment would boost Finnish exports.