1. Tax revenue trends in Asian and Pacific economies

Achieving the Sustainable Development Goals in the 2030 Agenda for Sustainable Development requires mobilising additional resources – in particular government revenues – to fund public goods and services in developing countries. Taxation provides the largest share of government revenues in almost all countries and is relatively predictable and sustainable, in contrast with non-tax revenue sources such as official development assistance and royalties.

Revenue Statistics in Asia and the Pacific 2021 is published at a time when the COVID-19 pandemic continues to pose severe challenges to health systems and economies across the Asia and Pacific region, as well as to citizens themselves. Data on fiscal revenues discussed in Chapter 1 demonstrate the strength of the region’s tax systems going into the crisis and are thus a valuable tool not only for understanding how the crisis will affect different countries but also for supporting countries to build more resilient fiscal systems in its aftermath. Chapter 2 of this report discusses the emerging challenges for the Asia-Pacific region in the COVID-19 era and ways to address them.

This report presents detailed and internationally comparable data on tax revenues in 24 Asian and Pacific economies: Australia, Bhutan, People’s Republic of China (hereafter “China”), the Cook Islands, Fiji, Indonesia, Japan, Kazakhstan, Korea, Lao People’s Democratic Republic (hereafter Lao PDR), Malaysia, the Maldives, Mongolia, Nauru, New Zealand, Papua New Guinea, the Philippines, Samoa, Singapore, the Solomon Islands, Thailand, Tokelau, Vanuatu and Viet Nam. It also provides information on non-tax revenues for Bhutan, the Cook Islands, Fiji, Kazakhstan, Lao PDR, the Maldives, Mongolia, Nauru, Papua New Guinea, the Philippines, Samoa, Singapore, Thailand, Tokelau, Vanuatu and Viet Nam. This chapter discusses key tax indicators for these 24 economies: the tax-to-GDP ratio; the tax structure and the share of tax revenue by level of government; and non-tax revenue for selected economies. The discussion is supplemented by the comparative tables in Chapter 3 and detailed information for each economy in Chapters 4 and 5.

Tax-to-GDP ratios in 2019

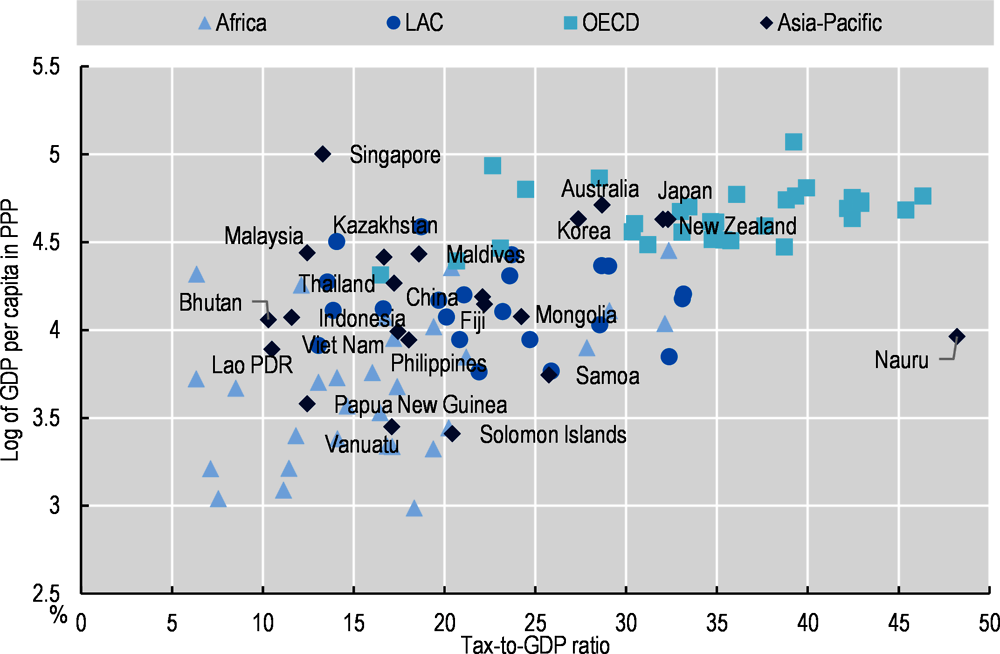

In 2019, tax-to-GDP ratios in Asia and the Pacific ranged from 10.3% in Bhutan to 48.2% in Nauru (Figure 1.1). Ten of the 24 economies had tax-to-GDP ratios above the Asia-Pacific (24) average of 21.0% in 2019, and all economies in the publication had lower ratios than the OECD average of 33.8%, with the exception of Nauru. Most of the Asian countries covered in this report had a tax-to-GDP ratio below the average of 21.0%, with the exceptions of Japan (32.0%, 2018 figure), Korea (27.4%), Mongolia (24.2%) and China (22.1%). By contrast, six of the ten Pacific economies in this publication had a tax-to-GDP ratio above 21.0%, with the exception of Papua New Guinea (12.4%), Vanuatu (17.1%), Tokelau (19.2%) and the Solomon Islands (20.4%).

The tax-to-GDP ratio measures tax revenues as a proportion of gross domestic product (GDP). Taxes are defined as compulsory, unrequited payments to general government. In the OECD classification, taxes are classified by the base of the tax and include taxes on incomes and profits, compulsory social security contributions (SSCs) paid to the general government, taxes on payroll and workforce, taxes on property, taxes on goods and services and other taxes.

Tax-to-GDP ratios in Asian and Pacific economies, inclusive and exclusive of SSCs, are shown in Figure 1.1. In countries that levy SSCs, tax-to-GDP ratios exclusive of SSCs range from 11.1% of GDP in Indonesia to 20.1% of GDP in Korea in 2019 (Lao PDR and Viet Nam are not included as data are not available). For all countries with SSC data, seven countries in Asia had tax-to-GDP ratios exclusive of SSCs between 15% and 20% of GDP: the Philippines (15.5%), China (16.0%), Kazakhstan (16.1%), Thailand (16.2%), Maldives (18.6%), Japan (19.2%) and Mongolia (19.4%), while four countries had tax-to-GDP ratios exclusive of SSCs below 15%: Bhutan (10.3%), Indonesia (11.1%), Malaysia (12.1%) and Singapore (13.3%). While excluding revenues from social security contributions does not impact the tax-to-GDP ratios in Pacific economies, where social protection is funded predominantly from general revenues and not through SSCs, it plays a more significant role in the ratios of all Asian economies except Bhutan, Maldives and Singapore which also do not levy SSCs.

Structural factors are a key determinant of tax-to-GDP ratios across economies. These include the importance of agriculture in the economy, openness to trade and the size of the informal economy. Agriculture, for example, is a challenging sector to tax: most people in the agriculture sector in developing economies are on low incomes and many are not registered for tax purposes (PEAKS, 2013[2]). In addition, agriculture benefits from numerous tax exemptions. For example, Malaysia allows an agriculture allowance to be deducted from profits of eligible businesses (Inland Revenue Board of Malaysia, 2016[3]), and goods and services related to the agriculture sector are exempt from import duty and excise duty (Ministry of International Trade and Industry of Malaysia, 2016[4]) The common challenges that small island developing states (SIDS) confront, such as remoteness, exposure to natural disasters and low economic diversification, also influence tax-to-GDP ratios and tax structures in these islands. These factors are discussed in more detail in Box 1.1.

In addition to structural factors, tax policy and tax administration settings also strongly influence the level of tax revenues. These include tax rules and statutory rates, the power of tax administrations, the levels of corruption within these administrations and tax morale (i.e. willingness of people to pay taxes) (OECD, 2014[5]). For example, Aizenman (2015[6]) found that tax-to-GDP ratios in Asia are positively correlated with government effectiveness and institutional quality. Finally, tax-to-GDP ratios tend to be higher in high-income economies, although the relationship is not direct and is less pronounced at lower levels of income due to the influence of other factors. (Figure 1.2).

The relationship between GDP per capita and tax levels across the Asian and Pacific economies in this publication is less direct than that observed across LAC or OECD countries. Nine Asian and Pacific economies (China, Fiji, Kazakhstan, the Maldives, Mongolia, the Philippines, Samoa, Thailand and Viet Nam) have broadly similar GDP per capita and tax-to-GDP ratios as the majority of LAC countries. Papua New Guinea, Vanuatu, Lao PDR and the Solomon Islands have similar per capita levels of income but their tax-to-GDP ratios differ markedly. In contrast, Australia, Japan, Korea and New Zealand have higher per capita income and tax-to-GDP ratios. Finally, Singapore has the highest GDP per capita of the 24 economies considered here and one of the lowest tax-to-GDP ratios.

The high GDP per capita in Singapore results from significant inward flows of foreign direct investment (FDI) (UNCTAD, 2012[7]), whereas the tax-to-GDP ratio is explained by lower income tax rates (particularly on corporate income) and value added tax (VAT) rates compared to other Asian and Pacific economies (UNESCAP, 2014[8]). Nauru, on the other hand, has a similar GDP per capita level to Lao PDR, Viet Nam and the Philippines but reports the highest tax-to-GDP ratio of the 24 economies in this publication, as a result of high revenues generated in connection with the Refugee Processing Centre (RPC) (Government of Nauru, 2020[9]).

Small Island Developing States (SIDS) comprise a diverse group of the smallest and most remote economies in the world located across Africa, Asia and the Pacific, and Latin America and the Caribbean. They share a common and unique set of development challenges owing to their small populations and landmasses, spatial dispersion and remoteness from major markets, and exposure to severe climate-related events and natural disasters. With small and undiversified economies, SIDS are highly vulnerable to external shocks, as they rely strongly on the global economy for financial services, tourism, remittances and concessional finance.

Two common challenges faced by SIDS are the achievement of adequate domestic resource mobilisation and debt sustainability. Domestic revenues are often erratic due to narrow economic productive bases, often concentrated in sectors that are exposed to external fluctuations, such as natural resources or tourism. At the same time, SIDS typically have large current expenditures, as the high unit costs of providing services to small and scattered populations increase public sector expenditures above the average levels of other developing countries (31.7% of GDP in SIDS, compared to 21.3% in other developing countries) (World Bank, 2020[13]). Severe climate events and natural disasters also tend to have heavy fiscal and economic impacts. These factors lead to high levels of public debt for many SIDS [59.5% of GDP, compared to 44.6% for other developing countries (World Bank, 2020[14])] and reduce the fiscal space to invest in development.

Taxes are an important and relatively more stable source of revenues in many SIDS, although economies’ ability to raise domestic revenues varies significantly. The Global Revenue Statistics publications and database (OECD, 2021[15]) show that Pacific Islands had the biggest variation of tax-to-GDP ratios among SIDS, from 12.4% in Papua New Guinea to 48.2% in Nauru in 2019. Among African SIDS, Cabo Verde had a tax-to-GDP ratio of 21.2%, Mauritius of 20.4% and Seychelles of 32.4% in 2018 (OECD/AUC/ATAF, 2020[16]). Finally, for SIDS in Latin America and the Caribbean, ratios varied from 13.5% in the Dominican Republic to 42.0% in Cuba in 2019 (OECD et al., 2021[17]).

The COVID-19 pandemic is hampering SIDS’ ability to mobilise and improve the stability of domestic revenues. Public revenues in SIDS have been affected by the crisis via a variety of channels, most notably the sharp fall of tourism activity, the decline in overall economic activity, and fluctuations in commodity and natural resource prices. To recover from the COVID-19 crisis, enhanced management of key sectors, including fisheries, tourism and natural resource extraction, may provide opportunities to enhance domestic revenue mobilisation in SIDS. Policies to reduce “leakages” from these sectors – especially tourism – and to support backward and forward linkages with other domestic sectors (e.g. food and agriculture, consumer goods and construction) could expand the taxable production base.

Improving the efficiency of revenue collection, enlarging the tax base and employing efficient tax policies are also essential to increase the resources required to sustain development. The Global Revenue Statistics project supports 21 SIDS in these efforts by providing accurate, comparable and detailed data on their tax revenues. This information is essential for tax policymaking and administrative reforms, and forms a common evidence base for mutual learning across SIDS on how to scale up domestic resource mobilisation.

Source: Piera Tortora and Talita Yamashiro Fordelone, based on OECD (2018[18]), (World Bank, 2020[14]), (World Bank, 2020[13]) and on the Global Revenue Statistics database (OECD, 2021[15]).

Changes in tax-to-GDP ratios in 2019

Since 2018, over two-thirds of the economies in this publication for which 2019 data are available have experienced decreases in their tax-to-GDP ratios (Figure 1.3). Fifteen economies had lower tax-to-GDP ratios in 2019 relative to 2018, whereas seven had higher ratios than in 2018 (Australia and Japan do not have 2019 data). The largest increases were seen in Nauru and Tokelau at 12.9 percentage points (p.p.) and 1.2 p.p, respectively. The increases in the remaining economies were smaller than 1 percentage point. By contrast, six economies experienced decreases in their tax-to-GDP ratios larger than 1 percentage point: China (1.0 p.p., exclusive of SSCs), Fiji (1.3 p.p.), Samoa (1.4 p.p.), Bhutan (2.3 p.p.), the Cook Islands (3.0 p.p.) and the Solomon Islands (3.6 p.p.). The 2019 fiscal year in some of these economies includes part of the 2020 calendar year, and their tax-to-GDP ratios were therefore impacted by the COVID-19 crisis (indicated by an asterisk in Figure 1.3). In the remaining nine countries with decreases, the difference was less than 1 percentage point.

Higher revenues from taxes on income were the main reason for the largest increases in the tax-to-GDP ratios in the region between 2018 and 2019 (Figure 1.4).

In Nauru, income taxes increased by 13.1 p.p. in 2019. This increase was due to higher tax rates for employees and service providers of the Regional Processing Centre (RPC) and higher than expected revenue from the Centre ((Republic of Nauru, 2019[19]), (2020[20])). The government of Nauru is committed to a positive fiscal budget (IMF, 2020[21]) and is aware of the uncertainty of revenues from the RPC after the contract with the Australian government expires in 2021 ((Republic of Nauru, 2021[22]), (2020[23])). The increase in income tax revenue was slightly offset by a decrease in revenues from other taxes on goods and services (-0.2 p.p.), leading to an overall increase in tax-to-GDP ratio of 12.9 p.p. between 2018 and 2019. In Tokelau, where the 2019 fiscal year includes the first six months of 2020, an increase in income tax revenues of 1.8 p.p. of GDP was primarily the result of general increases in salaries.1 This increase was partially offset by a decrease in revenues from other taxes on goods on services, reflecting lower imports in 2020 due to the COVID-19 pandemic, leading to a total increase in tax-to-GDP ratios of 1.2 p.p. in the 2019 fiscal year.

A variety of factors drove the decreases in tax-to-GDP ratios observed in the region in 2019, and as noted, six countries saw decreases of over 1 percentage point (China, Fiji, Samoa, Bhutan, the Cook Islands and the Solomon Islands) between 2018 and 2019:

The decrease of 1.0 p.p. in China’s tax-to-GDP ratio, exclusive of SSCs, was the result of lower revenues from VAT (0.7 p.p.), especially on imports, and from PIT (0.5 p.p.), due to a reform of individual income taxes2, which was partially offset by an increase of 0.2 p.p. in revenues from other taxes on goods and services.

Fiji’s tax-to-GDP ratio decreased by 1.3 p.p. due to a general economic downturn (IMF, 2020[25]), which led to decreases in revenues from corporate income taxes and from other taxes on goods and services via lower import revenue. Both categories declined by 0.6 p.p. in 2019. Revenues from other taxes also decreased by 0.1 p.p. in 2019.

The tax-to-GDP ratio in Samoa, where the 2019 fiscal year ends on 30 June 2020, declined by 1.4 p.p. because of a downturn in economic activity related to a measles outbreak in late 2019 and due to the COVID-19 pandemic in the first months of 2020 (Central Bank of Samoa, 2020[26]). GDP contracted by 3.5% in the fiscal year 2019. The economic downturn particularly impacted commerce, business services, electricity and water, and food and beverage manufacturing (Central Bank of Samoa, 2020[26]). The revenue from VAT declined by 0.2 p.p. between 2018 and 2019, while income taxes and other taxes on good and services both declined by 0.6 p.p.. Declines in corporate tax revenue and in custom duty revenues were the main driver of the falls in these last tax categories, respectively, which both decreased sharply in the second quarter of 2020.

Three economies experienced declines in tax-to-GDP ratios larger than 2 p.p. in 2019: the Solomon Islands, the Cook Islands and Bhutan.

The largest decrease of tax-to-GDP ratios (3.6 p.p.) occurred in the Solomon Islands, where the fiscal year aligns with the calendar year: revenues from income taxes decreased by 0.4 p.p. and taxes from other taxes on goods and services fell by 3.2 p.p. in 2019. These decreases were mainly due to a temporary pause in economic activity during the national elections and a decline in revenues from logging exports as a result of lower demand from China (IMF, 2020[27]).

The second largest decrease in tax-to-GDP ratios (3.0 p.p.) occurred in the Cook Islands, where the 2019 fiscal year ended on 30 June 2020, following the collapse in tourism due to travel restrictions during the COVID-19 pandemic. Tourism generates over 60% of the Cook Islands’ GDP (ADB, 2020[28]). Declines in revenues from income taxes accounted for the bulk of revenue reductions (2.5 p.p.) between 2018 and 2019: many workers received the minimum wage or entered unemployment, both of which reduced revenues from personal income tax (PIT) by 1.3 p.p. between 2018 and 2019.3 CIT revenues decreased by 1.2 p.p. during the same period. In addition, government measures such as tax payment deferrals or reductions in instalment payments and increasing the provisional tax threshold also contributed to the overall decrease (Ministry of Finance of the Cook Islands, 2020[29]).

Revenues in Bhutan, whose 2019 fiscal year ended on 30 June 2020, decreased by 2.3 p.p. between 2018 and 2019 due to lower revenues from income taxes (0.4 p.p.) and other taxes on goods and services (1.8 p.p.). Income tax revenue decreased due to tax deferrals for businesses to the next fiscal year, introduced in response to the COVID-19 pandemic (ADB, 2021[30]). The decrease in other taxes on goods and services was due to the cessation of the excise duty refund from India, which accounted for 11.5% of total taxes in 2018, following the introduction of a goods and services tax in India, which subsumed excise duty 4 (IMF, 2018[31]).

This edition of Revenue Statistics in Asia and the Pacific features a regional average of the 24 Asian and Pacific economies for the tax indicators presented in this publication for the first time.

Country coverage in this publication has been expanding continuously since its first edition: the number of participating economies has increased from four in 2014 to 24 economies in 2021, which together account for 77% of GDP in the Asia-Pacific region. The publication now covers 14 Asian and 10 Pacific economies, accounting for 76% and 99% of regional GDP respectively1.

The Asia-Pacific (24) average is an unweighted average of the 24 economies, calculated for the years 2010 to 2019, for tax revenue as percentage of GDP and tax revenue by tax type as percentage of total taxation. The average includes all 24 economies between 2014 and 2019, but excludes Nauru between 2010 and 2013 due to lack of data. For individual tax types, data is not yet available for some economies. For example, SSC data are not yet available for Lao PDR and Viet Nam, while they are partially reported for China (available only for 2019). The regional average should therefore be interpreted with caution, particularly when compared across time.

In addition, it should be noted that ten of the 24 economies report their data on a fiscal year instead of a calendar year. Japan and Singapore have a fiscal year from April to March; the fiscal year in Australia, Bhutan, Cook Islands, Nauru, New Zealand, Samoa and Tokelau runs from July to June; and Thailand’s fiscal year is from October to September. The use of fiscal years can raise difficulties for some countries to provide revenue data for the latest period and this is especially true for data for the 2019 fiscal year due to the COVID-19 pandemic. As a result, regional averages for the latest year may be subject to change as more information arrives. For example, revenue data for the fiscal year 2019 were not available for Australia and Japan (in both countries, this would include at least three months of 2020) in Revenue Statistics 2020. As a result, 2018 data are used for the calculation of 2019 regional average, which is likely to change once the revenue data of Australia and Japan are available.

In comparison with the other regional averages that are part of the Global Revenue Statistics Initiative, the OECD average, the Latin American and Caribbean (LAC) average and the Africa (30) average, variation across the 24 economies included in the Asia-Pacific average is relatively small, reflected by lower standard deviations for tax-to-GDP ratios (around 5-6%) than those of Africa (above 6%), LAC (around 7%) and OECD (around 7-8%) between 2010 and 2017. However, the recent hike in tax revenues of Nauru has contributed to rising standard deviations in 2018 and 2019.

Additionally, the following observations can be made about the Asia-Pacific (24) average:

The tax-to-GDP ratio for the Asia-Pacific (24) average (21.0%) is higher than the Africa (30) average (16.6%, 2018 figure) and below the LAC average (22.9%) in 2019 while all three regions have significantly lower tax-to-GDP ratios than the OECD average (33.8%).

In terms of tax structure, the Asia-Pacific average is similar to the Africa average, with a heavy reliance on taxes on goods and services as well as income taxes but a minor contribution from SSCs. However, tax structures may vary among sub-regions within the group. For example, ASEAN member states receive higher revenues from CIT than PIT, while the reverse is the case for Pacific Island economies (see Box 1.1).

← 1. Calculation based on data from WEO 2021 (IMF).

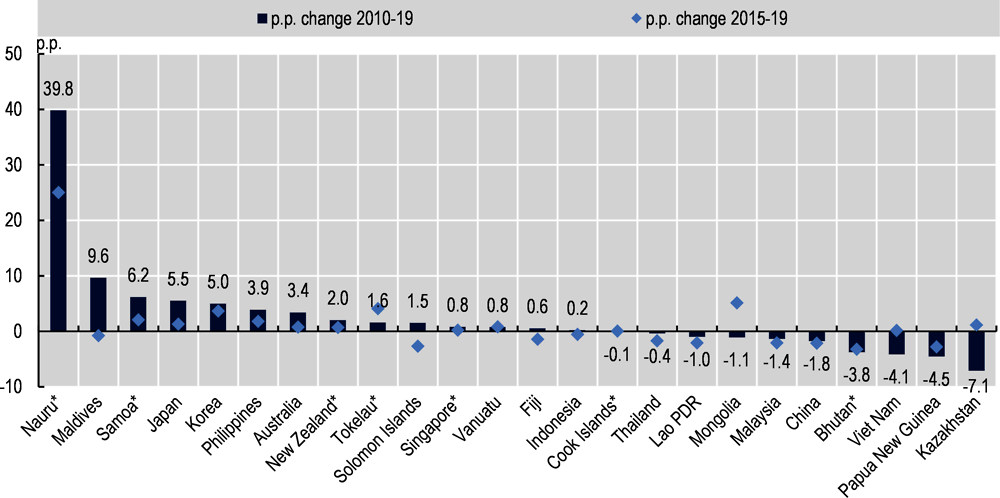

Evolution of tax-to-GDP ratios since 2010

Across a longer time horizon, 14 of the 24 economies in the publication have increased their tax-to-GDP ratios since 2010 (Figure 1.5).5 Across the period, the largest decreases in tax-to-GDP ratios were observed in Viet Nam, Papua New Guinea and Kazakhstan (by 4.1 p.p., 4.5 p.p. and 7.1 p.p., respectively), which were affected by the fall in mineral resource prices between 2010 and 2019. By contrast, the tax-to-GDP ratios of Korea, Japan, Samoa, the Maldives and Nauru (since 2014) grew by over 5 p.p. during the same period. For Korea and Japan, the tax-to-GDP ratios were particularly low in 2010 as a result of the global financial crisis and increased again in the following years. The change in the tax-to-GDP ratios for the remaining economies ranged from a decrease of 3.8 p.p. in Bhutanto an increase of 3.9 p.p. in the Philippines.

Across the Asian countries in the publication, the change in tax-to-GDP ratios ranged from -7.1 p.p. in Kazakhstan to 9.6 p.p. in the Maldives, with ratios increasing in six of the 14 Asian economies considered and decreasing in eight. Across the Pacific economies in this publication, tax-to-GDP ratio changes ranged from -4.5 p.p. in Papua New Guinea to 6.2 p.p. in Samoa. The majority of Pacific economies increased their tax-to-GDP ratios since 2010 (Nauru since 2014), while only two (the Cook Islands and Papua New Guinea) had lower tax-to-GDP ratios in 2019 than in 2010.

In eight Asian and Pacific economies, changes in tax-to-GDP ratios over the last decade did not reflect the more recent trend in tax-to-GDP ratios in the last five years. While tax-to-GDP ratios in the Cook Islands, Mongolia, Viet Nam and Kazakhstan decreased between 2010 and 2019, tax-to-GDP ratios in these economies showed either no change (in the Cook Islands) or an increase between 2015 and 2019. The opposite can be observed in Indonesia, Fiji, the Solomon Islands and the Maldives: while tax-to-GDP ratios increased in these economies over the last decade, they decreased between 0.5 p.p. in the Indonesia and 2.7 p.p. in the Solomon Islands during the last five years (2015 to 2019).

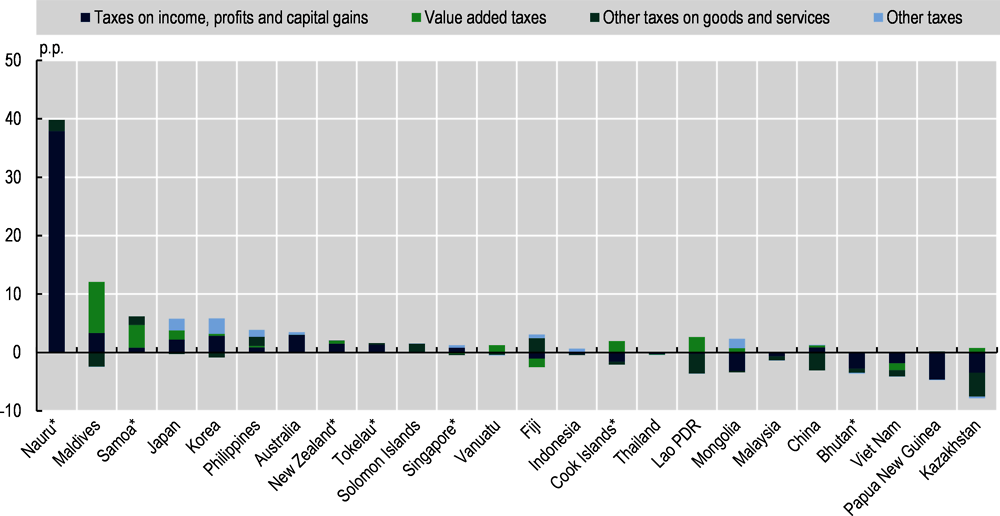

Changes in tax-to-GDP ratios between 2010 and 2019 by tax category

Between 2010 and 2019, corporate income tax (CIT) revenues were the major driver of decreases observed in tax-to-GDP ratios in many economies, whereas different tax types drove the increases (Figure 1.6). These changes reflect the diverse range of policy measures and economic developments in the 24 Asian and Pacific economies over this period.

Of the ten economies where tax-to-GDP ratios declined between 2010 and 2019, lower CIT revenues contributed to the declines in eight. The largest declines in the tax-to-GDP ratios were in Bhutan (3.8 p.p.), Viet Nam (4.1 p.p.), Papua New Guinea (4.5 p.p.) and Kazakhstan (7.1 p.p.) and resulted primarily from declines in CIT revenues:

The decrease in Bhutan (3.8 p.p.) was mainly driven by decreases in revenue from CIT (3.2 p.p.) and excises (1.6 p.p.), due to lower revenues from the business income tax and a generally lower economic activity (World Bank, 2021[32]). Additionally, as described in the previous section, the removal of the excise duty refund from India due to the introduction of Goods and Service Tax caused a decrease in revenues from excises in 2019. The use of a fiscal year which includes the first six months of 2020 also means the 2019 figures were affected by the COVID-19 pandemic.

The decrease in tax-to-GDP ratio between 2010 and 2019 in Viet Nam was the result of lower revenues from CIT (2.4 p.p.), VAT (1.2 p.p.) and excises (1.2 p.p.). Over the last decade, Viet Nam lowered the CIT rate from 25% to 22% in 2013, and to 20% in 2016, introduced preferential tax rates for SMEs in 2018 and reduced several excises (OECD, 2015[33]) (PwC, 2021[34]).

Papua New Guinea and Kazakhstan were affected by declines in natural resource prices:

Between 2010 and 2019, CIT revenues in Papua New Guinea decreased by 4.4 p.p. due to lower revenues from the mining and petroleum tax, which accounted for half as much tax revenue in nominal terms in 2019 as it did in 2010. Other factors such as slower economic growth and an earthquake in 2018 also contributed to the decline in the tax-to-GDP ratio in Papua New Guinea (IMF, 2020[35]).

The decline in tax-to-GDP ratio for Kazakhstan was mainly driven by decreases in CIT (3.3 p.p.), decreases in customs and import duties (1.1 p.p.) and decrease in taxes on the production of useful minerals (3.1 p.p.). Kazakhstan was particularly affected during the commodity price shock in 2014, as more than one-third of budgetary revenues are generated through the oil sector (OECD, 2019[36]).

Fourteen economies recorded increases in their tax-to-GDP ratios between 2010 and 2019. The highest increases were seen in the Maldives, Nauru (since 2014), and Samoa, which all recorded increases larger than 6 percentage points.

In Samoa, the increase in the tax-to-GDP ratio of 6.2 p.p. was due to VAT increasing by 3.9 p.p., other taxes on goods and services by 1.5 p.p. and income taxes by 0.8 p.p.. Samoa has implemented a variety of reforms to broaden the tax base and remove exemptions, and to improve tax administration efficiency and tax compliance (IMF, 2018[37]; Cullen, 2017[38]).

Both the Maldives and Nauru have introduced a variety of taxes over the last decade to increase government revenues:

Since 2014, Nauru has introduced an employment and services tax and a business tax, and improved revenue collection (IMF, 2020[21]).

The Maldives have undertaken a large tax policy reform since 2011 to increase tax revenue. Key policy changes included the introduction of a goods and services tax in 2011, a business tax, a corporate profit tax and a personal income tax (ADB, 2017[39]). For example, the tax-to-GDP ratio increased by 3.2 p.p. between 2010 and 2011, mainly due to the introduction of VAT. Subsequent rate increases in these three taxes have also contributed to the increase in tax revenues (ADB, 2017[39]).

Levels of revenues from tax categories in 2019 (as a percentage of GDP)

Australia, New Zealand and Tokelau had the highest levels of personal income tax (PIT) revenues as a percentage of GDP in 2019 (Figure 1.7). Revenue from PIT equated 12.8% of GDP in New Zealand, 11.8% of GDP in Australia (2018 figure) and to 10.3% of GDP in Tokelau. In the other Pacific economies covered in this publication, revenue from PIT was above 3.0% of GDP and closer to the Asia-Pacific (24) average of 3.6%, except in Fiji (1.7%) and Vanuatu (which does not have a PIT). For Nauru, it is not possible to distinguish between revenues from PIT and CIT. However, Nauru has the highest level of revenue from income taxes of all economies included in the publication, at 37.9% of GDP. In the Asian countries in this publication (excluding the Maldives, which do not levy PIT, and Japan and Korea), revenue from PIT in 2019 ranged from 1.0% of GDP in Lao PDR to 2.6% of GDP in Malaysia and the Philippines. Japan and Korea both had higher revenues from PIT than the rest of the Asian countries included in this publication, at 6.1% (2018 figure) and 4.8% respectively.

Revenues from corporate income tax (CIT) accounted on average for 3.6% of GDP across the Asia-Pacific region. They were higher than revenues from PIT in 13 of the 21 economies considered here (excluding Tokelau and Vanuatu, which do not have a corporate tax, and Nauru, for which a distinction between PIT and CIT revenues is not possible). Revenues from CIT ranged from 1.3% of GDP in the Lao PDR, to 5.6% in Malaysia. CIT revenue exceeded 5% of GDP in two countries, Australia and Malaysia, at 5.5% of GDP (2018 figure) and 5.6% of GDP respectively.

SSCs play a small role in the tax revenues of Asian and Pacific economies. Thirteen economies in this publication, including all Pacific economies, do not levy SSCs. In most of the other economies, revenues from SSCs were relatively low in 2019, including in Malaysia (0.3% of GDP), Indonesia and Kazakhstan (0.5% of GDP), Thailand (1.0% of GDP) and the Philippines (2.6% of GDP). These levels are significantly below the LAC average (3.9% of GDP) and the OECD average (9.0% of GDP in 2018). Four Asian countries reported relatively high revenues from SSCs: Mongolia (4.8% of GDP), China (6.1%), Korea (7.3%) and Japan (12.9%, 2018 figure).6 Data on SSC were not available for Viet Nam and Lao PDR.

Revenues from taxes on goods and services amounted to 9.9% of GDP on average across the 24 Asian and Pacific economies. In most of the Asian economies in this publication, revenues from taxes on goods and services as a percentage of GDP were below 10%, with the exception of Viet Nam (11.1%), Mongolia (12.0%) and the Maldives (14.6%) in 2019. In contrast, the majority of the Pacific economies in this publication generated revenues from taxes on goods and services above 10% of GDP, ranging from 10.3% of GDP in Nauru to 20.1% in Samoa in 2019. The exceptions in the Pacific were Papua New Guinea (5.2% of GDP), Australia (7.3% of GDP, 2018 figure) and Tokelau (8.9% of GDP).

The tax structure, measured as the composition of tax revenues from different tax types, is the second key indicator in Revenue Statistics. Considering the structure of taxation is useful for policy analysis as different taxes have different economic and social effects. Across the 24 economies in this publication, the composition of taxes varies widely, reflecting economies’ different policy choices, economic structures and conditions, tax administration capabilities and historical factors.

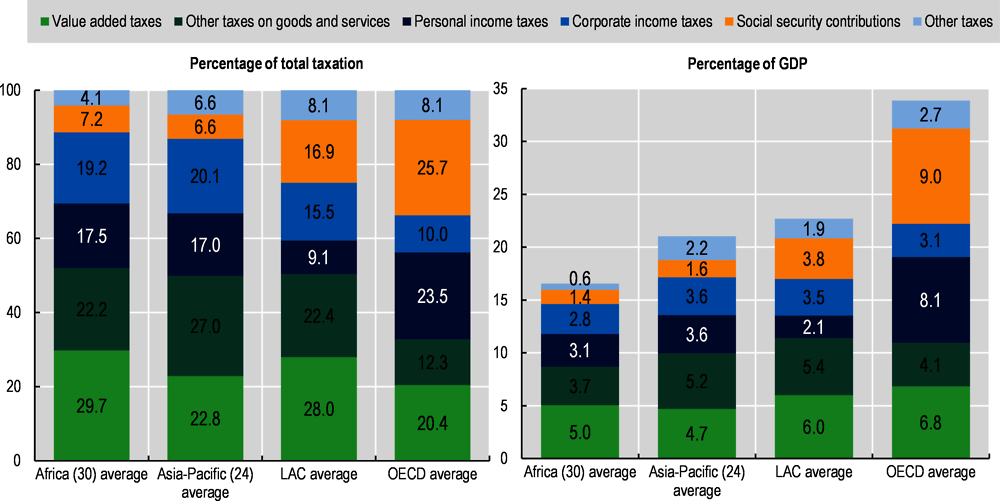

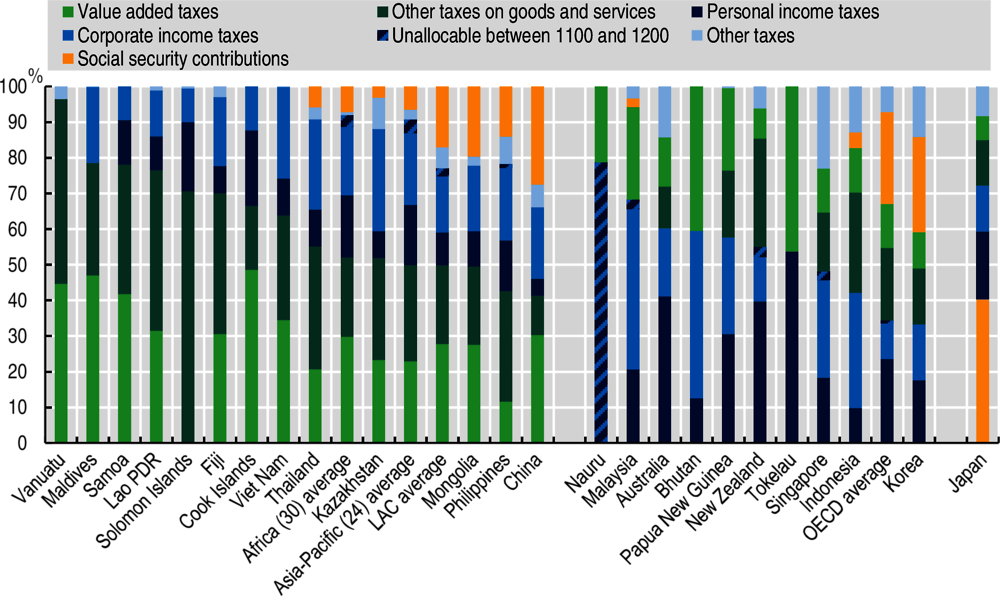

Tax structures in 2019 and evolution since 2010

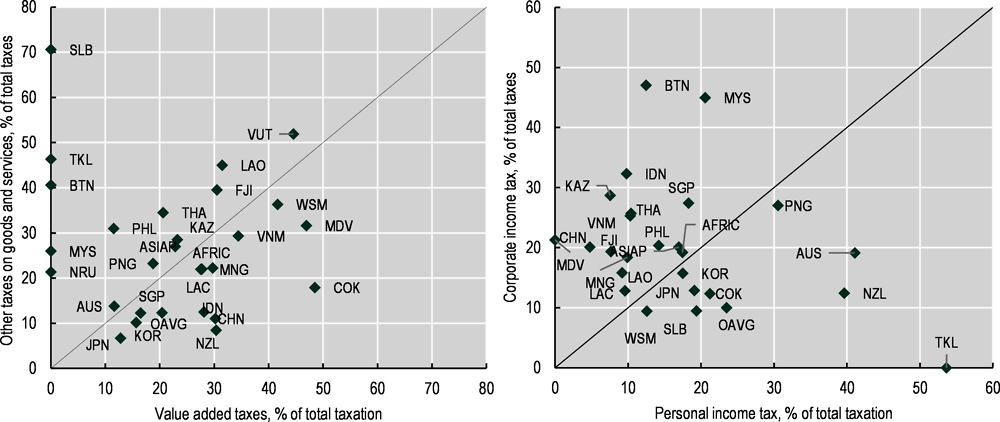

Average tax structures across the Asian-Pacific region, Africa, Latin America and the Caribbean and the OECD, shared some similarities in 2019. Revenues from goods and services contributed a similar share to total tax revenues across the Africa, Asia-Pacific and LAC regions, with 51.9% (2018 figure), 49.8% and 50.3% respectively and were higher than the OECD average of 32.7% (2018 figure). Taxes from other goods and services generated the largest share of total tax revenue (27.0%) in the Asia-Pacific region (Figure 1.8), which is significantly higher than the share in Africa (22.2%, 2018 figure) and the LAC average (22.4%), and is more than twice the level of the OECD average (12.3%, 2018 figure). Revenues from VAT were equivalent to 4.7% of GDP in Asia-Pacific, which had the smallest average share. At 22.8% of total taxation, they were closer to the OECD average of 20.4% (2018 figure), which was lower than the average share of VAT in Africa (29.7%, 2018 figure) or LAC (28.0%).

On average, income tax revenues in the Asian-Pacific region accounted for a similar share of total taxation as in Africa (39.2% and 38.7% (2018), respectively). In the Asian-Pacific region, revenues from PIT accounted for 17.0% of total taxes, similar to the Africa (30) average of 17.5% (2018 figure), above the LAC average (9.1%) and below the OECD average (23.5%, 2018 figure). CIT revenues accounted for a larger share of total tax revenues in the Asian-Pacific region, on average, at 20.1%, similar to the Africa (30) average (19.2%, 2018 figure) and above the shares in LAC (15.5%) and the OECD (10.0%, 2018 figure). The Asian-Pacific region had the lowest share of SSCs of the four averages: they contributed 6.6% of total taxes in Asia-Pacific, 7.2% in Africa (2018 figure), 16.9% in LAC and 25.7% of total taxes in OECD countries (2018 figure).

Within the Asia-Pacific region, tax structures also varied greatly in 2019. In 13 economies, the main source of tax revenue was taxes on goods and services, while ten economies obtained the primary share of tax revenues from income taxes. Japan is the only country in which the greatest share of revenues was derived from SSCs. There were also notable differences between the ASEAN countries in the publication and the Pacific Islands, discussed further in Box 1.3.

In 2019, income taxes were the largest source of revenue for Australia (2018 figure), Bhutan, Indonesia, Korea, Malaysia, Nauru, New Zealand, Papua New Guinea, Singapore and Tokelau. Among these economies, the share of income tax revenue in total tax revenue varied from 33.2% in Korea to 78.6% in Nauru. CIT revenues were higher than PIT revenues in four Asian countries (Bhutan, Indonesia, Malaysia and Singapore), while all Pacific economies in this group (Australia, New Zealand, Papua New Guinea and Tokelau), as well as Korea, raised higher shares of revenue from PIT.7

Taxes on goods and services were the main source of tax revenue in China, the Cook Islands, Fiji, Kazakhstan, Lao PDR, the Maldives, Mongolia, Philippines, Samoa, the Solomon Islands, Thailand, Vanuatu and Viet Nam in 2019, contributing between 41.3% (China) and 96.4% (Vanuatu) of total tax revenue. In seven of these economies, taxes on goods and services other than VAT, such as excises and import duties, typically contributed a larger share than VAT revenues to total tax revenues. Revenues from other taxes on goods and services in these economies ranged from 28.5% of total tax revenues in Kazakhstan to 70.6% in the Solomon Islands, while six economies received a larger share of revenue from VAT, ranging from 27.5% in Mongolia to 48.5% in the Cook Islands.

Among the 24 economies included in this publication, two distinct subgroups can be identified: a group of eight Pacific Island economies and a group of seven members of the Association of Southeast Asian Nations (ASEAN). The Pacific Island economies share, despite their diversity, common characteristics, such as remoteness, small populations, limited economic diversification, particular exposure to natural disasters and climate change (ADB, 2016[41]). The eight Pacific Island economies included in this publication are the Cook Islands, Fiji, Nauru, Papua New Guinea, Samoa, the Solomon Islands, Tokelau and Vanuatu, and form the Pacific Islands (8) average. The second sub-regional group includes the seven ASEAN member states in this publication. ASEAN is a regional organisation, founded in 1967, that promotes economic, political and social collaboration amongst its member states and within the region (ASEAN, 2021[42]). Seven of the ten ASEAN members are included in this publication: Indonesia, Lao PDR, Malaysia, the Philippines, Singapore, Thailand and Viet Nam, grouped into the ASEAN (7) average.1

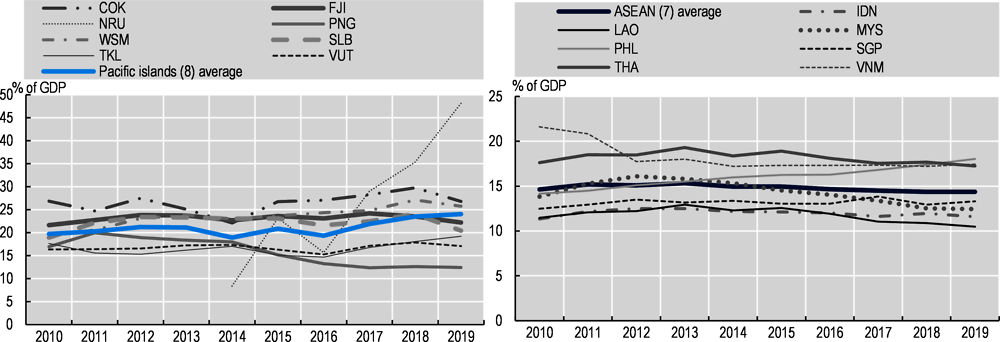

The Pacific Island economies generally had higher tax-to-GDP ratios than the ASEAN (7) countries (Figure 1.9). Tax-to-GDP ratios ranged from 12.4% of GDP in Papua New Guinea to 48.2% in Nauru in 2019 across the Pacific Island economies, with an average of 24.0%. Across the ASEAN (7) economies, tax-to-GDP ratios ranged from 10.5% in Lao PDR to 18.0% in the Philippines in the same year, with an average of 14.4%.

Since 2010, tax-to-GDP ratios in the Pacific Island economies increased, while they decreased on average in the ASEAN (7) economies. Most Pacific Island economies increased their tax-to-GDP ratios between 2010 and 2019, with the exception of the Cook Islands (declined by 0.1 p.p.) and Papua New Guinea (declined by 4.5 p.p.). The increases varied between 0.6 p.p. in Fiji to 39.8 p.p. in Nauru (since 2014), while the average tax-to-GDP ratio in Pacific Island economies, excluding Nauru, increased by 0.9 p.p. between 2010 and 2019. Tax-to-GDP ratios decreased in four of the seven ASEAN countries, and increased in Indonesia (0.2 p.p.), Singapore (0.8 p.p.) and the Philippines (3.9 p.p.).

Regional differences are also reflected in the average tax structures, as displayed in Figure 1.10. While revenues from taxes on goods and services play an important role in both regions (47.6% of total taxes in the ASEAN (7) countries and 61.4% in the Pacific Island economies), the composition of the taxes on goods and services differs. Revenues from VAT contributed on average 20.4% of total taxation in the ASEAN (7) economies in 2019, which is lower than the Asia-Pacific (24) average (22.8%) and the Pacific Islands (8) average (23.0%). Revenues from other taxes on goods and services accounted for the largest share of total taxes in both the ASEAN (7) and the Pacific Island economies. However, the share of these taxes was 38.4% in the Pacific Island economies, 10 p.p. larger than the average share of 27.2% in the ASEAN (7) countries in 2019.

Another difference in structure between the averages is seen in the balance of personal and corporate income tax revenues. CIT revenues played a relatively small role in the tax structures of Pacific Island economies and contributed only 9.7% on average to total tax revenue in 2019, whereas revenues from CIT accounted for 27.0% on average in the ASEAN (7) countries and 20.1% of total taxes of the Asia-Pacific (24) average. Revenues from PIT accounted for an average of 13.3% of total taxes in the ASEAN (7) countries, 17.0% in the Asia-Pacific region and 18.1% in Pacific Island economies in 2019.

← 1. The ASEAN members not included are Cambodia, Myanmar and Brunei Darussalam.

As discussed earlier, SSCs played a small role in revenues for most Asian and Pacific economies, with a few exceptions in Asian countries. Japan derived the largest share of total tax revenues from SSCs (40.2% in 2018) while these also played a significant role in revenues in Mongolia (19.8%), Korea (26.7%) and China (27.5%).

VAT is an increasingly important source of revenues for most economies in this publication, particularly in the Pacific. Excluding Nauru, Malaysia, Bhutan, Tokelau and the Solomon Islands, which do not have value added taxes, VAT revenues in 2019 ranged from 11.5% of total tax revenue in the Philippines to 48.5% in the Cook Islands. In eight of the 14 Asian economies included in this publication the share of revenues from VAT was below 25% and ranged from11.5% in the Philippines to 23.2% in Kazakhstan, whereas VAT generated more than 25% of total taxes in six Asian economies (Mongolia, Indonesia, China, Lao PDR, Viet Nam and the Maldives). The share of revenues from VAT in total taxes was generally higher across Pacific economies, with only two economies (Australia at 11.7% and Papua New Guinea at 18.8% of total taxes) reporting shares below 30%, while the share in the rest of the economies ranged from 30.4% in New Zealand to 48.5% in the Cook Islands in 2019. On average, the share of VAT in total tax revenue in Asia-Pacific (24) in 2019 (22.8%) was similar to the OECD average of 20.4% (2018 figure) and lower than the LAC (27.7%) and Africa (30) averages (29.7%, 2018 figure).

In 2019, revenues from other goods and services contributed between 6.7% of total tax revenue in Japan (2018 figure) and 70.6% in the Solomon Islands (Figure 1.11). The high share in the Solomon Islands was derived from general taxes on goods and services, such as the goods tax and the sales tax and export duties on various products, particularly logging (the Solomon Islands do not apply a VAT). Shares of other taxes on goods and services in total revenue are also comparatively high in Bhutan, Fiji, Samoa, Tokelau, Lao PDR and Vanuatu, where they are larger than 35% of total tax revenues.

In 2019, revenue from other taxes on goods and services played a more prominent role in the Pacific economies than in the Asian countries covered in this publication. Seven of the ten Pacific economies generated more revenue from other taxes on goods and services than from VAT, whereas eight of the 14 Asian countries received more revenue from VAT. For the Africa, LAC and OECD averages, revenue from VAT contributed a larger share to total tax revenue than other goods and services while the opposite was true for the Asia-Pacific (24) average.

Between 2010 and 2019, the share of revenue from VAT increased most in the Maldives (by 46.9 p.p.), Lao PDR (25.8 p.p.) and Kazakhstan (10.2 p.p.). Both the Maldives and Lao PDR introduced VAT within this timeframe (in 2011 and 2010, respectively). While Lao PDR replaced the earlier turnover tax with a VAT, (Keomixay, 2010[43]) the Maldives introduced a VAT (also known as the goods and sales tax) for the first time to raise revenue (ADB, 2017[39]). Increases in the share of VAT in total taxation in Kazakhstan were mainly the result of improved VAT administration (IMF, 2020[44]).

Seven economies experienced a decline in the share of VAT revenues over this period: Australia, Fiji, Korea, New Zealand, the Philippines, Singapore and Thailand. In Fiji, the share of VAT revenue declined by 7.5p.p. in 2019 to 30.5% of total tax revenue, following a decrease of the VAT rate from 15% to 9% in 2016. Decreases in Australia (2010 to 2018), Korea and the Philippines were less than 2 p.p., while the share decreased by 3.1 p.p. in Singapore over the same period. The share of VAT revenues decreased the least in New Zealand (-0.3 p.p.) and Thailand (-0.2 p.p.).

The composition of revenues from income taxes between CIT and PIT also varied in Asian and Pacific economies (Figure 1.12). In most Asian economies included in this publication, the share of revenues from CIT as percentage of total taxation was higher than the share of revenues from PIT in 2019, except for Japan and Korea. In contrast, all Pacific economies, with the exception of Fiji, reported higher shares of revenues from PIT than CIT (see Box 1.3).

In 2019, revenues from CIT contributed between 9.4% of total tax revenue in Samoa and 47.0% of total tax revenue in Bhutan. In eight economies, the share of CIT revenues in total tax revenue exceed 25% and many of these economies receive a significant share of CIT from companies in the oil and mining sector (Mongolia, Malaysia, Kazakhstan, Indonesia and Bhutan). By contrast, revenue from PIT as a percentage of total tax ranged from 4.8% in China to 53.7% in Tokelau (the latter does not have a CIT).

Between 2010 and 2019, revenues from CIT and PIT were relatively variable as a share of total tax revenues in all economies covered in this publication, while the magnitude of the change was greater for CIT than PIT revenues. The share of CIT revenues was lower in 2019 than in 2010 in twelve economies, by between 0.5 p.p. of total tax revenues in the Solomon Islands and 18.7 p.p. in Papua New Guinea.

The share of revenues from PIT decreased for four Asian and Pacific economies between 2010 and 2019, and decreased by 1.0 p.p. in Samoa and the Solomon Islands and by 6.5 p.p. and 7.6 p.p., respectively, in Fiji and the Cook Islands. Revenue from PIT increased as a share of total taxation for 17 economies (excluding China, Nauru and Vanuatu) over this period, from 0.3 p.p. in Thailand to 6.9 p.p. in Papua New Guinea.

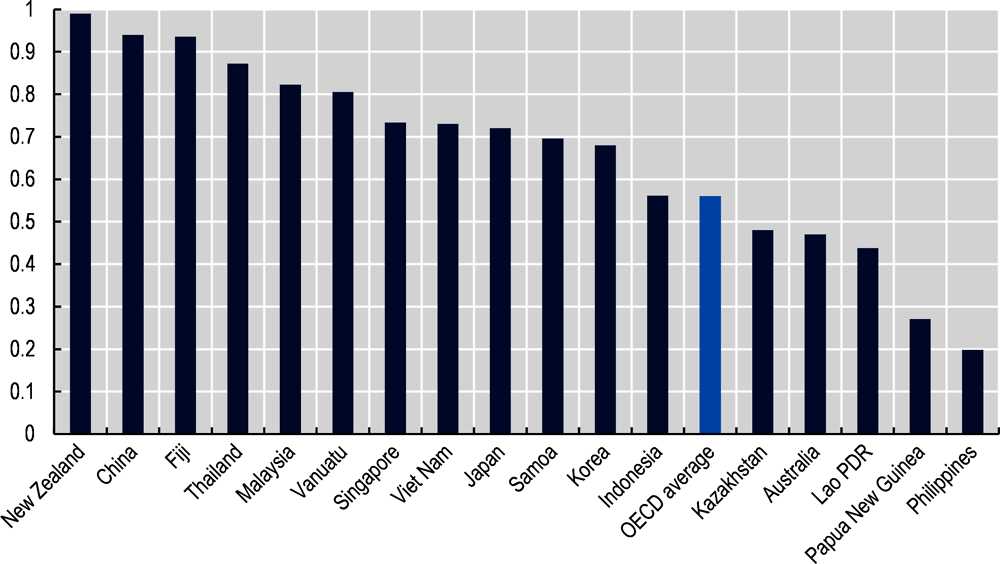

The VAT revenue ratio (VRR) measures the difference between the VAT revenue collected and what would theoretically be raised if VAT was applied at the standard rate to the entire potential tax base in a “pure” VAT regime and all revenue was collected. A VRR of 1 suggests no loss of VAT revenue as a consequence of exemptions, reduced rates, fraud, evasion or tax planning. This box describes the VRR levels in selected Asian and Pacific economies in this publication.

There was a wide disparity of VRRs in the Asia-Pacific region in 2018 (Figure 1.13). The Philippines had the lowest VRR (at 0.2)1 while New Zealand had the highest (at 0.99)2. Of the economies with available data in this publication, 12 economies (China, Fiji, Indonesia, Japan, Korea, Malaysia, New Zealand, Samoa, Singapore, Thailand, Vanuatu and Viet Nam) had relatively high VRRs in 2018, above the OECD average of 0.56. This is partially because of the relatively broad-based VAT in some economies: for example, New Zealand and Japan did not have any reduced rates in 20183, while Singapore only exempts sales and leases of residential properties, the import and local supply of investment precious metals, and some financial services (IRAS, 2021[45]). Korea has a reduced rate on a limited number of products. In comparison, many other OECD countries have one or more reduced rates (OECD, 2020[46]), which partly explains the lower average VRR in the OECD region as a whole.

The VRR needs to be interpreted with caution and can be affected by several factors that inflate it. One reason can be where exemptions on products and services relating to intermediate consumption can lead to a cascading effect that increases VAT revenue (IMF, 2017[47]). For example, in Thailand, a large number of exemptions on a variety of products may cause “cascading”, which artificially increases the VRR. Another reason the VRR may be inflated is if refund processes do not work correctly, which may discourage taxpayers from claiming their VAT refunds, resulting in artificially higher VAT revenue and VRR.

In addition, the interpretation of the VRR is also more difficult for economies relying significantly on tourism, such as many Pacific Island economies. These economies may record a high VRR due to methodological reasons: purchases by non-residents may not be included in final consumption expenditure (the denominator) whereas the VAT on these purchases is included in the overall VAT revenues (the numerator) (Keen, 2013[48]).

On the other hand, the VRR can be deflated by the absence of rules and mechanisms for the collection of VAT on inbound business-to-consumer (B2C) supplies of services resulting from the ever-growing digital trade. To date, over 60 countries in the world have adopted rules for the application of VAT to such supplies and 40 of them have implemented simplified registration and collection regimes for the actual collection of VAT according to the OECD standards. Japan and Korea collect VAT on these supplies since 2015; Indonesia and Singapore implemented similar measures in July 2020 and January 2021 respectively.

← 1. The low VRR observed in the Philippines is partly due to missing VAT revenue collected at customs as this revenue could not be distinguished from import duties.

← 2. The constant very high VRR in New Zealand is caused by three factors. First, New Zealand operates a very broad GST tax base with limited exemptions and a limited use of zero rates. Second, New Zealand treats public services as GST taxable. Although this does not generate actual additional revenue, this increases the share of revenues from GST in total tax revenues, which has an upward effect on the VRR. Third, the potential GST base determined on the basis of the national accounts does not include the value added by the government (OECD, 2020[46]).

← 3. Japan introduced a reduced rate on 1 October 2019.

Environmentally related taxes,8 and price-based policy instruments more generally, play an increasingly significant role in many countries to support a transition to a sustainable and low-carbon economic growth. By incorporating a price signal into consumer and producer decisions, these taxes give effect to the polluter-pays principle and encourage businesses and households to consider the environmental costs of their behaviour. Although environmentally related tax revenues9 are not separately identified in the standard OECD tax classification, they can be identified through the detailed list of specific taxes included for most countries within this overarching classification. It is on this basis that they are included in the OECD Policy Instruments for the Environment (PINE) database.10

A detailed examination of country-specific taxes for the Asian and Pacific economies for which information is available demonstrates that revenue from environmentally related taxes in 2019 ranged from no (or very close to zero) environmentally related taxes in Tokelau, Viet Nam and Papua New Guinea, to 5.4% of GDP in the Solomon Islands.11 The case of the Solomon Islands is notable as their environmentally related tax revenue is particularly high compared to other Asian and Pacific economies or the OECD average, due in large part to higher export duties, particularly on timber. The next highest revenues from environmentally related taxes in the region in 2019 were found in Mongolia, Japan, New Zealand and Fiji, amounting to 1.7% of GDP in Mongolia and 1.3% in the other three countries. On average, environmentally related taxes amounted to 1.1% of GDP in the Asia-Pacific region.

Asian and Pacific economies rely on different environmentally related tax revenue (ERTR) bases:

In the Solomon Islands and Kazakhstan, the majority of ERTRs comes from resource taxes (excise taxes on timber in the Solomon Islands, and excise taxes on minerals in Kazakhstan). They represent the totality for the Solomon Islands and 69.6% of total environmentally related tax revenue in China.

In other Asian and Pacific economies, ERTRs are principally raised via taxes on energy (five countries, most commonly from diesel and petrol excises) and from transport taxes (six countries, registration or road use of motor vehicles or departure taxes). In almost all of these countries, a combination of these two types of taxes is used; Nauru and Maldives are the exception as they resort entirely to transport taxes, sourcing most of the ERTRs from departure taxes and passenger taxes.

The composition of environmentally related tax revenues is markedly different in Asian and Pacific economies than in African, LAC and OECD countries. In 2019, revenues from transport taxes and resources taxes generated the highest share of total environmentally related tax revenue in the Asia-Pacific region (0.4% of GDP for both), whereas energy taxes amounted to 0.2% of GDP on average (19.6% of total environmentally related tax revenue in Asia-Pacific). In contrast energy taxes were the principal share of environmentally related tax revenue in the other regions (69.8% in Africa [2018 figure], 69.9% in the OECD [2018 figure] and 62.9% in LAC).

In general, the use of taxation to address environmental issues is low in the region and there is scope to increase use of such instruments, as recently shown by Singapore. In 2019, Singapore became the only country in Southeast Asia to impose a carbon tax. Its payment was first levied in 2020, based on emissions in 2019. The tax is applied on the total direct emissions of facilities that emit 25 000 tCO2e or more annually, and covers six greenhouse gases (NCCS, 2020[52]). This tax complements the carbon emissions-based vehicle scheme (CEVS) introduced in January 2013, which levies a tax on all new cars, taxis and newly-imported used cars, based on their CO2/km performance.

The under-utilisation of environmental taxes in the Asia-Pacific region needs also to be understood in the context of the extensive use of fossil fuels subsidies. Reforming energy subsidies is considered by ADB (2016[53]) as “one of the most important policy challenges for developing Asian economies”. UN ESCAP (2016[54]) recommends that governments gradually phase out energy subsidies while implementing measures to compensate vulnerable groups and to ensure international competitiveness in a sustainable way. Reforming energy subsidies while at the same time implementing environmental taxation has the potential to mobilise significant government revenues and help to meet the Sustainable Development Goals (SDGs).

This section discusses the relative share of tax revenues attributed to different levels of government in 2019: central government, regional or provincial government (including state government, where relevant), and local government as well as social security funds.

In many economies included in this publication, sub-national taxes generated a small share of total tax revenues in 2019 (Table 1.1). Shares of sub-national government tax revenue in the Asian countries ranged from 0.1% of total revenues in Bhutan to 35.3% in China. In Indonesia, revenues attributed to sub-national governments rose to over 11% in 2019, following the shift of property taxation to the local level in 2014. Revenue collected by sub-national governments accounted for 14.5% of total taxes in 2019 in Mongolia. In New Zealand, sub-national government revenues were 7.0% and in Australia, subnational revenues (including both state and local tax revenues) amounted to 18.8% of total tax revenues (2018 figure).

The types of taxes levied by local governments vary between countries. Local governments in the Philippines have a narrow range of taxes under their jurisdiction, relying on property taxes and taxes on income and profits. Sub-national governments in Japan and Korea raised revenue from taxes on income and profits, property taxes, taxes on goods and services, payroll (Korea only) and other taxes. The share of sub-national government revenue also depends on the range of services that local governments are expected to provide: for example, local revenues are higher in Japan, where local governments finance a wide range of goods and services including public welfare and are responsible for financing some education and debt servicing (Beshho, 2016[55]).

Between 2000 and 2019, the share of revenues collected by sub-national governments was stable, with the exception of Indonesia and Kazakhstan. In Indonesia, the share of revenues attributed to sub-national governments increased by 8.2 p.p., whereas in Kazakhstan it decreased by 29.6 p.p.

With SSCs generating a smaller proportion of total revenues in Asia and the Pacific than in other regions, the share of revenues attributed to social security funds was also low. Australia, Bhutan, New Zealand and Singapore do not have social security funds and the proportion of total tax revenues collected by social security funds therefore was zero in 2019, and was under 6% of total revenues in Indonesia, Kazakhstan, Malaysia and Thailand. By contrast, countries that source a greater share of their revenues from SSCs also had higher shares of revenues attributed to social security funds: at 40.2% of tax revenues in Japan in 2018, 27.5% in China, 26.7% in Korea,19.8% in Mongolia in 2019. The share of tax revenues attributed to social security funds has increased in Japan (by 5.0 p.p.) and Korea (by 10.0 p.p.) since 2000, and in Mongolia since 2006 (by 9.6 p.p.).

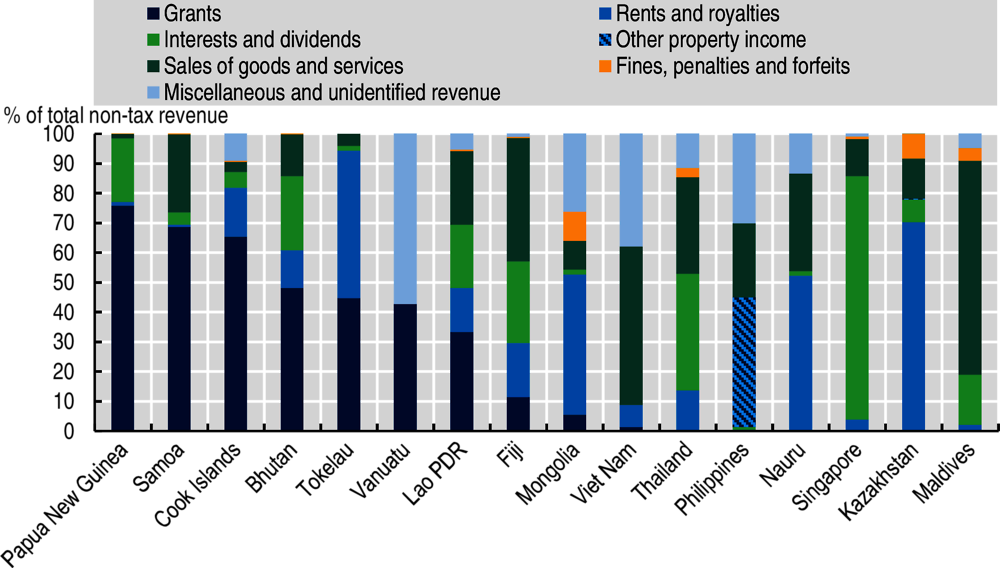

This publication also includes information on non-tax revenues for selected economies for which data are available. Non-tax revenues are defined as all revenues received by general government that do not meet the OECD definition of taxes, as set out in the Interpretative Guide (Annex A). They are further divided into five categories according to the definitions set out in Annex B: grants; property income; sales of goods and services; fines, penalties and forfeits; and miscellaneous and unidentified revenues.

Non-tax revenues as a percentage of GDP

Non-tax revenues were equivalent to a significant share of GDP in 2019 for six economies for which data are available. Non-tax revenues amounted to 11.0% of GDP in 2019 in Samoa, 15.3% in the Cook Islands, 19.2% in Bhutan and 24.4% of GDP in Vanuatu, whereas they amounted to 85.2% of GDP for Nauru and to 220.1% of GDP for Tokelau. The very high level of non-tax revenues in Tokelau, measured as a share of GDP, is due to the fact that non-tax revenues are derived primarily from payments by foreign vessels for access to Tokelau’s fishing waters. In the 2008 System of National Accounts, these revenues are recorded as part of GNI but they do not add to GDP. By contrast, non-tax revenues are below 8.5% of GDP in the remaining economies.

Non-tax revenues have been increasing since 2010 (or earliest available year) as a share of GDP in the majority of the economies but declining for Bhutan, Lao PDR, Maldives, Mongolia and Papua New Guinea. The largest increases occured in Tokelau (65.5 p.p.), Nauru (56.4 p.p., since 2014) and Vanuatu (16.1 p.p.). The upward trend for Tokelau has been driven by higher revenues from property income, which is entirely sourced from fishery income. Tokelau receives support from New Zealand to strengthen the management of its Exclusive Economic Zone to maximise Tokelau's revenue collection from its international fisheries (New Zealand Foreign Affairs & Trade, 2018[56]). Fisheries income also increased after Tokelau became a partner to the Nauru Agreement, which administers the fishing vessel-day scheme (VSD). The VSD is the system to sustainably manage the world’s largest tuna fishery in the Western and Central Pacific Ocean, and has increased revenue to participating islands by over 500% in the past six years (Parties to the Nauru Agreement, 2016[57]). The increase in non-tax revenue for Vanuatu is mainly due to the government citizenship programme (Department of Finance and Treasury of Vanuatu, 2018[58]).

Structure of non-tax revenues

Non-tax revenues are divided into different categories: grants; property income; sales of goods and services; fines, penalties and forfeits; and miscellaneous and unidentified revenues.

In 2019, the shares of each of these categories in total non-tax revenues varied across the 16 economies for which data are available (Figure 1.15). Notable trends include:

Grants were an important source of revenues for half of the economies in 2019, exceeding 30% of total non-tax revenues in seven economies: Lao PDR (33.2%), Vanuatu (42.6%), Tokelau (44.7%), Bhutan (48.1%), the Cook Islands (65.4%), Samoa (68.6%) and Papua New Guinea (75.8%). In 2019, they were the main source of non-tax revenues for the Cook Islands, Samoa, Papua New Guinea and Bhutan.

Property income accounted for over 40% of total non-tax revenue in more than half of the economies for which non-tax revenue data are available. There were only four economies in which property income accounted for less than 20% of total non-tax revenue: Vanuatu, which does not generate revenues from property income, Samoa (4.9%), Viet Nam (7.4%) and the Maldives (18.9%). Property income accounted for more than half of the total non-tax revenues in five economies in 2019: Tokelau (51.2%), Thailand (52.6%), Nauru (53.8%), Kazakhstan (78.1%) and Singapore (85.7%). Property income in Tokelau and Nauru was derived predominantly from fisheries (i.e. fishing rents, fishing days, support vessels, etc.), which represented more than 80% of total property income in both economies. Rents and royalties accounted for 70.2% of total non-tax revenue in Kazakhstan in 2019, mainly from oil revenues. Interests and dividends represented the majority of non-tax revenues for Thailand (39.3%) and Singapore (81.9%).

References

[30] ADB (2021), Bhutan | ADB COVID-19 Policy Database, https://covid19policy.adb.org/policy-measures/BHU.

[28] ADB (2020), COVID-19 Active Response and Economic Support Program: Report and Recommendation of the President.

[39] ADB (2017), “Fast-Track Tax Reform Lessons from Maldives”, https://doi.org/10.22617/TIM178673-2.

[53] ADB (2016), Fossil Fuel Subsidies in Asia: Trends, Impacts, and Reforms, https://www.adb.org/sites/default/files/publication/182255/fossil-fuel-subsidies-asia.pdf.

[41] ADB (2016), Pacific Approach 2016-2020, https://www.adb.org/documents/pacific-approach-2016-2020 (accessed on 4 June 2021).

[6] Aizenman, E. (2015), “Tax revenue trends in Asia and Latin America: A comparative analysis”, NBER Working Paper No.217555, Cambridge, http://www.nber.org/papers/w21755.

[42] ASEAN (2021), History - ASEAN | ONE VISION ONE IDENTITY ONE COMMUNITY, https://asean.org/asean/about-asean/history/ (accessed on 4 June 2021).

[55] Beshho, S. (2016), “Case Study of Central and Local Government Finance in Japan”, ADBI Working Paper No.599, https://www.adb.org/publications/case-study-centraland-centraland-and-local-government-finance-japan/

[26] Central Bank of Samoa (2020), CBS maintains easing monetary policy stance for FY2020/21, https://www.cbs.gov.ws/index.php/media/press-releases/ (accessed on 6 May 2021).

[38] Cullen, R. (2017), E-government in Pacific Island countries, Springer, https://doi.org/10.1007/978-3-319-50972-3_1.

[58] Department of Finance and Treasury of Vanuatu (2018), Treasury Monthly Budget Report-November 2018, https://doft.gov.vu/images/2019/November_Monthly_Report_FINAL.pdf (accessed on 10 June 2020).

[9] Government of Nauru (2020), GON 2019-20 Final Budget Outcome, https://naurufinance.info/wp-content/uploads/2020/10/GON-Final-Budget-Outcome-2019-20-20201018.pdf (accessed on 3 June 2021).

[12] IMF (2021), World Economic Outlook, April 2021: Managing Divergent Recoveries, https://www.imf.org/en/Publications/WEO/Issues/2021/03/23/world-economic-outlook-april-2021 (accessed on 11 May 2021).

[49] IMF (2021), World Economic Outlook, April 2021: Managing Divergent Recoveries, International Monetary Fund, Washington, DC, https://www.imf.org/en/Publications/WEO/Issues/2021/03/23/world-economic-outlook-april-2021 (accessed on 15 June 2020).

[35] IMF (2020), Papua New Guinea : 2019 Article IV Consultation and Request for Staff Monitored Program-Press Release; Staff Report; and Statement by the Executive Director for Papua New Guinea, https://www.imf.org/en/Publications/CR/Issues/2020/04/06/Papua-New-Guinea-2019-Article-IV-Consultation-and-Request-for-Staff-Monitored-Program-Press-49307 (accessed on 17 May 2021).

[25] IMF (2020), Republic of Fiji : 2019 Article IV, https://www.imf.org/en/Publications/CR/Issues/2020/03/19/Republic-of-Fiji-2019-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-49279 (accessed on 6 May 2021).

[44] IMF (2020), Republic of Kazakhstan : 2019 Article IV Consultation-Press Release; and Staff Report, https://www.imf.org/en/Publications/CR/Issues/2020/01/29/Republic-of-Kazakhstan-2019-Article-IV-Consultation-Press-Release-and-Staff-Report-49002 (accessed on 10 May 2021).

[21] IMF (2020), Republic of Nauru : 2019 Article IV Consultation, https://www.imf.org/en/Publications/CR/Issues/2020/01/29/Republic-of-Nauru-2019-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-49001 (accessed on 30 June 2020).

[27] IMF (2020), Solomon Islands : 2019 Article IV Consultation, https://www.imf.org/en/Publications/CR/Issues/2020/02/18/Solomon-Islands-2019-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-49060. (accessed on 28 May 2020).

[10] IMF (2019), World Economic Outlook - Frequently Asked Questions, https://www.imf.org/external/pubs/ft/weo/faq.htm#q4d (accessed on 6 September 2019).

[31] IMF (2018), Bhutan : 2018 Article IV Consultation, https://www.imf.org/en/Publications/CR/Issues/2018/10/30/Bhutan-2018-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-46319 (accessed on 6 May 2021).

[37] IMF (2018), Samoa : 2018 Article IV Consultation-Press Release; Staff Report; Staff Statement; and Statement by the Executive Director for Samoa, https://www.imf.org/en/Publications/CR/Issues/2018/06/04/Samoa-2018-Article-IV-Consultation-Press-Release-Staff-Report-Staff-Statement-and-Statement-45934 (accessed on 24 June 2020).

[47] IMF (2017), Indonesia : Selected Issues, https://www.imf.org/en/Publications/CR/Issues/2017/02/11/Indonesia-Selected-Issues-44654 (accessed on 24 June 2020).

[3] Inland Revenue Board of Malaysia (2016), “Agriculture allowances public ruling no. 1/2016”, http://www.hasil.gov.my/pdf/pdfam/PR_01_2016.pdf.

[45] IRAS (2021), Supplies Exempt from GST, Inland Revenue Authority of Singapore, https://www.iras.gov.sg/irashome/GST/GST-registered-businesses/Working-out-your-taxes/When-is-GST-not-charged/Supplies-Exempt-from-GST/.

[48] Keen, M. (2013), The anatomy of VAT, WP/13/111, International Monetary Fund, https://www.imf.org/en/Publications/WP/Issues/2016/12/31/The-Anatomy-of-the-VAT-40543.

[43] Keomixay, D. (2010), Value Added Tax in Lao PDR: Agenda for the Future.

[29] Ministry of Finance of the Cook Islands (2020), COVID-19 Tax Updates - Cook Islands - Ministry of Finance and Economic Management, http://www.mfem.gov.ck/rmd-tax/covid-19-tax-updates (accessed on 6 May 2021).

[4] Ministry of International Trade and Industry of Malaysia (2016), http://www.miti.gov.my/index.php/pages/view/content5235.html.

[52] NCCS (2020), Carbon Tax, https://www.nccs.gov.sg/faqs/carbon-tax/ (accessed on 22 June 2020).

[56] New Zealand Foreign Affairs & Trade (2018), “Aid partnership with Tokelau”, https://www.mfat.govt.nz/en/aid-and-development/our-work-in-the-pacific/tokelau/.

[24] OECD (2021), “Revenue Statistics in Asia and the Pacific: Comparative tables”, OECD Tax statistics (database).

[60] OECD (2021), ERTR restricted database.

[15] OECD (2021), Global Revenue Statistics Database, OECD Publishing, http://www.oecd.org/tax/tax-policy/global-revenue-statistics-database.htm.

[40] OECD (2021), Revenue Statistics - Asian and Pacific Economies: Country tables, OECD Tax statistics (database).

[50] OECD (2020), Annual national accounts (database), https://stats.oecd.org/Index.aspx?DataSetCode=SNA_TABLE1.

[46] OECD (2020), Consumption Tax Trends 2020: VAT/GST and excise rates, trends and policy issues, OECD Publishing, Paris, https://doi.org/10.1787/152def2d-en.

[51] OECD (2020), Database on Policy Instruments for the Environment, https://pinedatabase.oecd.org/ (accessed on 15 June 2020).

[1] OECD (2020), Revenue Statistics 2020, OECD Publishing, Paris, https://dx.doi.org/10.1787/8625f8e5-en.

[36] OECD (2019), Application of the Going for Growth Framework to Kazakhstan.

[18] OECD (2018), Making Development Co-operation Work for Small Island Developing States, OECD Publishing, Paris, https://dx.doi.org/10.1787/9789264287648-en.

[59] OECD (2017), Policy INstruments Environment, http://oe.cd/pine (accessed on 15 June 2020).

[5] OECD (2014), Development Co-operation Report 2014 : Mobilising Resources for Sustainable Development., OECD Publishing, Paris.

[16] OECD/AUC/ATAF (2020), Revenue Statistics in Africa 2020: 1990-2018, OECD Publishing, Paris, https://dx.doi.org/10.1787/14e1edb1-en-fr.

[17] OECD et al. (2021), Revenue Statistics in Latin America and the Caribbean 2021, OECD, https://doi.org/10.1787/96ce5287-en-es.

[33] OECD, I. (2015), Examples of Successful DRM Reforms and the Role of International Co-operation, https://www.oecd.org/ctp/tax-global/examples-of-successful-DRM-reforms-and-the-role-of-international-co-operation.pdf (accessed on 17 May 2021).

[57] Parties to the Nauru Agreement (2016), “PNA members confirm: Vessel Day Scheme is here to stay”, https://www.pnatuna.com/node/340.

[2] PEAKS, E. (2013), Taxation and Developing Countries, Overseas Development Institute training notes.

[34] PwC (2021), Vietnam - Corporate - Taxes on corporate income, https://taxsummaries.pwc.com/vietnam/corporate/taxes-on-corporate-income (accessed on 17 May 2021).

[22] Republic of Nauru (2021), 2021-22 Fiscal Strategy, https://naurufinance.info/wp-content/uploads/2021/06/Nauru-Fiscal-Strategy-2021-22.pdf (accessed on 4 June 2021).

[20] Republic of Nauru (2020), Quarterly budget performance report Quarter 4 2019-20, https://naurufinance.info/wp-content/uploads/2020/08/GON-Quarterly-report-Q4-2019-20-20200812.pdf (accessed on 12 May 2021).

[23] Republic of Nauru (2020), Republic of Nauru Government Gazette, http://www.naurugov.nr/media/136527/gazette_234-20.pdf (accessed on 8 June 2021).

[19] Republic of Nauru (2019), Employment and Service Tax Act.

[7] UNCTAD (2012), World Investment Report 2012, Towards a new Generation of Investment Policies, New York, http://unctad.org/en/PublicationsLibrary/wir2012_embargoed_en.pdf.

[54] UNESCAP (2016), Environmental Tax Reform in Asia and the Pacific, https://www.unescap.org/sites/default/files/S2_Environmental-Tax-Reform.pdf (accessed on 25 June 2020).

[8] UNESCAP (2014), Economic and Social Survey of Asia and the Pacific 2014, Regional Connectivity for Shared Prosperity, UN, https://www.unescap.org/sites/default/files/Economic20and%20Social%20Survey%20of%20Asia%20and%20the%20Pacific%202014.pdf.

[11] WHO (2015), Purchasing Power Parity 2005, http://www.who.int/choice/costs/ppp/en/.

[32] World Bank (2021), GDP growth (annual %) - Bhutan, World Development Indicators, https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=BT.

[14] World Bank (2020), “Central government debt, total (% of GDP)“, World Development Indicators (database), https://data.worldbank.org/indicator/GC.DOD.TOTL.GD.ZS.

[13] World Bank (2020), “Expense (% of GDP)”, World Development Indicators (database), https://data.worldbank.org/indicator/GC.XPN.TOTL.GD.ZS.

Notes

← 1. This information was provided by the Tokelau Statistical Office during exchanges with the OECD Secretariat in preparation of this publication.

← 2. This information was provided by the Ministry of Finance of China during exchanges with the OECD Secretariat in preparation of this publication.

← 3. This information was provided by the Ministry of Finance of the Cook Islands during exchanges with the OECD Secretariat during the technical webinar held on April 8 2021.

← 4. This information was provided by the Ministry of Finance of Bhutan during exchanges with the OECD Secretariat in preparation of this publication.

← 5. Data for Bhutan and Fiji are only available from 2008, so the data used for both economies in this section are from 2008-18. Data for the Africa (26) average cover 2008 to 2017. In addition, 2018 data for Australia, Japan and the OECD average are not available in (OECD, 2021[60]), so 2017 data are used instead. Nauru is excluded from this analysis as data are only available from 2014 onwards.

← 6. Detailed data on SSCs for China were not available, but the OECD Secretariat estimates SSCs to be approximately 4.0% of GDP in 2018 based on publicly available data from China's Ministry of Human Resources and Social Security.

← 7. For Nauru, it is not possible to distinguish between revenues from PIT and CIT.

← 8. An environmentally related tax is a tax whose base is a physical unit (or a proxy of a physical unit) of something that has a proven, specific harmful impact on the environment regardless of whether the tax is intended to change behaviours or is levied for another purpose (OECD, 2005[33]).

← 9. The figures in this report do not include revenues (that may be significant) from other policies addressing environmental issues such as fees and charges or revenues from emissions trading schemes. However the PINE database provides additional data on fees and charges, subsidies, voluntary approaches, tradable permits, deposit-refund systems for more than 80 countries (OECD, 2017[59]).

← 10. Data on environmentally related tax revenue are presented for four tax-base categories: energy (including all CO2 related taxes); transport (mostly motor vehicle taxes); pollution (e.g. discharges of waste or pollutants, taxes on waste or packaging); and resources (e.g. water extraction, hunting and fishing, mining) (OECD, 2017[59]).

← 11. These figures need to be treated with caution as some environmentally related taxes may not be captured if the data are not sufficiently disaggregated.