3. Tax revenue effects of Pillar Two

174. This chapter presents the analytical framework and data sources used by the OECD Secretariat to assess the effect on corporate tax revenues of Pillar Two. It also contains high-level estimates of the impact of Pillar Two at the global level and at the level of broad groups of jurisdictions. Pillar Two addresses remaining BEPS challenges and is designed to ensure that large internationally operating businesses pay a minimum level of tax regardless of where they are headquartered or the jurisdictions they operate in (OECD, 2020[1]).

175. The analytical framework presented in this chapter explores the implications of (i) several illustrative design and parameter options under Pillar Two, (ii) the interaction between Pillar One and Pillar Two and how this interaction can affect the revenue effects of Pillar Two, and (iii) potential behavioural reactions by multinational enterprises (MNEs) and governments to the introduction of Pillar Two. A number of design elements and parameters of Pillar One and Pillar Two will be the subject of future decisions by the Inclusive Framework. The Pillar One and Pillar Two design and parameter options considered in this chapter are only illustrative examples and should not be seen as prejudging any final decisions to be taken by the Inclusive Framework.

176. Similar to the framework used to assess the effect of Pillar One (see Chapter 2), the framework presented in this chapter spans more than 200 jurisdictions and combines a variety of micro- and macro-level data sources into a consistent structure. One central element of this structure is the set of data matrices described in detail in Chapter 5.

177. The framework is building on the best data sources available to the OECD Secretariat, and the underlying data has been subject to extensive checks and comparisons across data sources. The resulting estimates are nevertheless subject to a number of important caveats:

The assessment of Pillar Two revenue effects in this chapter is based on a number of simplifying assumptions on the design and implementation of Pillar Two, reflecting the challenges involved in modelling certain potential provisions of Pillar Two with the available data. In particular, the switch-over rule and the subject to tax rule have not been modelled, while the income inclusion rule and the undertaxed payments rule have been modelled only in a relatively stylised way. The potential effect of temporary or permanent differences between financial accounting profit and the Pillar Two tax base, and the effect of a loss carry-forward mechanism under Pillar Two (or any other profit smoothing mechanism) have not been taken into account. The modelling of a potential formulaic substance-based carve-out is based on a number of simplifying assumptions, as discussed further in this chapter.

The approach to estimating the effect of Pillar Two focuses on low-taxed profits in generally low-tax jurisdictions,1 but leaves aside potential “pockets” of low-taxed profit in generally higher-tax jurisdictions, due to limitations in the available data. The upper bound of the uncertainty ranges surrounding the estimates in this chapter has been increased to account for this uncertainty, as described further in this chapter.

Due to data limitations, the effect of certain provisions that may already allow jurisdictions to levy taxes on profit that would otherwise be subject to low levels of effective taxation (e.g. withholding taxes, CFC rules) is not taken into account in the modelling in this chapter, which could lead to overestimating potential revenue gains.

The data underlying the analysis have limitations in terms of coverage, consistency and timeliness. In particular, the reliance on aggregate data in certain parts of the analysis and for certain jurisdictions implies that some firm-level heterogeneities are overlooked, which could affect the results. Data on MNEs’ profit relates primarily to years 2016 and 2017. It therefore pre-dates some significant recent developments, including the implementation of various measures under the OECD/G20 Base Erosion and Profit Shifting project,2 the US Tax Cuts and Jobs Act (TCJA) and, more recently, the impact of the COVID-19 crisis. More specifically:

The implementation of the BEPS Action Plan is expected to reduce the amount of global low-taxed profit by reducing opportunities for MNEs to shift profit to low-tax jurisdictions. This reduces the potential revenue gains from Pillar Two.

Regarding the US TCJA, while no decision has been taken by the Inclusive Framework yet, the analysis assumes illustratively that the US Global Intangible Low Tax Income (GILTI) regime that has been in place since 2018 and results in a form of minimum tax on the foreign profit of US MNEs would “co-exist” with Pillar Two. Potential gains from Pillar Two presented in this chapter exclude US MNEs on the basis of the assumption that they would remain subject to GILTI and not be subject to the Pillar Two rules. Revenue gains from GILTI are discussed in section 3.8 of this chapter, based on ex ante estimates by the US Joint Committee on Taxation (US Joint Committee on Taxation, 2017[2]).

The COVID-19 crisis is likely to reduce the profitability of many MNEs – and, in turn, the amount of profit subject to Pillar Two – in the short and medium run, due to lower consumer demand, as well as potential difficulties with production (e.g. locked-down workers, supply chain disruptions, restrictions on travel). The longer term effect of the crisis on MNE profitability remains highly uncertain and will depend on the shape and speed of the economic recovery, as well as potential structural changes to the economy that the crisis may bring or accelerate (e.g. changes in the sectoral structure of economies, including faster-than-expected digitalisation of certain activities, as well as potential changes in the structure of global value chains and competition dynamics among firms).

The methodology takes into account, in a stylised way, potential strategic reactions by MNEs and governments to the introduction of Pillar Two. More specifically, the analysis focuses on (i) potential changes in MNEs’ profit shifting intensity, and (ii) potential tax rate increases in jurisdictions with an average effective tax rate (ETR) below the Pillar Two minimum rate. However, the exact nature and intensity of these reactions is difficult to anticipate with certainty, especially in the context of a coordinated multilateral tax reform, while existing studies are mainly based on jurisdiction-specific reforms. In particular, the exact location of MNE profits in a post-Pillar Two world is difficult to anticipate because MNE profit shifting schemes are often complex and could be modified in ways that are complex and difficult to anticipate following the introduction of Pillar Two.

The analysis in this chapter does not try to model other potential reactions by MNEs and governments, including potential changes in MNEs’ real investment decisions and policy reactions by other jurisdictions. The implications of Pillar One and Pillar Two on MNEs’ real investment decisions and on tax competition between jurisdictions are discussed in detail in Chapter 4. Overall, the assessment in Chapter 4 is that Pillar One and Pillar Two would have a small negative direct effect on global MNE investment that could be partly or even fully offset by positive indirect effects. In addition, a consensus-based multilateral solution involving Pillar One and Pillar Two would lead to a more favourable environment for investment and growth than would likely be the case in absence of an agreement by the Inclusive Framework (see Chapter 4). Still, Pillar Two could lead to significant increases in investment costs in jurisdictions where the ETR is currently below the potential level of the minimum rate under Pillar Two. This could significantly affect MNE investment in these jurisdictions and, in turn, affect CIT revenues, as well as revenues from other tax bases (e.g. personal income tax, value added tax) in these jurisdictions.

178. Given these caveats, the estimates based on the framework presented in this chapter should be interpreted as illustrating the broad order of magnitude of the impacts of Pillar Two, rather than precise point estimates. Actual gains from Pillar Two may differ from these ex ante estimates as these gains will ultimately depend on the final design and parameter decisions to be taken by the Inclusive Framework, the actual responses of MNEs and governments to the introduction of Pillar Two and the economic situation at the time of implementation. In light of this, the estimates presented in this chapter are expressed as ranges to reflect the uncertainty surrounding them. For simplicity, some intermediate results in this chapter are presented as point estimates, but the overall results in the final section are presented as ranges.

179. As described in the Pillar Two Blueprint report (OECD, 2020[1]), Pillar Two comprises a number of interlocking rules that seek to (i) ensure minimum taxation while avoiding double taxation or taxation where there is no economic profit, (ii) cope with different tax system designs by jurisdictions as well as different operating models by businesses, (iii) ensure transparency and a level playing field, and (iv) minimise administrative and compliance costs.

The principal mechanism to achieve this outcome is the income inclusion rule (IIR) together with the undertaxed payments rule (UTPR) acting as a backstop (the “GloBE rules”). The operation of the IIR is, in some respects, based on traditional controlled foreign company (CFC) rule principles and triggers an inclusion at the level of the shareholder where the income of a controlled foreign entity is taxed at below the effective minimum tax rate. It is complemented by a switch-over rule (SOR) that removes treaty obstacles from its application to certain branch structures and applies where an income tax treaty otherwise obligates a contracting state to use the exemption method. The UTPR is a secondary rule and only applies where a Constituent Entity is not already subject to an IIR. The UTPR is nevertheless a key part of the rule set as it serves as back-stop to the IIR, ensures a level playing field and addresses inversion risks that might otherwise arise.

The subject to tax rule (STTR) complements these rules. It is a treaty-based rule that targets risks to source countries posed by BEPS structures relating to intragroup payments that take advantage of low nominal rates of taxation in the other contracting jurisdiction (that is the jurisdiction of the payee).

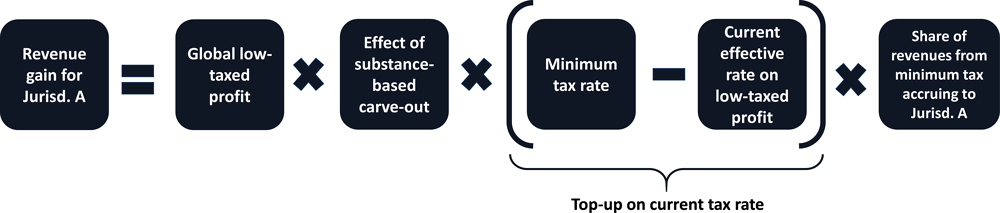

180. In this chapter, the revenue effects of Pillar Two are assessed by identifying low-taxed profits of MNEs (i.e. profits that are taxed below a potential minimum rate) and assuming that a top-up tax would apply to bring the ETR on these profits (after application of a potential formulaic substance-based carve-out) up to the level of the minimum rate (Figure 3.1). The four components listed above (IIR, UTPR, SOR and STTR) would all contribute to this outcome. In practice, as further discussed in the next paragraphs, it is difficult to disentangle with precision the contribution of each of these components, due to data limitations and uncertainties about the exact design of the Pillar Two components and their interactions, which will ultimately be defined by the Inclusive Framework.

181. Consistent with the Pillar Two Blueprint report, the approach in this chapter is to assume that MNEs’ low-taxed profits would generally be subject to a top-up tax in the jurisdiction of the ultimate parent entity of the MNE group under the income inclusion rule. The switch-over rule is not explicitly modelled in this chapter, but would implicitly contribute to the application of the income inclusion rule. Similarly, it is challenging to determine, based on the design of the subject to tax rule and the available data, what impact that rule would have on a jurisdiction’s tax base. Given these challenges, the impact of the subject to tax rule has not been modelled in this chapter.

182. In the stylised scenarios considered for the purpose of modelling in this chapter, certain ultimate parent jurisdictions would not necessarily introduce an income inclusion rule (e.g. jurisdictions that do not have a corporate tax system today). The low-taxed profits of MNEs with an ultimate parent in these jurisdictions are assumed to face the top-up tax in other jurisdictions, in proportion to the distribution of their economic activity across these other jurisdictions. This assumption is a proxy for the transaction-based approach envisaged under the undertaxed payments rule, with the idea that transactions subject to this rule are likely to originate in jurisdictions where the MNE group considered engages in economic activity. This assumption can also be seen as a possible proxy for situations where the jurisdiction of an intermediate parent would apply the income inclusion rule, as envisaged in the Pillar Two Blueprint report, assuming that the location of these intermediate parents (on which no data are available in most jurisdictions) is broadly aligned with the location of economic activity.

183. Another important Pillar Two design question is the degree of “blending” (i.e. the level of aggregation at which the effective tax rate would be computed and the minimum rate applied). While no decision has been taken by the Inclusive Framework yet, it is assumed in this chapter that Pillar Two would entail jurisdictional blending in line with the Pillar Two Blueprint report. This would imply that the ETR of an MNE would be computed by aggregating taxes paid and profits at the jurisdiction level. This ETR would then be compared to the minimum tax rate.

184. Other Pillar Two design and parameter choices will also influence the revenue effects of Pillar Two. A key parameter is the potential minimum tax rate – in this area, several possibilities are illustratively explored in this chapter. Other questions include the definition of the tax base (including questions related to adjustments for permanent and temporary book-tax differences), the definition of taxes covered in the computation of the ETR, the existence and design of a potential loss carry-forward mechanism, and the existence and scope of potential ‘carve-outs’ based on substantive activities and/or for certain sectors or in relation to MNE size. Consistent with the Pillar Two Blueprint report, MNEs with a global turnover below EUR 750 million (i.e. the Country-by-Country Reporting threshold) are assumed not to be in the scope of Pillar Two in the estimates in this chapter. The implications of a potential formulaic substance-based carve-out are illustratively modelled in this chapter, while no sectoral carve-outs are considered in the estimates due to data limitations. Finally, the effect of a potential loss carry-forward mechanism is not taken into account, due to lack of time series data on MNE profit across jurisdictions,3 while the inclusion of such a mechanism could reduce potential revenue gains from Pillar Two.

185. While no decision has been taken by the Inclusive Framework yet, the estimates in this chapter are based on the illustrative assumption that the US GILTI regime would “co-exist” with Pillar Two. Reflecting this, the estimates presented in this chapter generally exclude the potential revenue gains related to US MNEs on the basis that they would remain subject to GILTI and not subject to Pillar Two rules. This means that in the tables and figures presenting estimates of Pillar Two revenue gains in this chapter, gains related to US MNEs (including both direct gains from the minimum tax and indirect gains from reduced profit shifting or ETR increases) are generally excluded. This is indicated in the subtitles and reading notes of these tables or figures. Other tables containing intermediate data or results not directly representing Pillar Two gains (e.g. profit matrix at an aggregated level) generally include data relative to US MNEs, as indicated in the notes of these tables. Revenue gains related to US MNEs are discussed in Section 3.8, based on the ex ante estimates of GILTI revenue gains from the US Joint Committee on Taxation (JCT).

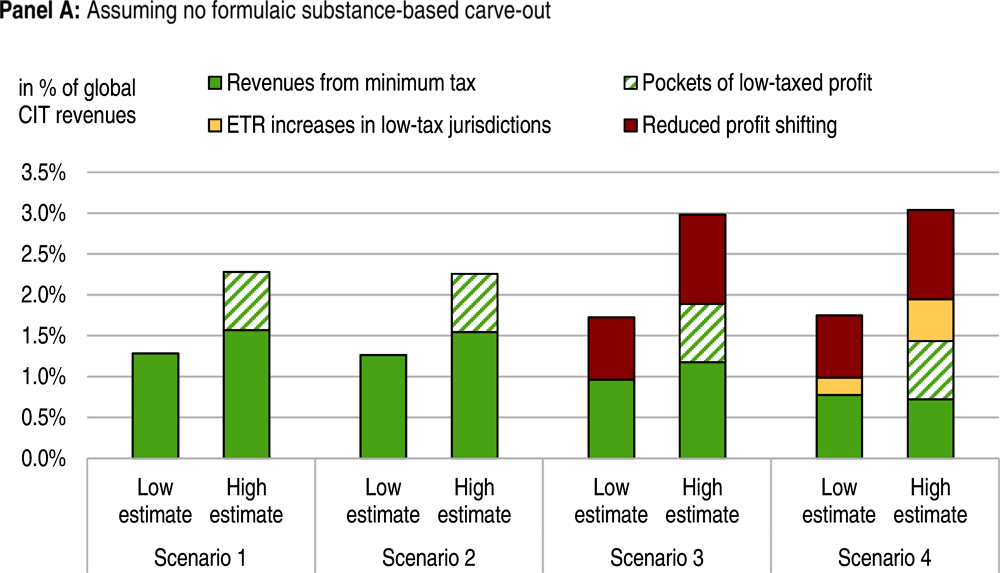

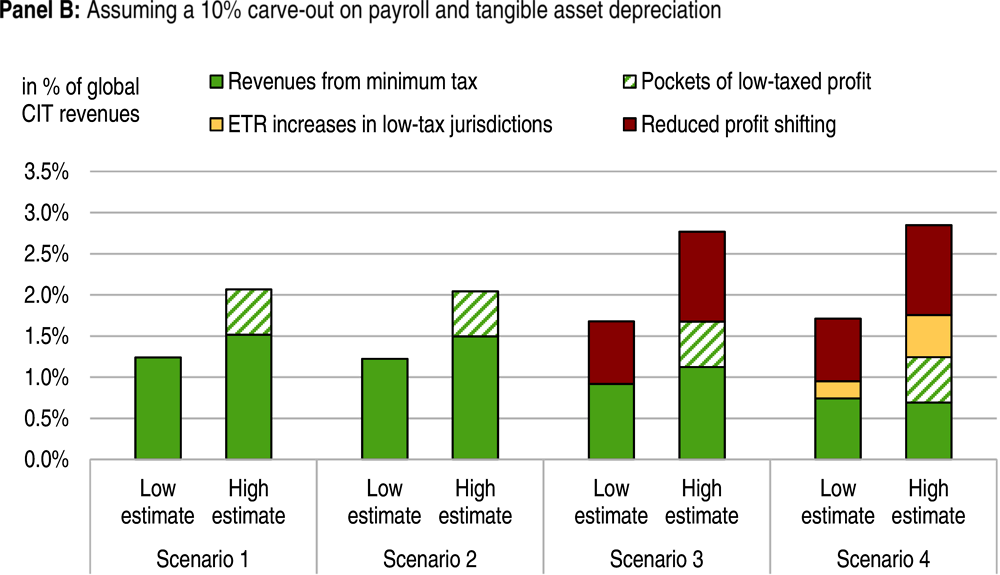

186. In considering potential behavioural reactions, a series of four stylised scenarios are modelled. These scenarios are summarised in Figure 3.2. These scenarios and the strategy to quantify their revenue implications are described in more detail in the following sections.

Scenario 1, which is the starting point for the estimates, is a “static” scenario. In this scenario, potential behavioural reactions of MNEs and governments to the introduction of Pillar Two are not taken into account, and Pillar Two is modelled in isolation, in the sense that its potential interaction with Pillar One is not taken into account.

Scenario 2 takes into account the interaction between Pillar One and Pillar Two. In this scenario, Pillar Two is assumed to apply on profit after the reallocation implied by Amount A of Pillar One, as modelled in Chapter 2, based on illustrative assumptions on Pillar One design and parameters. Alternative results ignoring this interaction but accounting for the reactions of MNEs and governments modelled in Scenarios 3 and 4 are presented in Annex 3.B.

Scenario 3 builds on Scenario 2 by adding the assumption that MNEs’ profit shifting intensity would be reduced by Pillar Two. This is because Pillar Two would reduce tax rate differentials between jurisdictions, which are a primary driver of profit shifting. This reduction in profit shifting is assessed based on stylised modelling assumptions that are discussed further in Section 3.6.

Scenario 4 builds on Scenario 3 by adding the assumption that certain jurisdictions would change certain tax rules/rates to increase the ETR on MNE profit that is currently taxed below the minimum rate in their jurisdiction. The rationale for this reaction is that it could allow the jurisdictions increasing their ETR to collect a greater share of global tax revenues, while having only a generally limited effect on the overall tax payments of MNE groups (as discussed below, this effect would depend on the design of Pillar Two and notably on the potential inclusion of a formulaic substance-based carve-out, as well as the potential co-existence of the US GILTI regime with Pillar Two).

187. The timing of MNEs’ and governments’ reactions considered in Scenarios 3 and 4 is uncertain, raising the question of the order in which they should be considered in the analysis. It is possible that MNEs’ profit shifting strategies would be adjusted faster and with more precision than governments’ corporate tax systems. Indeed, the latter may involve a multiplicity of interconnected statutory provisions, all having different effects on the tax position of different firms, and any adjustments could require lengthy law-making processes to take place. This justifies considering MNE reactions first (in Scenario 3) and government reactions second (in Scenario 4). However, given the scenarios and assumptions considered in this chapter, reversing this order (i.e. considering government reactions first and MNE reactions second) would have virtually no (or at most a quantitatively very small) effect on the final results. The reason is that the government reactions considered in this chapter do not significantly affect the profit shifting incentives of MNEs, since they do not change significantly the overall amount of taxes paid by MNEs (they only change where taxes are paid).4 As a result, MNEs’ reactions are not expected to depend substantially on whether they are considered before or after government reactions, at least under the stylised scenarios considered in this chapter.

188. The four stylised scenarios presented in this chapter do not aim to cover the full universe of possible reactions, but to illustrate the implications of some of the most widely expected reactions to Pillar Two. The reactions considered have been selected based on earlier discussions with jurisdiction representatives, academics, private sector representatives and other international organisations. Other potential reactions are not modelled in this chapter, including MNEs modifying their ‘real’ investment behaviour (as opposed to profit shifting intensity), MNEs modifying their profit shifting strategies in more complex ways than envisaged in this chapter, and governments from higher-tax jurisdictions (i.e. with average ETRs above the potential minimum rate under Pillar Two) reacting to the introduction of Pillar Two by changing their tax rules or rates:

On MNEs’ real investment behaviour, the OECD Secretariat estimates suggest that Pillar Two would only result in limited effects on forward-looking average ETRs at the global level and across most jurisdictions (Chapter 4). This would indicate that the scale of investment effects would generally be limited (in addition, these effects could be offset, partly or fully, by the indirect effects discussed in Chapter 4), providing justification for the assumption not to take these effects into account in this chapter. An important exception is that jurisdictions that currently have an ETR below the potential minimum rate could face significant ETR increases. This would affect MNE investment into these low-tax jurisdictions, while possibly benefitting higher-tax jurisdictions where some investment may be redirected. In turn, this would reduce corporate tax revenues in these low-tax jurisdictions, as well as revenues from other tax bases (e.g. personal income tax, value added tax). These effects are not modelled in this chapter.

On MNE profit shifting strategies, the modelling in this chapter is based on simplified assumptions described below relating to profit shifting intensity to tax rate differentials between jurisdictions. In practice, MNE profit shifting schemes are often complex and largely firm-specific. The exact way in which these schemes could be modified in reaction to Pillar Two may differ from these simplified assumptions, which would influence final outcomes, but this is impossible to model with precision, as further discussed below.

On the policy reaction of “higher-tax” jurisdictions (i.e. jurisdictions with an average ETR above the potential minimum rate), the expected reaction is ambiguous and therefore difficult to anticipate with certainty, as further discussed in Chapter 4. In theory, the introduction of a minimum rate could strengthen or weaken tax competition depending on the assumptions considered (Keen and Konrad, 2013[3]).5 An empirical study on the 2004 introduction of a minimum tax rate at the municipal level in Germany suggests that, on average, it led to municipalities with rates above the minimum significantly increasing their rates (von Schwerin and Buettner, 2016[4]), However, it is not clear to what extent these results can be generalised from a national to a global context.

189. The simplified approach followed in this chapter is to identify jurisdictions where the average (backward-looking) ETR on MNE profit is below the potential minimum tax rate. All MNE profit in these jurisdictions is assumed to be taxed at this average ETR (due to lack of available firm-level data on ETRs in most jurisdictions), and therefore – after application of a potential formulaic substance-based carve-out – to face a top-up tax up to the level of the minimum tax.

190. This is a simplification in the sense that it does not take into account that (i) some MNE profit may be subject to a higher ETR than the minimum rate in low-tax jurisdictions (pockets of high-taxed profits) and (ii) some MNE profit may be subject to a lower ETR than the minimum rate in higher-tax jurisdictions (pockets of low-taxed profits). Pockets of low-taxed profit are further discussed in Box 3.1 below and are taken into account in the uncertainty ranges around the results. Pockets of high-taxed profit seem likely to be less common than pockets of low-taxed profit and the effect of their omission is a priori ambiguous (because taking pockets of high-taxed profit into account would reduce the estimated amount of profit subject to Pillar Two in low-tax jurisdictions, but also reduce the average ETR on profit subject to Pillar Two in these jurisdictions). Due to data limitations, the approach also overlooks the fact that some foreign profit may already be taxed at the parent level via controlled foreign company (CFC) rules and withholding taxes. This would reduce Pillar Two gains.

191. This modelling approach requires data on the location of profit as well as data on ETRs. The source of data on profit is described in the next section, while data on ETRs are presented in the following one. The modelling of the implications of a potential formulaic substance-based carve-out is described afterwards.

3.4.1. Data source on profit location: The “profit matrix”

192. As in Chapter 2, the analysis in this chapter relies on the “profit matrix”, which combines data from different sources on the location of MNE profit (see stylised illustration in Figure 3.3 and detailed description in Chapter 5).

193. The profit matrix draws on three main sources of data, presented below in descending order of preference:

1) Anonymised and aggregated data from Country-by-Country Reports (CbCRs), across 25 jurisdictions of ultimate parent (see list in Annex 5.A of Chapter 5);6

2) ORBIS unconsolidated account data in 24 jurisdictions of affiliate with good ORBIS coverage (see list in Annex 5.A of Chapter 5);

3) Extrapolations based on macroeconomic data (e.g. FDI data) in other cells.

194. Wherever possible, the data in the profit matrix (and in the tangible assets and payroll matrices described below) focus on MNE sub-groups with positive profits (i.e. entities belonging to an MNE group that is reporting an overall profit in the jurisdiction considered), rather than all MNE sub-groups (i.e. profit-making and loss-making sub-groups). Indeed, only MNE sub-groups with positive profits potentially face additional taxes under Pillar Two, while loss-making sub-groups generally do not pay corporate income tax. Subtracting the losses of loss-making MNE sub-groups when computing total profit in a jurisdiction could therefore lead to an underestimation of the amount of profit that could be subject to Pillar Two.

195. Still, a limitation of the approach is that the effect of a loss carry-forward mechanism under Pillar Two is not taken into account in the estimates. Such a mechanism could reduce revenue gains from Pillar Two in situations where an MNE sub-group in a low-tax jurisdiction makes a (low-taxed) profit and can use its past losses in that jurisdiction to offset it partly or fully. Estimating with precision the effect of the loss carry-forward mechanism would require firm-level information on the profitability of MNE sub-groups over several successive years. This information is not available to the OECD Secretariat in most jurisdictions.7 In practice, the effect of the loss-carry forward mechanism on Pillar Two revenue gains will depend on how frequently MNE sub-groups in low-tax jurisdictions switch from being loss-making to being profitable. This may depend on the economic situation – for example, the COVID-19 crisis is likely to make losses more frequent – but also on profit shifting and loss shifting behaviour by MNEs. For example, even taking into account a carry-forward mechanism under Pillar Two, it may still be more beneficial for MNEs to incur losses in higher-tax than in low-tax jurisdictions, as these losses can be used to offset future profits at a higher rate in higher-tax jurisdictions.

196. The profit matrix – at a relatively high level of aggregation – is displayed in Table 3.1. The full methodology underlying the construction of the profit matrix is presented in detail in Chapter 5. Chapter 5 also contains detailed information on the data sources used in the profit matrix, including a discussion of the caveats around their use. In addition, Chapter 5 displays a more disaggregated version of the profit matrix (i.e. with more detailed jurisdiction groups than in Table 3.1), as well as information on the relative importance of the different data sources underlying the matrix. Finally, Chapter 5 contains the results of the extensive benchmarking that was undertaken to assess the quality of the data and its consistency across sources.

3.4.2. Data sources on effective tax rates (ETRs)

197. The relevant ETR to assess if an MNE has low-taxed profit in a jurisdiction and would be subject to Pillar Two will be computed at the level of each MNE sub-group in each jurisdiction (assuming that Pillar Two would involve jurisdictional blending). Estimating with precision the effect of Pillar Two would therefore require data on ETRs at that level. However, the data are not available to the OECD Secretariat in most jurisdictions, and the approach therefore relies on average ETRs computed from aggregated data.

198. The average ETR on MNE profit in a jurisdiction is measured as the median estimate obtained across the three following data sources:

Data from Tørsløv et al. (2018[5]). These data, themselves based on a combination of sources and assumptions, focus on the ETR on the profit of foreign-owned MNEs across a range of jurisdictions in 2015. The underlying data generally does not distinguish between profit-making and loss-making MNE sub-groups and can thus lead to higher measures of ETR than data that would focus only on profit-making sub-groups.8

Data from the US Bureau of Economic Analysis (BEA) on US MNEs. In an annual report on the global activity of US MNEs, the BEA provides information on foreign taxes paid by affiliates of US MNEs across a set of jurisdictions. In each of these jurisdictions, the average ETR of US MNEs is computed by dividing foreign taxes paid by “profit-type return”, which is a measure of profit included in the BEA data that aims to approximate profit before tax and excludes various sources of financial income. To reduce the impact of potential volatility in the data, the ETR used in this chapter is computed as the average ETR over several years (2013-16), i.e. the sum of taxes paid in a jurisdiction over the period divided by the sum of profit-type returns in this jurisdiction over the same period.9 As with the data from Tørsløv et al. (2018[5]), the BEA data aggregates data relative to profit-making and loss-making MNE sub-groups, which leads to higher ETRs than when focusing only on profit-making sub-groups.

Data from anonymised and aggregated CbCR reports. The anonymised and aggregated CbCRs from 25 jurisdictions of ultimate parent (see list in Annex 5.A of Chapter 5) have been used to compute average ETRs by jurisdiction of affiliate. The ETR in a given jurisdiction of affiliate is computed as the total taxes paid by foreign-owned MNEs (on an accrual basis) over total profit of foreign-owned MNEs, focusing only on profit-making sub-groups (contrary to the other two sources). Extreme outliers are eliminated (e.g. ETRs above 100%) and jurisdictions covered in the data of fewer than three ultimate parent jurisdictions are excluded. An important caveat is that due to potential inclusion of intracompany dividends in profit reported in CbCRs, ETRs may be underestimated, especially in jurisdictions with a large presence of parent companies (OECD, 2020[6]).

199. None of these three measures of ETRs is subject to the issue of profit double counting pointed out by Blouin and Robinson (2019[7]) (see also discussion in Clausing (2020[8])). In addition, using the median value across the three measures reduces the potential impact of limitations of individual data sources on the final revenue estimates (e.g. limitations related to the potential inclusion of dividends in CbCR data, which could lead to overestimating Pillar Two gains, or to the fact that data from Tørsløv et al. (2018[5]) and BEA data include loss-making sub-groups, which could lead to underestimating Pillar Two gains). A robustness analysis excluding CbCR data from the calculation and relying only on the average of the other two sources suggests that it could lead to lower estimates of Pillar Two gains, but without changing the broad order of magnitude of the results (see Annex 3.D).

200. All three data sources are available jointly for 42 jurisdictions representing 86% of world GDP (Table 3.2). At least one of the three data sources is available for another 99 jurisdictions, representing another 12% of world GDP. For the other 81 jurisdictions considered in the analysis, which are mainly lower income jurisdictions that together represent only 1% of world GDP, none of these three sources are available and the ETR is assumed to correspond to the statutory CIT rate, sourced from the OECD Corporate Tax Statistics (OECD, 2020[9]), complemented with other sources.10 This is a conservative assumption since ETRs are generally lower than statutory rates. However, the impact of this assumption on the global estimates is likely to be marginal as less than 1% of total MNE profit is found to be located in these jurisdictions.

3.4.3. Global low-taxed profit and global revenue gains (before carve-out)

201. Based on the profit matrix and the ETR data described above, the global amount of low-taxed profit (i.e. profit taxed below a potential minimum rate) is presented in Table 3.3 for an illustrative range of potential minimum rates. Estimated global gains from Pillar Two are then obtained by topping up the tax rate on the low-taxed profits up to the level of the minimum rate.11 A ±10% uncertainty range around the point estimates is applied to take into account data uncertainty. The results, which are presented in Table 3.3, correspond to the revenue gains in Scenario 1 (i.e. in a static scenario that does not take into account the interaction with Pillar One, nor behavioural reactions by MNEs and governments) with no formulaic substance-based carve-out. Consistent with the assumptions on GILTI discussed above, the table excludes the low-taxed profit of US MNEs and the corresponding revenue gains (revenue gains from GILTI are discussed in Section 3.8).

202. These estimates do not take into account potential gains related to pockets of low-taxed profit in higher-tax jurisdictions (i.e. jurisdictions with an average ETR above the minimum rate). These pockets, while difficult to assess with the available data, may be substantial, as discussed in Box 3.1. Not taking them into account could lead to significantly underestimating the revenue gains from Pillar Two. In light of this, the upper bound of the uncertainty ranges surrounding the estimates of the direct gains from Pillar Two in Scenario 1 is increased by 50% (last row in Table 3.3). Such an increase in revenue gains would correspond to a situation where pockets of low-taxed profit would represent close to 10% of total profit in higher-tax jurisdictions (Box 3.1). The lower bound of the uncertainty ranges is not changed and therefore assumes conservatively no revenue gains from these pockets. In scenarios with a formulaic substance-based carve-out (discussed below), the uncertainty around these pockets is reduced in proportion to the share of carved-out profit in higher-tax jurisdictions.12

203. The estimates in Table 3.3 are broadly consistent with recent estimates by the Oxford University Centre for Business Taxation (Devereux et al., 2020[10]). Assuming a 10% minimum tax rate, no formulaic substance-based carve-out, and including MNEs with an ultimate parent in the United States, they assess that global Pillar 2 revenue gains in a static scenario could reach USD 20 billion (1.1% of global CIT revenues) in an approach excluding pockets of low-taxed profit in higher-tax jurisdictions, or USD 32 billion (1.8% of global CIT revenues) in an approach including them.13 This is higher than the estimates with corresponding assumptions in Table 3.3 (i.e. estimated gains of 0.8%-1.0% of CIT revenues excluding pockets of low-taxed profit, and 0.8%-1.5% of CIT revenues including them) but the difference is likely explained in large part by the fact that the estimates in Table 3.3 exclude MNEs with an ultimate parent in the United States, while the estimates by Devereux et al. (2020[10]) include them.

The methodological approach in this chapter focuses on low-taxed profit in low-tax jurisdictions (i.e. jurisdictions with an average ETR below the minimum rate) and overlooks potential “pockets” of low-taxed profit in higher-tax jurisdictions. It is impossible with the available data to assess with precision the size of these pockets. Indeed, this would require detailed data on profit and taxes paid at the firm level. The limited sources available to the OECD Secretariat (i.e. ORBIS database in jurisdictions with good data coverage, and confidential information from national sources collected via jurisdiction delegates to the OECD Working Party No. 2 on Tax Policy Analysis and Tax Statistics) suggest that the shape of the distribution of MNE ETRs varies widely across the jurisdictions covered. In addition, while these sources suggest that these pockets can be substantial, they give inconsistent signals on the shape of the ETR distribution in certain jurisdictions, suggesting potential differences in the definition of ETR considered (e.g. due to different accounting methods) or data quality issues. In particular, the available data may not necessarily allow for the measurement of ETRs in a way that would be consistent with the approach used in the context of Pillar Two.

An estimate based on stylised and illustrative assumptions on the distribution of ETRs across firms suggest that low-taxed profit (i.e. profit taxed at an ETR below the minimum rate) could represent about 8% of total profit in higher-tax jurisdictions, assuming a 12.5% minimum tax rate. This estimate is based on a methodology developed by the European Commission and applied to the data underlying this chapter.1 Given the uncertainty around the actual distribution of ETRs, this estimate should be seen as an illustrative order of magnitude rather than a precise point estimate.

The total amount of profit in higher-tax jurisdictions (i.e. jurisdictions with an average ETR above the minimum rate) is about USD 3 400 billion, if one assumes illustratively a 12.5% minimum rate (for comparability with other results in this chapter, this excludes US MNEs). If, out of this total, one would assume – for the purpose of illustration – that 5-10% of profit is taxed below the minimum rate (consistent with the 8% estimate above), this would represent USD 170-340 billion of additional low-taxed profit globally, which would come on top of the USD 604 billion of profit in low-tax jurisdictions already considered in the analysis (see Table 3.3). This could imply an increase in estimated revenue gains (in a static scenario) by about 30-60%.2

As further discussed below, a formulaic substance-based carve-out could reduce the size of these pockets. Indeed, under the range of carve-out design and parameter options considered in this chapter, about 10-35% of profit in higher-tax jurisdictions could be carved out (Table 3.5), potentially reducing the size of these pockets by that amount.

← 1. The assumption is that ETRs in each jurisdiction follow a bilinear distribution between zero and the statutory rate, centred around the average ETR. This amounts to assuming that a fraction of profit is uniformly distributed between zero and the average ETR, and the rest is uniformly distributed between the average ETR and the statutory rate. The share of profit in each group is determined in a way that ensures that the average of ETRs across the distribution corresponds to the average ETR in the jurisdiction.

← 2. This assumes implicitly that the current average ETR in these pockets of low-taxed profit (which is not observed), is the same as the average ETR in low-tax jurisdictions. A different assumption would give different estimates.

3.4.4. Modelling the implications of a formulaic substance-based carve-out

General approach to model a formulaic substance-based carve-out

204. The Pillar Two Blueprint report envisages that the GloBE rules (IIR and UTPR) could include a formulaic substance-based carve-out based on a fixed percentage of payroll plus a fixed percentage of depreciation expenses on a broad range of tangible assets (OECD, 2020[1]). These two percentages could be identical or different. The illustrative results presented in this chapter assume identical percentages.

205. For example, if one assumes illustratively a 10% carve-out percentage (or "mark-up”) for both payroll and depreciation expenses, the GloBE rules would only apply to a given MNE sub-group in a given jurisdiction on the profits that exceed 10% of the sum of payroll plus depreciation expenses of that MNE sub-group in that jurisdiction. For example, if the profit of the sub-group is 100, its payroll 150 and its depreciation expenses 50, the profit on which Pillar Two applies would be 100-10%*(150+50)=80.

206. On this profit, Pillar Two would apply, as before, by topping-up the average ETR paid by the MNE sub-group in that jurisdiction up to the level of the agreed minimum tax rate. The Inclusive Framework will define at a later stage the exact rules to calculate this ETR in the presence of a carve-out, and in particular whether an MNE group that claims the benefit of the carve-out should be required to make a corresponding and proportional adjustment to the covered taxes. For example, if before the application of the carve-out a taxpayer has EUR 100 of profit and EUR 20 of covered taxes, the ETR in absence of carve-out is 20% (EUR 20 divided by EUR 100). If the carve-out reduces the taxpayer’s profit to EUR 80, then the ETR for the purposes of the GloBE rules could be either (i) EUR 20 of covered taxes divided by EUR 80 of profit (i.e. 25%) if the MNE is not required to make an adjustment to the covered taxes, or (ii) EUR 16 of covered taxes divided by EUR 80 of profit (i.e. 20%) if the MNE is required to make an adjustment to the covered taxes that would be corresponding and proportional to the effect of the carve-out on profit. The approach modelled in this chapter is the second, since the modelling relies on the same ETRs in the scenarios with and without the carve-out. This reflects that modelling the situation without adjustment would be difficult with the available data, and does not prejudge future decisions by the Inclusive Framework on this question. Since the first approach (i.e. without adjustment) would result in higher ETRs than the second approach, it would lead to lower revenue gains (for a given level of the minimum rate and the carve-out percentage).

207. Modelling with precision the impact of a carve-out would require firm-level information on tangible assets depreciation and payroll across all jurisdictions. Sufficiently detailed firm-level data at the unconsolidated level is available in the ORBIS database with good coverage for only 18 to 24 jurisdictions depending on the variable considered (see list in Annex 5.A of Chapter 5).14 In these jurisdictions, the share of carved-out profit is computed directly with ORBIS data, at the level of each MNE sub-group, as discussed below. In the other jurisdictions, the approach relies on more aggregate data, in combination with an analysis based on ORBIS data on the average relationship between firm-level and aggregate data, which is also described below.

208. The approach in this chapter is to estimate the share of carved-out profit in all jurisdictions, even those with average ETRs above the minimum rate. This offers the benefit of helping to gauge the effect of the carve-out on potential pockets of low-taxed profit in these jurisdictions. For practical reasons, the payroll carve-out and the depreciation carve-out are modelled separately, and their effects are summed to obtain the effect of a combined carve-out.15 This represents an approximation compared to the actual effect of a combined carve-out, because it could lead to some ‘double counting’ of carve-out effects in cases where the sum of the amounts carved out under each carve-out taken individually would exceed the total profit of the MNE sub-group considered.16 Computations based on ORBIS firm-level data suggest that this double counting is not quantitatively significant under the carve-out percentages considered in this chapter, as it leads to an overestimation of the effect of the carve-out by less than 4% on average across jurisdictions.

209. The coverage of depreciation expenses in ORBIS is less extensive than the coverage of tangible assets. In addition, depreciation is generally aggregated with amortisation of intangible assets. In aggregate data as well, the level of tangible assets is generally better covered than depreciation expenses. Against this background, the approach to approximate depreciation expenses is to use data on tangible assets combined with an assumption on the average depreciation rate. Evidence from the available data from the US BEA and the ORBIS database suggests that the average depreciation rate of tangible assets (i.e. property, plant and equipment) is about 5-10%,17 and this percentage is conservatively assumed to be 10% in the estimates of this chapter.

The aggregate data in the tangible assets and payroll matrices

210. Aggregate data on the location of MNE tangible assets and payroll across jurisdictions are based on a ‘tangible assets matrix’ and a ‘payroll matrix’ that combine various data sources and extrapolations, in the same spirit as the profit matrix. These data sources and methodology underlying these two matrices, as well as extensive benchmarking and checks to assess their quality are presented in Chapter 5. These matrices are presented at an aggregate level in Table 3.4.

211. An important caveat to the analysis of carve-outs is that the definition of tangible assets and payroll in the data underlying the matrices may not necessarily match the exact definitions of the variables considered for a formulaic substance-based carve-out. The tangible assets matrix focuses on property, plant and equipment, net of accumulated depreciation, while the payroll matrix focuses on expenditures for salaries and wages, including bonuses, social contributions and other employee benefits (see Chapter 5). While this is broadly consistent with the variables considered for a carve-out, which are described in the Pillar Two Blueprint report, there may be differences related, for example, to the treatment of land or subcontracted labour expenses, which, depending on the exact definition of the carve-out, could affect the accuracy of the estimates.

Average relationship between firm-level estimates of carved-out profit and aggregate data on profitability

212. The share of profit that would be carved out for a range of illustrative carve-out percentages is computed with precision, at the level of each MNE sub-group, with ORBIS unconsolidated firm-level data across the jurisdictions with good ORBIS coverage on both foreign and domestic MNE entities (see list in Annex 5.A of Chapter 5). ORBIS financial and ownership data used for this analysis have been cleaned extensively using OECD Secretariat expertise from past projects, as described in Annex 5.B of Chapter 5.

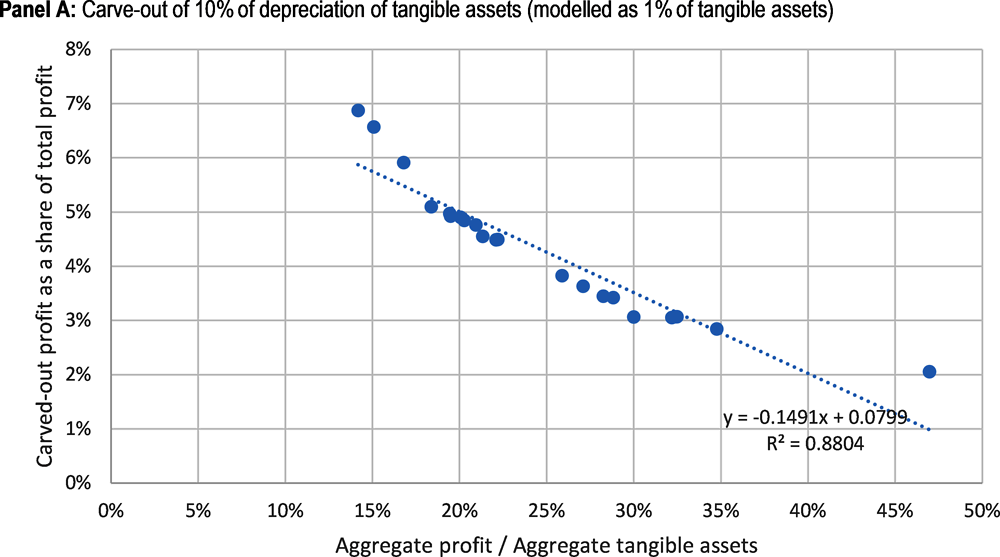

213. As discussed above, the effect of the payroll and depreciation components of the carve-out are computed separately, and then summed. The results on the share of carved-out profit for each component are presented in Figure 3.4 for an illustrative value of the carve-out percentage (10%) across the jurisdictions with good ORBIS coverage (each dot corresponding to one jurisdiction).

214. The results in Figure 3.4 suggest that the share of carved-out profit in a jurisdiction is relatively well correlated with the aggregate profitability ratio at the jurisdiction level (profit to tangible assets or profit to payroll, depending on the panel considered). For example, results in Panel A suggest that the share of carved-out profit with a 10% carve-out on tangible assets depreciation is well correlated with the ratio of aggregate profit to aggregate tangible assets at the jurisdiction level. This average relationship is used to extrapolate the share of carved-out profit in jurisdictions with poor ORBIS coverage, based on aggregate data from the profit, tangible assets and payroll matrices. The approach is very similar to the one employed on the assessment of Pillar One to assess the share of profit that is residual based on aggregate profit and turnover (see Chapter 2). For example, in the case of tangible assets, the relationship, which is estimated over the jurisdictions with good ORBIS coverage, is the following:

215. This relationship is estimated for each carve-out percentage considered in the analysis (5%, 10%, 15% and 20%). There is no theoretical reason why this relationship should be linear, but in practice a linear relationship seems to offer a reasonably good fit and the number of observations is insufficient to consider more complex specifications.18

216. The estimation for a 10% carve-out percentage is presented in Figure 3.4 for depreciation (Panel A) and payroll (Panel B). The correlation for the other percentages considered in the analysis is broadly similar to the correlation observed with a 10% percentage, but the coefficients and differ. In general, a higher carve-out percentage would lead to a higher since it would increase the share of carved-out profit, while the differences in depend on the shape of the distribution of profit, tangible assets, and payroll across jurisdictions. The results presented in the following sections are based on the specific coefficients and corresponding to the carve-out percentage considered (e.g. results for a 5% carve-out percentage are based on the and estimated for that percentage).

Share of carved-out profit across jurisdiction groups

217. Based on this methodology, the share of carved-out profit in each cell of the profit matrix is computed for a range of carve-out percentages. The results are presented (at a high level of aggregation) in Table 3.5. For example, assuming a 10% carve-out percentage, 15% of global profit would be carved out. This share is much lower in investment hubs (2%) than in other jurisdictions groups (16-19%) reflecting that a relatively high share of MNE profit is located in investments hubs compared to their share of tangible assets and payroll. Among investment hubs, the share of carved-out profit tends to be even lower among zero-tax jurisdictions (less than 1%) than non-zero-tax jurisdictions (2%).

218. As Pillar Two operates by allowing jurisdictions to ‘tax back’ low-taxed profit that is located in other jurisdictions, the share of carved-out profit in a jurisdiction influences Pillar Two gains in other jurisdictions. In particular, the fact that the share of carved-out profit in investment hubs is relatively small (while an important share of global low-taxed profit is located in investment hubs) implies that the effect of the formulaic substance-based carve-out considered in this chapter on Pillar Two revenue gains across jurisdictions is limited, as can be seen in the next section.

Effect of formulaic substance-based carve-out on Pillar Two gains under Scenario 1

219. The effect of Pillar Two in a static scenario (i.e. Scenario 1) with a formulaic substance-based carve-out is computed in the same way as before the carve-out, with the difference that the amount of profit on which Pillar Two is applied is non-carved-out profit, instead of total profit. The data on ETRs are the same as in the no-carve-out case, which, as discussed above, is consistent with the assumption that MNEs would be required to make an adjustment to the covered taxes that would be corresponding and proportional to the effect of the carve-out on profit.

220. The results, which are presented in Table 3.6, suggest that the effect of a formulaic substance-based carve-out on Pillar Two revenue gains is relatively small, especially when pockets of low-tax profit in higher-tax jurisdictions are not considered. For example, in the case of a 10% carve-out, the estimated Pillar Two gains would be reduced by about 3%. When taking into account the potential effect of the carve-out on pockets of low-taxed profit in the uncertainty ranges (last row in Table 3.6), the upper bound of the ranges is reduced significantly by the carve-outs. This reflects that profit in these pockets is likely to benefit more from a formulaic substance-based carve-out than profits in jurisdictions with low average ETRs, where less economic activity may generally be located.19

3.4.5. Methodology to estimate jurisdiction-level revenue gains

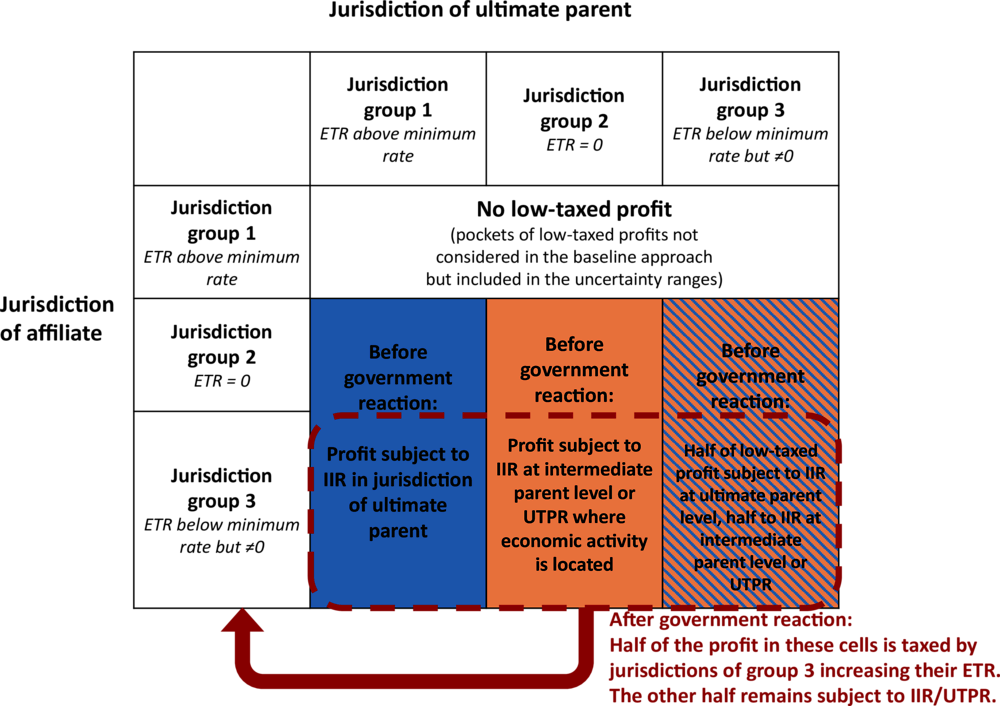

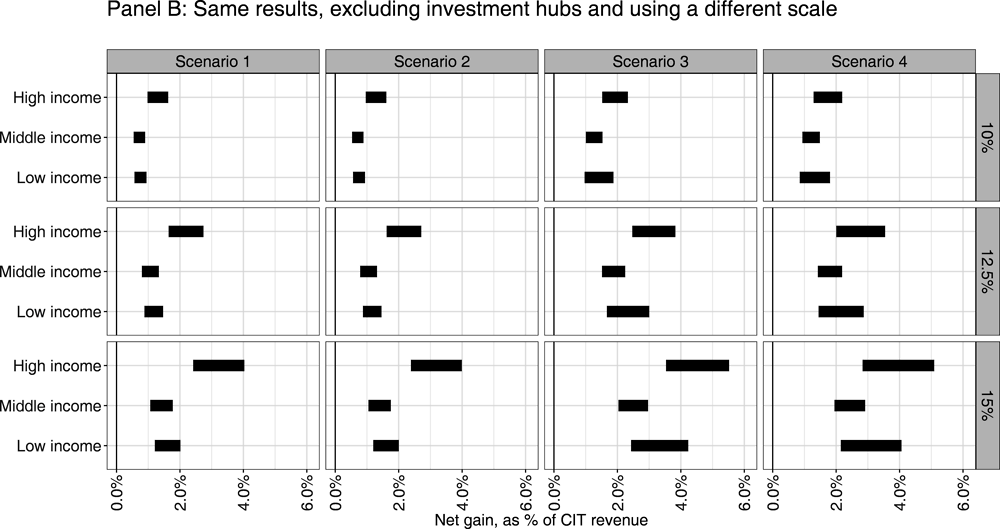

221. Revenue gains at the jurisdiction level and, in turn, for jurisdiction groups are derived using the following stylised modelling assumptions, also summarised in Figure 3.5, which do not pre-judge jurisdictions’ actual implementation decisions:

Group 1: Jurisdictions with an average ETR above the minimum rate. These jurisdictions are assumed to implement an income inclusion rule (IIR), in the sense that they would apply a top-up tax to ensure that the profit of MNE entities (blended at the jurisdictional level) with an ultimate parent in their jurisdiction is taxed at least at the minimum rate.20 They are also assumed to implement an undertaxed payments rule (UTPR). Consistent with the Pillar Two Blueprint report, the IIR is assumed to apply in priority to the UTPR.21

Group 2: Jurisdictions with a zero corporate tax rate. For the purposes of modelling, these jurisdictions are assumed not to introduce an IIR nor a UTPR, as it would also require introducing a corporate income tax (CIT) system, which many of these jurisdictions do not have. As a result, the low-taxed profit of MNE entities with an ultimate parent in these jurisdictions would not be taxed by these jurisdictions (since they would not introduce an IIR). If an intermediate-level parent (i.e. a parent entity that is not the ultimate parent) in the MNE group is located in a jurisdiction introducing an IIR, this low-taxed profit would be taxed by the jurisdiction of this intermediate parent (if there are several intermediate parents in this case, the highest one in the ownership chain would have priority according to the top-down principle described in the Pillar Two Blueprint report). If the low-taxed profit is not in scope of an applicable IIR (e.g. if there is no intermediate-level parent, or if intermediate parent jurisdictions are not introducing an IIR, or if the ultimate parent jurisdiction is low tax), the low-taxed profit could be taxed under the UTPR of a jurisdiction introducing a UTPR and from which intra-group payments originate.

In practice, it is difficult with the available data to model these rules with precision, as little information is available on the location of intermediate parents and transaction origins. Reflecting this, it is assumed for the purposes of modelling in this chapter that the profits of MNEs with an ultimate parent in Group 2 would be subject to a top-up tax imposed by other jurisdictions, in proportion to the amount of economic activity located in these jurisdictions (as a proxy for the location of intermediate parents in the case of IIR, and of the transactions-based nature of the UTPR).

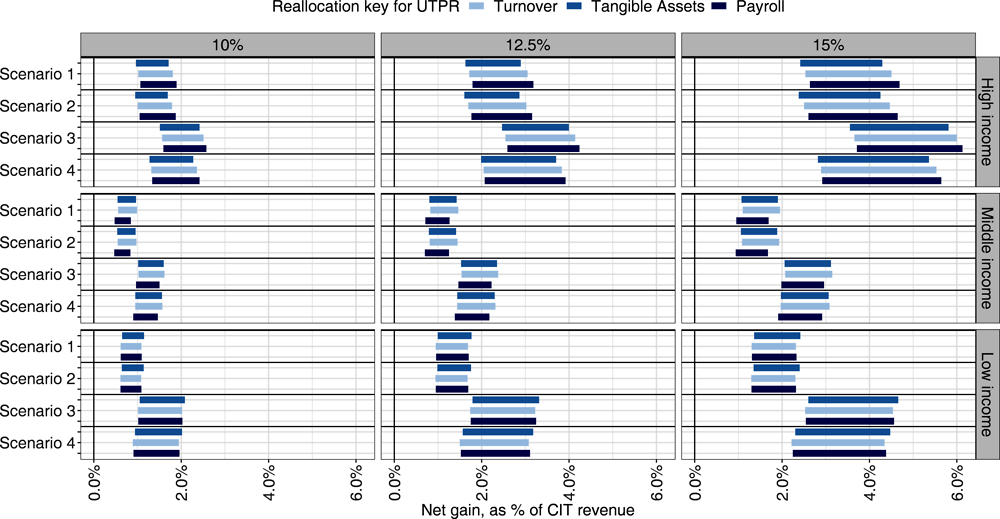

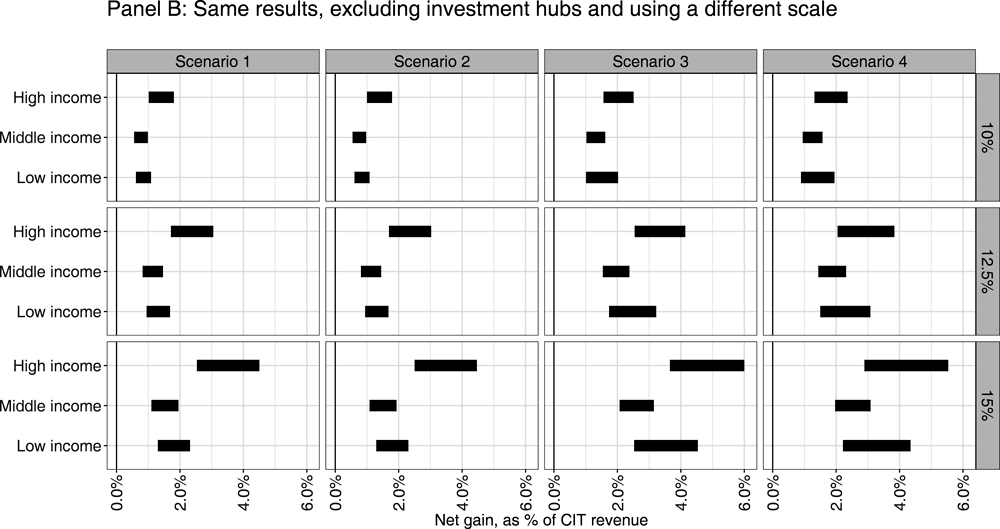

Economic activity is proxied by MNE turnover, sourced from the “turnover matrix” described in Chapter 5.22,23 Results are broadly robust to using tangible assets or payroll instead of turnover as a proxy (see Annex 3.C). When economic activity is located in a jurisdiction that does not implement an IIR nor a UTPR (e.g. a jurisdiction in Group 2), the corresponding low-taxed profit is assumed not to be subject to the top-up tax. However, this represents a relatively small fraction of total low-taxed profit under the assumptions considered in this chapter.

Group 3: Jurisdictions with an average ETR below the minimum rate, but greater than zero. Among jurisdictions in Group 3, for the purposes of this modelling scenario, half are assumed to implement an IIR and a UTPR (as jurisdictions in Group 1), and the other half are assumed not to implement them (as jurisdictions in Group 2). One reason why it is likely that not all jurisdictions in this group would implement an IIR and a UTPR is that some of these jurisdictions may decide that imposing a minimum tax rate on foreign profits could seem inconsistent with maintaining an average ETR below this minimum rate on local profit. As a result, this choice may be linked to choices relative to other tax policy parameters, and more specifically whether the ETR on local profit is increased, which not all jurisdictions in this group may be willing to do (see assumptions underlying Scenario 4 in section 3.7.1 below, with which these assumptions aim to be consistent). In practice, identifying the jurisdictions in this group that would implement an IIR and a UTPR is not straightforward. Instead of arbitrarily selecting half of the jurisdictions in the group, a simplifying assumption is made that all jurisdictions in this group apply an IIR and a UTPR on half of the low-taxed profit on which they could apply them. This is by no means realistic in itself, but it aims to be a representative and neutral proxy for a situation where half of the jurisdictions in this group would implement and the other half would not.

3.5.1. Rationale for taking the interaction between both pillars into account

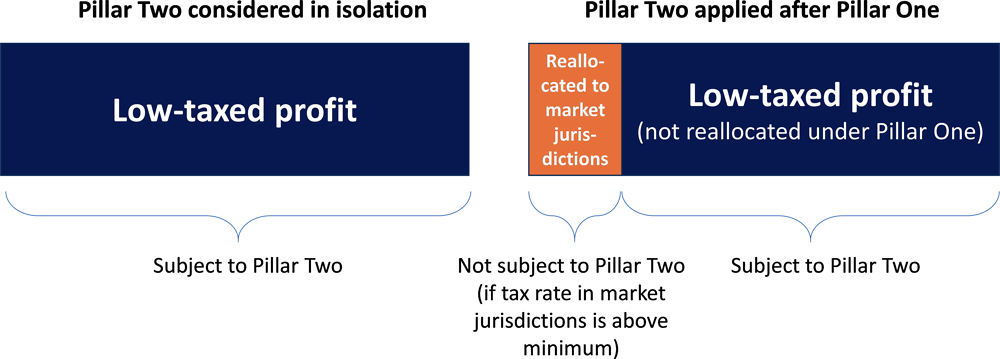

222. Scenario 1 considers Pillar Two in isolation, without taking into account its potential interaction with Pillar One. Scenario 2 aims to take this interaction into account, by assuming illustratively that both pillars would be introduced together and that Pillar Two would apply after the reallocation of profit induced by Pillar One.

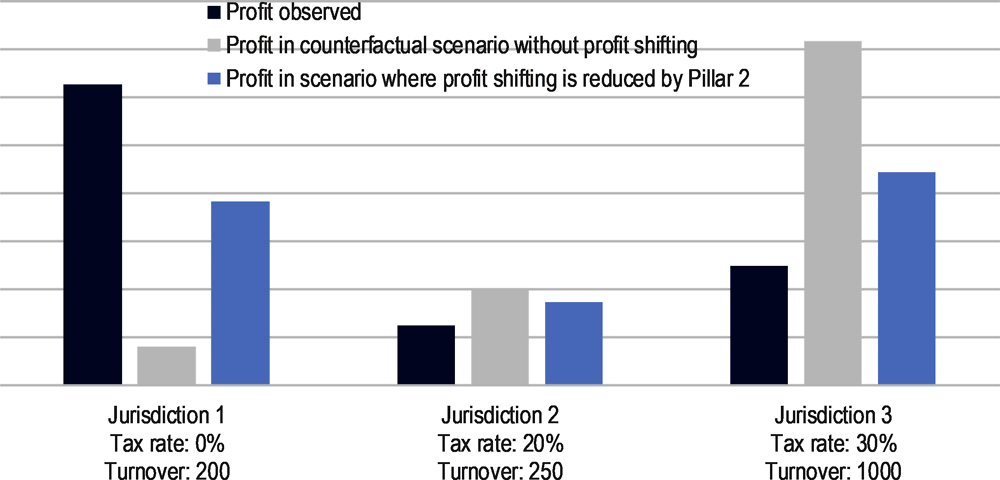

223. For example, in an extreme case where an MNE group would have all its profit in a jurisdiction where it is taxed at a rate below the Pillar Two minimum rate, all its profit (after potential application of a formulaic substance-based carve-out) would be subject to Pillar Two if Pillar Two was introduced in isolation (Figure 3.6). However, if the reallocation of profit induced by Pillar One was applied first, a portion of these profits (or, more precisely, the taxing rights corresponding to these profits) would be reallocated to market jurisdictions (assuming that the MNE group is in scope of Pillar One and above the residual profit threshold). If the tax rate in these market jurisdictions is above the minimum rate under Pillar Two, these reallocated profits would not be subject to Pillar Two, reducing the overall revenue gains from Pillar Two.

224. In this example, computing the revenue gains from Pillar One and Pillar Two independently of each other would overstate the overall gains compared to computing the joint effect of both pillars in a way that takes into account the interaction between them. It is possible to consider an opposite example, where the reallocation taking place under Pillar One would increase the amount of low-taxed profits and therefore increase the revenue gains from Pillar Two. This would be the case for example if an MNE group had most of its profit located in higher-tax jurisdictions and most of its sales in low-tax jurisdictions. However, in practice, MNE profit tends to be more concentrated in low-tax jurisdictions than MNE final sales, which is why the reallocation taking place under Pillar One is expected to reduce the global amount of low-taxed profit. Therefore, taking into account the interaction with Pillar One is expected to reduce the estimated revenue gains from Pillar Two.

3.5.2. Methodology on the interaction between both pillars

225. To take the interaction between both pillars into account, Scenario 2 applies Pillar Two in exactly the same way and with the same assumptions as in Scenario 1, but after adjusting the location of profit for the reallocation induced by Pillar One. In practice, this is done by computing an adjusted profit matrix post Pillar One reallocation. Each matrix cell (corresponding to the profit in jurisdiction i of MNE groups with an ultimate parent in jurisdiction j) is adjusted in the following way:

226. The amount of profit received and relieved under Pillar One in each matrix cell is based on the Pillar One estimates described in Chapter 2.24 In theory, this adjustment can be done for any combination of Pillar One parameter and design options. For simplicity, only one illustrative set of Pillar One design and parameter assumptions among those explored in Chapter 2 is considered in this chapter (i.e. residual profit threshold percentage of 10%, reallocation percentage of 20% and global revenue threshold of EUR 750 million).

3.5.3. Results on Scenario 2

227. The resulting profit matrix, adjusted for Pillar One reallocation is presented in Table 3.7. Compared to the original profit matrix (Table 3.1), the total in each column is the same (by construction), but there has been some reallocation across rows, away from investment hubs and into other jurisdiction groups. The scale of this reallocation is limited, which implies that the global amount of low-taxed profit and the estimated revenue gains from Pillar Two are reduced only slightly by taking into account the interaction with Pillar One (Table 3.8). To the extent that the interaction with Pillar One has only a modest effect on Pillar Two results, considering different assumptions regarding Pillar One would likely affect the Pillar Two estimates only at the margin.

228. Scenario 3 is based on the assumption that MNE profit shifting intensity would be reduced by the introduction of Pillar Two. This is because Pillar Two would reduce tax rate differentials between jurisdictions, which are a primary driver of profit shifting. The effect of this reduced profit shifting intensity on tax revenues is estimated based on the assumption that profit shifting generally depends on tax rate differentials, and by comparing tax rate differentials before and after Pillar Two implementation. An adjusted profit matrix incorporating the reduced profit shifting intensity is derived from this comparison, as further described below.

229. Based on this adjusted profit matrix, revenue gains from Pillar Two in Scenario 3 are computed as the sum of two components: (i) a revenue effect of the reduction in profit shifting intensity, reflecting that profits that are no longer shifted are now taxed in the jurisdiction where they were generated, rather than in the jurisdiction where they used to be shifted, and (ii) revenues collected via the IIR and UTPR on remaining low-taxed profits, including profits that are still shifted to low-tax jurisdictions. This second component is expected to be smaller than the amount of revenues collected in Scenario 2, since the reduction in profit shifting should reduce the global amount of low-taxed profit. However, the sum of the two components is expected to be greater than the overall revenue gains in Scenario 2, since some profit that is no longer shifted to low-tax jurisdictions may ultimately be taxed at a higher rate than the minimum rate in the jurisdictions where it has been generated.

3.6.1. Assessing current profit shifting patterns

230. To evaluate the effect of Pillar Two introduction on MNE profit shifting patterns, the first step is to assess current profit shifting patterns. For consistency with the methodology applied to quantify the revenue effects of Pillar Two in this chapter, profit shifting needs to be assessed on a “trilateral” basis, i.e. for each combination of (i) jurisdiction where profit was located before shifting (“profit origin”), (ii) jurisdiction where profit has been shifted (“profit destination”), and (iii) jurisdiction of ultimate parent of the profit shifting entity (“ultimate parent”).25 This third jurisdiction may or may not be the same as the “profit origin” jurisdiction. This level of granularity is necessary to create an adjusted profit matrix taking into account the effect of Pillar Two on profit shifting intensity, so that Pillar Two can then be applied to this adjusted profit matrix (with assumptions consistent with those used in Scenarios 1 and 2). This requires going beyond most studies on profit shifting, which often focus on measuring an average profit shifting semi-elasticity across a range of destination jurisdictions – for recent reviews of these studies, see for example Bradbury et al. (2018[11]) and Beer et al. (2019[12]).

Profit shifting: Overview of the approach

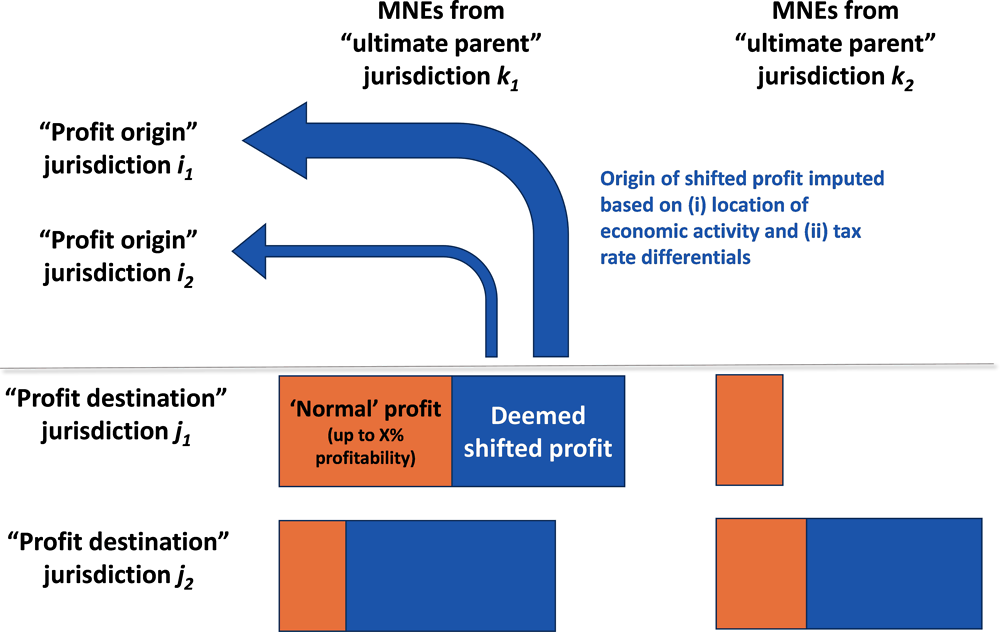

231. To obtain this “trilateral” profit shifting intensity, the approach in this chapter is based on the following steps, which are further detailed in the following sections and presented in a stylised way in Figure 3.7:

(i) Identifying “profit destination” jurisdictions, i.e. jurisdictions where profit may have been shifted to, based on foreign direct investment (FDI) and ETR data;

(ii) Computing the amount of deemed shifted profit in these jurisdictions, assuming that profit up to a certain “normal” profitability rate may not have been shifted, but may instead reflect real economic activity in these jurisdictions. The share of shifted profit is measured on a “bilateral” basis, i.e. for each pair of “profit destination”-“ultimate parent” jurisdictions;

(iii) Identifying where the shifted profit originates from. For each “profit destination”-“ultimate parent” pair of jurisdictions, shifted profits need to be reattributed to “profit origin” jurisdictions. This is done based on tax rate differentials vis-à-vis the “profit destination” jurisdiction (assuming that a higher tax rate differential leads to more profit shifting, all else equal) and on the geographic distribution of economic activity of MNEs from the “ultimate parent” jurisdiction considered (with the idea that profit is more likely to originate from jurisdictions where these MNEs have more economic activity).

232. This approach to measuring profit shifting is new, although it shares some common features with Tørsløv et al. (2018[5]), Cobham et al. (2019[13]) and Clausing (2020[8]). The approach is enabled by the level of detail offered by the profit matrix and the underlying data sources, including anonymised and aggregated CbCR data, which give a detailed account of the amount of profit located across low-tax jurisdictions for each ultimate parent jurisdiction. To benchmark the results against the vast existing literature on profit shifting, an average aggregate profit shifting semi-elasticity is computed based on the results and compared with existing estimates of this semi-elasticity.

Profit shifting: Identifying “profit destination” jurisdictions

233. Potential “profit destination” jurisdictions are assumed to be those meeting at the same time both of the following two criteria:

Having an inward FDI-to-GDP ratio above 100%, as computed based on hard or extrapolated FDI data (see Annex 5.C of Chapter 5 on the FDI extrapolation methodology);26

Having an average ETR on MNE profit below 17.5%, based on the median of the three data sources considered in Section 3.4.2 above. This rate of 17.5% is not meant to represent an ETR ceiling above which profit shifting would not occur. Indeed, there may be profit shifting taking place between jurisdictions with higher rates than 17.5%. Instead, this rate is the highest rate in the range of potential minimum rates illustratively considered in this chapter. Since the incentive to shift profit into jurisdictions with an average ETR above the minimum rate would not be directly affected by Pillar Two as modelled in this chapter,27 the focus in this chapter is exclusively on profit shifting into jurisdictions with an average ETR below the minimum rate. For example, when the minimum rate is assumed to be 12.5%, only profit shifting to jurisdictions with an average ETR below 12.5% is assumed to be modified by Pillar Two.28

234. Based on these criteria, 39 jurisdictions are identified as potential “profit destinations”. However, not all of them host deemed shifted profit, as this also depends on the profitability rate of MNEs in the jurisdiction (see next section). Overall, the list of jurisdictions with substantial amounts of deemed shifted profit overlaps widely with other lists in the literature, such as Tørsløv et al. (2018[5]), which often relate to the early list developed by Hines and Rice (1994[14]).

Profit shifting: Separating deemed shifted profit from “normal” profit

235. In these potential “profit destination” jurisdictions, only a share of reported profits are deemed shifted. This is because MNEs can have local economic activity in these jurisdictions, which generate local (non-shifted) profits. To account for this, only profit above a certain “normal” profitability rate is deemed shifted. This normal profitability rate is set at 7.9% (on the ratio of pre-tax profit to turnover) in the baseline estimates, which corresponds to the average global profitability of MNEs observed in the ORBIS sample.29 Robustness checks have been performed with other rates, including 5% and 10%. They give results that are qualitatively similar to the baseline (Table 3.9).

236. Based on data in the profit matrix and data on ETRs from Section 3.4.2, estimates of shifted profit are derived for each “profit destination”-“ultimate parent” jurisdiction pair. At the aggregate level, the amount of deemed shifted profit is estimated to be about USD 650-850 billion, or about 10-14% of global MNE profit (Table 3.9).30 This is broadly consistent with the estimates of USD 741 billion and USD 667 billion obtained by Tørsløv et al. (2019[15]; 2019[16]), which are updates, for 2017 and 2016 respectively, of their earlier USD 616 billion figure for 2015 (Tørsløv, Wier and Zucman, 2018[5]). The share of deemed shifted profit in total profit tends to be higher among zero tax jurisdictions (88-94%) than in other “profit destination” jurisdictions (55-74%), which is in line with the intuition that there is less economic substance (and therefore a greater share of shifted profits) in zero-tax jurisdictions than in other “profit destination” jurisdictions.

Profit shifting: Identifying “profit origin”

237. Once shifted profit has been identified, further assumptions are required to identify where profit originates from, i.e. the jurisdiction where it was generated before being shifted. This is done at the level of each “profit destination”-“ultimate parent” pair, using the following formula:

238. In this formula, is the amount of profit shifted from jurisdiction i to jurisdiction j by MNEs with an ultimate parent in jurisdiction k. The intuition is that this profit is proportional to the economic activity in i of MNEs with an ultimate parent in k. For example, an MNE with very little economic activity in a jurisdiction is unlikely to have profit shifted away from this jurisdiction, whatever the tax rate differential with this jurisdiction. This economic activity is proxied by the turnover in i of MNEs with an ultimate parent in jurisdiction k (denoted ) sourced from the turnover matrix.31 Results are broadly robust to using tangible assets or payroll instead of turnover (Annex 3.C).

239. The amount of shifted profit is also assumed to be a function of the tax rate differential between jurisdictions i and j: . The tax rates considered are the statutory CIT rates in “profit origin” jurisdictions, in line with most of the profit shifting literature that focuses on statutory rates, and the ETRs in “profit destination” jurisdictions (with the same data sources as in the rest of this chapter), as ETRs sometimes differ considerably from statutory rates in these jurisdictions. Several shapes of the relationship between profit shifting intensity and tax rate differentials (i.e. of the function ) are explored in this chapter, as further discussed below.

240. Finally, the amount of profit shifted depends on an array of scaling factors, which are specific to each “profit destination”-“ultimate parent” pair of jurisdictions. These scaling factors capture that certain “profit destination” jurisdictions are more attractive to MNEs of a given “ultimate parent” jurisdiction – owing to, for example, geographic proximity or the legal environment – and that tax rate differentials alone do not predict where shifted profits are located. Instead of being taken from the literature, or set at arbitrary levels, these factors are set at the unique level that is consistent with the amount of profit that is deemed shifted in each “profit destination”-“ultimate parent” pair of jurisdictions, as computed in the previous section. Formally, these factors are computed based on the following formula:

241. This way of defining the factors ensures the consistency of the approach, in the sense that the total profit attributed across “profit origin” jurisdictions – for a given “profit destination”-“ultimate parent” pair of jurisdictions – corresponds exactly to the total profit deemed shifted in that pair of jurisdictions. Ultimately, the average of these factors can be compared to estimates of the profit sensitivity to tax rate differentials from the literature, as further discussed below.

242. A central question is the shape of the function, i.e. the relationship between profit shifting and tax rate differentials. This is important for the modelling of profit shifting in this section, but also because this assumption defines the way in which reduced tax rate differentials under Pillar Two will affect profit shifting intensity. The academic literature offers limited insights in this area. Most studies assume a linear relationship between profit shifting and statutory tax rate differentials and find evidence that this relationship is significant, but do not test empirically for other potential shapes (see for example Bradbury et al. (2018[11]) and Beer et al. (2019[12]) for recent reviews). Such a linear relationship is consistent with the theoretical framework of Huizinga and Laeven (2008[17]), which is based on the underlying assumption that the cost of profit shifting is quadratic. With this assumption, an “interior” solution to the MNE’s profit maximisation problem implies that profits are shifted in proportion to tax rate differentials.

243. However, some recent studies suggest that the position is more complex in reality. In particular, Bilicka (2019[18]) and Johannesen et al. (2019[19]) show that many MNE entities report zero profit in higher-tax jurisdictions. This would suggest that these MNEs are able to shift all their profit from these jurisdictions, in which case the solution to the MNE’s profit maximisation problem is not always “interior” and the relationship between profit shifting and tax rate differentials is no longer linear. Also, Dowd et al. (2017[20]) find a non-linear relationship according to which US MNEs shift more profits to jurisdictions with very low tax rates than a linear elasticity would imply.32 However, the question considered in that paper is somewhat different from the one considered in this chapter. Indeed, Dowd et al. (2017[20]) focus on the choice of potential “profit destination” jurisdictions for a given “ultimate parent” jurisdiction (in which case, the fact that MNEs shift as much profit as possible to jurisdictions with the lowest ETRs seems intuitive), while this chapter aims to identify “profit origin” jurisdictions for given “ultimate parent” and “profit destination” jurisdictions.

244. Another insight from the literature is that, all else equal, profit shifting tends to be more intense in lower income jurisdictions than in higher income ones. For example, Fuest et al. (2011[21]), based on German micro-data, find that profit shifting via intra-company loans is approximately twice as intense among the developing countries in their sample compared to other jurisdictions, which they suggest may be due to the limited capacity of these jurisdictions to enforce anti-tax avoidance policies. Johannesen et al. (2019[19]) find that a 10 percentage point decrease in foreign affiliates’ tax rates increases the likelihood that an MNE reports zero profits by 3 percentage points in low/middle income countries, but only by 1.7 percentage points in high income countries, based on firm-level data from ORBIS. Finally, Cobham and Janský (2018[22]) relying on macro data, find that “the intensity of losses is substantially greater in low‐income and lower middle‐income jurisdictions; and in sub‐Saharan Africa, Latin America and the Caribbean and in South Asia compared with other regions.”

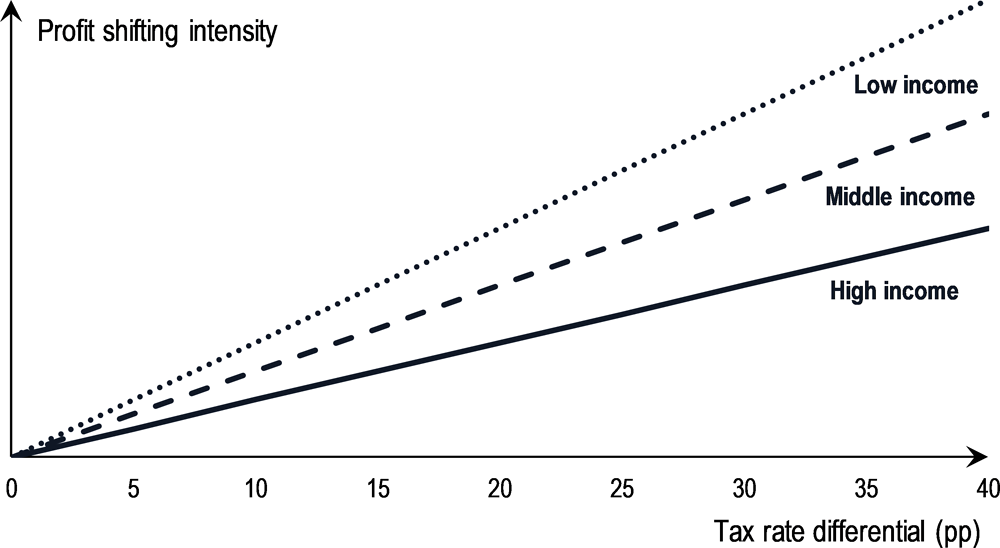

245. Against this background, the baseline assumption in this chapter is that profit shifting is generally proportional to tax rate differentials, but more intense in lower income jurisdictions than in higher income ones. Formally, the function is assumed to be defined as follows: if is positive, and zero otherwise. The coefficient is equal to 1 in high income jurisdictions, 1.5 in middle income ones and 2 in low income jurisdictions (based on the World Bank classification of jurisdictions by income groups). This shape of the relationship between profit shifting and tax rate differentials is presented in Figure 3.8. As discussed above, the absolute amounts of shifted profit attributed to each “profit origin” jurisdiction will depend on the assumptions presented in this figure, but also on the factors that capture the amount of deemed shifted profit in each “profit destination” jurisdiction (and for each “ultimate parent” jurisdiction).

Profit shifting: Alternative shapes of the relationship between profit shifting and tax rate differentials

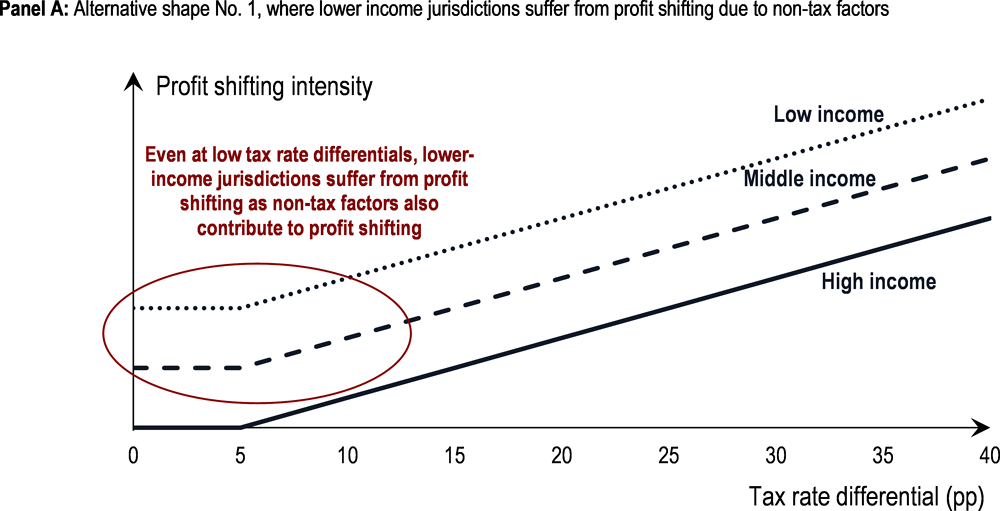

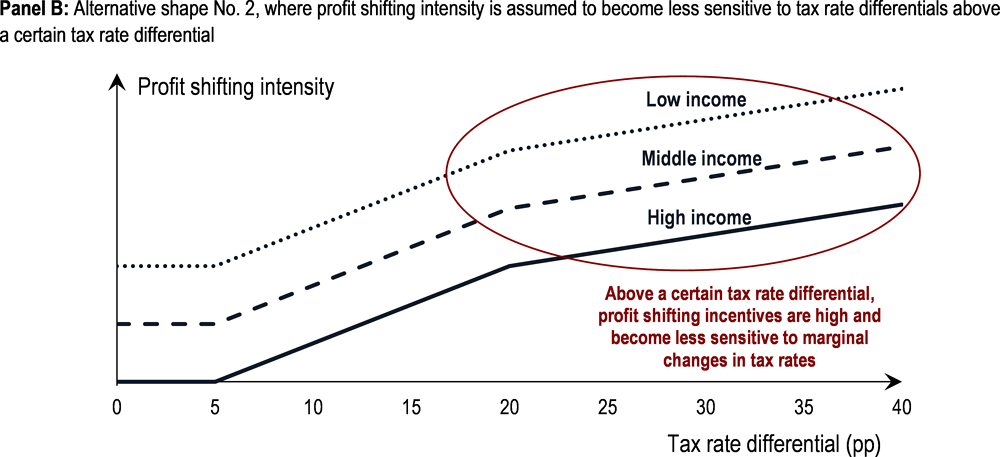

246. To account for potential non-linearities in the shape of the relationship between profit shifting and tax rate differentials, alternative shapes are considered as robustness checks. These shapes are used for the purpose of creating uncertainty ranges around the estimates.