Slovenia

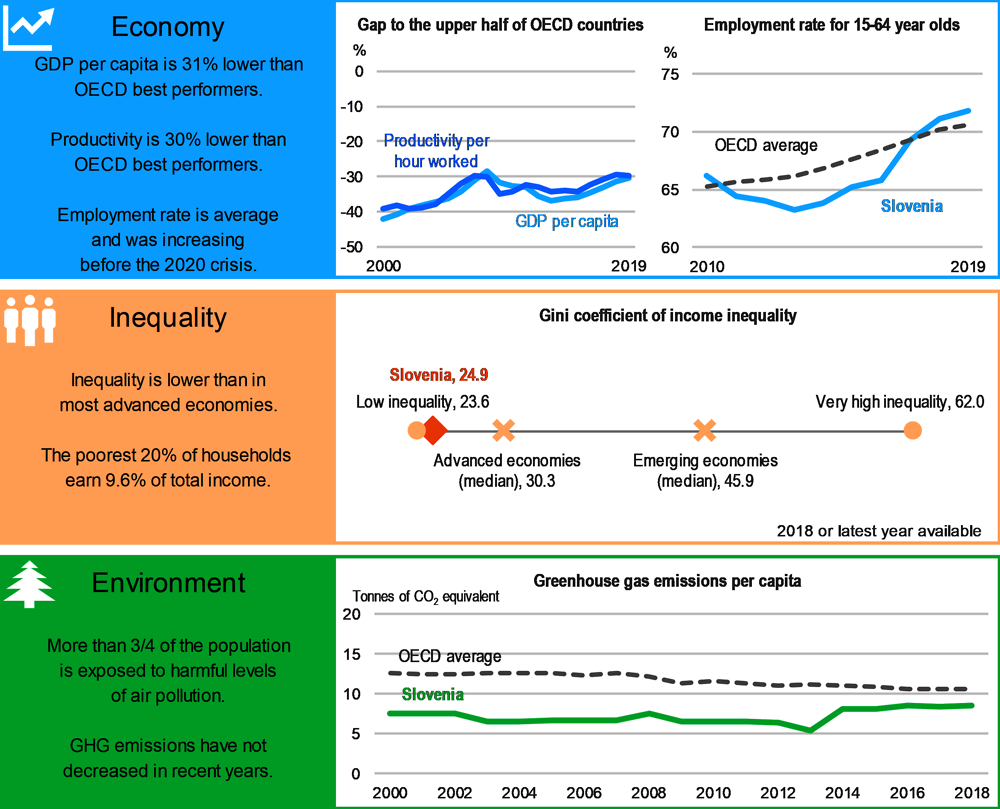

Several long-standing vulnerabilities risk slowing down the recovery. Lowering labour taxes should be a priority. Currently, low-skilled workers have few incentives to enter employment or increase work efforts as high-income taxes erode their income gains. Another concern is the relatively high share of state-owned enterprises, present across all sectors, which hinder competition and reallocation of resources to most productive firms during the recovery.

Lower labour taxes and increase competition to speed up the recovery

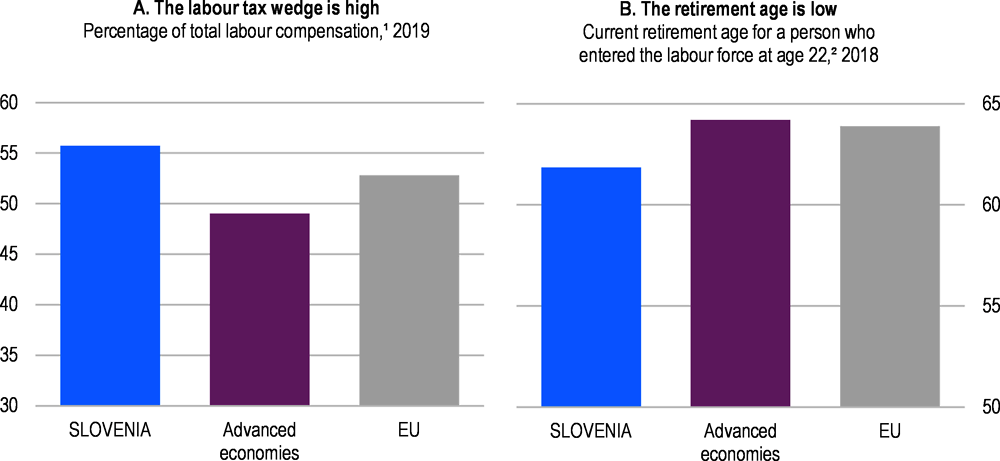

Reforms should aim to make the tax system more conducive to growth by reducing tax rates on labour income and bolstering property taxation. This should be combined with in-work benefits or transfers to low-income workers to improve their incentives to work. High marginal tax rates for high earners are likely to have large costs in terms of work incentives and may deter investment in skills (Panel A). Reforms of the wage setting process are also needed to enhance reallocation of labour towards growing sectors, raise labour market participation and labour mobility. Wage setting should be more decentralised at the firm level, where social partners would have greater responsibilities in the process. At the same time, framework conditions such as seniority bonuses and minimum wage levels could be set at the sectoral level. Targeting of employment and training subsidies to jobseekers with high assistance needs would make the labour market more inclusive.

Widespread public ownership combined with weaknesses in corporate governance and significant entry barriers reduce competition. This can impede effective reallocation of resources to the most productive firms during the recovery. Conditional on the market situation, continued privatisation efforts could increase competition and improve resource allocation. In any case, reforms should strengthen the governance of state-owned enterprises, resources as well as expertise of the competition authority. Moreover, reducing the tax bias against R&D and intangibles can encourage productivity-enhancing investment and help enterprises move up the value-added chain.

Educational outcomes of the adult population are below OECD average, including adults with tertiary education. High tuition fees for part-time students keep enrolment among older cohorts low. There is scope to improve efficiency and equity in tertiary education. Policy should raise the work-experience content of technical programmes, equalise tuition fees for full- and part-time students on a per course basis, and offer grants and loans to students from vulnerable backgrounds. A more efficient tertiary education system that equips students with skills demanded in the labour market will also improve labour productivity.

Unless addressed, ageing will significantly raise pension costs and erode long-term fiscal sustainability. The effective retirement age remains among the lowest in the OECD (Panel B) and pension spending is rising due to population ageing. By 2055, pension spending is projected to increase more than in almost any other European country. Pension reform should lower pressures on public finances while ensuring income adequacy during retirement. Ensuring a higher effective retirement age will bolster fiscal sustainability. To this end, the statutory retirement age should be increased to 67 for both women and men. In the second pension pillar, a higher ceiling for tax exempt and matching contributions for low-wage workers can provide additional pension income avoiding poverty risks.

Recent progress on structural reforms

The pace of structural reforms has slowed down in 2020 as the COVID-19 crisis has demanded the government’s attention, making reforms all the more urgent. Limited progress has been achieved in pension reforms, despite the projected significant increase in spending related to ageing. Some progress has been achieved with labour market reforms. This includes stronger work incentives for people who are eligible for full pensions, but who continue to work. Moreover, recent tax reforms reduced labour tax rates for lower income earners.