Turkey

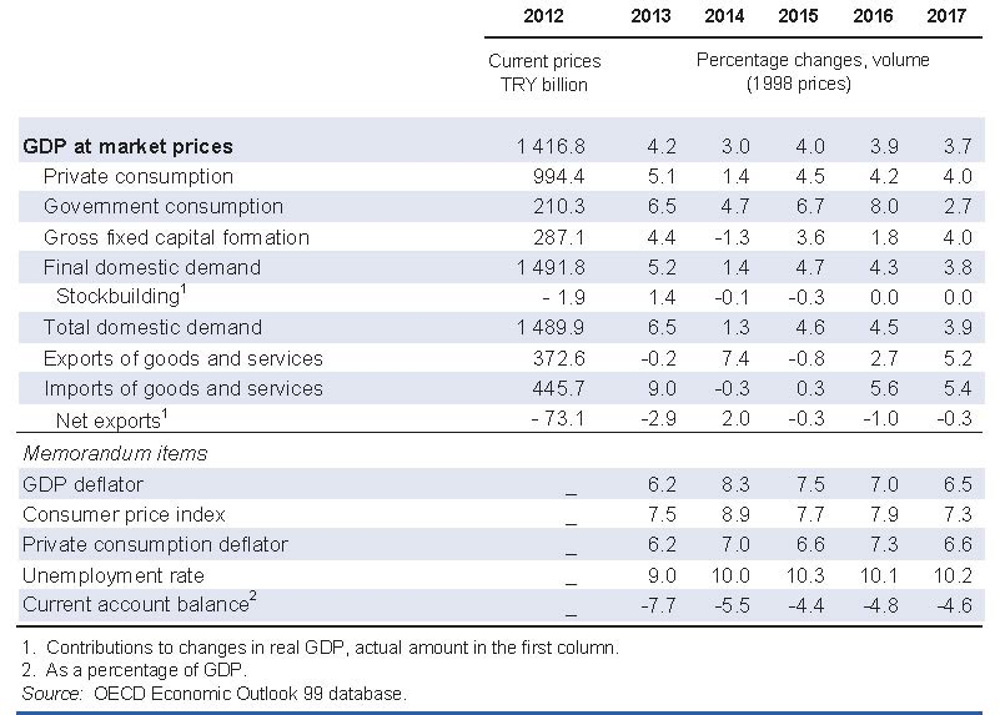

GDP growth is projected to remain close to 4% per annum in 2016 and 2017. A sharp hike in the minimum wage and social transfers in early 2016 will boost private consumption. However, the associated increase in labour costs, despite subsidies to alleviate them in the first year, will hurt competitiveness and exports. As the short-run impact of the jump in household income wanes, growth is projected to edge down in 2017.

Business and household confidence remain frail in the context of severe regional geopolitical tensions and a difficult domestic political climate. The implementation of the key provisions of the 2016 Action Plan, which entails convergence towards OECD good practices in many areas, would improve both domestic and international confidence, and support investment and growth.

Productivity is undermined by the fragmentation of the business sector. Efficient firms cannot grow at full potential due to shortcomings in the regulatory framework. At the same time, low-productivity entities, which employ a large share of the low-skilled, survive thanks to the incomplete enforcement of rules and regulations. The resulting stalemate calls for a comprehensive upgrading of the business environment and skills, to foster the shift of resources from low to higher-productivity firms.

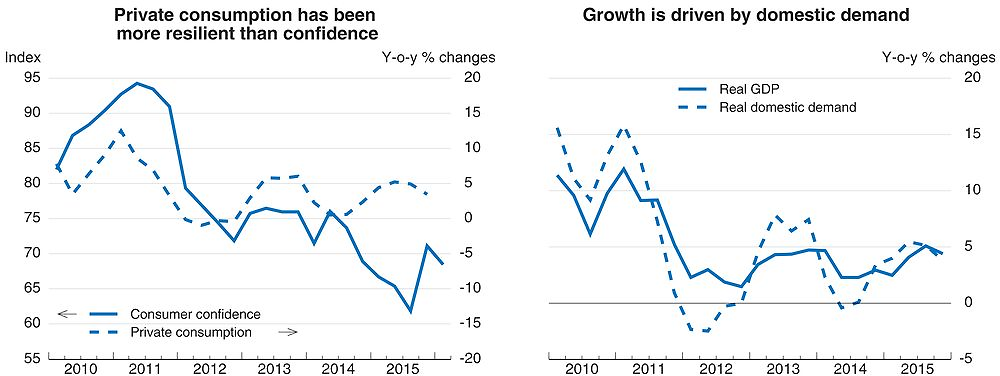

Strong growth has been driven by domestic demand

GDP growth has been strong since early 2015, driven by private consumption. The deterioration of household confidence amid domestic political uncertainties and severe regional conflicts has not held back consumption. Household spending remained robust, boosted by promises of a large hike in the minimum wage and increases in social transfers. The influx of refugees from Syria also stimulated demand. In contrast, private business investment stayed subdued.

Source: OECD Economic Outlook 99 database; and Turkish Statistical Institute.

Exports remained weak due to a sharp contraction in regional markets, despite competitiveness gains stemming from exchange rate depreciation through 2015. As of January-February 2016, exports to Russia had fallen by 63% year-on-year and exports to Iraq by 21%. At the same time, exporters of manufactured goods gained market share in the EU and US markets. Still, total goods and services exports declined in volume in 2015, while the current account deficit fell owing to the sharp drop in oil prices. The Russian embargo on Turkey’s exports from January 2016 heralds further contraction of the Russian market, notably for tourism which accounts for 7% of total employment. Foreign funding needs, which will approach 20% of GDP in 2016, have so far been financed smoothly by capital inflows.

Macroeconomic policies are supportive in the short term

At least 30% of wage earners earn the minimum wage, so the 30% minimum wage hike granted in January and increases in other social transfers are giving a significant boost to private consumption. But they are also heightening pressures on inflation, which had reached 8.8% at the end of 2015 before declining to 7.5% at the end of the first quarter thanks to favourable food prices and a stronger exchange rate. Despite competitiveness losses induced by the minimum wage jump, business confidence was helped by a Government Action Plan announced in early 2016 which included important structural reform objectives in labour and product markets. If fully implemented, this programme should support firms in the formal sector and thereby create higher-productivity and better-paid jobs. At the same time, tensions in the Eastern regions, persisting geopolitical strains across borders and terrorist attacks in early 2016 have affected general confidence.

Macroeconomic policies are supportive in the short term, and the projection assumes that the new government will stick to the basic orientations of the Medium-Term Economic Programme published in January. The fiscal stance will be expansionary in 2016 with the fulfilment of election promises, but spending restraint is planned from 2017, with the share of general government spending in GDP inching back down to 41%. Monetary policy was loosened between February and April in the context of supportive global financing conditions, with a decline in the average funding rate of the central bank and cuts in the upper end of the interest-rate corridor. Macro-prudential policies were slightly relaxed, facilitating the use of credit cards for certain categories of consumer purchases.

Risks are significant on both sides

Annual growth is projected to approach 4% in 2016 and to edge down in 2017. Inflation is projected to be just under 8% in the second half of 2016, well above the target of 5%, before subsiding somewhat in 2017. If the intended structural reforms proceed, and domestic political and regional geopolitical conditions improve, stronger private investment and exports may propel growth to higher levels. The projection, however, is conditional on political stability and assumes that the key orientations of the existing medium-term economic framework are retained. If not, or if regional and domestic tensions were to intensify, domestic demand and tourism would be adversely affected. Any associated weakening in international confidence may trigger capital outflows and exchange-rate volatility, weighing on short-term growth. In addition, Turkey is exposed to global risks arising from China’s prospects and from the expected normalisation of US monetary policy and would be negatively affected by a slowdown in Europe.