copy the linklink copied!Executive Summary

copy the linklink copied!Wellbeing is high, but must be sustained

Norway continues to enjoy among the highest living standards in the OECD area but faces challenges in sustaining them for the future.

OECD wellbeing indicators put Norway alongside the top-ranking countries. Reported well-being, jobs and earnings, work-life balance and the distribution of income are very favourable compared with most countries.

However, sustaining the high levels of economic output and comprehensive public services that are key to Norway’s wellbeing is a challenge. There is no longer scope for rapid public spending growth from fast growth in the wealth fund. It is tougher to fund public services and develop new projects. Continued weak productivity growth, relatively high labour costs, plus weakening labour-force participation are lessening economic capacity to support good outcomes in wellbeing.

Norway will need to substantially reduce transport-related greenhouse-gas emissions to achieve targets. Thanks to extensive hydropower, Norway has comparatively low baseline emissions, but substantial emission reduction is needed to hit targets. Around half of emissions are outside the European Trading Scheme and a large share of these relate to transport. Wide differences in carbon pricing mean policy is inefficient.

copy the linklink copied!The economy is vulnerable to trade and property-market risks

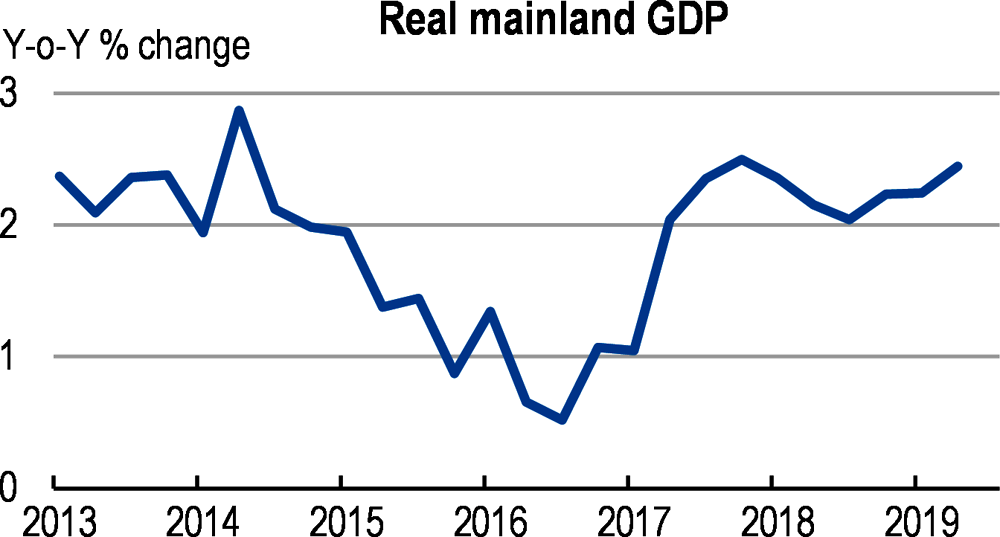

Growth in real mainland GDP has recovered from the 2014 oil-price shock and remains robust. However, external risks are substantial.

Mainland GDP growth remains sufficiently strong to drive further declines in unemployment. Also, wage growth has picked up. Mainland output growth is projected to ease over the projection horizon.

Monetary and fiscal policy stances are appropriate given current economic conditions. Following four hikes, the first in September 2018, the policy rate is now on hold, reflecting slowing output growth prospects and external risks. Government budgets have been aiming for a neutral stance.

External-demand risks remain elevated. The global slowdown in trade and investment, together with faltering business and consumer confidence in the euro area, is a risk to Norway’s predominantly European trade.

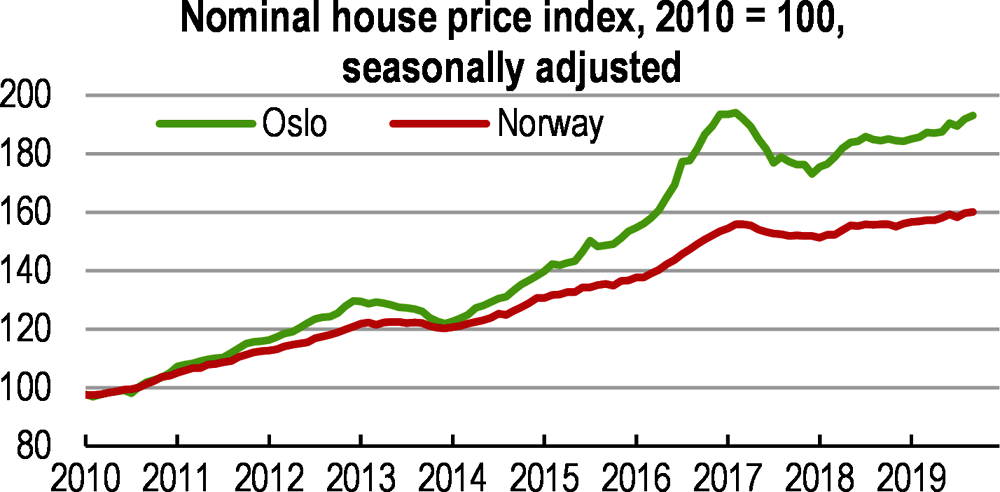

Property markets and related credit appear to be heading for a soft landing but risks remain. House-price growth has resumed at a subdued rate following some downward correction, suggesting demand for housing remains robust. Household debt continues to increase faster than disposable incomes, signalling a continued build-up of risk. Estimated selling prices of commercial real estate have been rising rapidly, which has previously foreshadowed wider economic difficulties.

The impact from any further housing market correction is most likely to come via consumption. Debt servicing remains high, implying a greater cutback in consumption in the event of an economic downturn. Thanks to mortgage-lending regulation, the quality of credit is sound and direct risks to banks via mortgage default appear well contained by their strong capitalisation.

The high share of wholesale bank funding is a concern. The scale of this funding, which is largely through covered bonds, is equivalent to just under 70% of GDP. Substantial cross holding of these bonds within the Norwegian financial sector increases inter-connectedness risks.

copy the linklink copied!Fiscal space is set to increase more slowly in the coming years

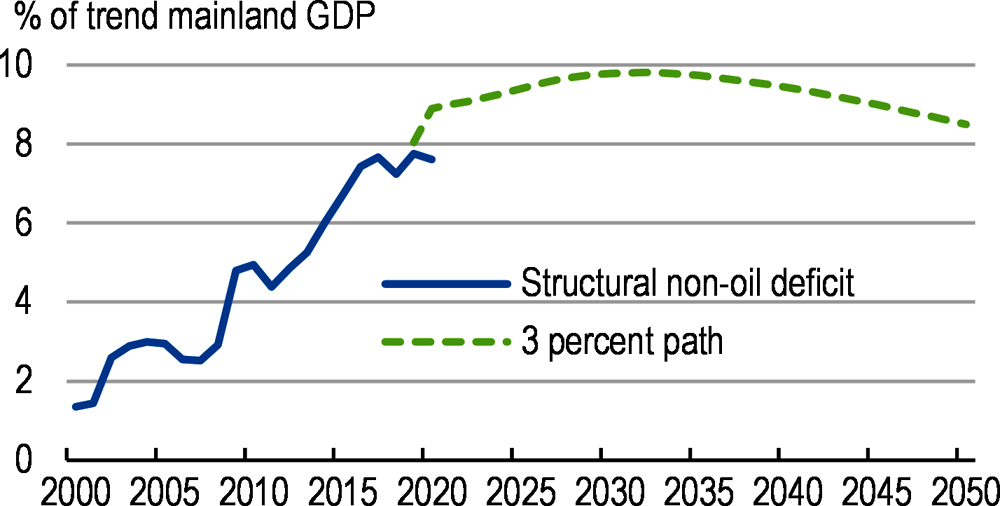

Due to a likely slowdown in wealth-fund growth, fiscal non-oil deficits in the coming years will only be able to increase marginally under the fiscal rule. Fiscal pressures will also come from additional spending commitments. These commitments are estimated to cost at least 0.3 percentage points of GDP each year on average. Rising health care and pension costs from population ageing are a significant component. A proposal in early 2019 to fund some public spending through an off-budget channel has illustrated the strong temptation to circumvent the fiscal rule; such proposals should be avoided.

Managing public finances within the fiscal rule should be achieved primarily through higher labour supply and increased value for money in public spending. There is scope for better public spending in many areas, as identified in the current, and past, Surveys, including through greater influence of cost-benefit analysis on investment decisions. Meanwhile, the tax burden is among the highest in the OECD.

Reforms to eliminate tax distortions and reduce burdens have been a central pillar of economic policy and good progress has been made. The headline rate of corporate-income tax has been reduced, value-added tax is now more uniform and efforts to tackle base erosion and profit shifting (BEPS) continue. However, tax concessions for owner-occupied property remain too generous and some revenue-raising policies have been reversed. For instance, the government reduced road tolls in response to popular protests.

copy the linklink copied!Productivity growth is low and labour force participation has been slipping

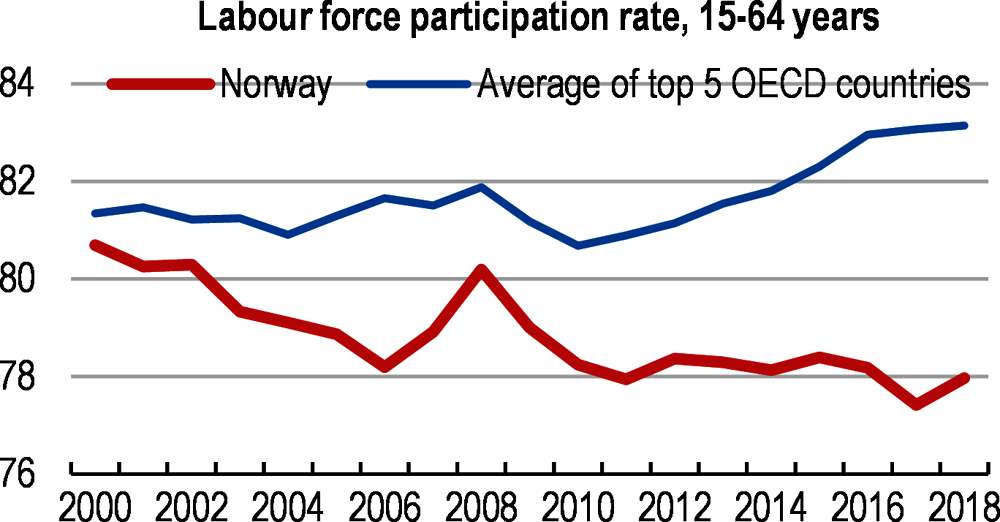

The “Nordic” socio-economic model requires a high productivity business sector and high labour-force participation.

Sustaining high levels of wellbeing requires a high-productivity business sector, which is competitive in a high-wage, high-tax environment. Norway is generally well placed to harness the next generation of digital technology and research and development (R&D) activity is picking up pace. However, policy improvements are still needed, including in insolvency arrangements and sectoral support, notably the extensive support for agriculture.

Norway’s labour market achieves low unemployment, high incomes and good job quality. A narrow wage distribution and high labour-force participation of women are primary drivers of the low levels of income inequality. The system of coordinated annual wage negotiations generally delivers wage awards consistent with macroeconomic conditions.

However, labour-force participation has been declining and Norway is no longer among the top-ranking countries. This is weakening its good record on economic inclusiveness and raises concerns for future growth as the population ages. Employment is a central focus of this Survey’s in-depth examination of labour markets.

. High rates of sickness absence among workers and large numbers on disability benefits remain problems that are not yet fully addressed. A government-appointed commission has made promising proposals for reform. These head in the direction of OECD recommendations, in particular proposing to strengthen employee and employer incentives for a return to work, including on a part-time basis.

Old-age pension reform is improving retirement choices but issues remain. Recent reforms have made retirement incentives more balanced for public-sector employees. However, reform of special retirement schemes for those working in areas such as police and defence is overdue, pension arrangements for those on disability benefits need adjusting and there is scope for more life-expectancy adjustment in the mainstream pension system. Introduction of the “sliterordningen” (early retirement scheme) is a sign of some backtracking on earlier reform.

The labour-market integration of low-skilled immigrants requires further attention. Migrants with low education and skills are now more numerous, partly due to an increased share of refugees. This has deepened the challenges for labour-market integration policy, especially as demand for low-skill workers is limited in Norway.

Improving education and training is part of the solution to the productivity-growth slowdown and weakening labour-force participation.

Norway’s education system provides substantial support and encouragement for learning. Yet, PISA scores of secondary-school student skills are only around the OECD average and boys’ academic performance in school has been declining relative to girls. In post-secondary education, non-completion of vocational courses is high and many students in higher education do not graduate until their mid-to-late 20s.