9. Impacts of energy prices on economic and environmental performance in the Indonesian manufacturing sector

This chapter focuses on the environmental and economic effects of energy prices in the Indonesian manufacturing sector. In a similar vein to the previous chapter, this chapter evaluates the joint environmental and economic effects of changes in energy prices but this time focusing on an emerging economy. The study uses a rich national dataset, which covers the whole population of medium-sized and large Indonesian manufacturing plants and makes use of geographic, industrial and temporal energy price variations to pursue a causal analysis. The study finds that a 10% increase in energy prices leads to a decline in energy use by 5.2% and to a decline of CO2 emissions by 5.8%, alongside small, heterogeneous effects on employment. Smaller plants seem to increase their number of workers in response to higher energy prices while larger plants show a slight reduction in employment. Energy price shocks seem to trigger investment in more energy-efficient machinery. Moreover, the probability of plant exit rises particularly for energy-dependent plants in times when energy prices are rising. An additional analysis at the industry-level shows no effects on aggregate net job creation, suggesting that rising energy prices lead to a reallocation of workers but not to permanent employment losses.

The chapter is a summary of “Assessing the impact of energy prices on plant-level environmental and economic performance: Evidence from Indonesian manufacturers” (2021[1]) by A. Brucal and A. Dechezleprêtre, OECD Environment Working Papers, No. 170, OECD Publishing, Paris.

Energy costs might increase through energy subsidy reforms

Energy subsidy reforms are a special type of environmental fiscal reform, which aims, for example, at reducing fossil fuel subsidies. These subsidy reforms are, however, often assumed to harm economic growth, especially in emerging economies, because they increase energy costs across all end users. The reaction of firms to energy subsidy reforms depends inter alia on the substitutability of inputs in the production process but also the ability of firms to adapt to changing energy policy environments. Analysing firm reactions to changes in energy prices in general – which reflects the ultimate effect of the reform as previously subsidised firms face higher energy prices – can provide insights into the environmental and economic effects of energy subsidy reforms.

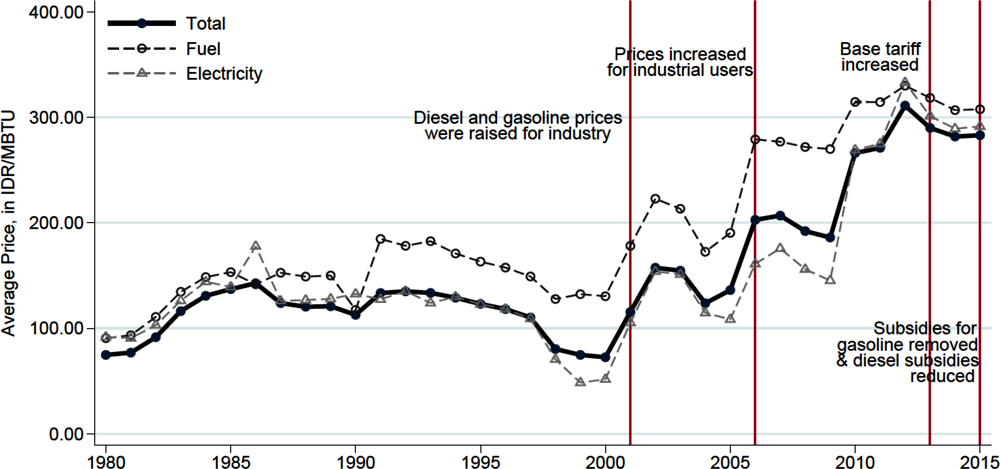

Indonesian energy prices rose, when fuel subsidies were removed

The Indonesian manufacturing sector experienced a steady energy price increase at the same time as fuel subsidies were reduced. As Figure 9.1 shows, energy prices in the Indonesian manufacturing sector rose in the early eighties, followed by a decline in the nineties and a sharp increase since 2000, when fuel subsidies for diesel and marine fuels were removed. In 2005, a presidential decree announced the phasing-out of any remaining fuel subsidies, leading to increased energy prices for industrial users. While Figure 9.1 does not necessarily show a causal relationship, the figure illustrates that Indonesia’s fossil fuel subsidy reforms are fairly well reflected by industrial energy prices since 2001.

Plants might react in different ways to changes in energy prices

Firms or plants might differ considerably in the way they react to rising energy prices. On the one hand, firms might be able to absorb the price shock and decide not to adjust prices, their output or input in terms of employment. On the other hand, firms might pass through the additional costs or they might change their production processes towards more energy-efficient technologies. Plants might also react differently depending on their size or energy-intensity. Larger plants in energy-intensive sectors (e.g. basic materials producers) might thus improve their energy use more in the event of an energy price shock than smaller plants. Moreover, there is the concern that plants exit the market (Rentschler and Kornejew, 2017[2]) or relocate to other countries (Cole, Elliot and Zhang, 2017[3]), if they are not able to cope with higher energy prices.

The empirical literature has focused on industrial economies so far

The study contributes to the literature investigating the effects of higher energy prices on environmental and economic outcomes. The earlier literature investigating the relationship between energy prices and energy use has found significant effects of fuel and electricity price changes (Houthakker, 1951[4]; Taylor, 1975[5]; Bohi and Zimmerman, 1984[6]; Al-Sahlawi, 1989[7]; Espey, 1996[8]; Brons et al., 2008[9]; Havranek, Irsova and Janda, 2012[10]; Labandeira, Labeaga and Lopez-Otero, 2017[11]). The two most relevant papers for this study have investigated the impact of energy prices on employment and environmental performance in the French manufacturing sector (Dussaux (2020[12]); Marin and Vona, (2017[13])). Both studies find a negative effect of rising energy prices on energy consumption, CO2 emissions as well as on employment. However, these studies focus on an industrialised economy, leaving the question open whether effects of changing energy prices differ for emerging economies. An analysis of small Indonesian firms (i.e. less than 20 employees) indicates that rising energy prices are associated with a small adverse effect on firm competitiveness, but with increasing energy-efficiency (Rentschler and Kornejew, 2017[2]).

The combination of plant and industry-level analysis provides causal analysis of joint effects for an emerging economy

The study summarised in this chapter offers a causal analysis on the environmental and economic effects of rising energy prices in Indonesia by combining a plant-level with an industry-level analysis. Using a dataset of more than 71 000 Indonesian plants observed over 35 years, from 1980 to 2015, energy price variations at the geographic, industry and temporal dimension are exploited to analyse exogenous changes in energy prices and their implications on plant performance. In addition to environmental outcomes (energy use, CO2 emissions), the study also investigates the effect on several economic outcomes (e.g. output, employment, capital). The study looks at heterogeneous effects across space and sectors. Moreover, the industry-level analysis sheds light on the employment dynamics following changes in energy prices, providing insights on how whole industries can cope with policy shocks like energy subsidy reforms.

The instrumental variable approach based on exogenous price variation allows for causal analysis

The empirical analysis identifies plant responses to exogenous changes in energy prices by using an instrumental variable approach, estimating effects at the plant- as well as at the industry-level. Following Sato et al. (2019[14]), a fixed-weight energy price index is created where the energy price, which an individual plant faces, is calculated by using constant, pre-sample weights of fuel intensity for each plant and province-specific energy prices. The share of each energy source is taken from the first available observation (which is dropped later) and kept constant over the sample period. Using this fixed-weight energy price index as an instrument for average energy costs ensures that effects captured in the analysis are only due to exogenous variations in energy prices and not due to endogenous changes that might be driven by the plant itself. The industry-level analysis allows for investigating between-plant adjustments by going beyond surviving plants in the analysis. In order to analyse employment dynamics at the industry-level, job flow metrics at the province-level are calculated following the method by Davis and Haltiwanger (1992[15]).

Empirical model

The following model is estimated at the plant-level for several outcome variables, using a fixed-effects estimator:

where is an outcome variable of plant i at time t (i.e. output, energy use, CO2 emissions). is the time-varying energy price index faced by each plant and is calculated by dividing total energy costs by total physical energy use. are plant-specific, time-invariant fixed effects which control for potentially endogenous plant characteristics, are sector-year fixed effects which control for sudden shocks at the sector level like technological improvements or economic fluctuations, are province-specific trends which control for long-term trends in individual regions which might affect energy consumption or sales, and is the remaining error term. In order to test for heterogeneous effects of plant size and energy-intensity, two interaction terms are added to the equation: one interaction term between the energy prices and the pre-sample size of the plant (i.e. number of employees) and one interaction term between energy prices and pre-sample energy-intensity.

The empirical model at the industry-level slightly differs from the plant-level model, with the following equation being estimated:

where is a job flow metric in province p at time t (i.e. job creation rate, job destruction rate, net change in jobs), is the average plant-specific energy price as used in the plant-level analysis, are time fixed effects, are province specific fixed effects, and is the remaining error term.

Data

The dataset used in this study covers all plants in Indonesia’s manufacturing sector, which have 20 or more employees. The data are observed yearly and span from 1980 to 2015. The data are taken from the Indonesian Census of Manufacturing for Medium and Large Enterprises (IBS) conducted by the National Statistical Office and contains detailed information on fuel-specific consumption and electricity use, as well as data on plant performance such as output and employment figures. The fuel and electricity data allow calculating energy use, taking into account own-electricity generation, as well as calculating CO2 emissions.

Increases in energy prices led to decreasing emissions of Indonesian manufacturing plants

The results of the study show an average reduction of energy use and CO2 emissions (Table 9.1. ). A 10% increase in energy prices leads to a decrease of 5.2% in energy use and a reduction in CO2 emissions by 5.8%. The analysis of economic outcomes shows that a 10% increase in energy prices leads to a decrease in employment by 0.2%. However, the latter effect is only significant at the 10%-level. No statistically significant effect is found for plant output. Looking at the effect of energy price increases on energy-intensity shows that, for example, a 10% increase in energy prices leads to a reduction in energy (per worker by 5% (Table 9.1. , column 6). This implies that increasing energy prices apparently trigger improvements in the production and/or management processes, ultimately increasing the efficiency of energy use. An additional analysis shows that this efficiency improvement is driven by changes in the capital stock of the plants (see Brucal and Dechezleprêtre (2021[1]) for detailed results).

Larger and more energy-intensive plants reduce energy use more than smaller plants

Analysing potential heterogeneous effects shows that changes in energy use depend significantly on the plant’s initial output and energy-intensity. Larger plants experience greater reductions in energy use when energy prices increase than smaller plants. In a similar vein, more energy-intensive plants reduce their energy use disproportionately more than energy-efficient plants. Moreover, larger plants also reduce their CO2-intensity per unit of output more than smaller plants in times of rising energy prices. Relating to the findings in the previous chapter that efficiency improvements are driven by changes in the capital stock, the study also finds that larger plants decrease their capital in response to higher energy prices while smaller plants increase their capital stock. In terms of employment adjustments, smaller plants tend to increase their employment. With increasing plant size, this effect vanishes.

Energy-intensive plants are more likely to be driven out of the market

Looking specifically at plant exit, an additional probit estimation is conducted which analyses the effect of rising energy prices on the probability of market exit (see Brucal and Dechezleprêtre (2021[1]), for details on the estimation and results). The results of this estimation show that increasing energy prices increase the probability of exiting the market, independent of the size of the plant. However, more energy-intensive plants show a higher probability of exit when energy prices rise. Combining these findings with the findings on employment adjustments, this might imply that inefficient plants are exiting the market, leaving more market share to smaller, more efficient plants, which, in turn, increase their employment.

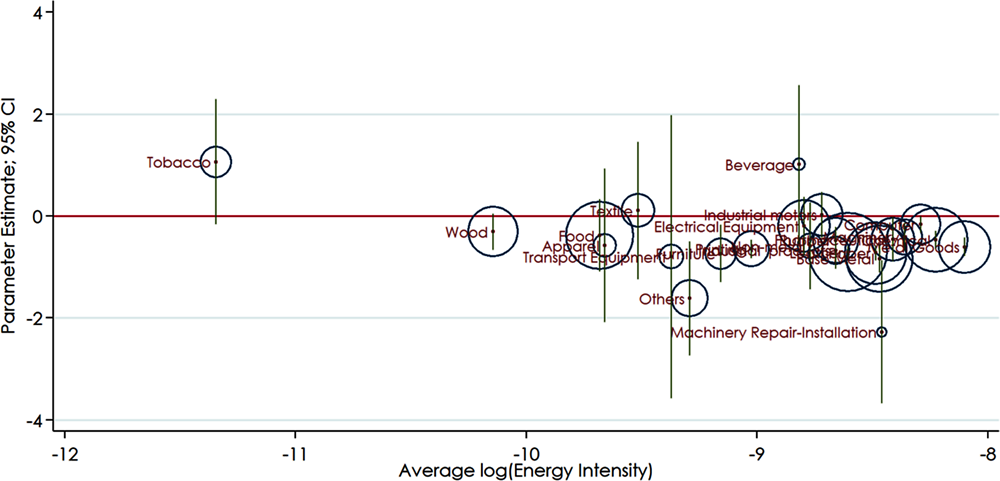

All sectors reduce energy consumption in response to higher energy prices

Allowing for heterogeneous effects at the sector level shows that plants in almost every sector reduce their energy use in response to higher energy prices (Figure 9.2). The main equation above is estimated for each two-digit sector separately, allowing to investigate whether plants in different sectors react differently to changes in energy costs. The coefficient estimates are displayed in Figure 9.2, showing that almost all sectors reduce their energy use significantly, especially the largest sectors (with the exception of the food industry). This finding also applies to total CO2 emissions.

No significant employment effects found at the industry-level

The industry-level analysis shows no statistically significant effects on job destruction, job creation, or net employment in response to rising energy prices (see Brucal and Dechezleprêtre (2021[1]), for estimation results). Consistent with the previous findings from the within-sector estimation, where only small plants were found to slightly increase their employment, results at the industry-level show no effects on net job creation.

Rising energy prices in the Indonesian manufacturing sector reduced emissions significantly without large negative effects on economic outcomes

The results of the study show that energy price increases in the Indonesian manufacturing industry led to significant reductions in energy use and thus CO2 emissions, while large economic effects were absent. A 10% increase in energy prices is found to reduce CO2 emissions by 5.8% on average, while employment is reduced by 0.2%. There are no other negative economic effects found, i.e. on real output. The CO2 reduction combined with a constant output implies a decrease in energy-intensity of output, which is found to be driven by updates in the capital stock of plants. The effects are found to be heterogeneous across plants, depending on their initial output, energy-intensity, and sector they operate in. Larger plants as well as more energy-intensive plants are found to decrease their energy use more. For the economic outcomes, smaller plants are found to increase their employment with rising energy prices, while larger plants do not react to changes in energy prices. For all plants, rising energy prices increase the probability of plant exit. However, at the aggregate sectoral level, no significant employment effects are detected, suggesting that job losses due to plant exit are compensated by increases in the employment in surviving plants.

The effects on demand for skilled and unskilled labour are not accounted for in analysis

The results of the analysis suggest that surviving plants adopt newer and energy-saving technologies. It remains, however, outside of the scope of this study, how this change in technologies affects the demand for skilled and unskilled labour – and thus potentially the wage distribution. The study is thus not able to analyse whether energy subsidy reforms do, as they are often assumed to, harm the poorest citizens most through changes in demand for unskilled labour.

Economic effects of rising energy prices might be lower in emerging economies due to more flexible labour markets

Energy subsidy reforms are shown to have significant positive effects in terms of environmental outcomes while almost having no effects in terms of economic outcomes. Reallocation effects in terms of employment are found to be small without effects at the industry level. Comparing this analysis to the analysis summarised in the previous chapter, suggests that economic effects of rising energy prices might be lower in emerging economies. One reason for this might be that emerging economies have more flexible labour markets, which allows firms to adapt more quickly and more flexibly to new environmental policy settings.

References

[7] Al-Sahlawi, M. (1989), “The demand for natural gas: a survey of price and income elasticities”, The Energy Journal, Vol. 10/1, pp. 77-90, https://www.jstor.org/stable/41322309.

[6] Bohi, D. and M. Zimmerman (1984), “An update on econometric studies of energy demand behavior”, Annual Review of Energy, Vol. 9/1, pp. 105-154, https://doi.org/10.1146/annurev.eg.09.110184.000541.

[9] Brons, M. et al. (2008), “A meta-analysis of the price elasticity of gasoline demand. A SUR approach”, Energy Economics, Vol. 30/5, pp. 2105-2122, https://doi.org/10.1016/j.eneco.2007.08.004.

[1] Brucal, A. and A. Dechezleprêtre (2021), “Assessing the impact of energy prices on plant-level environmental and economic performance: Evidence from Indonesian manufacturers”, OECD Environment Working Paper No. 170, https://doi.org/10.1787/9ec54222-en.

[3] Cole, M., R. Elliot and L. Zhang (2017), “Foreign direct investment and the environment”, Annual Review of Environmental and Resources, Vol. 42, pp. 465-487, https://doi.org/10.1146/annurev-environ-102016-060916.

[15] Davis, S. and J. Haltiwanger (1992), “Gross job creation, gross job destruction, and employment reallocation”, The Quarterly Journal of Economics, Vol. 107/3, pp. 819-863, https://www.jstor.org/stable/2118365.

[12] Dussaux, D. (2020), “The joint effects of energy prices and carbon taxes on environmental and economic performance: Evidence from the French manufacturing sector”, OECD Environment Working Papers, No. 154, OECD Publishing, Paris, https://dx.doi.org/10.1787/b84b1b7d-en.

[8] Espey, M. (1996), “Explaining the variation in elasticity estimates for gasoline demand in the United States: a meta-analysis”, The Energy Journal, Vol. 17/3, pp. 49-60, https://www.jstor.org/stable/41322693.

[10] Havranek, T., Z. Irsova and K. Janda (2012), “Demand for gasoline is more price-inelastic than commonly thought”, Energy Economics, Vol. 34/1, pp. 201-207, https://doi.org/10.1016/j.eneco.2011.09.003.

[4] Houthakker, H. (1951), “Some calculations on electricity consumption in Great Britain”, Journal of the Royal Statistical Society, Vol. 114/3, pp. 359-371, https://www.jstor.org/stable/2980781.

[11] Labandeira, X., J. Labeaga and X. Lopez-Otero (2017), “A meta-analysis on the price elasticity of energy demand”, Energy Policy, Vol. 102, pp. 549-568, https://doi.org/10.1016/j.enpol.2017.01.002.

[13] Marin, G. and F. Vona (2017), “The impact of energy prices on employment and environmental performance: Evidence from French manufacturing establishments”, Working Paper 053.2017, Fondazione Eni Enrico Mattei, https://www.ofce.sciences-po.fr/pdf/dtravail/WP2017-26.pdf.

[2] Rentschler, J. and M. Kornejew (2017), “Energy price variation and competitiveness: Firm level evidence from Indonesia”, Energy Economics, Vol. 67/C, pp. 242-254, https://doi.org/10.1016/j.eneco.2017.08.015.

[14] Sato, M. et al. (2019), “International and sectoral variation in industry energy prices 1995-2015”, Energy Economics, Vol. 78, pp. 235-258.

[5] Taylor, L. (1975), “The demand for electricity: a survey”, The Bell Journal of Economics, Vol. 6/1, pp. 74-110, https://www.jstor.org/stable/pdf/3003216.pdf.