2. Tax policy and administration responses to COVID-19

COVID-19 is an infectious disease which first emerged in late 2019-early 2020. Although COVID-19 initially affected Asia-Pacific economies, it has rapidly spread to all corners of the world. The World Health Organization (WHO) declared COVID-19 a pandemic on 11 March 2020. The pandemic has exacted a heavy toll on global public health, infecting more than 8 million people and causing more than 425 000 deaths worldwide by 16 June 2020. The trajectory of the pandemic remains subject to a great deal of uncertainty. 1

Asia has been hard hit by COVID-19, with all sub-regions and countries of the continent affected, as well as several Pacific countries. The Asia-Pacific region is already responding to the COVID-19 outbreak in various ways, with many governments establishing inter-agency task forces and other co-ordinating mechanisms to ensure a harmonised public health response.

At the same time, the lockdowns, travel bans, community quarantines, and other restrictions due to COVID-19 have derailed the world economy, with the OECD projecting global output to decline by between -6% and -7.6% in 2020 (OECD, 2020[1]). The economies of the Asia-Pacific region will also suffer a sharp downturn. The evolution of the outbreak, and hence Asia-Pacific’s outlook, remain highly uncertain but the Asian Development Bank’s (ADB) baseline forecast is that regional growth will slow steeply from 5.2% in 2019 to 2.2% in 2020, before recovering to 6.2% in 2021. Excluding the newly industrialised economies, growth is seen to slow from 5.7% in 2019 to 2.4% in 2020, and then to pick up to 6.7% in 2021, according to (ADB, 2020[2]).

Growth will weaken in all of Asia-Pacific’s sub-regions in 2020. Lower global demand will weigh on the 2020 outlook, particularly in the more open sub-regions and tourism-dependent economies such as those in the Pacific. (ADB, 2020[2]) forecasts that growth in East Asia will dip from 5.4% in 2019 to 2.0% in 2020, before accelerating to 6.5% in 2021. Southeast Asia is forecast to slow to 2.8% in 2020, before recovering to 4.4% in 2021. Growth in Central Asia will also slow to 2.9% this year due in part to lower oil prices, and the Pacific will contract by 0.3% due to declining tourism, before rebounding in 2021. South Asia’s growth rate is forecast to slow from 5.0% in the 2019 fiscal year to 4.7% in 2020, before accelerating to 6.2% in 2021, largely tracking the recovery in India.

Across Asia and the Pacific, governments have introduced fiscal stimulus packages and eased monetary policy to support economic activity. In addition, to support economic growth and help the most vulnerable population groups, the region’s governments are ramping up spending. In the immediate future, tax revenues will suffer as corporate revenues and household incomes fall due to the economic downturn. Given the magnitude of the economic shock, the drop in tax revenues is likely to be substantial. As the pandemic eventually recedes, higher government spending to boost health care, economy and society in the aftermath of COVID-19 will not be sustainable without adequate fiscal revenues. The need to balance economic stimulus with mobilising fiscal revenues brings into sharp relief the importance of tax administration and tax policy in Asia and the Pacific.2

This chapter, and the virtual meeting from which it is drawn, provide an overview of government responses to the challenges posed by the COVID-19 crisis. Section 2.2 below considers the impact of the crisis on tax revenues, including the channels of impact and the changes seen in the global financial crisis. Sections 2.3 and 2.4 consider the responses of tax administrations and policy makers to the challenges posed by different phases of the COVID-19 crisis, respectively, while Section 2.5 discusses policy and administrative considerations for low-income governments facing this shock.

With the slowdown of growth estimated by the ADB in the Asia-Pacific region, public revenues will most likely decline in 2020 as a result of COVID-19. However, the pandemic will affect public revenues in different economies differently and the timing of the impact may also vary. In addition to the nature and extent of the COVID-19 impact, and of confinement measures to address it, the structure of a country’s economy, exposure to international flows including trade and tourism, sources of government revenues, and the measures it takes to cushion firms and households from the economic impact of the pandemic, will all be significant.

Revenue data for the first months of calendar 2020 give some indication of the impact. For example, initial reports from Japan indicate a fall in revenues of 9.2% in the year ending March 2020 (Reuters, 2020[3]), and in Korea, revenues for Q1 2020 declined by KRW 8.5 trillion relative to Q1 2019 (a fall of approximately 11%) (Eun-joo, 2020[4]). However, given that the pandemic and its economic impact are still evolving, it is difficult to extrapolate from these initial indications. In addition, it is difficult to disentangle the causes of revenue declines (and their respective magnitudes): the direct impact on tax receipts associated with declining economic activity and emergency fiscal response measures may be augmented by the deferral of tax payments. Finally, the nature and depth of the crisis is unprecedented, limiting the ability to predict revenue impacts on the basis of already available information and estimates based on historical data.

While it is difficult to predict the impact of COVID-19 on government revenues at this stage, certain economies are likely to be more vulnerable than others. South Asia’s revenues are particularly vulnerable to the current slowdown in global trade, which (according to the World Trade Organization [WTO]) will be more severe than during the global financial crisis (GFC): revenues from trade taxes in the sub-region averaged nearly 15% of total revenues in 2015-17. Meanwhile, travel restrictions have taken a massive toll on tourism in the Pacific Islands (a number of which have no recorded cases of Covid-19), where tourism receipts represented more than 40% of exports on average over 2008-17 and are a key source of public revenues.3 Sharp declines in commodity prices will affect producer countries. Countries such as Brunei, Indonesia, Kazakhstan, Malaysia, Singapore, Thailand and Viet Nam, which generate significant public revenues from the production or refinery of oil, will likely experience a sharp drop in revenues as a result.

The economic changes associated with Covid-19 will also affect tax types in different ways, even before taking into account the measures to mitigate the consequences of the crisis. Corporate income tax (CIT) revenues, which are typically most responsive to economic cycles, are likely to decrease by more than the fall in economic activity. A reduction in employment and in wages will likely translate into lower personal income tax (PIT) revenues and social security contributions. Revenues from consumption taxes, especially from valued-added taxes (VAT), are also likely to fall due to the impact of lockdowns and lower consumer confidence, as well as a potential shift towards the consumption of staple goods, which are often taxed at reduced or zero rates. The structure of tax revenues in Asian and Pacific economies may render them more vulnerable due to their high reliance on CIT, that accounted for 19.0% of total tax revenues in 2017 in the countries included in this publication, on average, compared to 9.3% for OECD countries (OECD, 2020[5]).

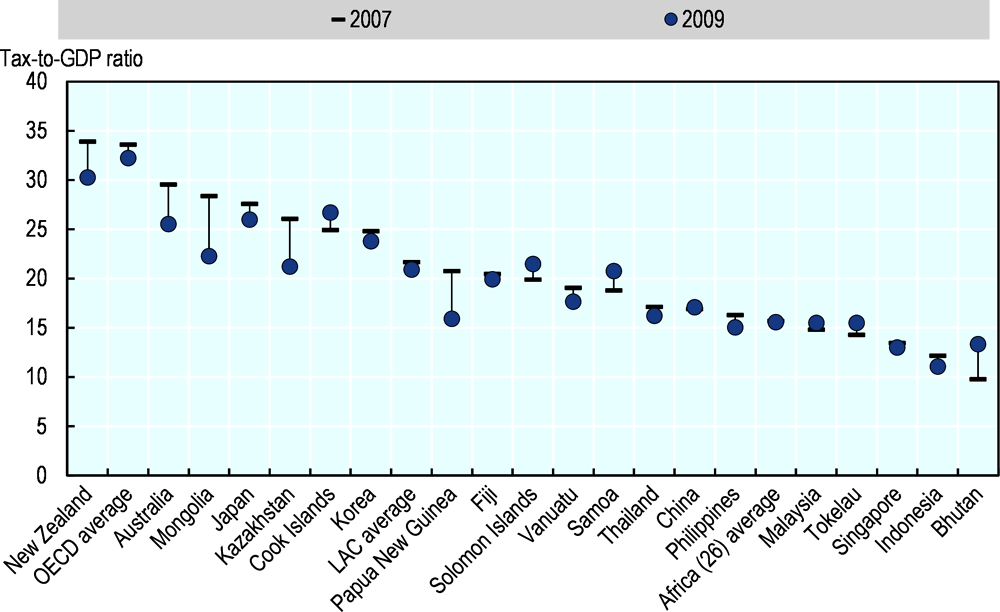

One indication of the potential impact of Covid-19 is to analyse how a previous crisis – the global financial crisis from 2007 to 2009 – affected tax revenues in the region, although this is likely to be a lower bound estimate. Over that period, the tax-to-GDP ratio in Asian and Pacific economies declined by 1.0 percentage point on average, with almost all countries in the region experiencing a decrease (Figure 2.1). CIT was most affected, declining from 4.9% of GDP in 20074 to 4.1% of GDP in 2009. Some countries were more affected than others: those dependent on revenues from natural resources, such as Kazakhstan and Papua New Guinea, experienced the largest losses in revenue due in large part to the fall of commodity prices. On average, it was not until 2012 that the tax-to-GDP ratios of Asian and Pacific economies exceeded their pre-crisis levels.

Tax administrations across the globe have played a critical role in supporting citizens and the economy at a time of crisis, including by helping to mitigate cash flow difficulties and minimise compliance burdens and, in many cases, by working with other parts of government in providing assistance to businesses and citizens, including through grants or loans (Suzuki, 2020[12]).5

Slower economic growth during COVID-19 will have a significant impact on tax policy across the region. Countries in Asia and the Pacific can take specific steps that will benefit their economies both during the pandemic and over the longer term. Throughout the region, countries must optimise tax policy to take into account shrinking economic growth during the pandemic and increased economic activity in the years that follow.

During the pandemic, tax agencies have focused on maintaining the operation of essential business processes, including taxpayer registration, taxpayer services, tax return and payment processing. The need to ensure the safety of staff to be deployed in the core business processes is an important part of this response, including strict compliance with policies on health and hygiene. Data and cyber security are also of critical importance.

In the immediate response phase, tax-related policies have been implemented in many countries to assist businesses and other taxpayers during the crisis. These included a holistic approach to tax relief measures that will help stabilise the economy, with some countries deferring or waiving taxes. Box 2.1 provides an overview of the combined tax policy and administrative responses to COVID-19 in Malaysia.

These measures need to be considered against the specific legal and regulatory operational framework, as well as the existing tax policies and incentives that vary from country to country. This should be done following the “Three Ts” Principle: the most effective immediate measures are those that are timely, targeted and temporary (Summers, 2008[6]). These policies have often been combined with other financing/liquidity measures to stabilise the economy, in particular, with those targeting small and medium-sized enterprises.

To ease the burden caused by the pandemic-induced state of uncertainty, delivering public services has also been a vital part of the response. Tax administration can aid this by being flexible in the use of staff to manage peaks in service demand and curtailing discretionary programmes where necessary, such as field audits. To ease the business cash-flow situation of taxpayers, policy options that have been implemented include tax debt payment plans and the prioritisation of value added tax refunds to ensure quick payouts.

The global economic impact of the pandemic could expand the informal economy, particularly among small businesses. It may also have a negative impact on tax compliance. These changes could trigger increases in value-added tax fraud or missing trader fraud, to which tax agencies need to be alert. Tax administrators should seek to strike the right balance between service demands and tax compliance.

According to ADB research, as economies open back up, economic growth in the region could rebound to 6.2% in 2021 (ADB, 2020[2]). In terms of debt sustainability and revenue mobilisation, tax policy makers and administrators should consider what tax reforms are needed in the aftermath of the pandemic. Digital transformation will help tax administrations and it will promote effective, timely, and corruption-free delivery of public services to support greater accountability.

Countries that innovate more tend to have faster economic growth, according to ADB research. Middle-income economies in Asia and the Pacific have increased spending on innovation, which is vital for productivity growth. Investment in research and development in these economies are three times bigger than their peers. In addition, innovations contribute to more inclusive and environmentally sustainable growth in the region. Tax policy should be part of this focus on innovation. New ideas and strategies will be needed for tax agencies working in the post-pandemic environment.

In the recovery period, governments will need to address several tax administration considerations: business restoration governance; scenario planning; analysis and monitoring; business restoration planning; opening of offices; staff welfare; reputation management and communication; working methods; and longer-term implications for tax administrations. As in the crisis period, it is important to keep to the forefront the various factors which distinguish the Covid-19 pandemic from one-off events or events hitting particular sectors or locations. These are: the continued risks to health, including from possible further outbreaks; the impacts on staff, taxpayers and administration systems from the need for continuing and careful adjustments; and the potential length and volatility of the recovery period given the depth and scale of the economic shock.

There are a number of overarching objectives which administrations might wish to consider adopting in the recovery period, notably:

Maintaining the decision-making processes of the crisis stage into the recovery phase. As in the crisis period, at times the environment will be fast moving, complex and involve all parts of the administration. The planning assumptions during the recovery phase should take into account the possibility of set-backs (and potentially major set-backs) in the containment of the virus, the possible volatility of the economy, different recovery speeds for different households and sectors, and potential new demands on tax administrations.

Effective joining-up with other parts of government. As well as taking supportive measures under existing powers, many tax administrations have also played a crucial role in delivering wider government support to affected taxpayers, such as the payment of grants and other financial reliefs. During the recovery period, the role of tax administrations within the wider government response will continue to be critical, including in ensuring that conflicting approaches are not taken. It will be important to join-up on both decision-making and information sharing.

Developing a dedicated communication strategy to support recovery. Most tax administrations have put in place COVID-19 crisis communication strategies. These have been both internal strategies to support staff and the effective operation of administration functions, and external strategies to provide timely information and support to taxpayers. During the recovery period, it would be sensible to refresh these strategies to take account of the move from a crisis to a prolonged and potentially difficult recovery period. In particular, consideration should be given as to how to best maintain the dual emphasis on a supportive relationship with taxpayers as well as bringing in tax revenue to fund public services.

Maintaining the safety of staff and taxpayers. Consideration will need to be given to how to maintain staff and taxpayer safety during the recovery period in light of continuing health risks, including the potential for further waves of the virus. There will need to be detailed plans for ongoing safety precautions as offices start to reopen. Engagement and consultation with staff and staff representatives will also be important to ensure clarity and transparency as to requirements and expectations.

Planning and prioritisation of the steps towards normalisation of administration functions. Administrations may also wish to ask those responsible for separate tax administration functions to draw up strategies for a return to normalisation, for example as regards compliance activities, debt recovery, dealing with backlogs, critical IT maintenance, etc. Ideally such strategies would reflect the different considerations which might arise under different recovery scenarios. The production of such strategies will help in taking decisions on relative priorities, in ensuring that decisions are taken and communicated in a holistic manner, and will make it easier to make rapid adjustments where necessary.

Logging lessons learned and updating business continuity plans. Logging of actions taken during both the crisis and recovery period, including their rationale and impact, will be important both for transparency purposes (for example independent reviews) and for the updating of business continuity plans in case of a recurrence of Covid-19 or a similar crisis. Tax administrations may wish to do this on a systematic and consistent basis, to ensure that full information is captured, issues identified, and early remedial actions are taken where appropriate.

Learning lessons. Many administrations have adopted different ways of working during the crisis, including remote working, remote auditing, more automated procedures and adjustments to risk parameters. It would be sensible for administrations to look at the way these different procedures and approaches have worked during the crisis and consider if they remain valid during the recovery period and, possibly, on a permanent basis to improve the efficiency of tax administration and to lower burdens.

The Malaysian government responded to COVID-19 with three stimulus packages worth a total of USD 60 billion across the period from 27 February to 6 April 2020 to mitigate the impact oCOVID-19, strengthen the economy and assist low- and middle-income households and individuals. As of 10 May 2020, around 10.6 million households and individuals have received financial aid from the government. The Inland Revenue Board of Malaysia (IRBM) has assumed responsibility of disbursement of this financial aid.

To supplement these policies, temporary tax incentives have been introduced and include: (i) tax deductions or capital allowance on expenses incurred in providing personal protective equipment to employees; (ii) a further tax deduction for owners of building or business space who reduced or waived rents for small and medium-sized enterprise (SME) tenants; and (iii) an accelerated capital allowance for machinery and equipment, including ICT equipment, applying from 1 March to 31 December 2020.

With respect to tax administration, IRBM has supported taxpayers through: (i) extending deadlines for tax filing; (ii) allowing for the revision of income tax estimates and deferral of payments; (iii) supporting debt payment plans; (iv) suspending debt recovery until 31 May 2020; (v) providing quicker refunds; (vi) changing the audit policy; and (vii) enhancing taxpayer communication initiatives.

Recognising its core role in responding to the crisis, IRBM has strengthened its business continuity. IRBM was well better prepared to evaluate the current and pending scenarios and to take appropriate action due to actions taken to improve governance arrangements before the crisis struck. It has also produced a Policy and Manual of Business Continuity System, which has been reviewed from time to time.

Source: Summary of presentation by Inland Revenue Board of Malaysia (2020[7]) on “Inland Revenue Board of Malaysia (IRBM) responses to COVID-19 outbreaks” at the virtual meeting on 14 May 2020.

Alongside the measures undertaken by tax administrations, tax policy makers are also considering a range of responses to the Covid-19 crisis. Policy responses to the Covid-19 crisis need to evolve as the crisis evolves across different phases: the emergency response, exit from confinement (for countries that have gone into some degree of lockdown), recovery and, over the long term, putting public finances on a sustainable footing (OECD, 2020[10]) (OECD, 2020[8]).6

The OECD is tracking measures taken by governments within and beyond the OECD membership in the emergency response phase. In this phase, fiscal packages have been put in place by many governments, with the size of such packages varying across countries. So far, policy measures introduced by emerging and developing countries have not been fundamentally different to those taken by OECD and G20 countries, but they have been more modest as the fiscal space in these economies is often smaller. Overall, policy measures taken in the emergency response phase can be grouped into four categories: support to businesses; support to households; support to investment and consumption; and support to the healthcare sector.

Support to business

A key priority from a tax perspective has been to support business cash flow. Measures to achieve this include: increased lending to firms; providing subsidies to non-wage business costs and support measures targeted at specific business sectors such as tourism, transport, airlines (e.g. Australia); providing subsidies to the self-employed; and allowing tax deferrals (and more rarely, tax waivers and tax rate reductions). For instance, tax payment deferrals have been introduced by three quarters of OECD and G20 countries, and correspond to 45% of the total number of measures reported by countries outside the OECD and the G20. Several countries have also adopted tax filing extensions and more flexible tax debt repayment plans (e.g. Australia and New Zealand). Only a few countries introduced tax waivers, which were particularly targeted at the tourism sector [e.g. Indonesia and Korea (OECD, 2020[8])].

Specific measures to boost business cash flows have been observed. These have included: deferral of taxes and social security contribution (SSC) payments (80% of OECD and G20 countries have changed due dates and/or reduced or waived advance payments, including Australia, Cambodia [see also Box 2.2], Japan and Indonesia), and the provision of enhanced tax refunds (e.g. Australia and Indonesia), in particular for VAT (30% of OECD and G20 countries). Tax loss provisions were also enhanced (carry forward or carry backward) (e.g. New Zealand).

Many governments have introduced measures to ensure that the connection between employers and employees is maintained through the emergency response phase. These include short-time work schemes or wage subsidies paid by governments to the employer (e.g. Australia, New Zealand and Thailand), under the condition that the employer does not fire its employees. These measures have been more common among OECD and G20 countries, which may be explained by their high cost and by the limited experience across emerging and developing countries with this type of measure.

Support to households

Governments have also moved very quickly to protect households via tax and expenditure measures, including payments delivered through the tax system. Measures to support households include: partial unemployment schemes for workers that continue to be employed (e.g. wage subsidies paid to the employee); increased eligibility of cash transfers (e.g. extending the availability of unemployment benefits to the self-employed [e.g. Australia]); increased access to benefits (e.g. eliminating waiting period before sickness or unemployment benefits can be received); and higher benefits. Decisions over the type of support have generally been driven by the need to deliver support quickly, leading to a preference for the use of existing systems and mechanisms over new ones. Some emerging and developing countries beyond the OECD and the G20 have reported introducing cash transfers for households, in particular to reach households not engaged in the formal sector, which might be excluded under other policy measures. Emerging and developing countries have not reported any expansions in sick leave or unemployment benefits, which may be a reflection of weaker social protection systems.

Support to investment and consumption

There have been very few tax measures so far to support investment and consumption, as these may conflict with measures to contain the pandemic, such as lockdown and social distancing. Some examples include increases in thresholds for low-value asset write-offs (e.g. Australia and New Zealand), and reductions in corporate taxes for manufacturing companies in a variety of sectors in Indonesia. Countries outside the OECD and the G20 have made greater use of tax measures with the goal of supporting investment and consumption. For example, Kazakhstan lowered the standard or reduced VAT rates. Policy measures to support investments and consumption are likely to take a more prominent role during the recovery phase to stimulate the economy.

Support to the healthcare sector

Tax policy measures to support the healthcare sector have been more common in countries outside the OECD and the G20. For instance, in some countries healthcare workers may benefit from a reduction in PIT or SSCs (e.g. Kazakhstan and Malaysia), and retired healthcare workers are able to resume work without losing pension and benefit entitlements. In Malaysia, healthcare and immigration workers receive a special allowance.

Businesses producing health equipment, goods and services may benefit from reduced tax rates or accelerated tax depreciation (e.g. Thailand). Further, some countries have introduced VAT exemptions or reductions for medicine, equipment and services directly involved in the containment and fight against COVID-19 (e.g. Indonesia and the Philippines). Other measures include expediting customs clearance for goods necessary in fighting COVID-19.

Cambodia has implemented three rounds of emergency policy measures to support businesses, families and the economy since the outbreak of COVID-19.

The first round of measures provided tax relief to businesses in vulnerable sectors such as tourism, real estate, garment, footwear, textile and others. For example, hotels and guesthouses in the province of Siem Reap were exempted from paying corporate income taxes for four months from February to May 2020, while comprehensive tax audits for these businesses were deferred for the entire year of 2020. The transfer tax was waived for any real estate purchases below USD 70 000 from licensed property developers in Cambodia for one year starting from February. Tax on salary (TOS) was waived for seniority indemnity payments (which function as an extended severance pay) made to Cambodian employees who worked in the garment, footwear, textile and other sectors in 2019 or earlier. For seniority indemnity payments made in 2020 and after, the TOS exemption will only apply to those who earn less than KHR 4 million per year. Tax exemptions were also given to companies that recruit, train, send and supervise Cambodian workers to work abroad.

The second round of emergency policies included income support for Cambodian workers, as well as more tax relief to businesses. In terms of support for workers, the government will contribute 20% to minimum wages paid to workers and employees of hotels, guesthouses, restaurants and travel agencies operating in Phnom Penh, Siem Reap, Sihanouk, Kep, Kampot, Bavet and Poipet. For businesses, the corporate income tax exemption implemented in the first round was extended to cover hotels, guesthouses, restaurants and travel agencies operating in the same areas. These businesses must file tax returns for 2019 by the end of March, but can make payments by monthly instalments until November 2020. Airline companies in Cambodia received a three-month exemption from paying the annual Minimum Tax between March and May 2020, while aviation fees were deferred for a period of six months and made payable by instalments.

Tax policies were not included in the third set of emergency policies. These measures mostly consisted of measures to combat COVID-19 and stimulate the Cambodian economy, such as the extension of travel restrictions, enhanced lockdown measures, establishment of a task force to control supply and prices of strategic goods, and improved budget financing and social assistance during the pandemic, as well as a co-financing scheme for SMEs.

At the time of writing, the government is planning a fourth round of policy measures that could be implemented in the near future.

Source: Summary of presentation by the General Department of Taxation of Cambodia (2020[9]) on “Tax policy and tax administration responses to the COVID-19 crisis by the Royal Government of Cambodia” at the virtual meeting on 14 May 2020.

The coronavirus (COVID-19) pandemic has affected many low-income countries in the Asia-Pacific region and around the world. Additional support for consumers and businesses may be required both from internal and external sources to allow these countries to respond to the crisis and to support an economic recovery. Tax policy makers and tax administrations will play an important role in supporting the wider government response to coronavirus across the crisis and recovery stages (Steel, I., Phillips, 2020[11]).7

There are three important considerations that Ministries of Finance and revenue administrations in low-income countries need to keep in mind in responding to COVID-19: (1) assessing revenue impacts and potentially take measures to shore up the fiscal position; (2) developing, appraising and implementing tax policy responses to different phases of the crisis and recovery; and (3) facilitating the use of tax data for economic, social and public health monitoring purposes.

1. Assessing revenue impacts in relation to global and domestic economic shocks is an important foundation for shoring up the fiscal position for responding to COVID-19. It will be important that governments closely monitor the fluctuating situations and update revenue impacts as the crisis unfolds, which will be essential to support cash and debt management operations, determine external financing requirements, and identify space available for additional health and fiscal support measures. Importantly, the revenue impacts are more likely to be acute in low-income countries because of their more limited access to capital markets and lesser scope for temporary central bank financing of government debts, as well as widespread and simultaneous calls on external finance.

2. The role of tax policy approach is likely to evolve alongside the different phases of the crisis:

Phase 1: Support ─ Immediate support to businesses is the priority during this phase, to help them survive the economic fallout from the crisis. In this phase, support to households is also critically important. The measures taken during this phase include tax payment deferrals, expedited refunds, and targeted help for affected sectors. Targeted support rather than broad-based stimulus is more appropriate while social distancing measures prevent normal economic activity and where fiscal situations are tight.

Phase 2: Stimulus ─ In this phase, the goal of tax policy is to boost demand to support the economic recovery once social distancing measures have been eased or lifted. Governments may wish to consider using a different range of tax policy options to deliver support in this phase, such as temporary VAT reductions or increases in capital allowances.

Phase 3: Consolidation ─ Once the economic recovery is underway, tax measures to restore fiscal sustainability, building on existing strategies and domestic resource mobilisation plans, will be increasingly important.

In each phase, country contexts are a key factor to consider in understanding the impact of the crisis and the effectiveness of measures to support the economy and households. Elements of the country context which are significant include: (i) administrative and policy evaluation capacity; (ii) fiscal capacity and government liquidity; (iii) the economic structure, including sectoral composition; and (iv) the other measures taken by the government to address the crisis (e.g. social distancing and lockdown).

During the support phase, the immediate focus of the response has been to support business cash-flow and to maintain formal sector employee-employer relationships, while avoiding new administrative and compliance burdens. A broader set of considerations than national tax policy has applied (e.g. social protection, funding for local government, and financial sector policies) – not least in countries with large informal sectors that are hard to reach directly through tax measures – and tax measures to support social distancing have also been implemented in some countries. During this phase, general reductions in CIT and PIT rates have been rarely utilised, in view of maintaining tax revenue from taxpayers less affected by the crisis.

While moving into the “stimulus” phase of the recovery, weak domestic and global demand may warrant fiscal stimulus measures, subject to fiscal capacity. Under this situation, explicit and temporary investment and consumption tax incentives could be considered in order to encourage businesses and consumers to bring forward investments and purchases. Given the high level of uncertainty, however, direct government investment may be more effective than tax incentives. At the same time, governments will need to give careful consideration as to how to unwind and modify the measures that were implemented during the “support” phase.

In the “consolidation” phase, there may be a chance to realise long-run reform agendas, while taking into account the post-crisis economic reality. The crisis can provide an impetus to implement difficult, but ultimately beneficial, reforms to the tax system. These could include measures to make the tax system greener and more consistent with climate change objectives. Also, this provides an opportunity to reconsider and rationalise tax expenditures and incentives.

3. Tax administrations can support the response to COVID-19 by facilitating the use of tax data for economic and public health monitoring purposes. Often, official economic statistics are too slow to inform policy, and economic data lag events in the real world. Tax administrations may have access to data that become available earlier, particularly from taxes collected frequently and with a closer link to economic activity (e.g. VAT or goods and services taxes [GST], withholding on salaries, customs duties). To the extent possible under confidentiality rules, anonymised (and aggregated) tax data can be shared within government, and with academics and researchers, to help them undertake analysis and inform policy.

Tax administrations can also make use of existing data-sharing protocols and agreements, or introduce them when necessary. These are a number of potential uses of tax data, for example:

securing supplies of essentials – using customs data to anticipate shortfalls in essentials and identify trade dependencies;

dealing with health impacts – falling receipts could be an indication of whether social distancing is effective or not;

monitoring economic situations – getting a snapshot of how the economy is developing by comparing weekly or monthly data with an equivalent period in previous years;

developing targeted responses – identifying the worst-affected sectors or regions, and targeting policy responses accordingly; and

preparing for recovery – using tax data to identify early signs of recovery and potential bottlenecks.

References

[2] ADB (2020), Asian Development Outlook 2020, Asian Development Bank, https://doi.org/10.22617/FLS200119-3.

[4] Eun-joo, L. (2020), “S. Korea’s Q1 tax revenue shrinks $6.9 bn, fiscal deficit hits record high by March”, Pulse by Maeil Business News Korea & mk.co.kr, https://pulsenews.co.kr/view.php?year=2020&no=466629 (accessed on 7 May 2020).

[7] Inland Revenue Board of Malaysia (2020), Responses to COVID-19 outbreaks, https://static1.squarespace.com/static/5c6aa605ca525b3b56a7e512/t/5ec7bb8414b2283a6e347f6a/1590147984395/Malaysia_IRBM+Responses+to+COVID-19+Outbreaks+_Dr+Sabin.pdf (accessed on 26 June 2020).

[5] OECD (2020), Global Revenue Statistics Database, http://www.oecd.org/tax/tax-policy/global-revenue-statistics-database.htm.

[10] OECD (2020), OECD Database of Tax Policy Responses to COVD-19, https://www.oecd.org/tax/tax-policy/tax-database/.

[1] OECD (2020), OECD Economic Outlook, Volume 2020 Issue 1: Preliminary version, OECD Publishing, Paris, https://dx.doi.org/10.1787/0d1d1e2e-en.

[8] OECD (2020), Tax and Fiscal Policy in Response to the Coronavirus Crisis: Strengthening Confidence and Resilience - OECD, http://www.oecd.org/ctp/tax-policy/tax-and-fiscal-policy-in-response-to-the-coronavirus-crisis-strengthening-confidence-and-resilience.htm (accessed on 22 June 2020).

[3] Reuters (2020), “Japan tax collections fall most since June, more drops seen as virus bites”, Reuters, https://www.reuters.com/article/us-health-coronavirus-japan-tax/japan-tax-collections-fall-most-since-june-more-drops-seen-as-virus-bites-idUSKBN22J1JX (accessed on 7 May 2020).

[9] Royal Government of Cambodia (2020), Tax Policy and Tax Administration Responses to COVID-19 By the Royal Government of Cambodia General Department of Taxation, https://static1.squarespace.com/static/5c6aa605ca525b3b56a7e512/t/5ec7bac883adba6fbbb27ba2/1590147787570/Cambodia_OECD_Meeting.pdf (accessed on 26 June 2020).

[11] Steel, I., Phillips, D. (2020), How tax officials in lower-income countries can respond to the coronavirus pandemic, Overseas Development Institute (ODI), https://www.odi.org/publications/16816-how-tax-officials-lower-income-countries-can-respond-coronavirus-pandemic (accessed on 22 June 2020).

[6] Summers, L. (2008), Fiscal Stimulus Issues: Testimony before the Joint Economic Committee, http://larrysummers.com/wp-content/uploads/2012/10/1-16-08_Fiscal_Stimulus_Issues.pdf.

[12] Suzuki, Y. (2020), How can tax agencies tackle the impact of COVID-19?, https://blogs.adb.org/blog/how-can-tax-agencies-tackle-impact-covid-19 (accessed on 22 June 2020).

Notes

← 1. This chapter is the summary of an ADB-CATA-OECD-PITAA-SGATAR virtual meeting that was held on 14 May 2020. The meeting discussed tax policy and tax administration responses to COVID-19 and had over 90 participants from 29 economies in Asia and the Pacific. This chapter draws on the presentations and underlying reports of the speakers at the meeting, who included: Donghyun Park (ADB), Yasushi Suzuki (ADB), Duncan Onduru (CATA), Peter Green (OECD), David Bradbury (OECD), Ben Dickinson (OECD), Varsha Singh (OECD), Koni Ravono (PITAA), John Hutagaol (SGATAR), Dr Sabin Samitah (Malaysia), Dr Lamy Mong (Cambodia), Ian Steel (ODI) and David Phillips (IFS). Presentations from this meeting are available at the following webpage: http://www.oecd.org/tax/tax-global/meeting-tax-policy-and-tax-administration-responses-to-covid-19-for-asia-pacific-may-2020.htm.

← 2. To help developing Asian countries cope with the devastating impact of the pandemic, ADB has scaled up the size of assistance to USD 20 billion (find the latest information here). ADB’s support will address the mid- to long-term economic impact of COVID-19 transmitted through various channels, including sharp declines in consumption and investment (information on the ADB COVID-19 Policy Measures can be accessed here). In terms of tax policy and administration, at a corporate strategic level, ADB is elevating domestic resource mobilisation (DRM) and international tax co-operation as one of the priorities under the new president’s direction. ADB will strengthen its effort in DRM and international tax co-operation in conjunction with ADB’s Strategy 2030.

← 3. Figure taken from the presentation of Iain Steel (ODI) and David Phillips (IFS) on “How tax officials can respond to the coronavirus pandemic” at the virtual meeting on 14 May 2020.

← 4. 2008 data were used for Bhutan and Fiji as 2007 data are not available.

← 5. This section draws on the presentations given by Peter Green (OECD) on “Tax Administration Responses to Covid-19” and by Yasushi Suzuki (ADB) on “ADB response” at the seminar virtual meeting on 14 May 2020, as well as on https://blogs.adb.org/blog/how-can-tax-agencies-tackle-impact-COVID-19.

In order to support these efforts the OECD Forum on Tax Administration (FTA) has published a number of reference documents. These cover measures taken to support taxpayers, business continuity considerations and, most recently, a reference document on the issues which tax administrations may wish to take into account in their planning for the recovery from COVID-19 (https://www.oecd.org/tax/forum-on-tax-administration).

← 6. This section draws on the presentation given by David Bradbury on “Tax policy responses to the Covid-19 crisis” at the virtual meeting on 14 May 2020, as well as on the OECD Database of Tax Policy Responses to Covid-19 and on Tax and Fiscal Policy in Response to the Coronavirus Crisis: Strengthening Confidence and Resilience. The policy measures outlined in this section have been collected on the basis of questionnaires and ongoing engagement with governments from countries participating in the Inclusive Framework on Base Erosion and Profit Shifting, the Working Party No. 2 on Tax Policy and Statistics and the Working Party No. 9 on Consumption Taxes of the Committee of Fiscal Affairs.

← 7. This section draws on the presentation given by Iain Steel (ODI) and David Phillips (IFS) on “How tax officials can respond to the coronavirus pandemic” at the virtual meeting on 14 May 2020.