Israel

Tourism directly accounts for 2.8% of Israel’s GVA and 3.6% of total employment, equivalent to 141 000 jobs. Taking into account the indirect impact, the total number of tourism-related jobs is estimated at 230 000, approximately 6% of total employment. International tourism receipts are estimated at USD 5.8 billion, accounting for 5% of total exports. Travel exports accounted for 14.5% of total service exports in 2018.

Israel welcomed 4.1 million international tourist arrivals in 2018, a growth of 14.1% over 2017. The most important international source markets are the United States (898 000 arrivals), France (346 000), the Russian Federation (316 000), Germany (263 000) and the United Kingdom (218 000). Together, these markets account for around 50% of all international tourist arrivals.

Domestic tourism accounted for around 17.1 million bednights, equivalent to 55.2% of total bednights across all means of accommodation. In total, 8.1 million domestic overnight trips were recorded in 2018, similar to in 2017.

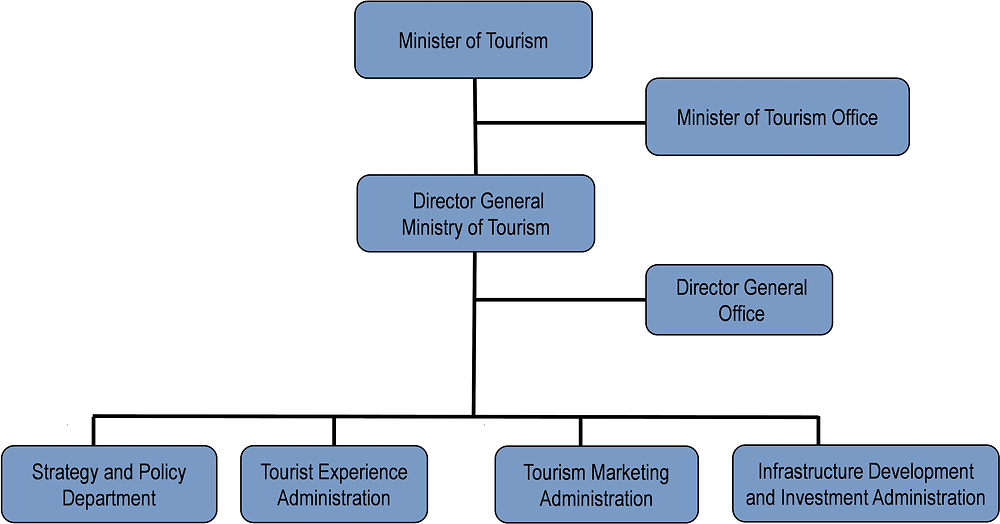

Tourism policy, development and marketing are the responsibility of the Ministry of Tourism, which has undergone significant recent reorganisation to improve its ability to handle upcoming challenges in marketing and product development. This has seen a new departmental focus on brand development, new market development, and promotion of direct foreign investment.

The Ministry collaborates on a regular basis with the Prime Minister’s Office and other ministries on issues relevant to tourism policy, including the ministries of Religious Services, Economy, Transportation and Environmental Protection. In such cases, the Ministry of Tourism usually contributes part of the budget to tourism related projects and policies that are directed by the above ministries.

Regional and local organisations promoting tourism have the following powers and responsibilities:

Developing and operating joint ventures with the Ministry of Tourism, including developing tourism infrastructure, domestic tourism marketing campaigns and local events and festivals.

Examination by local planning/zoning committees of tourism projects, with recommendations to the National Planning Committee.

Collecting local taxes, issuing construction permits and maintaining tourist sites.

The statistical data for Israel are supplied by and under the responsibility of the relevant Israeli authorities. The use of such data by the OECD is without prejudice to the status of the Golan Heights, East Jerusalem and Israeli settlements in the West Bank under the terms of international law.

Government Development Companies established in resort cities and regions operate under the Ministry's authority and usually according to a charter detailing specific objectives and its scope of operations, a geographical area. These include the Dead Sea Preservation Government Company, which was established to plan and implement development for the Dead Sea area, including coastal and tourism infrastructure. It and has recently been authorised to expand its operations to the Negev Desert and Eilat. The Old Acre Development Company was tasked with developing the UNESCO World Heritage Site as a tourism city, including boardwalks, public facilities, attractions, planning, zoning, administration and operations. Funding is usually provided by the responsible ministry, although there are additional sources of funding, such as local authorities, rent of premises, and ticket sales for attractions.

In 2018, The general budget of the Ministry of Tourism was ILS 1.2 billion in 2018. Of this, some 44% was allocated to marketing, 23% to public tourist infrastructure, and 13% to investment incentives.

There are a number of current challenges for tourism in Israel, not least the development of new visitor markets while at the same time consolidating existing markets. New investment is needed in both the tourism product and related public infrastructure, particularly to cater for visitors from emerging markets. Creating easier access to tourism information underpinned by digital platforms that can be a channel for marketing is also a priority. Work is also needed to develop the competitiveness of tourism SMEs and the opportunities of the sharing economy with training and marketing support, as well as improving skills levels and the creation of high quality jobs across the sector.

To address these challenges, policy priorities include:

Encouraging investment in tourism, including actively identifying and engaging entrepreneurs and negotiating with a range of online travel agents and airlines.

Expanding accommodation and hotel supply through new capital investment, construction of new hotels, and conversion of existing buildings into accommodations facilities.

Raising the competitiveness of Israel as a destination, in particular by lowering prices through easing hotel regulations and promoting alternative types of accommodation.

Improving access, mainly through incentivising airlines to include the country’s main Ben-Gurion airport and the new Ilan Ramon airport in their itineraries, in close co-operation with the Israel Airport Authority and the Ministry of Transportation.

Co-operation with travel agents, offering incentives to include Israel in tours and packages.

Improving the tourist experience, making information accessible via digital channels, and supporting and motivating innovators and start-ups to create digital services aimed at tourists.

Developing new products, such as the desert tourism product in the Negev Desert, and upgrading existing products, such as the Dead Sea Valley project by refreshing and expanding the existing resort.

Developing a marketing strategy that leads with sub-brands instead of Israel as the main brand, for example cities and other destinations.

Placing renewed emphasis on developing the tourism experience, building specific facilities such as cycle tracks and camp sites, lowering prices and upgrading tourism information offices. This includes developing national walking and cycle trails infrastructure in co-operation with the Israel Parks Authority.

Diversifying types of accommodation and increasing the overall number of hotel beds.

Consolidating research tools and programmes, and monitoring performance.

Work is underway to update the Tourism Services Law, which is 40 years old. Many provisions will be revised to reflect today’s customer trends but others will be maintained, relating to, for example, tax refunds and hotel grading arrangements. The most significant modification is deregulation connected to tour guiding. As a result, the new law will integrate the issues of tour guide education, licensing and working requirements, as well as putting a duty on inbound tourists to use an Israeli licensed tour guide.

The Ministry of Tourism has undertaken to update the 20 year old National Tourism Outline Plan due to recent growth trends and an acute shortage of accommodation and other tourism related businesses. The old Plan regulated different land uses by zones, but over time, zoning procedures have become laborious and expensive, affecting many aspects of tourism. Updating the Plan will speed up development for both private businesses and public authorities. A major change is to allow a more flexible definition of tourism usage/products nationwide. This will allow for different types of hotels and new accommodation businesses geared towards independent travellers. A more diversified accommodation offering at all price levels, combined with greater zoning flexibility to allow development in commercial areas, for example, will unlock the opportunity for much needed development.

The updated Plan is expected to reduce the regulatory burden, simplify and expedite zoning procedures and allow more planning flexibility for private sector investors. It is also likely to increase the approval rate for developments and enable SMEs to grow. The objective is to enable tourism to be a much more lucrative investment opportunity with beneficial effects for communities and the wider economy. It is also estimated that change would lead to more efficient usage of land, thereby reducing waste and unnecessary usage of open areas, leading to a more environmentally friendly, inclusive and sustainable development of tourism infrastructure and businesses.