Austria

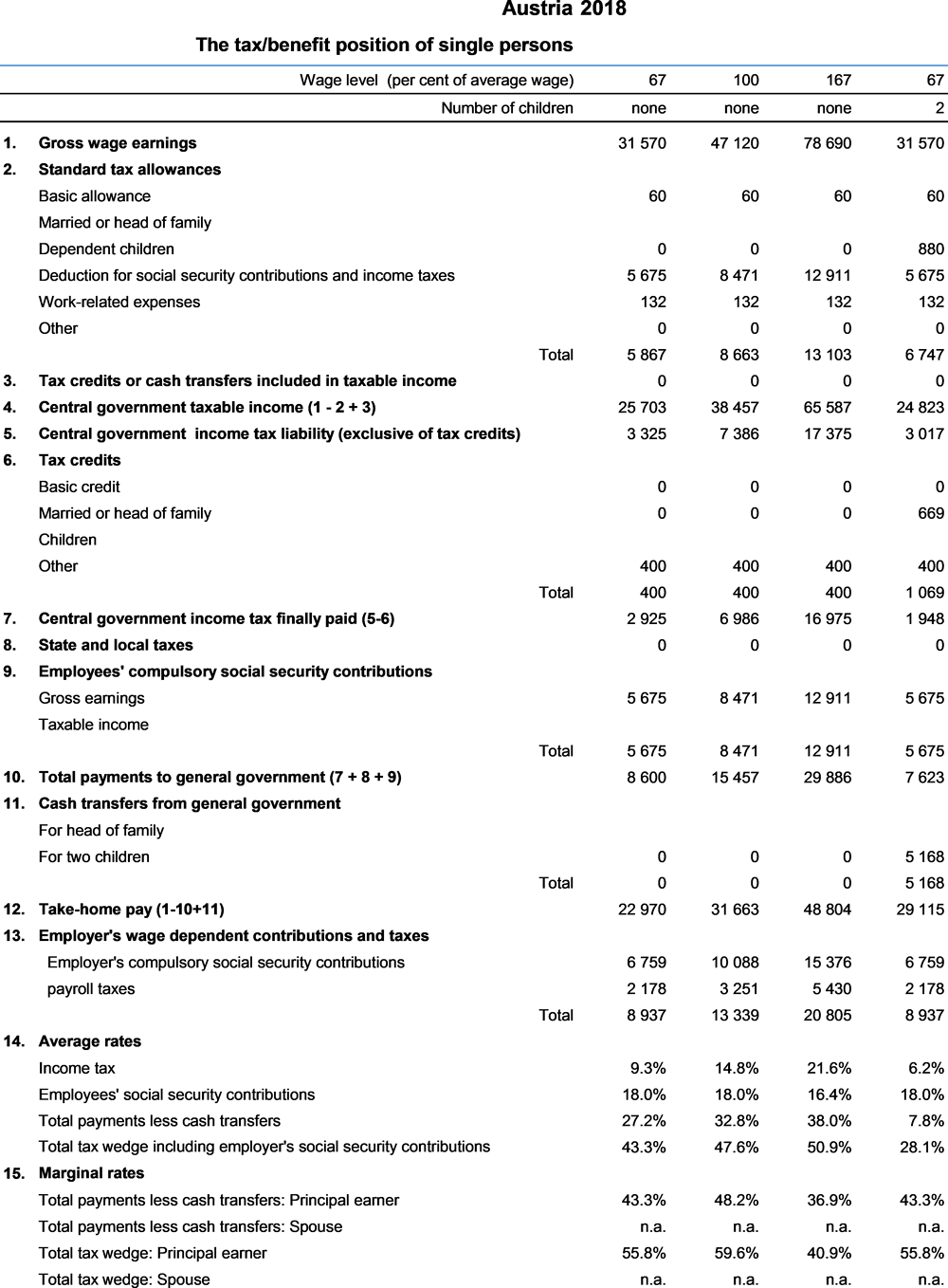

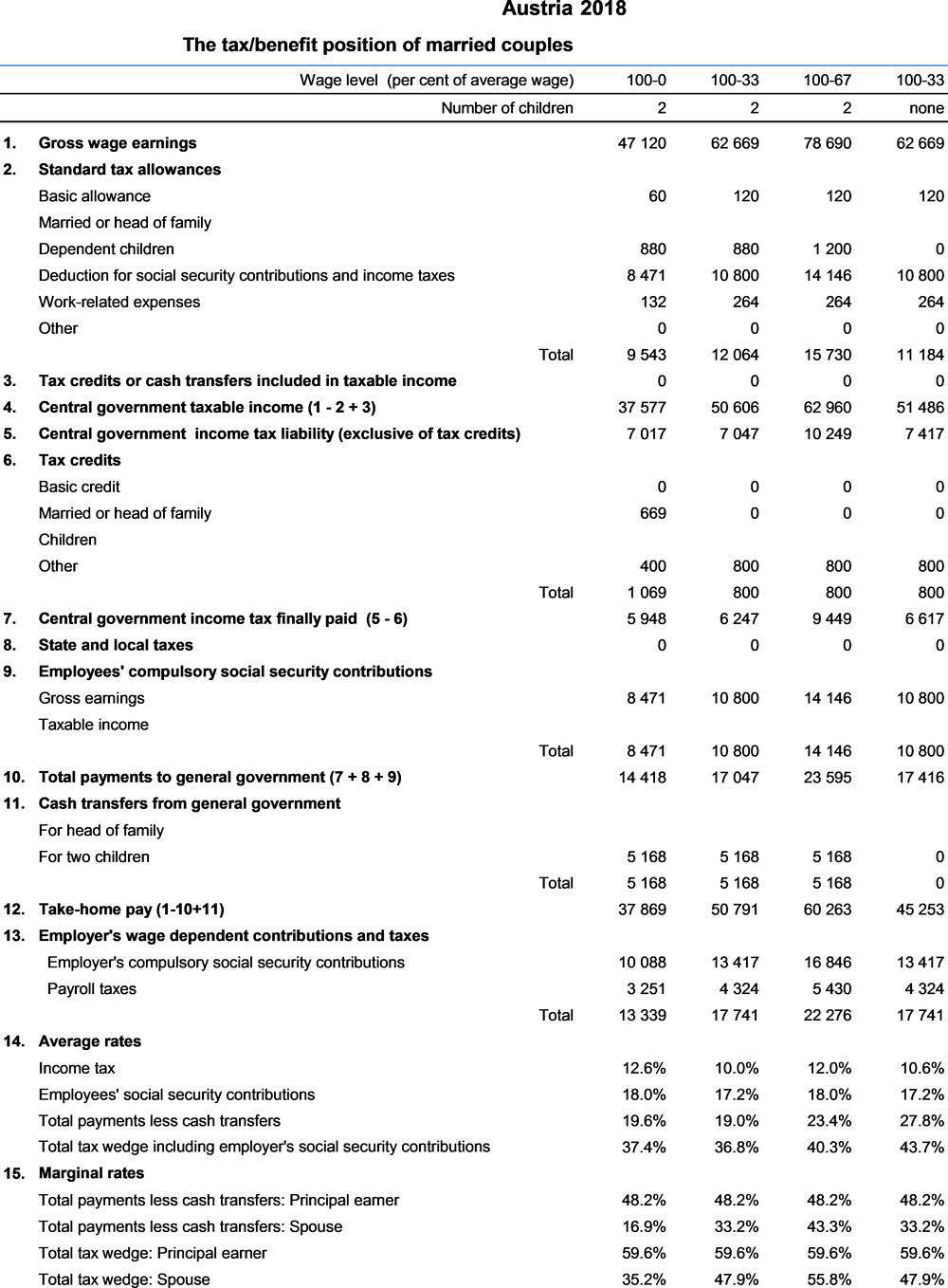

This chapter includes data on the income taxes paid by workers, their social security contributions, the family benefits they receive in the form of cash transfers as well as the social security contributions and payroll taxes paid by their employers. Results reported include the marginal and average tax burden for eight different family types.

Methodological information is available for personal income tax systems, compulsory social security contributions to schemes operated within the government sector, universal cash transfers as well as recent changes in the tax/benefit system. The methodology also includes the parameter values and tax equations underlying the data.

The Austrian currency is the Euro (EUR). In 2018, EUR 0.85 was equal to USD 1. In that year, the average worker in Austria earned EUR 47 120 (Secretariat estimate).

1. Personal Income Tax

1.1. Central government income tax

1.1.1. Tax unit

Each person is taxed separately.

1.1.2. Tax allowances

1.1.2.1. Standard tax reliefs

-

Work related expenses: a tax allowance of at least EUR 132 is available to all employees.

-

Tax allowance for special expenses of at least EUR 60.

-

Social security contributions and connected contributions (see Section 2).

-

Child allowance of EUR 440 per child for one parent or EUR 300 per child for eachparent. . Parents can choose between these opportunities.

1.1.2.2. Non-standard tax reliefs

-

Mainly work related expenses (‘Werbungskosten’).

-

Traffic relief depending on the distance between home and working place as well as the availability of public transport.

The following allowances are deductible from income (EUR per year):

-

Tax-free wage supplements exist for dirty, hard, dangerous, night, weekend and holiday work and overtime. The supplement for 10 hours of overtime up to EUR 86 per month is tax free, while other supplements are tax free up to EUR 360 (EUR 540 for night work) per month:

-

Tax allowances for contributions to state-approved churches up to EUR 400 per year and for donations up to 10% of income for research and humanitarian purposes, environmental protection, fire brigades, civil protection, etc.

1.1.3. Rate Schedule

Since 2016 the tax schedule is:

There is a special taxation other than the normal tax schedule for Christmas and leave bonus to the extent that their sum does not exceed two average monthly payments (1/6 of current income) or EUR 83 333. Otherwise, the tax amount is calculated according to the following formula:

If income for Christmas and leave bonus exceeds EUR 83 333, the exceeding amount is added to current income and taxed accordingly (MTR of 50% or 55%, see above).

1.1.4. Tax credits

The following tax credits exist:

-

Traffic (commuting) tax credit of EUR 400. If the overall income tax liability of current income is negative, a refund of social security contributions applies. The refund amounts to the absolute value of the negative result of the tax calculation for current income, limited to 50% of overall social security contributions paid, respectively EUR 400. For commuters with a traffic allowance (see 1.1.2.2.) the maximum amount is EUR 500.

-

Additional traffic tax credit in case of entitlement to traffic relief according to the distance between home address and working place (see 1.1.2.2.). In this case, employees are entitled to an additional traffic tax credit of EUR 2 per km distance from home to working place.

-

Sole earner and single parent tax credit for families with children. The sole earner credit is not given when a spouse’s income exceeds EUR 6 000. This tax credit is EUR 494 for one child and increases by EUR 175 for the second child and by EUR 220 for the third and every additional child. This tax credit is non-wastable and can be paid as a negative income tax (in addition to the refund of social security contributions in respect of the traffic tax credit).

-

Child tax credit of EUR 700.8 (58.40 per month) per child. This tax credit is paid together with child allowances and is not connected with an income tax assessment. Therefore, it is treated as a transfer in this Report (similar treatment as in Revenue Statistics).

-

A tax credit for retired persons which amounts to EUR 764 for single earners with income up to EUR 19 930 if the spouse’s income does not exceed EUR 2 200. Otherwise, the tax credit is EUR 400. The tax credit is linearly reduced to 0 for incomes between EUR 17 000 (EUR 19 930 for sole earners) and EUR 25 000. If the income tax liability is negative, a refund of social security contributions applies. The refund is limited to 50% of total social security contributions paid, respectively to EUR 110.

1.2. State and local income taxes

None.

2. Compulsory Social Security Contributions to Schemes Operated within the Government Sector

2.1. Employee and Employer Social Security Contributions

2.2. Payroll taxes

There are two payroll taxes which are levied on employers for all private sector employees with a monthly gross wage total of more than EUR 1 095: the contribution to the Family Burden Equalisation Fund (3.9%) and the Community Tax (3%). The wage-dependent part of the contribution to the Austrian Economic Chamber (listed under heading 1000, taxes on profits, Revenue Statistics), which is levied, together with the contributions to the Family Burden Equalisation Fund, at different rates depending upon the Länder Chamber (average rate is approximately 0.4%), is not taken into account. The contribution for the promotion of residential buildings (listed under heading 3000, taxes on payroll, Revenue Statistics) is included in the social security contributions shown above and it is levied by the Health Insurance Companies on monthly income (current) along with the other social security contribution amounts.

3. Universal Cash Transfers

3.1. Transfers related to marital status

No recurrent payments.

3.2. Transfers for dependent children

A family allowance is granted for each child. The monthly payment is EUR 114.00 for the first child, EUR 128.20 for the second, EUR 152.00 for the third and is further increased for each additional child. It rises by EUR 7.90 for children above 3 years of age, EUR 27.50 for children above 10 years of age and by EUR 51.10 for students (above 19 years of age). The taxing wages calculations only consider households with 2 children aged between 6 and 11 inclusive.

Parents are entitled to a childcare transfer, introduced in 2002. The flexibility of the childcare transfer was again increased significantly. The entitled parent can choose the period of payments between 365 and 851 days (if they split up parental leave: 456 and 1,063 days) resulting in a transfer of EUR 14.53 (in case of 851/1,063 days) to EUR 33.88 per day (in case of 365/456 days). Also, instead of fixed amounts the parents can opt for 80% of the last net-earning, limited to EUR 66 per day (14 months; 12 plus 2). Additionally, parents receive a bonus of EUR 1 000 if the period of transfer payments is split at least at a ratio of 40:60 between parents.

The child tax credit (EUR 58.40 per month, see § 1.14) is paid together with the family allowance and therefore treated as a transfer.

There is a supplement to the family allowance of EUR 20.00 per month for the third and every additional child if the family’s taxable income (i.e. the sum of the tax base for the progressive income tax schedule) in the preceding year did not exceed EUR 55 000. This supplement is paid on application after a tax assessment of the very year.

An additional family allowance (“13th family allowance”) of EUR 100 is given for children in the age between 6 and 16 years every September.

4. Main Changes in Tax/Benefit Systems Since 2004

In 2004, the first step of a comprehensive tax reform came into force. The general tax credit was increased from EUR 887 to EUR 1 264 and the phasing-out rules were considerably simplified and harmonized for all groups of taxpayers.

The tax reform in 2005 brought a new income tax schedule. Apart from the top rate of 50% for incomes exceeding EUR 51 000, it shows the average tax rate for two amounts of income. The tax amounts for incomes between these values have to be calculated by linear interpolation. The formulas that have to be applied are defined in the tax law. The tax reform included some measures which were made retrospective for 2004. These measures are an increase of the sole earner and the single parent tax credit depending on the number of children (together with a higher income limit for the spouse of a single earner) and an increase of traffic reliefs by about 15%. The maximum deductible amount for church contributions was increased as well. In 2006, the traffic reliefs were raised again by about 10%.

In 2007, the traffic allowance was increased by 10% (effective from 1st July). Additionally, the maximum negative tax for employees with traffic allowances was raised from EUR 110 to EUR 240 (for 2008 and 2009). In 2008, the family allowance for the third child and all subsequent children was increased. Furthermore, the unemployment insurance contribution of low-earning employees was reduced (effective from 1st July).Also in 2008, for monthly earnings up to EUR 1 100 the rate was set to zero, for earnings below EUR 1 200 the contribution was set to 1%, below EUR 1 350 2% and above it was set to the current rate of 3%. Since 2008, these income limits have been raised according to the increase of the ceiling levels of social security contributions every year.

In September 2008, the parliament decided some measures to compensate for the strong increase of food and energy prices: inter alia, the tax exemption of overtime supplements was increased and the 13th child allowance was introduced.

The tax reform 2009 (effective from the 1st of January) brought an increase of the zero bracket (from EUR 10 000 to EUR 11 000), a reduction of the marginal income tax rates (except the top rate), an upward shift of the top rate bracket (from EUR 51 000 to EUR 60 000) and several measures for families with children: child allowance (EUR 220 or EUR 132 each parent p.a.), deductibility of cost for child care (up to EUR 2 300 p.a. per child), tax-free payments (up to EUR 500 p.a.) from employers to their employees for child care and an increase of the child tax credit.

Starting in 2013 a progressive rate schedule is applied to Christmas and leave bonus instead of a flat rate regime of 6% (see 1.1.3.)

The tax reform 2016 decreased all marginal tax rates significantly, notably the marginal tax rate of the first tax bracket, which was reduced by 11.5 percentage points from 36.5% to 25%. Limited to the years 2016 to 2020 the top marginal tax rate is temporarily increased by 5% points to 55%. These 55% apply to those parts of income exceeding EUR 1 million a year.

The tax credit for employees was increased from EUR 345 to EUR 400. The non-wastable tax credit (reimbursement of social security contributions) for low earnings was extended. For employees the non-wastable tax credit was increased to a maximum of 50% of social security contributions up to a ceiling of EUR 400 a year. For commuters eligible for the commuter tax allowance the maximum amount of the non-wastable tax credit is EUR 500. This system of a non-wastable tax credit was extended to pensioners too, limited to EUR 110.

Besides the already existing broad financial support for families (payable tax credit and transfers as well as deductibility of cost for childcare) the tax reform 2016 increased the tax allowance for children from EUR 220 to EUR 440 per child. If both parents claim for this tax allowance, it increases to EUR 600 (two times EUR 300).

Tax expenditures (tax allowances) for private insurances (e.g. health and pension insurances) and mortgages were abolished for new contracts beginning with 2016. For existing contracts these tax allowances are maintained for a transitional period of five years.

5. Memorandum Items

5.1. Calculation of Earnings Data

-

Sector used: All private employees except apprentices employed full-time for the whole year

-

Geographical coverage: Whole country

-

Sex: Male and Female

-

Earnings base:

-

Items excluded:

-

Unemployment compensation

-

Sickness compensation

-

-

Items included:

-

Vacation payments

-

Overtime payments

-

Recurring cash payments

-

Fringe benefits (taxable value)

-

-

-

Basic method of calculation used: Average annual earnings

-

Income tax year ends: 31 December

Period to which the earnings calculation refers to: one year.

2018 Tax equations

The equations for the Austrian system are, in principle, on an individual basis. The only variable which is dependent on the marital status is the head of family (sole earner) tax credit, which is also given to single parents. For the Christmas and leave bonus (both amounting to one monthly wage or salary) there are special rules for the calculation of social security contributions (separate ceilings and slightly lower rate) and wage tax (reduced flat rate). The income tax schedule and the tax credits are applied only for "current pays". The child tax credit is in principle given to the mother (as a negative tax together with "family allowances" = transfer for children). The sole earner and the employee tax credit are connected with negative income tax rules. Therefore, the tax finally paid may be different from tax liability minus tax credits.