Denmark

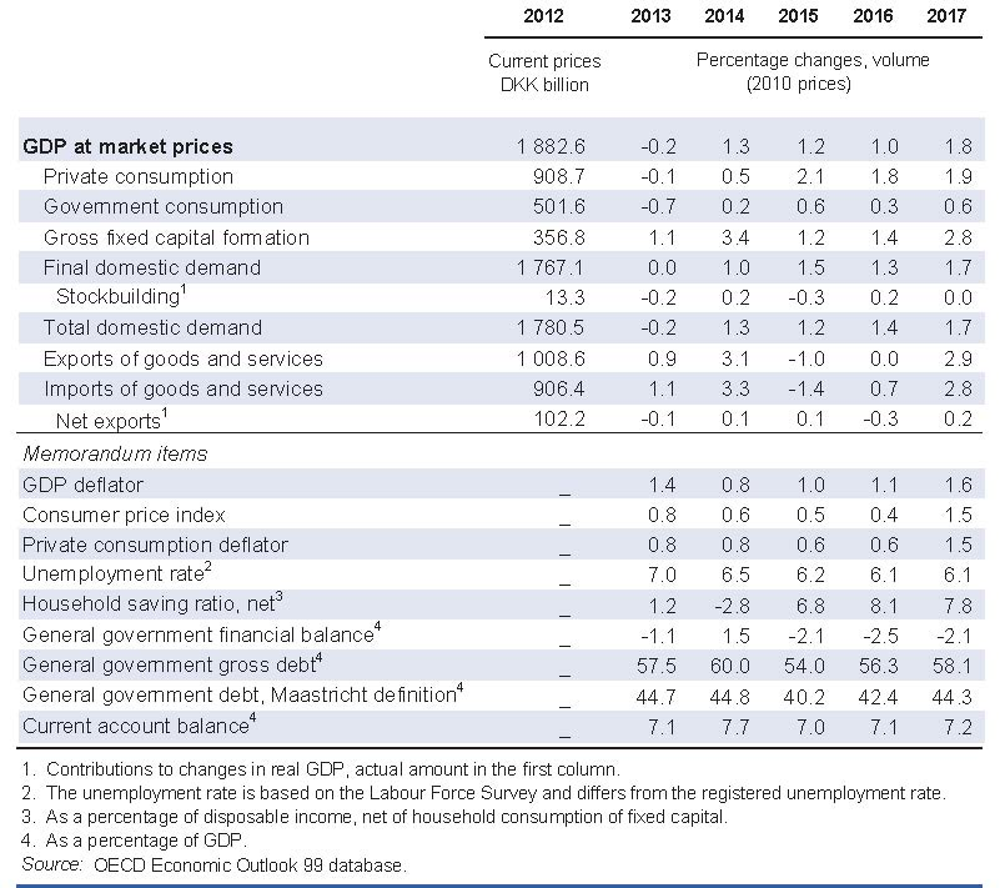

Economic growth is projected to rise to nearly 2% in 2017, driven mainly by domestic demand. Private consumption will be supported by growth in real incomes, related to higher employment and real wage gains, as well as by increasing property prices. Exports are projected to rebound somewhat after a very weak 2015.

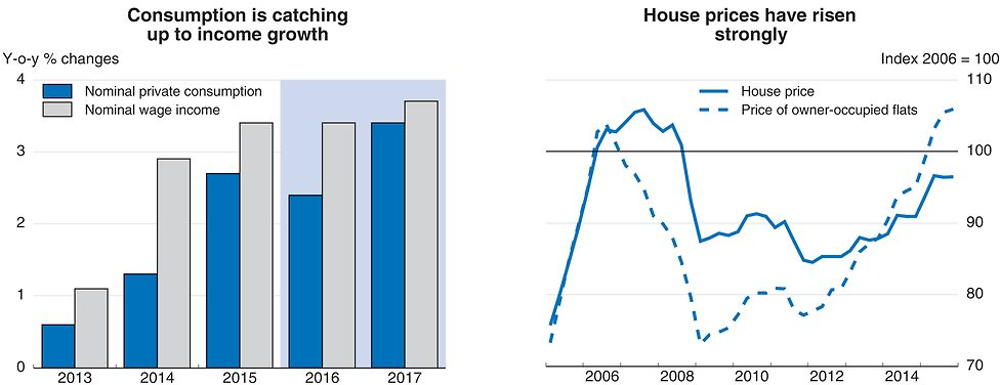

Spare capacity in the economy is diminishing, and accordingly fiscal policy should gradually move towards a more neutral stance. Investment activity should benefit from the accommodative monetary policy stance, which is expected to remain through the peg to the euro. As real estate prices continue to rise, notably in the Copenhagen area, macro-prudential measures have been rightly stepped up in order to prevent the build-up of imbalances.

Subdued productivity growth continues to be a major long-term challenge. More reforms are crucial, particularly in areas such as domestic services and innovation. A number of reforms have been launched, but more can be done, for instance boosting competition in retailing and pharmacies; such reforms would reduce prices, favouring the less well-off particularly.

The economy is growing – but only slowly

Exports have been weak, in part because of the slowdown in Europe and Asia. On the other hand, private consumption continues to underpin growth as households benefit from private sector job creation and real wage gains. Consumer sentiment is supported by loose monetary conditions, low inflation and rising house prices. Business investment is expanding only slowly, reflecting in part weak exports. Housing investment has not yet reacted to higher property prices, partly reflecting the lack of building land in metropolitan areas, where prices have increased most. Consumer price inflation hovers around zero, pulled down by low energy prices, while core inflation has come down to less than 1%.

Source: OECD Economic Outlook 99 database; and Statistics Denmark.

Economic policy remains accommodative

The central bank’s policy rate is -0.65% and has been negative since the fall of 2014, to contain surges in demand for the krone. The peg to the euro means that the policy rate is likely to remain negative and the interest rates are assumed to be low over the projection period. This may increase the risk of unsustainable increases in property prices. Before this risk materialises, fiscal and macro-prudential policies need to be stepped up to avoid a repeat of past boom and bust episodes. Fiscal policy has been accommodative overall. Low oil prices and declining oil production in the North Sea has weighed on government revenues, and are expected to continue to do so. Fiscal policy is expected to tighten only gradually, partly through a reduction in investment. However, this may be insufficient to contain emerging imbalances in the economy, particularly, given the already small degree of labour market slack. Further decreasing interest rate tax deductibility and regularly updating property valuations are the preferred forms of fiscal tightening in the medium term and would also establish tax neutrality across different asset classes.

Growth will remain slow in 2016 before accelerating

Growth is projected to pick up during 2016 as exports recover, notably due to improvements in the euro area. Private consumption should continue to support growth, underpinned by the strong labour market although high household debt will weigh on household finances. This will support property prices across the country, which should underpin residential investments. Investment should firm on the back of broad-based demand increases, higher capacity utilisation and low interest rates. Inflation is projected to rise gradually, as the spare capacity in the economy declines and commodity prices recover.

Continued trade weakness linked to a slowdown in emerging markets, in particular China, or disappointing growth in the euro area pose the main downside risks to exports. A potential Brexit could also hamper exports, as the United Kingdom is the fourth largest market for Danish exports. On the domestic side, stronger debt reduction among households would weaken domestic demand in the short term, but would provide room for stronger consumption and investment later on. The very supportive monetary policy stance, low energy prices and rising property prices could boost domestic demand further in the projection period. Likewise, recent labour market reforms could have a larger-than-expected effect on labour supply.