Chapter 1. Introduction to the Review of the Portuguese pension system

This chapter introduces the Review of the Portuguese pension system. This review provides policy recommendations on how to improve the Portuguese pension system, building on the OECD’s best practices in pension design. The review describes the Portuguese pension system in great detail and identifies strengths and weaknesses based on cross-country comparisons. After economically painful years during the financial crisis and its aftermath, Portugal’s economy has recovered. While public debt remains at high levels, the labour market has made remarkable improvements over the last years, with strongly increasing employment rates and falling unemployment. Portugal’s demographic situation is challenging. The country’s population is ageing very rapidly and shrinking, among other things due to very low fertility rates.

1.1. OECD Reviews of Pension Systems

The OECD Reviews of Pension Systems deliver an in-depth analysis of the pension system in selected countries. They focus on the pension system’s capacity to provide adequate retirement income in a financially sustainable way. The reviews examine how demographic, social and economic developments affect pension benefits and pension spending. They cover all components of the pension system, both old-age safety nets and earnings-related schemes, public and private pensions, and special regimes for specific occupations. The analyses heavily draw on OECD flagship publications (Pensions at a Glance and Pensions Outlook) and use country-specific sources and research.

OECD Reviews of Pension Systems: Portugal is the fourth in the series, after Ireland (2014), Mexico (2016) and Latvia (2018), with a fifth review on Peru currently being prepared. It is financed by the European Commission as part of the project Improving the Pension Prospects of EU Member States and jointly produced by the OECD Directorate for Employment, Labour and Social Affairs and the Directorate for Financial and Enterprise Affairs. This review provides policy recommendations on how to improve the Portuguese pension system, building on the OECD’s best practices in pension design. The review describes the Portuguese pension system in great detail and identifies strengths and weaknesses based on cross-country comparisons.

This introductory chapter starts by succinctly discussing why now is a good time for an OECD review of the pension system. It then describes Portugal’s broader economic and demographic background, focussing on aspects with a particular relevance for old-age pensions. It stresses that public debt is a major burden and potentially a source of vulnerability for the country. The chapter also summarises recent labour market developments that are of special interest for the pension system. While the labour market has been recovering from the recession in Portugal and while employment rates are now close to the OECD average, the crisis has left its mark and challenges persist. The chapter then describes the fast ageing prospects in Portugal resulting from record-low fertility rates on top of improvements in life expectancy, and summarises migration dynamics.

The second chapter describes first-tier pension schemes – the first layer of social protection in old age. First-tier pension schemes help protect those with short contribution periods or low pension entitlements more generally against old-age poverty. In Portugal its main components are the old-age social pension, a supplement (CSI) with broader means-testing rules than the social pension and the minimum pension from the earnings-related scheme. Several additional supplements combine into a nexus which provides almost every individual older than the retirement age with some income.

The third chapter describes the mandatory earnings-related pension scheme and its historical background. The main component of the Portuguese old-age pension system is a pay-as-you-go defined benefit scheme, the so-called Pensão de velhice. Entitlement to an earnings-related pension requires at least 15 years of contributions. This pension can be taken from the statutory retirement age – 66 and four months in 2018 – and in the case of a long contribution history from age 65 without a penalty. It can also be taken with a penalty from age 60 through early-retirement schemes.

The fourth chapter analyses Portugal’s voluntary funded pension system and proposes ways to improve it. Voluntary funded pensions play a fairly limited role in the Portuguese pension landscape today as coverage is low, including in the occupational private pension system. The chapter discusses the different aspects of voluntary funded schemes and evaluates those components with reference to international comparisons. It explores the tax treatment of private pensions, trends in assets under management and investment returns. Other issues the chapter covers include funding rules and competition in the private pension sector.

The fifth chapter describes the interaction between the labour market and pensions. The global financial crisis and the European debt crisis in the late 2000s and early 2010s had a profound impact on the Portuguese labour market. Given the tight link between labour market outcomes and pension entitlements, these labour market difficulties could have knock-on effects and result in low future pensions. While short career histories are uncommon among current retirees in Portugal, career breaks may become a more serious problem among future generations of retirees. The chapter also documents trends in non-standard work, such as self-employment, part-time work and temporary work, and analyses pension insurance of non-standard workers. In addition, it discusses potential consequences of automation and digitalisation on the labour market.

1.2. Why review the Portuguese pension system now?

Population ageing prospects, the effects of the financial crisis on pension entitlements and the fiscal space, and the risk of increasing inequality among future retirees are major challenges for retirement systems in OECD countries. In order to address these challenges, many countries have reformed their pension systems over the last decade, trying to keep up with demographic, financial and labour market developments. One of the key messages of the Annual Growth Survey of the 2018 European Semester (European Commission, 2018[1]) is that pension reform in Member States should aim to ensure financial sustainability and retirement income adequacy as broadly as possible.

In which way and how strongly governments reformed pension systems varied across countries. Among the most common reforms were changes in retirement ages, contribution rates and pension benefit levels. Some countries decided to introduce automatic adjustment mechanisms into their pension systems, based on demographic and economic developments (OECD, 2017[2]). While these innovations promise to reduce political risks, their correct design and implementation are challenging.

Portugal has been particularly active in reforming its pension system over past decades, mainly focusing on improving financial sustainability (European Commission, 2018[3]). Among the main reforms since the 1990s were (Chapter 3): increasing the period to calculate the reference wage; aligning the retirement age for women; linking the retirement age to life expectancy; reforming the minimum pensions; consolidating the scheme for civil servants with the general regime for private-sector workers; and, formalising indexation rules.

Now is the time to take stock of where these recent measures have taken the Portuguese pension system. Short-term pressure has fallen thanks to the sustained economic recovery, providing the opportunity to optimise the current design of various pension components. Improvements are all the more necessary as the pace of ageing will be fast in Portugal, with demographic projections pointing to a sharply decreasing total population size despite an increasing number of retirees. This might create imbalances in the financing of pensions and ultimately put downward pressure on retirement income. This Review will analyse: whether first-tier pensions efficiently meet the key objective of providing income protection for the most vulnerable retirees; whether the parameters of the public pension scheme are set in a way that makes the core of the system well equipped to face ageing challenges and possibly deep changes in the functioning of the labour market; and, how the voluntary funded pension scheme can be improved to provide complementary income.

The Portuguese pension system consists of old-age safety nets (Chapter 2), a pay-as-you-go defined benefit scheme (Chapter 3) and voluntary private savings (Chapter 4). The defined benefit scheme has two main components: the general social security scheme, regime geral da Segurança Social and the civil servants pension scheme, Caixa Geral de Aposentações (CGA). The latter has been closed to new entrants since 2006 with new civil servants contributing to the general scheme. The safety net includes an old-age social pension and a complement, the so-called Complemento Solidário para Idosos (CSI), both of which pursue similar objectives but have different eligibility criteria. Finally, funded voluntary pensions make up a very small share of total pension entitlements.

In total, 93% of the population aged over 65 receives an old-age pension. The general social security scheme pays pensions to 77% of the population over 65 while 22% of that age group receives a pension from the civil servant scheme. Minimum pensions are paid to 38% of the population aged over 65, while the old-age social pension and the CSI are received by 1% and 8% of this population, respectively.

1.3. Economic and demographic background

1.3.1. Recent economic context

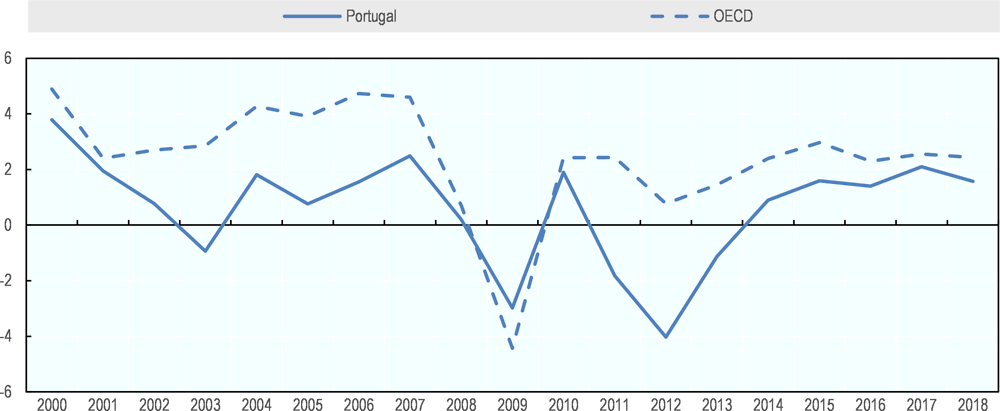

Unlike in Spain, for example, Portugal’s economy had already struggled in the years preceding the Great Recession, with sluggish economic growth and labour market difficulties. Portugal was among the countries that were most deeply affected by the crisis. Between 2009 and 2013, real GDP shrunk in four out of five years, dropping by more than 4% in 2012 alone (Figure 1.1). While most OECD countries were hard hit by the financial crisis in 2008/2009, real GDP grew again in the OECD on average in 2010. Portugal, by contrast, stood out as one of the countries facing a very severe economic downturn in 2011/2012. In 2011, Portugal agreed to implement a reform programme in return for a EUR 78 billion IMF-EU bailout. From 2014 onwards, real GDP growth rates turned positive again to reach 2.1% in 2017 and a projected 1.6% in 2018, against 2.6% and 2.4% on average in the OECD, respectively.

While Portugal’s recovery has been solid, the country’s economy still faces significant challenges. An exceptionally high debt burden built up during the crisis, resulting from high unemployment rates and expansionary fiscal policy until 2011 to support growth. Due to persistent general government deficits, the gross public debt had grown even before the crisis, from 50% in 2000 to 68% of GDP in 2007 – already above the Maastricht 60% threshold – and then rose sharply to 131% in 2014, decreasing to an estimated 123% in 2018 (Figure 1.2).1 According to OECD projections, public debt as a percentage of GDP is likely to decrease over the next years, but only at a slow pace, falling to about 120% of GDP in 2030 (OECD, 2017[4]). As a result, the scope for fiscal policy is limited today and old-age social protection – the biggest share of public expenditure in Portugal – is likely to remain exposed to financial pressure in the foreseeable future.

1.3.2. Labour market

Labour market disruptions were severe throughout the crisis. Job exits rates surged, finding new employment became difficult and unemployment rates escalated, reaching 15% in 2013 among 25-64 year-olds and 35% among 20-24 year-olds. Since the peak of the economic crisis five years ago, the Portuguese labour market has made remarkable progress.

Today, unemployment is in line with its pre-crisis levels and employment rates are close to the OECD average (Figure 1.3). In 2017, 67.8% of 15-64 year-olds worked, against 69.4% in the OECD. While employment rates are higher than for example in France (65.2%), Spain (62.1%) and Italy (58%), they are still well below top-performing countries, such as New Zealand (76.9%), Switzerland (79.8%) and Iceland (85.8%), leaving scope for further improvements.

Men have a higher chance of working than women, but the employment gender gap is narrow compared to other countries, with a 6.3 percentage-point gap between men and women against 10.8 percentage point on average in the OECD. Employment rates among men are below-average (71.1% against 74.9% in the OECD), while they are above-average among women (64.8% against 64% in the OECD). The recovery in employment in Portugal has been driven by a good performance of female employment. Indeed, employment rates among women are now higher than ten years ago, while male rates are still below their pre-crisis level.

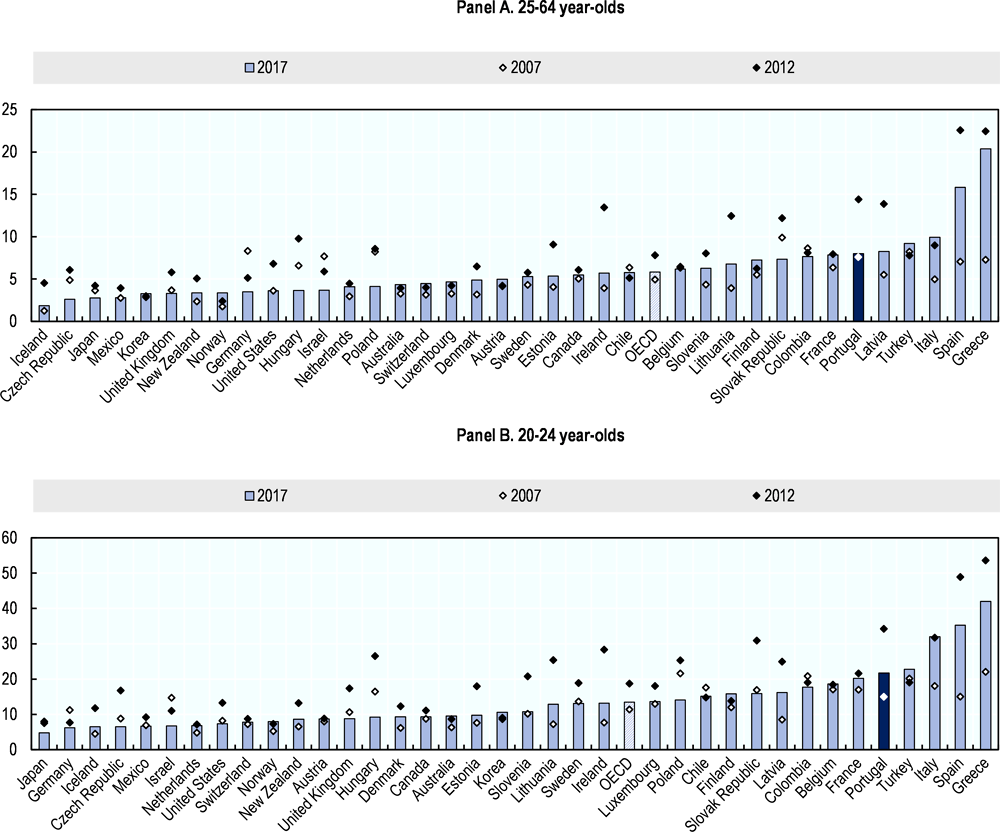

The repercussions of the Great Recession affected workers of all ages. Among 25-64 year-olds, unemployment soared, reaching a rate of 14.3% in 2012, up from 7.6% in 2007 (Figure 1.4, Panel A). Since the peak of the crisis, it has fallen sharply, standing at 5.8% in the third quarter of 2018.

Young people were hit even harder than prime-aged workers (Panel B). Unemployment among 20-24 year-olds reached close to 35% in 2012, against 17% in 2007, making a smooth labour market entry virtually impossible for a large number of young Portuguese. Employment prospects for young people, too, have improved since the crisis, but unemployment rates among 20-24 year-olds are still high.

While labour market difficulties experienced during the crisis bear the risk of long-lasting knock-on effects on employment prospects, future employment outcomes may be positively influenced by the strong increase in educational attainment that has taken place over the last two decades (Figure 1.5). The share of people with more than low educational attainment was very low just 20 years ago, but it has increased very markedly since then. In 1998, over 80% of 35-44 year-olds were low-educated, against 10.5% with medium education and 9% with high education. Since then, the share of low-educated 35-44 year-olds has almost halved, standing at just 41% in 2017, whereas 31% were highly educated in 2017 and 28% had medium education. Such an impressive advance in educational attainment, especially in times of quick technological change and automation, can be a central element permitting workers to keep pace with changing labour market trends and to update their skills more easily.

1.3.3. Demographics

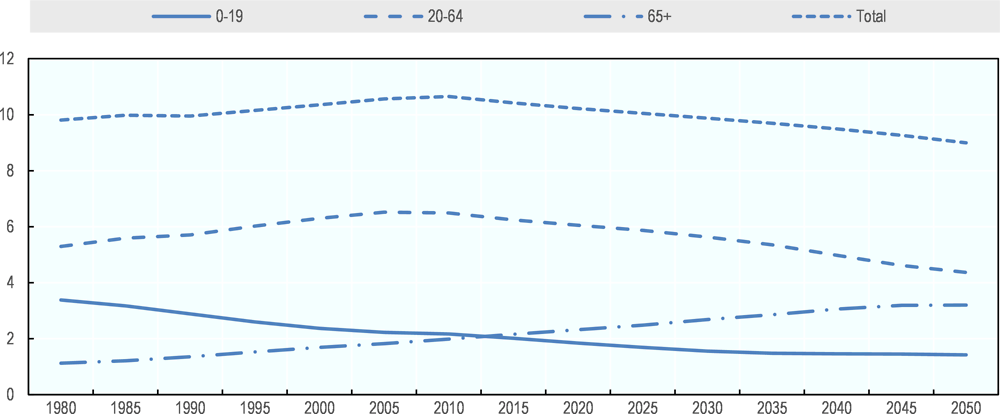

Portugal’s population has started to shrink a few years ago. After peaking at 10.7 million inhabitants in 2009, the population decreased to 10.4 million in 2015 and is expected to decline further, to under 10 million by 2030 and under 9 million by 2050 (Figure 1.6). The overall decrease in the population is due to a sharp decrease in the number of young people and working-age adults. While there were 2.2 million under-20 year-olds in Portugal in 2005, they were only 2.0 million in 2015. Their number is expected to fall to 1.6 million in 2030 and even further later on. As for 20-64 year-olds, they were 6.5 million in 2005 and 6.2 million in 2015, with a projected 5.6 million in 2030. Conversely, the upward trend in the number of people 65 and older is expected to continue during the first-half of the century. It stood at 2.2 million in 2015, up from 1.8 million in 2005, and would reach a peak of 3.2 million in 2050. As a consequence of the rapidly falling number of young people and increasing number of older people, Portugal is ageing very quickly. While there were more than three young people under 20 for every person aged 65 or above in 1980, the 65+ has outnumbered the under 20 year-olds since 2015 and there will be more than two people over 65 for every young person under 20 in 2050.

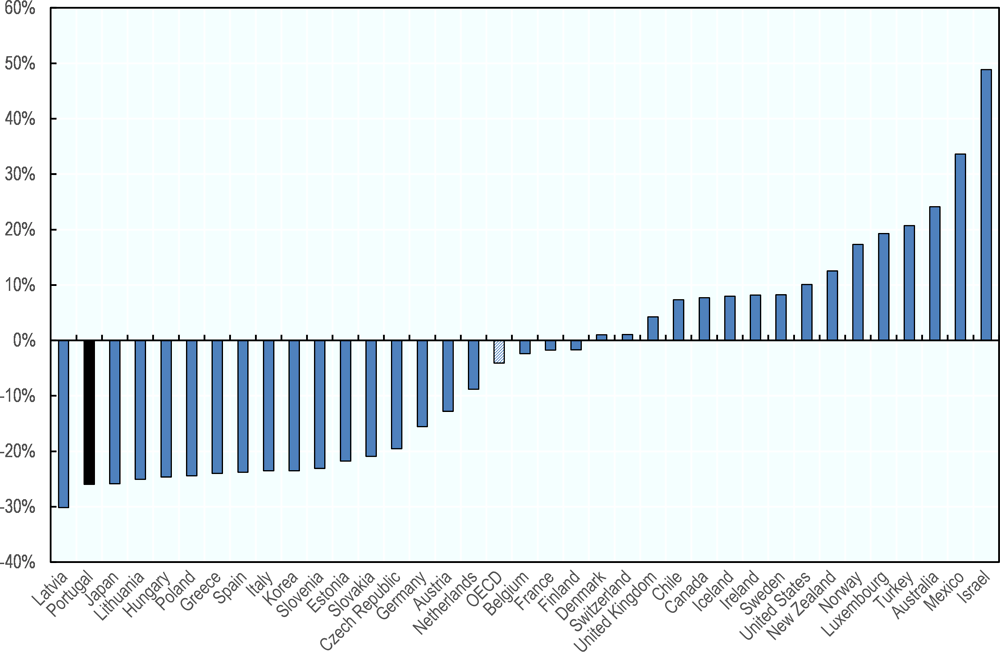

Among all OECD countries, Portugal is the country with the second largest decline (in percentage) in the size of the working-age population between 2015 and 2045, just after Latvia (Figure 1.7). The number of 20-64 year-olds is projected to fall by 26% in Portugal, against a decrease of 4% on average in the OECD and increases in 16 OECD countries, with a maximum increase in the working-age population of almost 50% in Israel. The falling number of working-age adults in Portugal may have major consequences for the labour market, GDP and pension finances.

Population ageing will accelerate at a fast pace in Portugal. The increasing share of older people in the population has pushed the so-called old-age dependency ratio - the number of people older than 65 years per 100 people of working age (20-64) - from 19.6 in 1975 (around the OECD average) to 34.6 in 2015 (Figure 1.8). By 2050, it is expected to be 73.2, making Portugal the fourth oldest country in the OECD based on this measure after Japan, Spain and Greece according to UN data. Eurostat data provide a similar picture, with only Greece being projected to have a higher old-age dependency ratio than Portugal in 2050 among EU countries. While longer lives are undoubtedly a positive development the financial pressure on Portugal’s pension system has been growing.

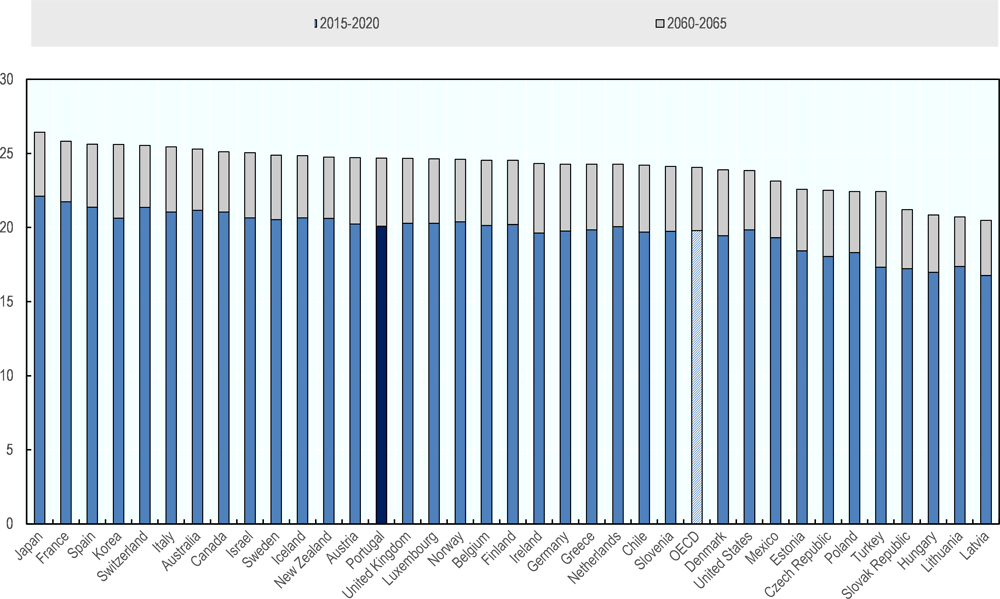

One of the factors contributing to the increasing number of old people is rising life expectancy. People who reach 65 in Portugal currently have a remaining life expectancy of 20.1 years (Figure 1.9), comparing to 19.8 years on average in the OECD. In 2060, it is projected to be 24.7 years against 24.1 in the OECD. The 4.6-year gain in life expectancy at age 65 in Portugal is projected to be among the highest in the OECD. Only few countries are expected to experience more pronounced improvements, such as Turkey (5.1 years) and Korea (5 years).

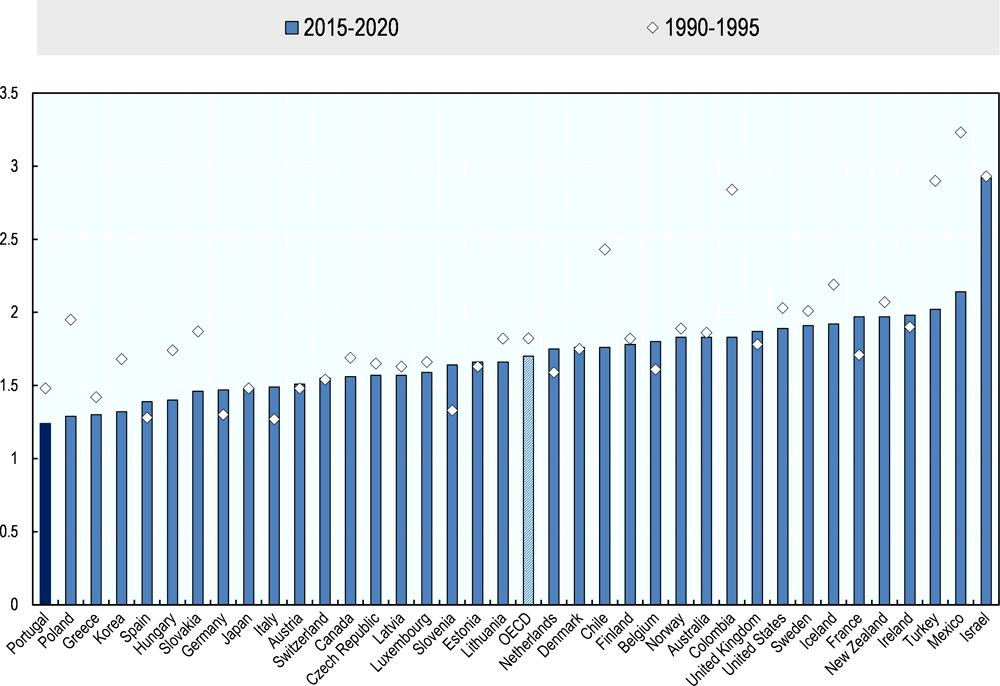

Another factor contributing to the falling number of young people is low fertility over past decades. Portugal currently reports the lowest fertility rates among all OECD countries, at only 1.24 children/woman, against 1.70 in the OECD (Figure 1.10), well below what is needed to stabilise the size of the population. While fertility rates were still relatively high in the early 1980s, they plummeted to about 1.5 children/woman in the early 1990s and have kept shrinking further until today.

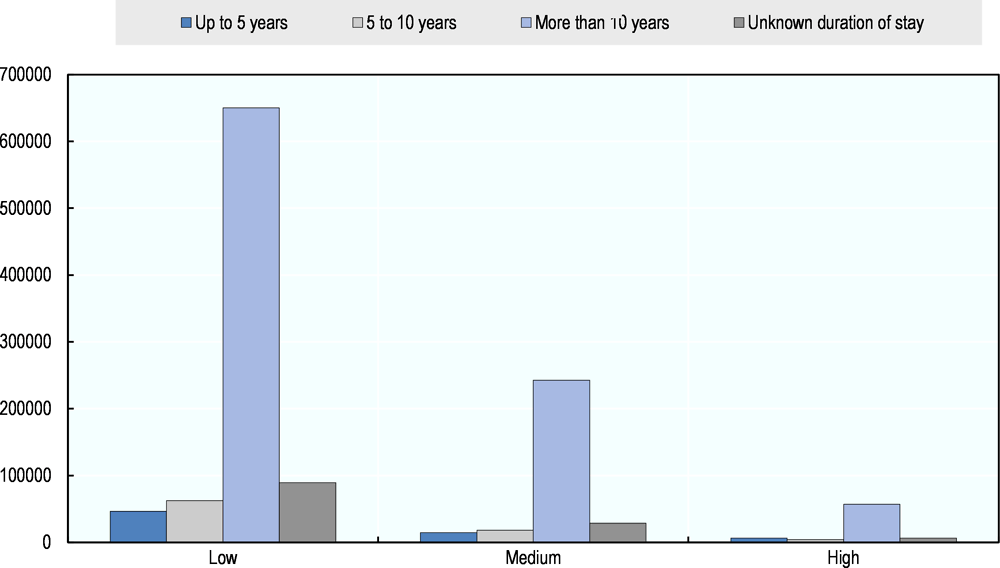

The number of Portuguese living in other OECD countries is very high. It is estimated that around 20% of the Portuguese live outside of Portugal (Eurofound, 2016[5]). Portuguese emigrants tend to stay abroad for a long time once they have left (Figure 1.11). Among Portuguese emigrants of all educational groups, most stay abroad for at least ten years and only very few return rapidly. Moreover, the largest group of Portuguese currently living abroad are low-educated immigrants. About 850 000 Portuguese-born low-educated emigrants live in other OECD countries, against just over 70 000 high-educated.

In the years preceding the European debt crisis, the number of people moving to Portugal exceeded the number of people leaving the country (Figure 1.12). In 2005, for instance, there were almost 50 000 entries to Portugal against just above 10 000 exits. When the financial crisis hit the country, entries to Portugal slowed down while exits jumped up significantly. Whereas fewer than 17 000 people left the country in 2009, they were close to 54 000 in 2013 when the crisis was at its peak. Many of the emigrants who left Portugal were young people, and worries arose that these exits might exacerbate ageing pressure.

References

[5] Eurofound (2016), Portugal: High and rising emigration in a context of high, but decreasing, unemployment | Eurofound, https://www.eurofound.europa.eu/publications/article/2016/portugal-high-and-rising-emigration-in-a-context-of-high-but-decreasing-unemployment (accessed on 24 October 2018).

[1] European Commission (2018), 2018 European Semester: Annual Growth Survey | European Commission, https://ec.europa.eu/info/publications/2018-european-semester-annual-growth-survey_en.

[3] European Commission (2018), Country Report Portugal 2018 Including an In-Depth Review on the prevention and correction of macroeconomic imbalances, https://ec.europa.eu/info/sites/info/files/2018-european-semester-country-report-portugal-en.pdf.

[6] OECD (2018), OECD Economic Outlook No. 103 (Edition 2018/1), https://doi.org/10.1787/494f29a4-en.

[4] OECD (2017), OECD Economic Surveys: Portugal 2017, OECD Publishing, Paris, https://doi.org/10.1787/eco_surveys-prt-2017-en.

[2] OECD (2017), Pensions at a Glance 2017: OECD and G20 Indicators., OECD Publishing, Paris, http://doi:https://doi.org/10.1787/pension_glance-2017-en.

Note

← 1. The Portuguese Government estimates public debt levels of 121.2% of GDP in 2018 and of 118.5% in 2019. Source: State Budget 2019.