Czech Republic

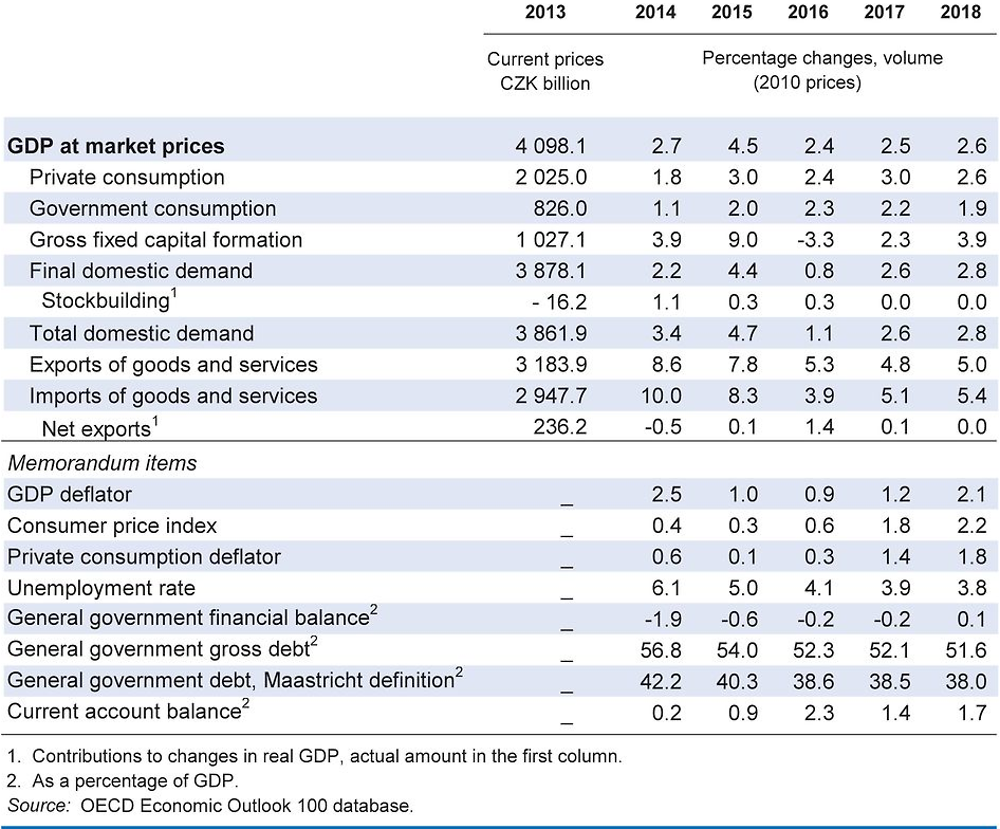

Stable economic growth is projected for 2017 and 2018. Solid labour demand will push unemployment towards its lowest rate in the last two decades, accelerating wage and supporting consumption. Investment was cut sharply in 2016 due to the transition in EU funding programmes, but is projected to rebound in 2017. Rising cost pressures will push consumer price inflation to the 2% target during 2017.

The central bank has committed to preventing exchange rate appreciation against the euro until at least the second quarter of 2017, to insure against deflationary forces. The policy rate could then cautiously be lifted, as the deflationary threat recedes, with fiscal policy supporting demand if needed. Structural policies addressing skill shortages and raising productivity would help sustain the expansion and increase inclusiveness. These include expanding childcare, increasing incentives for business R&D and reducing entry and exit barriers for firms.

Public debt is low and the budget is broadly in balance, providing room for fiscal support to enhance growth. Boosting investment should be a priority, and can take advantage of EU funds. Tax and spending policies could better support sustainable growth and equality, notably by lowering the tax wedge on labour income and increasing spending on childcare.

Growth has eased but remains robust

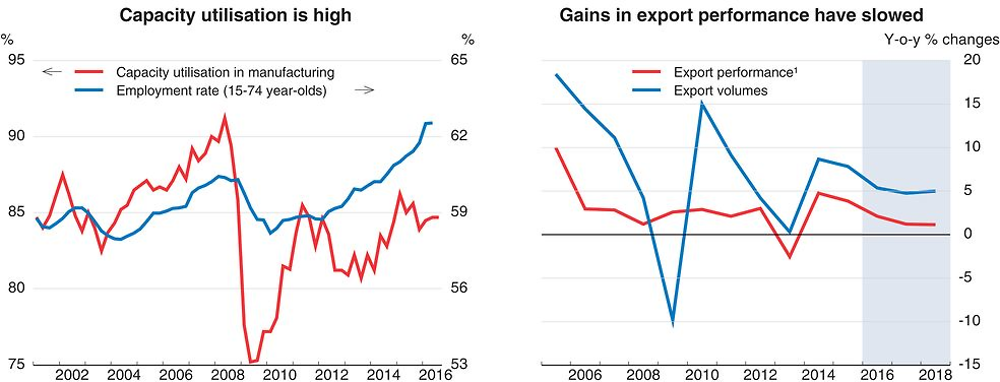

GDP growth slowed in 2016, largely due to the fall in public investment associated with the transition to a new EU programming period. New projects have been slow to commence. Businesses outside the construction sector are confident and financial conditions are supportive. Increasing labour shortages are raising wages and hours worked, and consequently, consumption. However, export growth has slowed amid subdued external conditions. Falling energy and food prices are restraining inflation but excluding these factors, inflation has hovered around 1¾ per cent during 2016.

1. Export volume growth relative to export market.

Source: Eurostat; Thomson Reuters; and OECD Economic Outlook 100 database.

Structural policies should be deployed now to sustain the expansion later

The projected rise in inflation will facilitate policy rebalancing. Monetary policy is very accommodative, with the policy rate near zero and the exchange rate floor preventing appreciation against the euro. To mitigate financial stability risks, the central bank lowered the recommended maximum loan-to-value ratio on housing loans from October 2016 and counter-cyclical capital buffers will be required from January 2017. The central bank should exit the floor as deflationary risks recede, as planned. It could then gradually lift the policy rate, as assumed in the projections. The strong fiscal position provides space to offset the demand effects of exchange rate appreciation, if needed.

Stronger-than-expected revenues due to income growth and increased tax compliance helped to almost close the budget deficit and will continue supporting public finances. Fiscal policy is projected to be broadly neutral in 2017-18. Steps should be taken to speed up absorption of EU funds for investment, ensuring efficient procurement processes and co-ordination across government. Wage increases and a pension supplement will increase spending in 2017. Implementation of the new fiscal framework, which includes creation of a fiscal council, should enhance medium-term fiscal credibility and sustainability.

Policies that would ease labour market shortages and skill mismatches include faster expansion of childcare access and reducing disincentives to return to work. Addressing childcare shortages would also reduce gender wage gaps. Working with employers on vocational training would improve the supply of skills. Reforms improving access to finance for innovative firms and speeding up the insolvency process would raise productivity and competitiveness.

Growth is projected to be domestically driven but key risks are external

Robust consumption growth will be maintained by strong income growth and favourable borrowing conditions. Incomes will also be boosted by the 11% minimum wage increase in 2017. A rebound in private investment is projected to raise imports, while only moderate growth in export markets and rising domestic costs will restrain export growth. Rising labour demand should lower the unemployment rate towards two-decade lows. That, and the fading effect of past import price declines, is projected to raise inflation to the 2% target by end-2017.

Key risks to the forecasts are external. Slower growth in world trade would lower exports through value chains. Conversely, exports could outperform if productivity gains offset rising costs. The risks from Brexit are two-sided: businesses may delay investment but any arrangement preserving European integration would particularly benefit Czech exporters. Domestic risks are mostly to the upside. Accelerating consumer credit or wages could fuel stronger consumption growth than projected. Increased public spending or faster take-up of EU funds would also raise output.