copy the linklink copied!Mexico

Economic activity will pick up modestly, supported by domestic demand. Consumption is set to strengthen on the back of robust remittances, lower inflation and higher social transfers. Announced infrastructure investment plans will also add to growth, but restraints on current spending will partly offset these effects. Policy uncertainty will continue to restrain private investment. The decline in oil activity will remain a drag on growth. Overall, growth will be too modest to allow for a reduction in high informality rates.

Monetary policy is appropriately tight to contain high inflation and keep expectations anchored. Inflation is projected to gradually return to target in the absence of additional shocks due to increased slack. Fiscal prudence will continue to keep public debt at a constant level. A renewed strategy to boost productivity and low potential growth is needed and should include stepping up efforts to improve the rule of law and competition. Raising education outcomes for all would also help make growth more inclusive. Increasing low female labour market participation by expanding good quality early childhood education and care would boost growth and inclusion. Overall, greater inclusion will require creating equality of opportunities for all, with a focus on under-privileged groups, such as the indigenous population and people with disabilities.

Economic activity has decelerated

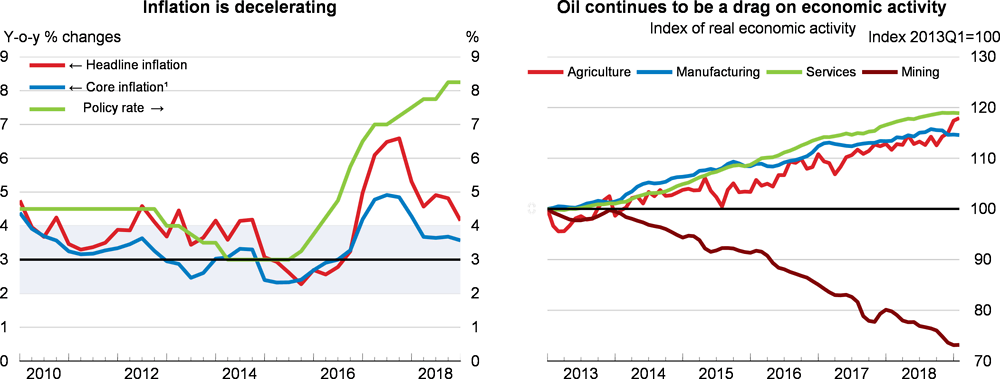

Growth has fallen recently, owing to weak investment and lower export growth, as US imports have slowed. Trade tensions and policy uncertainty have also dented business confidence. Disruptions in gasoline supply, strikes and railroad blockades affected supply chains at the beginning of 2019. Energy and food prices keep putting pressure on headline inflation, which is still above target. However, inflation expectations and core inflation, the central bank’s preferred measures, are already within the bank’s variability interval, although the latter is falling only slowly.

Containing public spending would stabilise debt and preserve confidence

A strong macroeconomic policy framework has supported the resilience of the economy amid several headwinds. The policy interest rate, which is at its highest level since the financial crisis, has prevented inflation from rising fast and helped to anchor inflation expectations. Inflation is projected to return progressively to target in the absence of further shocks as economic slack increases. The monetary authorities should remain vigilant to the evolution of core inflation, expectations and the balance of risks, and adjust the policy rate to a level consistent with reaching the inflation target.

Fiscal prudence is being maintained, and the government is committed to keeping the public debt-to-GDP ratio constant. As GDP growth has fallen and non-tax revenues are declining, spending adjustments will be necessary. Spending is shifting towards infrastructure, as the government plans to promote development in the southern regions and boost energy production. While private investment is being sought to upgrade ports and expand railroads, planned public investment in the energy sector is likely to be incompatible with a stable debt-to-GDP ratio, in the context of a rigid budget and no increase in taxation. Social spending has increased on the back of higher pension outlays and scholarships, but more investment is needed in schools in underprivileged areas, which would attenuate existing high inequalities in education services. Expanding good quality affordable early-childhood education and care is a priority to boost education outcomes and increase equity, as well as to facilitate the inclusion of women in the labour market. Efforts to continue improving the efficiency of tax collection, and reduce tax expenditures and exemptions should be pursued. Increasing the progressivity of personal income tax would enhance low tax collection and equity.

Growth is projected to increase modestly

Growth is set to rise modestly, supported by infrastructure investment and domestic consumption. Export growth will continue to support the economy, albeit at lower rates, consistent with a gradual slowdown in growth in the United States. Raising private investment is necessary to boost productivity and formal job growth. Improving the business environment is therefore a priority. Policy uncertainty, rising protectionism and the non-ratification of the trade agreement with the United States and Canada (USMCA) remain negative risks to the outlook, as they would dent exports and damp investment even further. On the other hand, more policy certainty, an improvement in the rule of law and competition, and a reduction in violence would support the business environment and lift well-being.

Metadata, Legal and Rights

https://doi.org/10.1787/b2e897b0-en

© OECD 2019

The use of this work, whether digital or print, is governed by the Terms and Conditions to be found at http://www.oecd.org/termsandconditions.