copy the linklink copied!Gross replacement rates: Public vs Private, Mandatory vs Voluntary schemes

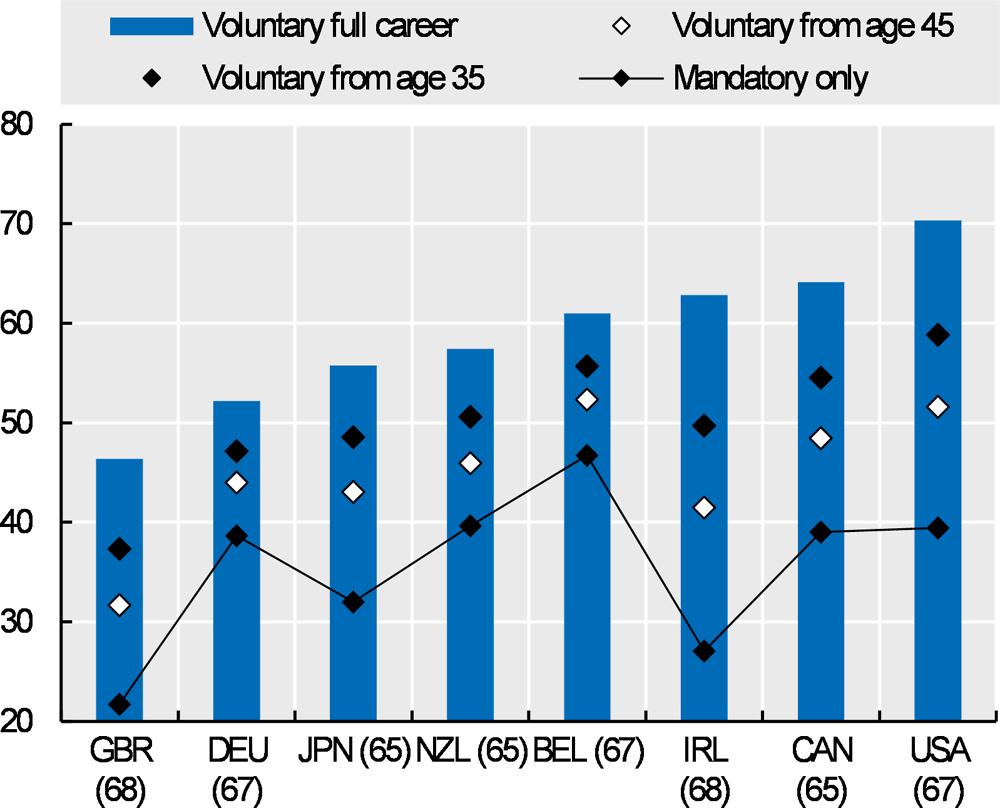

Private pensions play a large role in about half of OECD countries. For mandatory schemes, the OECD average for gross replacement rates of an average earner from public schemes alone is 40%, compared with 49% with private pensions included. For the eight OECD countries where voluntary private pensions are widespread, plus Israel and Mexico, the average replacement rate is 58% for an average earner choosing to contribute for the whole career compared with 36% when only mandatory schemes are considered. If the full-career average-wage earner only starts contributing in a voluntary scheme from age 45, the replacement rate is 45% against 59% when contributing for the whole career on average among the eight countries.

Table 5.3 shows the interplay between mandatory public, mandatory private and voluntary pension schemes. As shown in the previous indicator, the average replacement rate from mandatory schemes for a full-career average earner is equal to 49%: for the 17 OECD countries where the calculations of entitlements only cover mandatory public pensions, the average replacement rate for an average worker earner is 55%; for the 9 OECD countries with both public and mandatory private provision but no voluntary, the average replacement rate is 51%; and for the last 10 countries with significant voluntary pensions, the replacement rate from the mandatory component alone is 36%.

Mandatory private pensions

Mandatory private pensions exist in 11 countries including Denmark, the Netherlands and Sweden where private pensions have near-universal coverage, and are described as “quasi-mandatory”.

In Iceland, the Netherlands and Switzerland, private pensions are mainly defined benefit, whilst in the other countries they are defined contribution. Replacement rates from mandatory private schemes range from 6% in Norway to over 50% in Denmark and Iceland. All of the other countries are between 19% and 32% at the average wage, with the exception of the Netherlands at 42%. In Sweden the contribution rate for the private pension increases from 4.5% below to 30% above the ceiling for the public scheme, hence the total replacement rate is higher for high earners than average earners.

Voluntary private pensions

Voluntary private pensions are shown for eight countries where voluntary private pensions cover more than 40% of the population aged 15 to 64 (see the indicator of “Coverage of private pension plans” in Chapter 9). In addition, the housing account in Mexico and the severance account in Israel have been added as if they are not utilised during the working career, they are then transferred to the pension accounts at retirement. Voluntary private pensions include both voluntary occupational and voluntary personal plans. In Japan, a defined benefit plan is modelled, with the others having defined contribution schemes. In Israel the voluntary scheme modelled is the severance pay scheme, which is used as a pension if not utilised during the career. In Mexico the housing account is modelled, which is also used as a pension at the point of retirement if funds still remain.

When voluntary private pensions are taken into account for the whole career in Belgium, Canada, Germany, Ireland, Israel, Japan, Mexico, New Zealand, the United Kingdom and the United States the average replacement, for these ten countries, is 58% for an average earner compared with 36% when only mandatory schemes are considered. The voluntary component has the largest impact on the replacement rate (more than 29 percentage points) in Ireland, the United Kingdom and the United States.

The length of the contribution period clearly has an impact on the total replacement rate. The chart below compares the full-career full-contribution case with the full-career case but with contributions in the voluntary scheme from age 35 and 45 only, perhaps a more appropriate scenario. The schemes in Israel and Mexico are not considered as contributions are mandatory at all ages to severance and housing accounts respectively.

Among these eight countries, only contributing from age 35 (45) reduces the gross replacement rate by 10 (16) percentage points on average compared with the full-contribution case. In Belgium, Canada and the United States making contributions to the voluntary scheme from age 35 would result in a gross replacement rate above 55%.