Chapter 2. Latin American Agriculture: Prospects and Challenges

This chapter reviews the prospects and challenges facing the agricultural sector in Latin America and the Caribbean (LAC). The region accounts for about a quarter of global exports in agricultural and fisheries products, underscoring the importance of trade openness at the global level. Strong growth opportunities in high value fruit and vegetable crops provide opportunities for smallholders, but policies will need to be differentiated according to resource endowments and market potential. Food security continues to be a concern, with many households unable to afford the food they need. Given the simultaneous rise in the number of people who are overweight and obese, several initiatives seek to counter these trends. Raising agricultural productivity sustainably in LAC will rely on new strategic investments in agriculture’s enabling environment. However, due to the region’s diverse state of rural infrastructure, R&D initiatives and of environmental problems from agricultural production, mixed potential exists to further expand public spending and improve the environmental performance of the sector.

2.1. Introduction

The Latin America and Caribbean (LAC) region covers more than 2 billion ha and encompasses 34 countries with a total estimated population in 2018 of 657 million- a low average population density of 0.34 persons per ha. From the available area, 38% is used for agriculture (9.5% for crops and 28.5% for pasture) and the other 46% is covered with forests. The region’s land represents 15% of the earth's surface, receives 30% of precipitation and generates 33% of the world's water, which makes the region a great world reserve of arable land and forests. Due to its enormous latitudinal range, varied topography and rich biodiversity, LAC has one of the most diverse and complex range of farming systems of any region in the world (Box 2.1).

Agriculture is an important sector for the economy across much of LAC, accounting for an average of 4.7% of GDP in 2015-17. This share is 1.4% lower than in 1996-98, in line with traditional economic development trends, and reflects declining shares in all LAC countries except Argentina. Some countries have seen agriculture’s share in total GDP reduced drastically such as Ecuador (10% during the same period), Guatemala (13.6%) and Guyana (20.2%). Nevertheless, agriculture still accounts for around 10% or more of total GDP in these countries, as well as in Belize, Bolivia, Dominica, Ecuador, Haiti, and Paraguay.

Agriculture and fisheries in Latin America and the Caribbean have grown by an average of 2.7% per year (in constant 2010 US dollars, including forestry) over the past two decades, a slightly lower rate than overall economic growth, commensurate with the sector’s declining share of GDP. This pace of growth is considerably faster than that of OECD countries (1.2% annual growth), but slower than that of the more dynamic regions of South Asia, and East Asia and the Pacific, which grew by 3.1% and 3.7% respectively, or Sub-Saharan Africa, which outperformed every region by growing at 4.6% per year (World Bank, 2019[1]).

Performance has been diverse across the region. In general, agriculture and fisheries in South American countries have performed relatively better than in Central American countries. The sector has contracted in several Caribbean economies, yet the second fastest rate of growth (4.3%) was recorded in the Dominican Republic.

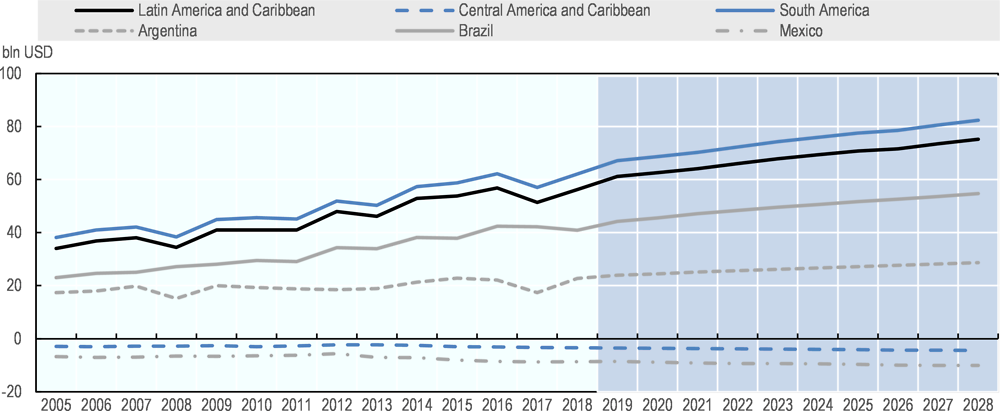

The region has positioned itself as a leading exporter of agricultural products. Latin American countries are major exporters of soybeans, pork, maize, poultry, animal feed, sugar, coffee, and fruits and vegetables. Brazil is the largest agricultural and food exporter (USD 79.3 billion in 2017) in the region, followed by Argentina, (USD 35.0 billion), Mexico (USD 32.5 billion), Chile (USD 17 billion), Ecuador (USD 10.4 billion) and Peru (USD 8.8 billion). Some Latin American countries are significant importers of agri-food products as well, such as Mexico, which is among the major world importers of maize, soybeans, dairy, pork and poultry, and Brazil, one of the top world wheat importers. Overall, however, LAC’s agricultural trade surplus has steadily increased over the past two decades, reaching USD 104.3 billion in 2017.

The sector is especially important to livelihoods. In 2018, 14.1% of total labour force in the LAC region was employed in agriculture. Countries such as Bolivia, Ecuador, Guatemala, Honduras, Haiti, Guatemala, Nicaragua and Peru employed more than a quarter of its labour force in the agricultural sector (World Bank, 2019). LAC countries managed to bring rural poverty rates down even during times of economic crises and sluggish economic growth. From 1990 to 2014, rural poverty in the region fell by almost 20 percentage points. Key to this successful performance was a switch in public policy from generalised consumer subsidies to targeted conditional cash transfer programmes, where Latin American countries have been pioneers. Moreover, during times of economic crises in the region, agriculture has served as a “buffer” during recessionary periods (Arias et al., 2017[2]).

The favourable poverty alleviation trend, however, has been reversed in recent years. Furthermore, there is still a high incidence of poverty and extreme poverty in rural areas (48.6% and 22.5%, respectively). Since 2015, the trend of closing the gap between the rural and urban poor has also reversed, and the poverty gap has widened when other dimensions of poverty (access to basic public services) are taken into consideration (CEPAL, 2018[3]; Food and Agriculture Organization of the UN (FAO), 2018[4]). In addition, the number of undernourished people increased for the third consecutive year in 2017, reaching 39.3 million in (Food and Agriculture Organization of the UN (FAO) et al., 2018[5]), a problem related to the affordability of food to poor consumers rather than the physical availability of food, given the agricultural and food surplus status of the region.

LAC’s abundant natural resource endowment will allow the region to continue playing a major role in world agricultural production and trade. The challenges for the future lies in maintaining growth in a context of slower demand growth and lower international prices, while ensuring that future agricultural growth is more sustainable and more inclusive than it has been in the past.

Agriculture in Latin America and the Caribbean (LAC) is heterogeneous from nearly every angle. The region covers a great variety of different agro-ecological zones, varied topography and vastly different farm sizes and structures, operating at different levels of technology and sophistication. This makes agriculture in the region immensely diverse in terms of production systems, economic importance and its contribution to income, employment and trade.

The region’s overall productive structure is highly diverse. A capital and technology-intensive corporate sector that has successfully managed to integrate itself into global agri-food markets alongside coexists alongside a broad socio-productive sector based on subsistence farming, non-farming rural activities and landless rural populations that have been unable to participate in dynamic economic circuits. Between these two extremes, there is an intermediate sector that is able to connect to markets, but that continues to be extremely vulnerable to economic and political shocks as well as to climatic risks.

The heterogeneity of agriculture in LAC is reflected in the diversity of the region’s farm structures. While agriculture in the Southern Cone is dominated by large, commercial and export-oriented farms, particularly in Argentina and Brazil but increasingly in other countries such as Uruguay, much of the rest of the region is characterised by smallholder and family agriculture. It is estimated that there are 15 million smallholder and family farmers in the LAC region, who are responsible for a substantial share of the region’s food production.

As regards trade, while the region as a whole is a major supplier of grains and oilseeds to global markets, as well as bananas, coffee and sugar, large differences exist across the sub-regions. For instance, the countries of the Southern Cone, in particular Argentina and Brazil, are among the world’s largest exporters of wheat, maize, soybeans and sugar, whereas the Caribbean countries depend on world markets to meet their food requirements.

There are also large differences in the contribution of agriculture to overall economic output. On average, primary agriculture merely accounts for less than 5% of GDP in LAC, but the regional average masks considerable differences across countries. While agriculture accounts for even less than 4 % of GDP in Mexico and Chile, it exceeds 15% in Belize and Nicaragua and even 20% in Paraguay. Nevertheless, regardless of the individual country situation, the importance of agriculture rises when upstream and downstream activities are added to primary production. Applying this broader definition of agriculture, the sector accounts for a share of more than 20% of GDP in most of the LAC economies.

2.2. Agricultural development

Agricultural performance

The Latin America and Caribbean region has experienced substantial agricultural output growth over the past two decades. Brazil was one of the agricultural growth leaders both in the region and worldwide, with an average growth rate of 4.1% between 1991 and 2015, while Southern Cone1 and Andean countries’ agriculture grew 2.8%, Central American agriculture grew 2.5%, and Caribbean countries reported a modest 1.0% average annual growth rate.

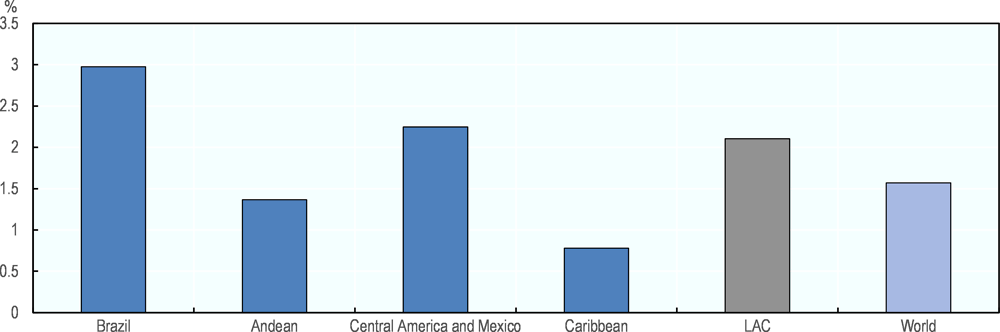

Most of this production growth has come from productivity improvements, rather than bringing more land into production. Agricultural Total Factor Productivity (TFP) in Latin America and the Caribbean grew at an annual average rate of 2.1% between 1991 and 2015, 0.5 percentage points above world average, but 1.3 percentage points below the fastest growing region in the world during that period, Northeast Asia. Agricultural TFP growth was uneven within the region: while Caribbean agricultural TFP growth was one of the lowest worldwide, Brazil’s (3.0%) was only surpassed by Northeast Asia (3.4%), a region in which agricultural TFP used to grow at around half Brazil’s rate during the 1970s and 1980s.

Productivity growth has been uneven between countries in the region; data from Brazil suggest that there are also important differences according to farm size, location, and degree of specialisation. In Brazil, large farms (500+ha) and small farms (0-5 ha) showed the fastest TFP growth during 1985 and 2006, whereas medium-large farms (100-500 ha) showed the slowest growth. Differences in TFP growth related to the farms’ degree of specialisation were also found (Rada, Helfand and Magalhães, 2018[6]). The relationship between farm size and TFP growth varies by region; for example, the highest TFP growth in the Brazil’s Northeast was recorded by the 5-20 ha farm size class, whereas in the Southeast the 500+ ha farms showed the highest TPF growth (Arias et al., 2017[2]).

Productivity growth across the region has been driven by R&D, accompanying investments in agriculture’s enabling environment, and specific support to farmers. Public investment in agricultural research and development (R&D) has been key to increased productivity in Latin American agriculture. Although volatile during the 1980s and 1990s, government expenditure on agricultural R&D shows a long-term positive trend; by 2013, the region spent USD 5.1 billion (2011 PPP prices) on agricultural R&D, with Brazil accounting for a little more than 50% of total expenditure (Stads et al., 2016[7]).

Government agricultural research institutions, sometimes working together with the private sector, have played a key role in operationalising government expenditure in R&D to increase productivity. For instance, Brazil’s EMBRAPA, the largest agricultural research institution in the region, completely transformed agriculture in the Cerrado region (savannah area) in Midwest Brazil by introducing technologies from abroad (nitrogen fixation, no-tillage practices, for example) and livestock breeds, and adapting them to the local conditions to produce cotton, soybeans, maize and cattle (OECD/FAO, 2015[8]). Argentina’s INTA, through its research on seed breeding, direct seeding, weed control, and working together with the private sector, was instrumental in soybean productivity growth (including the expansion of the double cropping soybean-wheat system) in the Pampa and extra-Pampa regions (Bisang, Anlló and Campi, 2015[9]). Research conducted by Chile’s INIA has contributed to boosting Chilean agricultural exports; by introducing new nut varieties, farmers estimate that nut exports increased 1000% in the decade from 2001 to 2011. INIA also introduced blueberries in various regions of Chile and, from being practically an unknown fruit to farmers only two decades ago, today Chile is an important blueberry producer and exporter in the Southern hemisphere (Instituto de Investigaciones Agropecuarias (INIA), 2014[10]). In Mexico, an assessment of 30 new technologies developed by INIFAP over the 2000-2010 period (new bean, oat, garbanzo, and garlic varieties, forage management, more efficient water use, for example) concluded that these technologies reached 536 369 farmers and 1.8 Mha, and yielded internal rates of return ranging from 10.6% to 73% (González-Estrada, 2016[11]).

Parallel investments in agriculture’s enabling environment can leverage the benefits of R&D. Complementary factors include policies that improve economic incentives for producers, stronger rural education and agricultural extension services, and rural infrastructure that improves access to markets. (Fuglie and Wang, 2012[12]).

Specific support has also been delivered to farmers. Mexico’s Alianza para el Campo, for example, has offered support to farmers under a wide array of instruments, including on-farm investment subsidies (Programa de Apoyo a la Inversión en Equipamiento e Infraestructura), income support (Procampo, Diesel Agropecuario, Fomento Productivo del Café, for example), natural resource conservation programmes, risk management and marketing support. The Mexican government has also implemented special strategic programmes such as PROMAF, which supports the maize and bean value chains, being these two products traditional staple foods of the Mexican diet.

Brazil has similarly implemented comprehensive agricultural policies addressing specific target farmer populations, such as PRONAF (National Programme to Strengthen Family Farming). Mid-size farmers have had access to special lines of credit through PRONAMP (National Programme to Support Medium Agricultural Producers) and larger producers have benefitted from price support and subsidised credit and insurance programmes.

Chile’s agricultural policy has focused both on developing efficient internal markets (improving market information, storage infrastructure, promoting contract agriculture, for example) and promoting agricultural exports through its Fondo de Promoción de Exportaciones Agropecuarias. The Chilean government subsidises small-scale irrigation projects through competitive tender processes. Through FONDOSAG, farmers receive government support to invest on phytosanitary, animal health and resource conservation matters. Smallholder farmers have traditionally been supported by INDAP, a Ministry of Agriculture Institute that provides a wide array of instruments for this type of farmers, including credit, training, on-farm investment subsidies, and marketing support.

Other Latin American and Caribbean countries have also supported farmers, by facilitating access to credit and new technologies, and providing other investments. However, their impact on agricultural productivity is difficult to assess, and there have been few formal impact evaluations.

Agricultural productivity also benefits from the building of human and social capital. Better management skills are complemented by the fast-paced growth in information technologies, which improve both technical and allocative efficiency. Better organisational skills also allow farmers to respond better to changing market conditions (Chang and Zepeda, 2001[13]). Over 33 000 agricultural cooperatives are active in the LAC region. In addition, several farmers’ organisations at national, sub-regional and regional levels operate with various degrees of effectiveness.

Colombia’s Federación Nacional de Cafeteros, for example, conducts marketing campaigns in several countries, directly trades coffee, and conducts research and technology transfer for its member farmers. The quinoa export boom would have probably not been possible without the existence of quinoa producer associations, such as Bolivia’s ANAPQUI and APQUISA, or Peru’s various quinoa cooperatives. At the regional level, the Latin American Poultry Producers Association, through its Technical and Scientific Committee, designs poultry disease prevention, control and eradication plans, as well as training programmes for poultry associations at the country level.

Changes in the structure of agricultural production

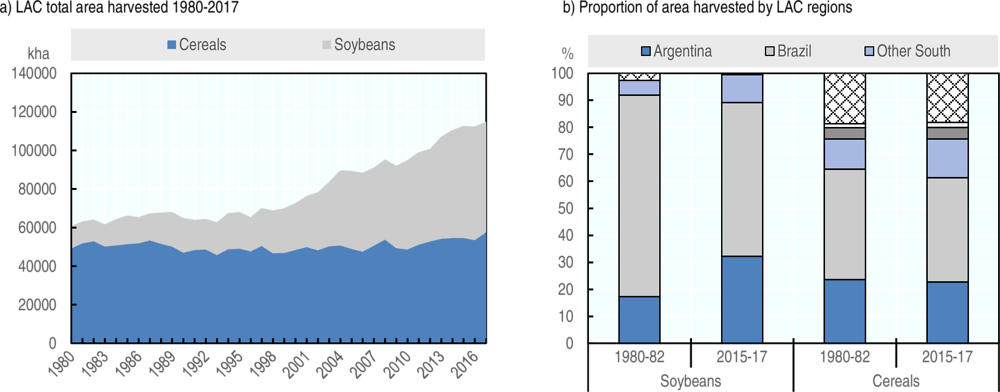

Since 2000, the pasture area in LAC has remained almost stable at 570 Mha, whereas crop land has increased by 1.2% p.a. to 188 Mha in 2018. Brazil alone increased agricultural harvested area by 55.7 Mha over the past three decades. Since 2000, nearly a third of the increase in area harvested of cereals, oilseeds and pulses in Argentina and Brazil has been due to double cropping. Oilseed (especially soybean) harvested area increased considerably in MERCOSUR countries, remained fairly constant in Andean countries, except for Bolivia, and declined steadily in Central America, Mexico and Chile. In contrast, fruits and vegetables gained considerable importance in Central America, Mexico and Chile.

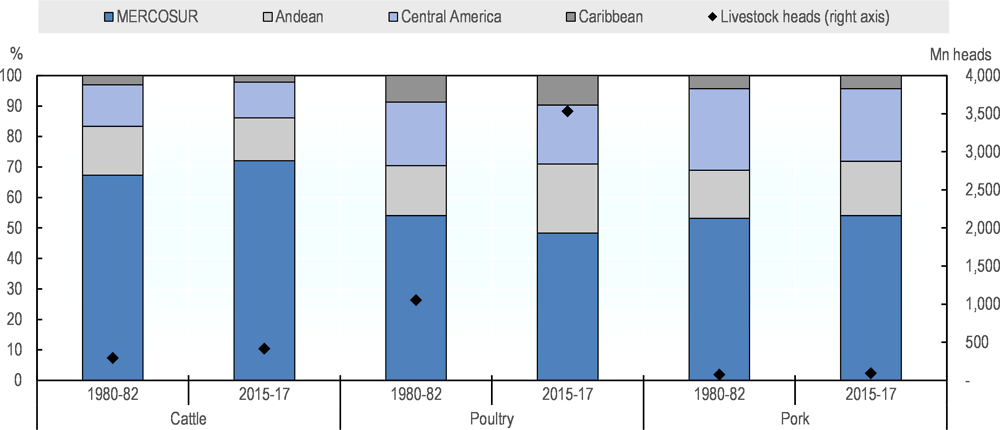

Cattle ranching has shown different dynamics in Latin America: while the cattle herd has remained relatively constant in the Caribbean (the fall in Cuba and small island countries has been offset by the increase in the Dominican Republic), it has grown moderately in Central America, Mexico, Andean countries and Uruguay, and rapidly in Brazil and Paraguay. Cattle herd increased from 293 million head in 1980-82 to 414 million head in 2015-17, with 80% of this growth occurring in Brazil alone. In 2015-17, Brazil accounted for 53% of the total LAC herd (11 percentage points more than in 1980-82).

Aviculture has been particularly dynamic in the region, with growing domestic and foreign demand underpinned by favourable prices relative to other meats. Poultry stocks have trebled in MERCOSUR and Central American countries over the past three decades, and more than trebled in Andean countries and in the Caribbean. In contrast to cattle ranching, aviculture growth has been less concentrated regionally. In fact, even though poultry stocks trebled in Brazil between 1980-82 and 2015-17, Brazil’s share of LAC’s total poultry stocks fell 4 percentage points; nevertheless, the country still accounts for 40% of total LAC poultry stocks. Andean countries’ share of total LAC poultry stocks increased 6 percentage points during this period, thanks mainly to Bolivia, whose expansion of soybean area made poultry feed more affordable for Bolivian producers.

The structure of Latin American agriculture is heterogeneous and has evolved differently across countries. Large, export-oriented, capital-intensive farms coexist with small, labour-intensive, subsistence-oriented farms. Out of the estimated 20.4 million farms in the region, 81.3% are smallholder family farms, occupying only 23.4% of farm land. Conversely, 18.7% of all farms own 76.6% of total agricultural land (Leporati et al., 2014[14]).

Over the past couple of decades, two contrasting phenomena have been observed regarding agricultural land structure in Latin America: land concentration has been recorded in countries such as Paraguay, Argentina, Uruguay, Chile and Venezuela, whereas land fragmentation has occurred in countries such as Brazil, Peru, Mexico, Costa Rica, Nicaragua and El Salvador. Economies of scale, inheritance, urbanisation, and the development of land markets are behind the observed phenomena, all of which may take place simultaneously at the country level. Average farm size has increased more than 20% in Argentina and Uruguay and almost 40% in Paraguay in less than two decades, whereas average farm size has declined around 30% in countries such as Nicaragua (from 2001 to 2011) and El Salvador (from 1971 to 2007-2008) (Sotomayor and Namdar-Irani, 2016[16]). Household survey data also suggest a land concentration process in the region. From 2002 to 2014, the number of agricultural households (wage and autonomous) fell by one fifth in twelve LAC countries and employment in agriculture fell 11 percentage points (UN Economic Commission for Latin America and the Caribbean (UNECLAC); Food and Agriculture Organization of the UN (FAO); Inter-American Institute for Cooperation on Agriculture (IICA), 2017[17]).

The above farm size averages do not consider land renting, a common practice in some countries such as Argentina, whose seeding pools may manage farms of several thousand hectares, or Mexico, with its long-established transnational agribusinesses that, through contract farming, implicitly control the whole production process of several thousand hectares. Furthermore, the above figures conceal concentration processes occurring under specific agricultural sectors. For example, even though Peru reported land fragmentation in the past couple of decades, one single economic group manages farms that range from 1 240 to 8 858 ha in the fruit and vegetable export sector. In Brazil, where land fragmentation was also reported, a single farmer was able to plant 223 000 ha of soybeans (Soto Baquero and Gómez, 2014).

In addition to land concentration, a relatively recent phenomenon appears to be increased foreign investment in agricultural land. Foreign investors have not only come from outside the region but also from within the region. Brazilians and Argentinians are producing soybeans, livestock and forest products in Bolivia, for example. Brazilian investors have acquired land not only in Bolivia, but also in Paraguay, Colombia, and Uruguay. Mexican, Costa Rican and Guatemalan investors are engaged in forest, cattle, rice, sugarcane, citrus and oil palm fruit production in Nicaragua, to name a few examples (Soto Baquero and Gómez, 2014). Both land renting and increased foreign ownership of agricultural land make farm operations reach a size of thousands of hectares, changing the agricultural land structure and dynamics of the region, and pointing towards higher land concentration rates not captured by census data. In any case, both phenomena have posed contrasting challenges for policy makers.

Trends in rural population, rural poverty, and food security

The Latin American agricultural boom has not stopped migration from rural areas to cities nor to countries outside the region. During the late 1980s, the rural population in the region stopped growing and a few years later started to decline slightly. The number of people living in rural areas in 2017 (126 million) equalled that recorded in the mid-1970s. Latin America has thus become increasingly urban, with 80.4% of its 644 million inhabitants living in urban areas. More males than females have migrated from rural to urban areas; thus, agricultural households headed by females increased by 40% between 2002 and 2014 (UN Economic Commission for Latin America and the Caribbean (UNECLAC); Food and Agriculture Organization of the UN (FAO); Inter-American Institute for Cooperation on Agriculture (IICA), 2017[17]).

For 25 years, Latin America witnessed continuous improvement in rural poverty reduction (20 percentage points from 1990 to 2014). Some countries were able to reduce rural poverty significantly such as Brazil (42 percentage points from 1990 to 2014), Ecuador (39 percentage points from 2000 to 2014), Chile (32 percentage points from 1990 to 2013) and Peru (27 percentage points from 1997 to 2014). Economic growth, public investment in infrastructure and public services, and the implementation of social protection programmes, mainly conditional cash-transfer programmes which, by 2015, covered about a fifth of the Latin American population, largely explain these achievements (Food and Agriculture Organization of the UN (FAO), 2018[4]).

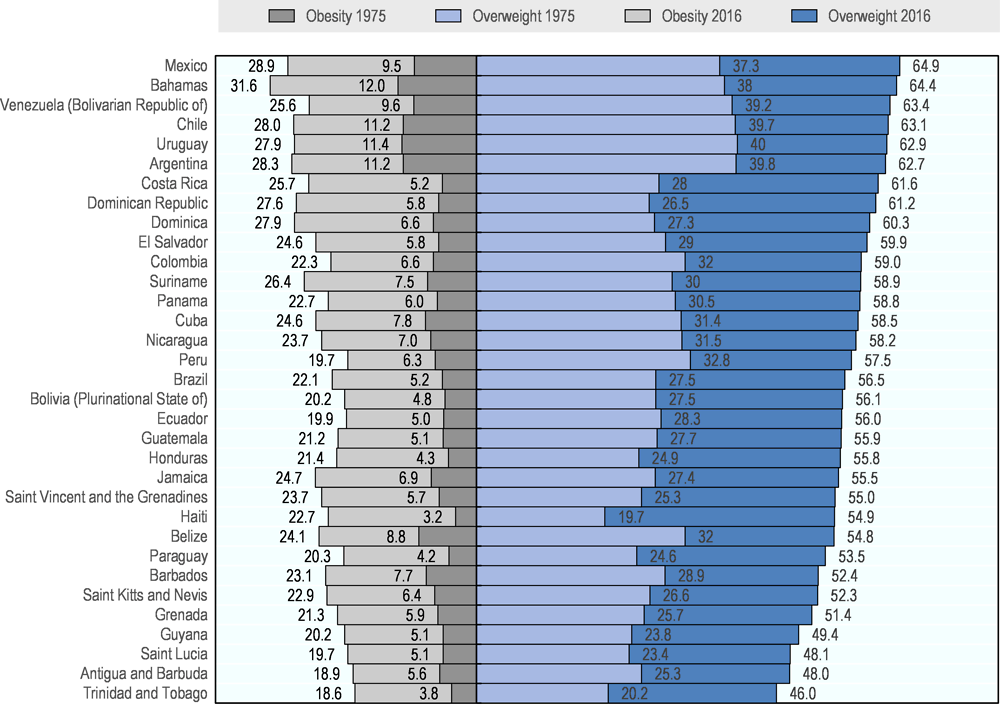

This positive poverty alleviation trend, including the narrowing of the rural/urban poverty gap, stagnated in 2014-2016 and reversed in some countries. Furthermore, significant gender inequalities prevailed in the region, indigenous and Afro-descendant peoples suffered from marginalisation, and social security, housing quality and educational-level inequalities were evident (Food and Agriculture Organization of the UN (FAO), 2018[4]). Paradoxically, being an agricultural and food surplus region, Latin America witnessed the number of food insecure population increase for the third consecutive year (Food and Agriculture Organization of the UN (FAO) et al., 2018[5]). Rather than the physical availability of food, the affordability of food to poor consumers has been behind the swing in food security trends in the region. In addition, overweight and obesity have increasingly become a public health problem in Latin American and Caribbean societies. One-fifth of LAC’s population is considered obese, and obesity seems to remain on the rise, particularly affecting lower-income sectors of the population, women, indigenous peoples, Afro-descendants and, in some cases, children (Box 2.2).

A regional look at diet composition and at policies that aim to halt an alarming trend

The Latin America and Caribbean (LAC) region has faced the challenge of malnutrition for a long time. Important progress in decreasing the prevalence of undernutrition has occurred over the last decades in part related to a strong political commitment by countries across the LAC region. A report by the World Food Programme (WFP) and the Economic Commission for Latin America and the Caribbean (ECLAC) (WFP-ECLAC, 2017[19]) states that over-nutrition is expected to become the main social and economic problem in the LAC region. Indeed, over-nutrition together with a lack of physical activity is a major driver towards people becoming overweight and obese (Graf and Cecchini (2017[20])). This is related to the energy imbalance between the calories consumed by an individual and the calories expended (WHO, 2019[21]). Over-nutrition leads to non-communicable diseases with consequences in terms of public health expenditures, rising prevalence of premature deaths and to productivity inefficiencies (Devaux and Sassi, 2015[22]).

The prevalence of individuals being overweight and obese in the LAC region has been well above average world levels for more than four decades and is comparable to the levels that prevail in high-income countries (Figure 2.4). In fact, LAC is the region with the second highest prevalence of individuals being overweight or obese in the world today, just behind North America.

According to WHO (2019[23]), the prevalence of people being overweight in the region has grown steadily from about 35% in 1975 to 60% in 2016 while the prevalence of people being obese has grown from 8% in 1975 to 25% in 2016. This rising trend has occurred in all countries across the region. Currently, the lowest prevalence of people being overweight is in Trinidad and Tobago (46%) and the highest in Mexico (65%).

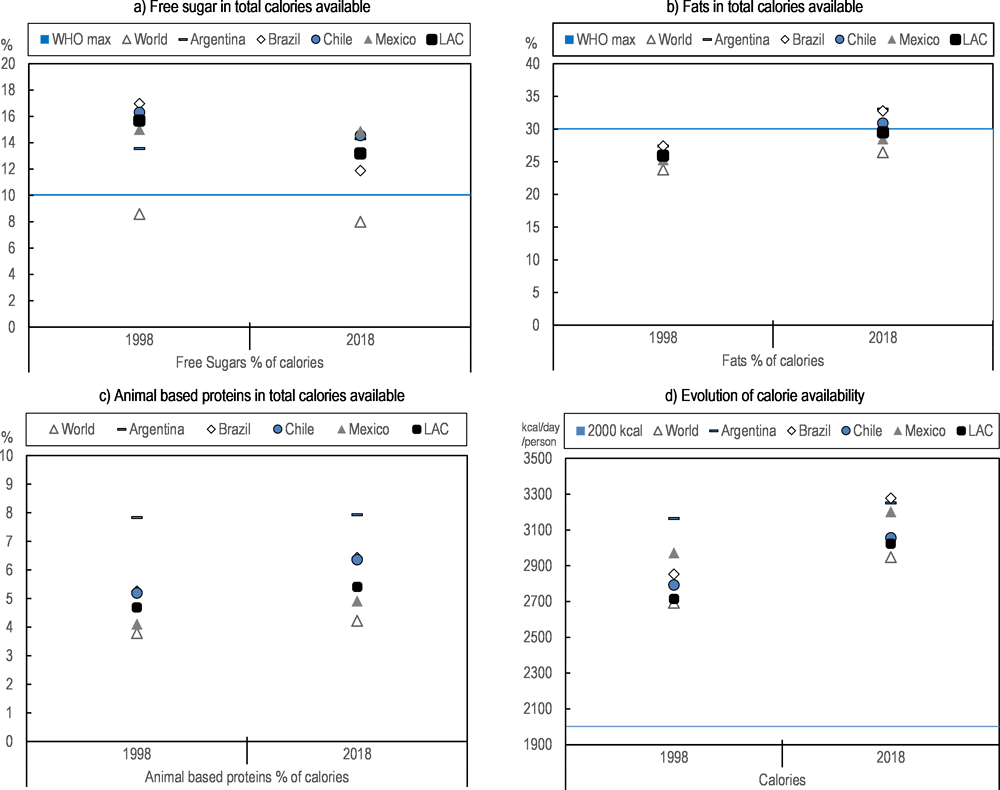

This box provides some insights on the evolution of diet composition in the LAC region based on historical data collected for the Agricultural Outlook. The Outlook assesses the current per capita calorie availability1 in the LAC region at around 3 000 calories, up by about 11% compared to 1998 levels (Figure 2.6.d). Even allowing for food waste at the processing, retail and household levels, such a per capita calorie availability level implies higher average consumption than would be consistent with the 2 000 calorie reference diet for the average individual (WHO, 2019[26]).

WHO recommends that the shares of free sugars and of fats do not exceed, respectively, 10% and 30% of total calories consumed. It appears that food habits in the LAC region are not in accordance with these recommendations. In the LAC region, the share of free sugar availability is well above the recommended WHO threshold although it has decreased from around 16% of total available calories in 1998 to 13% in 2018 (Figure 2.5.a). Brazil witnessed the strongest reduction in free sugar availability, with the share decreasing from 17% of total calories in 1998 to around 12% in 2018. However, this downward trend did not occur in all LAC countries. Other countries experienced a slight increase, for example in Argentina the availability increased from 13.5% to 14% in 20 years, while in other countries such as Mexico the share of free sugar availability in diets did not change.

There is rising trend across the LAC region in the percentage of fat based available calories, rising from about 26% to 29.5% over the last two decades and almost reaching the 30% maximum threshold recommended by WHO. Some countries in the region such as Argentina, Brazil and Chile are already above this threshold.

With regard to proteins, two decades ago the protein-based share of available calories in the LAC region was similar to the world average at almost 11%. However, about 45% of those protein calories were animal-based compared to only one third at the world level. A shift away from a traditional diet rich in cereals, roots, tubers and pulses towards more animal-based proteins has occurred in the region (Figure 2.5.c).

Given the alarming trends in the development of the prevalence of people being overweight and obese and the specificities of the diets in the LAC region, several countries in the region have introduced over the last five years policies to change consumers’ behaviour in terms of food choices. Table 2.2 provides an overview of the policies that are currently in place in four major countries in the region: Brazil, Argentina, Mexico and Chile. The classification of the policies in the table reflects the policy approach to encourage healthier food choices proposed in Towards Policies Encouraging Healthier Food, published in the OECD Food, Agriculture and Fisheries Paper series. Information was gathered concerning public interventions oriented towards the demand side, such as the provision of information to consumers, or at the supply-demand interface to modify the behaviour of food chain stakeholders.

Chile is particularly engaged with respect to nutrition policies. The Chilean government has implemented a policy package that covers advertisement control on processed foods and beverages marketed to children and the introduction of a mandatory warning front-of-pack labelling system that signals food products that are high in sugar, fats or sodium. Mexico was, in 2014, one of the first countries to develop a health-related tax on food. Brazil has developed the most comprehensive school meal law in order to reduce ultra-processed foods (Popkin and Reardon, 2018[24]). Ecuador was the first country in the region to have a mandatory traffic light labelling on food products (Pérez-Escamilla et al., 2017[25]). The private sector is also involved with voluntary commitments by food processors towards food reformulation.

This effectiveness of the public-private commitment to change the food environment and halt the obesity epidemic in the LAC region will need to be assessed in the future.

← 1. Per capita calorie availability refers to the calories associated with the total food use of agricultural products as evaluated in the Outlook (with the addition of fruits and vegetables consumption reported in FAOStat) divided by the population. Food use includes waste that might occur at different levels of the food chain and is different from food intake.

2.3. Medium-term outlook

The foregoing projections for agricultural markets in Latin America and the Caribbean reflect the structural determinants described previously. These projections could be affected by further actions to raise productivity, manage environmental resources sustainably and to make agricultural growth more inclusive. Strategic responses to these challenges and policy options are discussed, at the sectoral level, in Section 2.4.

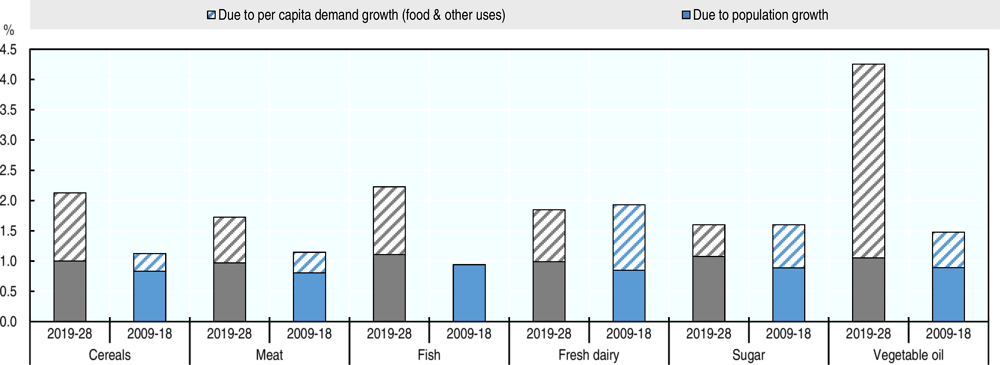

Demand

The demand for Latin American agricultural and food products will be mainly determined by population and income growth in the region and in its major markets. With 656.6 million inhabitants, LAC accounts for 8.5% of the world’s total population. South America is the most populous sub-region, with 65.6% of the total LAC population; Central America and Mexico account for 27.6% and the Caribbean for the remaining 6.7%. Population growth in the region has been declining over the past two decades, as the fertility rate in the region dropped from 3.06 births per woman in 1995 to 2.12 in recent years, and due to the net out- migration of the region. In 2005, for instance, emigration to developed countries peaked at 1.1 million people, and has stabilised at around 350 000 migrants per year in recent years. Annual average population growth in the region is expected to decline from 1.3% in the past two decades to 0.8% over the next decade. Population growth in the largest economy and most populous country of the region, Brazil (with a population of 212 million in 2019) is expected to halve in the next decade, to 0.6% per year, compared with other 1.1% over the past two decades. Mexico (with second largest population at 132 million) will also see a decline in population growth, going from 1.4% in 1995-2018 to 1.0% per year in 2019-2028.

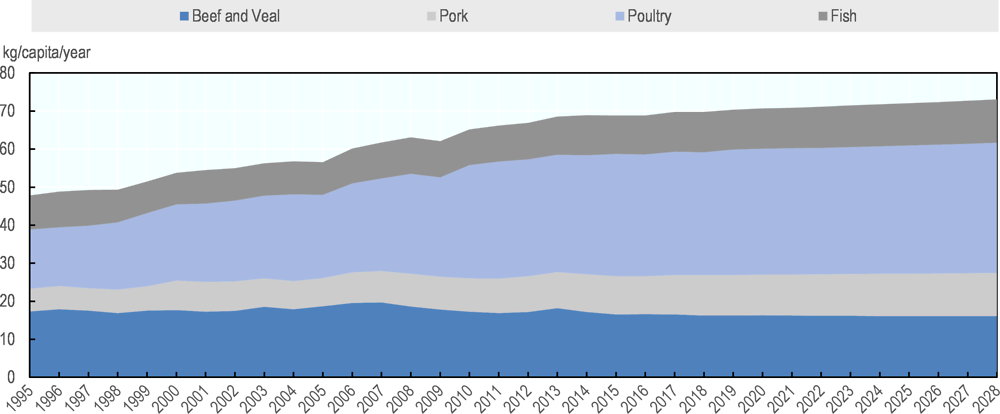

Real per capita GDP in the LAC region is expected to grow by an average of 1.9% per year in the next decade, 0.3 percentage points higher than in OECD economies. This will bring about changes in the composition of demand for LAC agricultural and food products. Increased demand for animal-based proteins, for example, could be expected. In addition, domestically, increased consumption of fruits, vegetables, meats, dairy, and fish could be expected relative to staples such as maize (whose per capita food consumption is expected to decline by 4.3% in the coming decade), wheat, rice and beans. Annual consumption of dairy products in the LAC region is projected to grow by 1.2% in the case of butter, 1.4% for fresh dairy products, 1.8% for whole milk powder, and 2.0% for cheese. Per capita beef, veal and pig meat consumption in LAC is expected to grow around 10% in the coming decade, fish by around 12%, and poultry by almost 15%. Thus, by 2028, poultry consumption, at 34.2 kg per capita per year, will account for 42.1% of total meat consumption. This is 14.8 percentage points higher than in the mid-90s, as LAC consumers, who are quite flexible regarding substitution between different types of meat, are expected to respond to favourable prices of poultry relative to other meats.

Biofuels (mainly ethanol and biodiesel) have been a significant contributor to increased demand for agricultural commodities in the past two decades, both in the region and worldwide. Ethanol production in Brazil, the second largest producer and exporter in the world after the United States, has been particularly dynamic, growing at an annual average rate of 5.3%. However, in the next decade, biofuels are expected to play a relatively smaller role in the demand growth for agricultural commodities.

Average annual growth in biodiesel and ethanol consumption in LAC is expected to drop from 10.8% and 7.2% in the previous decade to 1.6% and 1.3% in the coming decade, respectively. Developments in international biofuel policy will largely determine future biofuel performance. On the one hand, blending mandates, such those recently enacted in Argentina, Brazil, Colombia and Mexico, and programmes such as Brazil’s RENOVABIO initiative, will stimulate the market for biofuels. On the other hand, the policy debate that has started in Europe on “food-based” biofuels as a sustainable energy source, which has countries such as Norway considering the removal of the 20% ethanol blend achieved in 2017, could negatively impact biofuels market development (Renewable Energy Policy Network for the 21st century (REN21), 2018[27]). This policy debate could reach Latin American countries at some point, especially those that are net cereal and oilseed importers.

While demand growth for Latin American agricultural and food products is expected to slow, countries with more diversified trade partners or who can better respond to export opportunities in countries where food demand will continue to be dynamic (Sub-Saharan Africa, India, the People’s Republic of China – hereafter “China”) will be less affected. Furthermore, possible appreciation of China’s yuan and India’s rupee could boost the demand for Latin American agricultural exports. The baseline Aglink-Cosimo model macroeconomic projections assume an 11.2% depreciation of the yuan and a 22.7% depreciation of the rupee by 2028.

Production

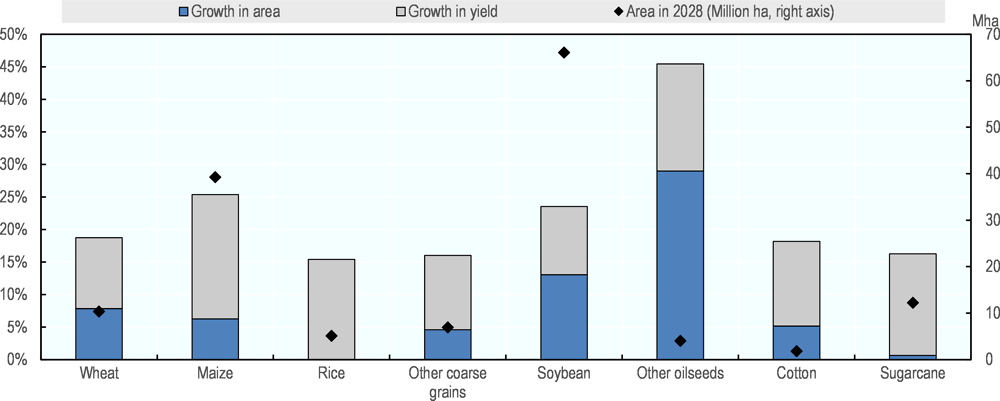

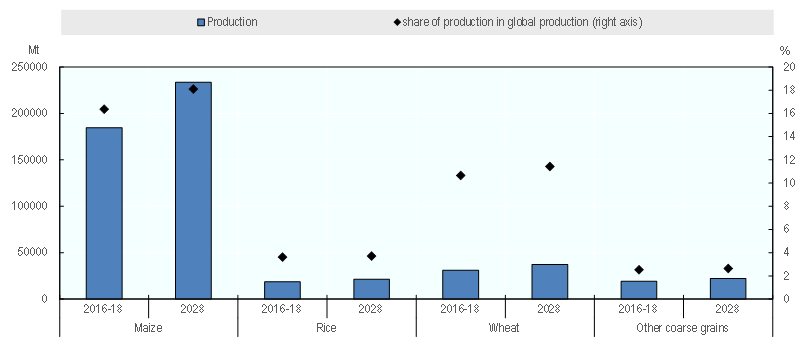

Cereals

Argentina and Brazil are the major cereal producers in the region. In 2016-18, these two countries accounted for around half of total LAC coarse grain and rice production, 75.1% of total maize production, and 77.8% of wheat production. Maize is the key staple in Mexican diets, but over the past two decades, Mexico’s share of total LAC maize production dropped almost 10 percentage points to a current 15.2%. A similar situation was observed regarding Mexico’s coarse grain (mainly sorghum) production, where the share in total LAC production fell by 11.7 percentage points from 42.9% to 31.2%. Though highly concentrated, wheat production shares have remained fairly constant over the past two decades.

Cereal production growth is expected to slow in the coming decade, with expected annual growth rates around half those observed in the past two decades for the major cereal producing countries. By 2028, the LAC region is expected to produce 233.5 Mt of maize (18% of world total), 22.1 Mt of coarse grains (3% of world total), 21.4 Mt of rice (4% of world total) and 37.3 Mt of wheat (11% of world total).

Oilseeds and vegetable oil

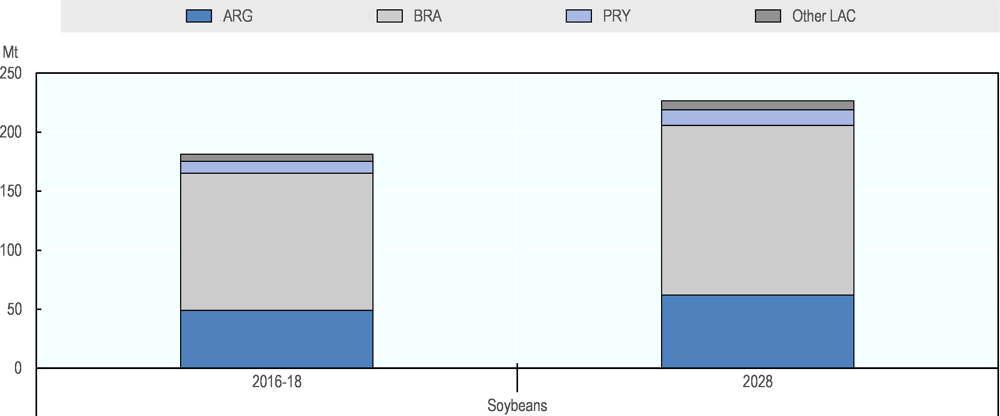

Soybean production has been particularly dynamic in South America, especially in Argentina, Brazil and Paraguay where yield improvement on the basis of technological innovation has been accompanied by land expansion. These countries brought into soybean cultivation an additional 12.7, 22.0 and 2.6 Mha, respectively, from 1995-97 to 2015-2017. From 1995-97 to 2016-18, soybean production increased by 300% in Argentina, Brazil, and Paraguay, combined. Most of this rapid expansion was due to additional harvested area which grew by 5.1% p.a. compared to a 1.3% p.a. grows in yields. These three countries currently account for 96.6% of total soybean production in the region.

Soybean production will continue to grow over the next decade, and further land use expansion for soybeans is projected at the expense of pasture, although a third of the increase in harvested area will come from double cropping. But the annual production growth rate for the region as a whole is expected to decline from 6.9% in the previous two decades to 2.8% for the coming decade. In the past two decades, growth in vegetable oil output has been relatively modest (137%) in the region as a whole but dynamic in Central America and the Caribbean (370%) due to rapidly expanding palm oil area. Vegetable oil output is slightly less concentrated in the LAC region: Argentina and Brazil account for shares of 34% each (most of it soybeans), Mexico and Colombia account for 7.2% and 7.0% respectively, while Central America and the Caribbean account for 7.5%. Vegetable oil production is expected to increase 26.8% by 2028.

Pulses

Pulses, mainly beans, are an important part of the diet in several LAC countries. Pulse production in the LAC region has grown modestly overall (30%) over the past two decades, but been relatively more dynamic in Central America and the Caribbean (162.6% growth from 1995-97 to 2016-18), underpinned by government programmes that were implemented in response to the 2007-8 world food crisis. Central American and Caribbean countries thus increased their share in LAC’s total pulse production by 10 percentage points, going from 9.2% to 18.6%, over the past two decades. Brazil and Mexico account for 41.2% and 24.8%, respectively, of total pulse production. Over the next decade, production trends similar to those observed in the past are expected, with an estimated production average growth rate of 1.3% p.a. for the LAC region as a whole.

Cotton

Cotton production doubled in the region over the past two decades. Brazil leads cotton production in LAC, with 78.4% of total production in 2016-18, followed by Mexico, which managed to increase its share from 5.8% in 2000-02 to 11% in 2016-18, and Argentina, with a total production share of 8.8%. Brazil is the world´s fifth largest cotton producer with around 6% of global production; its cotton exports represent around 10% of the global total. In the coming decade, LAC cotton production is projected to grow 0.9% per year, underpinned by growing demand for the fibre and the recent favourable relative prices of cotton with respect to competing crops such as wheat, soybeans, rice, maize and sugarcane. This growth, however, will be 3.5 percentage points lower than that in the previous two decades. Brazil’s export share in total world exports is projected to reach 14.7% by 2028.

Sugar

As in other developing countries, per capita sugar consumption will continue to grow in LAC countries. Because of socio-economic changes, increased demand for processed food will stimulate sugar production and thus contribute to the expected 2.6% average annual growth over the coming decade. Brazil will continue to be LAC’s main sugar producer, with an expected 62.4% share in total production by 2028, followed by Central American and Caribbean countries (13.6% of total), and Mexico (9.5% of total). But, after 15 consecutive years as the world’s main sugar producer, Brazil will be overtaken by India in 2019. As Brazil diverts more sugarcane toward ethanol production, Brazil’s share in world exports is expected to fall from 38.7% in 2016-2018 to 37.6% in 2028.

Roots and tubers

Root and tuber production in the LAC region grew relatively slowly (13.8% over the past two decades), compared to other agricultural products. Brazil is the main root and tuber producer in the region, but the area harvested to those products declined by 15.6% over the past two decades as Brazil’s share of the region’s root and tuber production declined from 56.9% to 46.0%. In contrast, Central American and Caribbean countries and Peru increased their production share by 5 percentage points, accounting for 10.3% and 11.4% of total, respectively, in 2016-18. Root and tuber production is expected to grow at an average of 1.4% per year over the coming decade.

Coffee

Brazil is the world’s leading coffee producer and exporter, while Colombia, Honduras, Peru and Mexico are also among the top ten coffee producers. Five LA countries are top-ten coffee exporters. Whereas coffee harvested area has remained relatively unchanged in Brazil over the past two decades, in Colombia and Mexico it has declined by 6.0% and 9.8%, respectively. In contrast, Honduras and Peru have more than doubled coffee harvested area. These production changes in the region have repositioned countries in export markets. Brazil increased its export market share from 23% to 29% over the past two decades while Colombia lost 8 percentage points, going from 17% to 9%. Mexico accounted for 5% of world coffee exports two decades ago, but now has lost its net exporter status. Guatemala remains among the major top coffee exporters with 3% market share (2 percentage points less than two decades ago); Costa Rica is no longer a major exporter, while Honduras and Peru have export market shares of 4% and 3%, respectively. Latin American countries will continue to play an important role in world coffee markets, despite the rising presence of Asian suppliers. The region’s favourable production potential is underpinned by growing consumption in emerging markets such as China, the Russian Federation and Korea, and in current exporting countries such as India, Indonesia and Viet Nam. However, in order to maintain market share, LA coffee producers will have to deal with changing climate conditions which will make some regions unsuitable for coffee production and facilitate the spread of pest and diseases, such as the Coffee Leaf Rust (Sänger, 2018[28]).

Fruits and vegetables

Underpinned by Free Trade Agreements, LAC production and exports of fruits and vegetables have grown considerably with most bound for the United States and Canada. Mexico has traditionally been the main fruit and vegetable supplier to its northern neighbour, but Central American countries and Chile, taking advantage of their FTAs with the United States, have also played an increasingly important role in the US winter fruit and vegetable import market. In 2017, Mexico, Peru, Guatemala and Costa Rica accounted for 75.4% of US total fresh vegetable imports. In the case of fresh fruits, nine LA countries accounted for 92.3% of total US imports, with Mexico, Chile, Guatemala and Costa Rica the main suppliers. Over the past two decades, harvested area of fruits and vegetables in Mexico increased 26.2%, reaching 1.9 Mha in 2015-17; this compares with increases of 42.2% in Chile and 45.8% in Central America. The region’s traditional fruit and vegetable production and exports (Mexican tomatoes and avocados, Chilean grapes and peaches, Central American bananas and pineapples, for example) have risen considerably and have expanded to include, for example, Chilean cherries and cranberries; Central American chillies and peppers, and eggplant; and Mexican blueberries and raspberries. Thanks to favourable climate conditions, and reflecting the labour-intensive nature of production, LAC countries may continue to enjoy a comparative advantage in fruit and vegetable production in the future which could be further strengthened by improving storage technology, infrastructure and production practices.

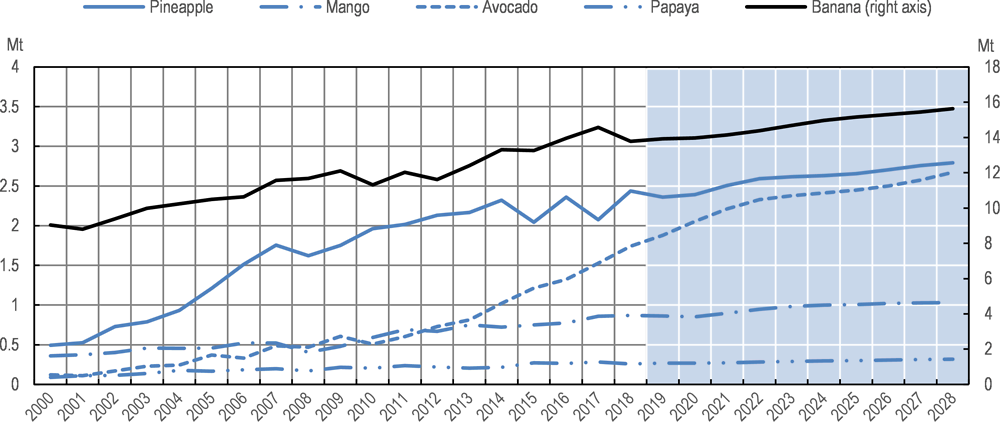

Bananas and tropical fruits1 constitute increasingly important commodities to both food security and rural sector growth of Latin America and the Caribbean (LAC). Predominantly cultivated within the tropical zones, these fruits first and foremost provide ready sources of vital calories and nutrients to the growing consumption needs of the region. Beyond domestic markets, international trade in bananas and tropical fruits has been gaining in importance as a source of export earnings for many producing countries in LAC. Rapidly growing demand in burgeoning import markets has bolstered high export prices for the majority of tropical fruits, making this group an attractive choice in export diversification away from lower-valued agricultural products.

Abundantly endowed with tropical land that features highly favourable agro-climatic conditions for the cultivation of tropical products, LAC ranks as the second leading production zone of bananas and tropical fruits globally, behind Asia. Between 2016 and 2018, LAC accounted for approximately 25% of total global production on average, which translates into roughly 54 Mt. In terms of individual fruits, bananas constitute the most important type for the region, displaying an annual production volume of approximately 30 Mt. At a per capita consumption of 55 kg of bananas and tropical fruits per annum, LAC also ranks as one of the major consumers of these fruits globally.

The importance of LAC to world fruit supply is further evident in the magnitude of the region’s trade volumes of unprocessed, fresh or dried bananas and tropical fruits. Aided by the region’s proximity to the United States of America, one of the largest importers of fruits globally, LAC has firmly established itself as the world’s primary supplier of both bananas and tropical fruits in recent decades, accounting for approximately 80% of global shipments of bananas, pineapples, papayas and avocados, and for approximately 50% of global mango exports on average.

On account of briskly expanding global demand, the pace of growth in exports of bananas and tropical fruits from the region shows to have accelerated ahead of production over the past decade. Building on a large and longstanding indigenous sector – with many tropical fruits being native to the region – national and multinational enterprises have invested heavily to capitalize on rising export prospects. While the commercialisation of banana and pineapple is well established, opportunities for substantial expansion have recently arisen for the other tropical fruits, which have been subject to rapidly growing consumer interest.

Total shipments of all five fruit commodities combined are estimated to have reached approximately 20 Mt on average over the three year period from 2016 to 2018. Assessing net trade of bananas and tropical fruits by region, LAC firmly ranks as the principal supplier to developed markets. Approximately 86% of EU pineapple imports are sourced from Costa Rica, and some 70% of EU banana imports from Ecuador, Colombia and Costa Rica combined. Virtually all banana and avocado imports to the United States originate in LAC, with Guatemala and Mexico the key suppliers respectively.

Although tropical fruits play a comparatively small role in overall agricultural trade in volume terms, their high average export unit value of well above USD 1 000 per tonne places them as the most valuable fruit group in absolute terms, behind bananas. Estimates point to a total export value of around USD 15.5 billion for bananas and tropical fruits from LAC combined in 2016-18, of which bananas and avocados accounted for some USD 6 billion and USD 3.5 billion, respectively.2 In some of the key producing countries, export earnings from bananas and tropical fruits weigh significantly in agricultural GDP. For example, Costa Rica’s exports of tropical fruits account for approximately one-third of its entire agricultural export earnings.

Beyond contributing to export earnings, trade in tropical fruits generates substantial income to smallholder producers in the region, contingent on fair and inclusive trade conditions. An estimated 80% of avocado cultivation in Mexico is carried out by smallholder farmers who are endowed with land of 5 ha or less. In many producing zones of the LAC region, tropical fruits furthermore continue to be cultivated mainly at the subsistence rather than commercial level, thereby contributing vitally to food security.

Outlook3

Underpinned by global population growth, improvements in per capita incomes in many consuming regions and associated shifts in diets, banana and tropical fruit production in Latin America and the Caribbean is projected to grow by 1.4% p.a. in the next decade. Total combined production is expected to rise by 9 Mt to reach 63 Mt by 2028, with bananas accounting for 50% of total supply. Encouraged by growing demand, incentives for higher production of tropical fruits are anticipated to be driven by strong profit margins and trend growth in crop yields as the sectors become more commercialized. Within the region, the largest suppliers of bananas and tropical fruits are Brazil, Colombia, Costa Rica, Ecuador, Guatemala and Mexico.

Preference changes towards higher consumption of tropical fruits in developed regions, particularly in the case of avocado, should meanwhile stimulate a further expansion in trade. Overall, banana and tropical fruit exports from LAC are projected to grow at 1.7% p.a. between 2019 and 2028, to reach 23 Mt by 2028. By and large, LAC will continue to be the main source of global supplies in bananas and tropical fruits, with its share in global trade projected to remain close to 80% by 2028. However, with regard to overall import volumes, the share by developed countries is projected to decline slightly over the medium term as imports by China are expected to rise more quickly, on the back of per capita income growth and related changing consumer tastes towards more premium tropical fruits, in particular avocados.

Expansion in banana and tropical fruit production will be largely demand driven. With the exception of bananas, where demand shows to be moving toward saturation in many countries, per capita demand is growing most in countries where it has started from a low base. Besides population growth, the principal determinant of fruit demand growth will be shifting consumer preferences on account of higher per capita incomes, both in the region and in key import markets. A higher awareness of the nutritional benefits of tropical fruits, particularly in the case of avocados and mangoes, which are oftentimes labelled as nutritional super fruits, will be central to this. In higher income countries, a growing preference for tropical fruits will be supported not only by a more widespread availability of these fruits but also by changing perceptions of the health implications of consuming refined sugar, with fruits, including tropical fruits, increasingly seen and promoted as a healthier alternative.

The projections affirm the view that bananas and tropical fruits will be among the fastest growing sectors in agriculture, and as such deserve attention from policymakers looking for sources of economic growth, nutrition and poverty alleviation in rural sectors. This will be particularly true for countries in LAC, which are supplying a large part of the global excess demand for these commodities. However, the threat of climate change and associated erratic and extreme weather events looms heavily over the sector, given that many production zones in the LAC region, particularly those located in the Caribbean, have acute vulnerability to the phenomenon. Detrimental environmental repercussions arising from issues such as land clearing, deforestation and irrigation as well as perils from pests and diseases, inter alia, add further stress to production and trade, threatening not only food security in the region but also the commercial viability of the sector. Trade tensions, phytosanitary restrictions, volatile freight costs and mounting price pressure in import markets additionally complicate a sustainable development of the sector in Latin America and the Caribbean.

← 1. Tropical fruits included in this analysis are pineapples, mangoes, avocados and papayas.

← 2. As indicated by reported export values from the region.

← 3. The projections are dependent on critically important assumptions concerning the growth of key driving factors such as incomes, population, and input costs, as well as the specific conditions surrounding tropical fruit production in the rural sector; these include opportunity costs for land, which are affected in turn by the prices of other agricultural commodities, rural activities and ownership structures. The agricultural conditions that are also likely to affect the sector were drawn from the OECD-FAO Agricultural Outlook 2019-28.

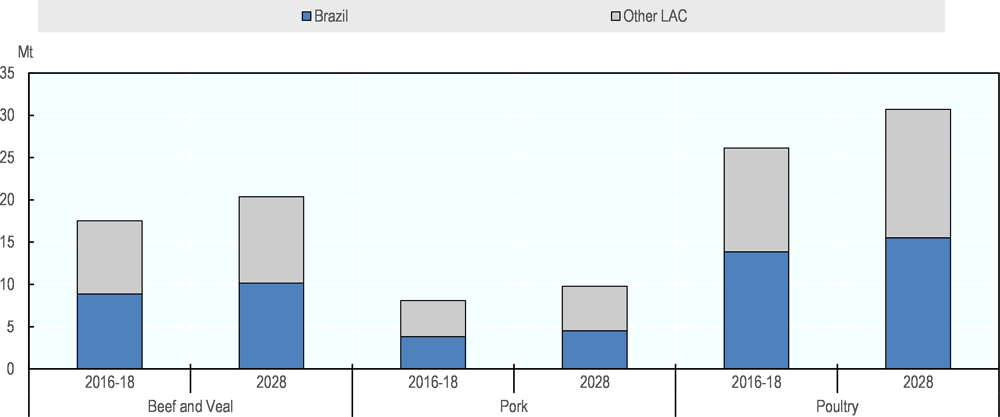

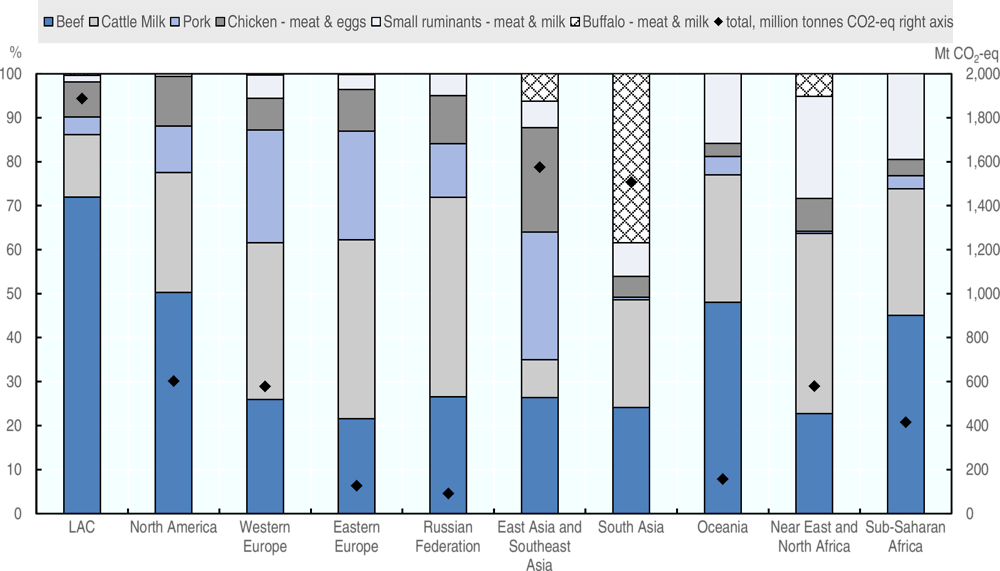

Livestock

Livestock production has also grown substantially in LAC: during the past two decades, beef production increased by 33%, pork by 111% and poultry by 302%. This growth has been driven by an expansion of the aviculture, swine and cattle ranching sectors and by technological innovation in all livestock sectors.

Average annual growth in beef and veal production will slow slightly in the coming decade to 1.2% compared to 1.4% in the previous two decades. This slowdown is less severe than that of domestic demand, as a rising share of LAC production will be destined for export. As in other regions, per capita demand growth is expected to slow as income rise. Brazil will continue to be the main beef producer in the region; with a projected two additional Mt, the country will account for 56.9% of total LAC beef production by 2028. Pork and poultry production will continue to be more dynamic than beef, growing at 2.2% per year in the coming decade. Brazil’s share in total pork and poultry production is expected to remain at around 50% in the coming decade.

Dairy

Fresh dairy production is expected to pick up in the next decade, growing at 1.4% per year, 0.6 percentage points higher than in the previous two decades as a result of strong domestic demand. Fresh dairy production growth will mainly originate in Southern Cone countries and in Brazil, but remain flat in the rest of the region. Butter output will also remain flat in the coming decade while cheese production will grow at 1.2% per year. Whole milk powder production in MERCOSUR countries is expected to display the same drive it has shown in the past by growing at around 3% per year over the coming decade. The region as a whole, however, will continue to be a net importer of dairy products, except for whole milk powder.

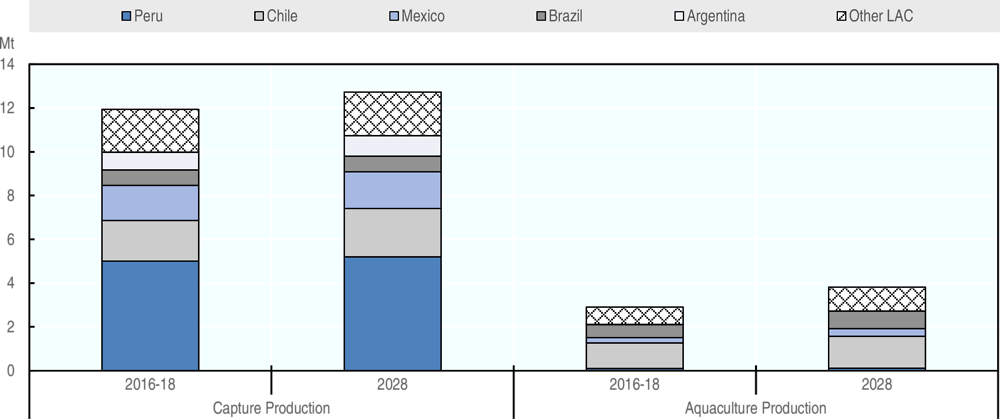

Fisheries and aquaculture

Fisheries and aquaculture play an important role in the region as they provide an important source of proteins, livelihood for millions of households, and of earning from exports. Peru, Chile, Mexico, Brazil, and Argentina are the main fish producers in the region. While world marine catch has remained fairly constant over the past decade, that of Latin American and the Caribbean declined substantially, although there was some recovery in 2017 and 2018 ((FAO), 2019[29]). This decreasing trend is particularly evident in Peru and Chile, the major fish producers in Latin America, and is due primarily to the implementation of stricter management plans, as well as reflecting climate variability (including El Niño). In some cases, increasing overexploitation is also a cause (Food and Agriculture Organization of the UN (FAO) Barange.M et al. (Eds.), 2018B[30]). El Niño has been responsible for the fall in anchoveta catches by Peru and Chile; in the case of Peru, anchoveta account for more than 75% of total marine catch. Aquaculture, in contrast to marine catch production, has been growing steadily over the past decade both worldwide and in the region. However, Latin America and the Caribbean account for only 3.4% of world aquaculture production (Chile alone accounts for 38.3% of aquaculture production in the region) (Food and Agriculture Organization of the UN (FAO), 2018[31]).

Fish production is projected to grow by 12% over the coming decade in LAC. Paraguay, Chile, and Brazil will witness the highest fish production growth (30%, 21% and 17%, respectively). Peru is projected to experience the lowest growth rate, at +4.0%, over the next decade. Aquaculture, which today accounts for less than 20% of total fish production in the region (compared to 46.8% globally), will become increasingly important in total fish production due to its high potential for expansion as compared to marine capture. Overall, the region will continue to be a net exporters of fishery and aquaculture products, with Peru and Chile among the major world exporters of fishmeal and fish oil and Chile of salmon.

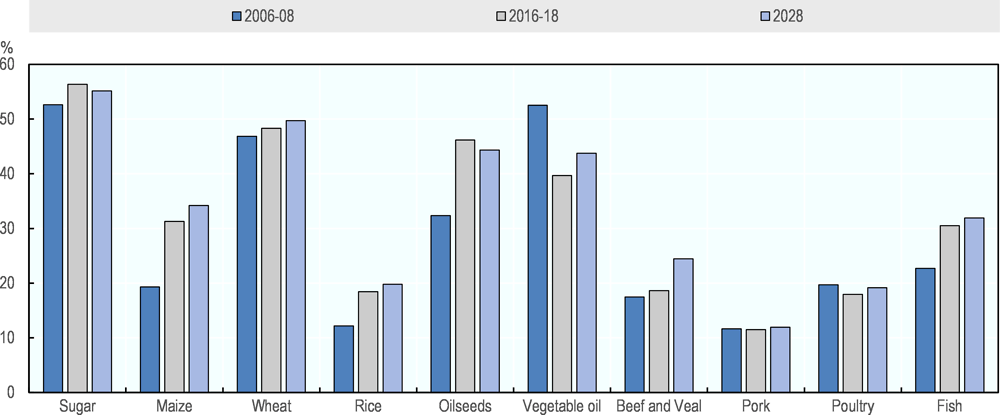

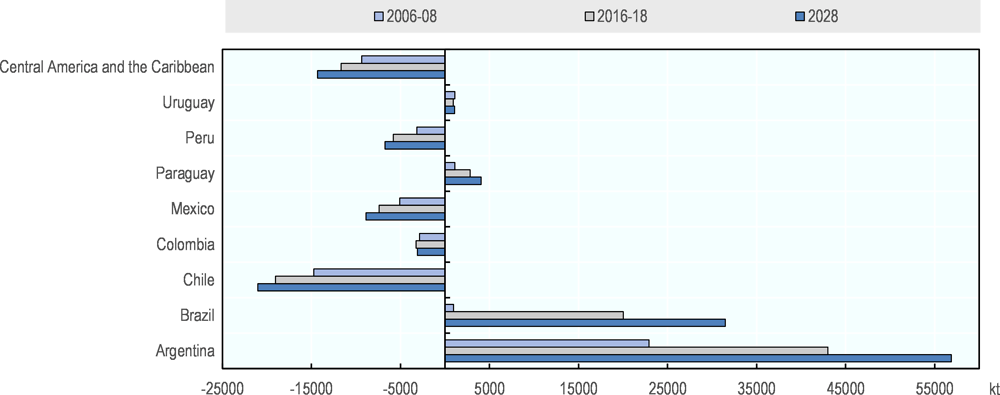

Trade

Despite the slowdown of growth in global agricultural trade volumes over the past two decades, the Latin America and Caribbean region has steadily increased agricultural exports, outperforming other regions of the world. LAC’s agricultural trade surplus has increased from USD 12 billion in 1996-98 to USD 54 billion in 2016-18; this compares with the agricultural trade deficits recorded by Sub-Saharan Africa (USD 17.3 billion in 2016-18) and South East Asia (USD 71.6 billion in 2016-18). Brazil and Argentina have kept leading roles as world exporters of soybeans, maize, vegetable oils, sugar, poultry and beef. The share of exports in domestic production is particularly high for oilseeds (46%), wheat (48%) and sugar (56%) (Figure 2.14). Brazil has positioned itself as the world’s third largest exporter of agricultural products, with exports reaching USD 79.3 billion in 2017. Argentina ranked tenth, with an agricultural export value of USD 35 billion. Although with much lower export values compared to Argentina or Brazil, Chile’s agricultural exports have grown three-fold in the past two decades, with products such as berries, apples, peaches, plums, poultry and salmon increasingly reaching diverse world markets. Central American and Mexican fruit (including avocado), vegetable, and coffee exports have also shown high dynamism. In 2016 Mexico, after almost four decades of continuous agri-food trade deficits (except during the Mexican crisis of 1985-87), became a net exporter of agri-food products and the main supplier of agri-food products to the United States outplacing Canada and the European Union. Over the next decade, LAC sugar exports are expected to grow by 6.9%, wheat and rice exports will increase by 23.1% and 24.0%, respectively, and vegetable oil exports will grow by 40.5%.

The LAC region has also emerged as a major world supplier of animal products. Livestock production and meat exports have grown quite rapidly: LAC beef exports increased from 1.2 Mt to 3.2 Mt from 1995-97 to 2016-18, poultry exports increased 639% over the same period, reaching 4.7 Mt in 2016-18, and pigmeat exports, which in the mid-1990s were modest, increased almost twelve-fold, reaching close to 1 Mt in 2016-18. Brazil dominates LAC meat exports, with a 45% share of total LAC exports of beef, 65% of pork, and 91.6% of poultry. Argentina, Chile and Mexico follow Brazil, albeit at a distance, as the main LAC meat exporters. In the next decade, meat export growth will slow from double-digit annual growth rates in the cases of pork and poultry to average annual growth rates of around 2% for beef and poultry and 2.5% for pork. Thus, by year-end 2028, LAC beef exports are expected to grow 57%, pork exports 33% and those of poultry 27%.

In recent years, LAC fruit and vegetable exports have shown great dynamism, reaching almost USD 30 billion in 2015-17. Central American fruit and vegetable exports trebled from 2002-04 to 2015-17; during the same period, Mexico’s exports of such produce grew 244.5%, South American exports rose by 281.2%, and those of the Caribbean increased 15-fold.

Some countries in the region play important roles as world importers of specific agricultural commodities, such as Mexico (soybeans, dairy, maize, pork and poultry) and Brazil (wheat). In fact, with the exception of MERCOSUR countries, all other LAC countries are net importers of cereals, often sourced from within LAC. Agricultural and food imports in these countries will continue to grow in the next decade. LAC wheat imports, for instance, are projected to increase by 3.5 Mt by 2028, and maize imports will increase by almost 7 Mt, reaching 40.3 Mt in 2028. Mexico is projected to account for 41% of total maize imports in the region, Colombia for 15% and Peru for 10%. In the case of wheat, Brazil will lead LAC’s imports, with 6.6 Mt in 2028, accounting for 25.1% of total LAC wheat imports, followed by Mexico (20.2%) and Peru (9.8%).

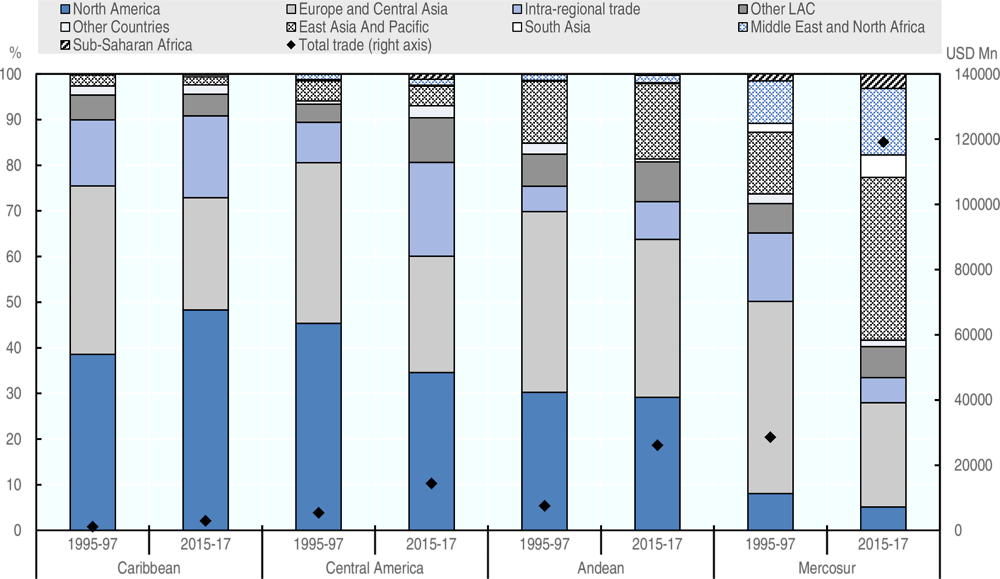

Important trade flow changes have occurred over the past two decades in the LAC region. Asian countries, especially China, have become increasingly important destination markets for LAC agricultural exports. Andean agricultural and fishery exports to East Asia and the Pacific increased four-fold in the past two decades, while MERCOSUR’s exports to that region increased eleven-fold. During 2015-17, East Asia and the Pacific became the main export destination of MERCOSUR´s agricultural and fishery exports with a 35.7% total export share, outplacing Europe and Central Asia. In fact, the relatively modest growth of LAC agricultural and fishery exports to Europe and Central Asia compared to that to other regions of the world made Europe and Central Asia lose share in the export destination from all LAC sub-regions.

North America (United States and Canada) has been a growing agricultural and fishery export market for all LAC sub-regions in absolute terms and, because of its proximity and preferential access, it has been particularly important for the Caribbean in relative terms, increasing its share of total Caribbean exports by 10 percentage points at the expense of Europe and Central Asia. Mexico’s agricultural and fishery exports to North America increased 352.3% over the past two decades, but this region’s share of Mexico’s total exports has remained fairly stable at around 80%.

Intra-regional trade has also become more relevant. Andean countries increased agricultural and fishery trade among themselves by 2.7 percentage points over the past two decades; Caribbean countries did so by 3.5 percentage points, and Central American countries increased intra-regional trade by 11.6 percentage points. In fact, by 2015-17, 20.5% of total Central American agricultural and fishery exports was bound to countries in the same sub-region, and 9.8% of total exports was bound to other LAC countries (Figure 2.16).

No trend has been observed so far in terms of the share of processed agricultural exports with respect to total agricultural exports. Latin America continues to specialise in the exporting of bulk products. Unlike Southeast Asian countries, which show strong agro-food global value chain linkages both within the region and with other regions, LA countries show low integration in global agro-food value chains due, in part, to the high prevalence of non-tariff measures. In fact, Latin America (together with North American countries) ranks last in terms of average total global value chain participation, with Asia in the lead, followed by Europe, Africa and the Middle East. Trade and investment policies, agricultural capabilities (e.g. education, agricultural R&D), and structural characteristics are found to be influencing factors on global value chain participation (Greenville, Kawasaki and Beaujeu, 2017[33]).

The dynamism in agricultural trade observed in the region is explained, in part, by the active participation of LAC countries in Free Trade Agreements (FTAs). In addition to the sub-regional economic integration efforts made by Caribbean, Andean, MERCOSUR, and Central American Countries, which have faced several challenges, LAC countries have established over 70 intra- and extra-regional FTAs. Chile and Mexico, for instance, hold FTAs with most of the countries in the region, the United States and Canada, the European Union, and several Asian countries, including (in the case of Chile) China and Japan.

Population growth elsewhere in the world will also drive the demand for LAC agricultural and food products, especially in China, whose populations is expected to reach 1 441 by 2028. Global food demand growth, including that for China, is projected to slow in the coming decade.

In the next decade, favourable export prospects are expected for LAC agricultural exports, but export growth will slow down, and the risk of protectionist policies could make the slowdown in agricultural trade more severe. Furthermore, the recently signed (March, 2018) Comprehensive and Progressive Agreement for Trans Pacific Partnership (CPTPP) could change the level and direction of agricultural trade flows for LAC countries. The CPTPP Agreement, which entered into force on 30 December 2018, opens up export opportunities to countries such as Japan, Viet Nam, Malaysia, Australia, and New Zealand. The only LAC countries participating in the CPTPP are Mexico, Peru and Chile. If the United States joins the Agreement, having withdrawn from the earlier TPP, that could reduce the Latin American market share in Asian countries in products such as soybeans, meat, sugar, dairy products and vegetables. A similar diversion could occur if the European Union and the United States were to lower their agricultural and food import tariffs under an eventual Transatlantic Trade and Investment Partnership. LAC countries will need to identify trade policies and strategies in order to take advantage of their agricultural comparative advantage under the dynamic FTA environment.

2.4. Strategic challenges and policy options

LAC governments have pursued a number of agricultural policy objectives according to their own visions and changing socioeconomic and political contexts. Objectives have included improved productivity and competitiveness, food security, environmental protection, access of smallholder farmers to markets and increased foreign exchange earnings. Governments have used an array of policy instruments to address their policy objectives. This section examines the policy mix across the LAC region, and the extent to which it supports sustainable productivity growth, as well as greater inclusiveness.

Policy responses

The extent to which farmers depend on government support varies widely across the region. For most countries, the %PSE (i.e. the Producer Support Estimate expressed as a percentage of gross farm receipts) is lower than the OECD average of 18%, exceptions being Panama, Peru, the Dominican Republic and El Salvador. Producer support is low (with a %PSE less than 5%) in several countries, including Guatemala, Uruguay, Paraguay, Chile and Brazil. Argentina stands out an exception in the region, with a negative %PSE, implying that the country’s farmers are on balanced taxed by government policies. The low average rate of producer support reflects the competitiveness of agriculture in most countries, and associated net-export position.

Across the LAC region, these is a tendency to rely on market support and other potentially trade distorting instruments (such as input subsidies) as opposed to direct payments to farmers that are decoupled from production. Mexico is an exception, with a similar rate of support to the United States and more than half that support provided via less distorting direct payments to farmers. Direct payments also dominate in Paraguay, Chile and Brazil, although the overall rate of support to producers is low in these countries.

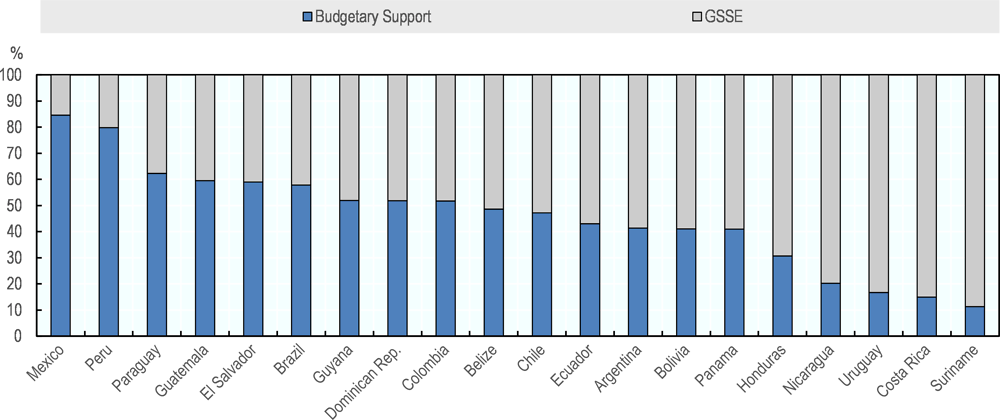

Reflecting the importance of price interventions in the policy mix, budgetary support to agriculture tends to be relatively low. Moreover, of total budgetary payments to the sector, between 40% and 60% is paid to producers (i.e. is included in the PSE), with the remainder comprising payments to the sector as a whole (the General Services Support Estimate, or GSSE). The latter category includes important/ areas of investment, including agricultural R&D, extension services, technical assistance, innovation systems and agricultural infrastructure. Spending in this latter category is just 15% in Mexico, but 85% in Costa Rica. In general, the LAC region would appear to be under-spending on public goods with the potential to accelerate agricultural development.

The allocation of investments to agriculture requires proper diagnostics and evaluation. Evaluation is probably the link in the policy cycle that suffers the most. Sometimes multi-million dollar programmes are inadequately evaluated or not evaluated at all. Thus, policy makers often do not know if their policies and programmes are achieving their expected results, or are unable to interpret the results they are observing. Making policy evaluation an institutional process becomes thus essential, especially when governments need to deal with tight budgets. Instilling an “evaluation culture” is a long-term process, but some countries such as Mexico and Chile have already made important progress in this regard with potential lessons for other countries in the region.

Raising productivity and the necessary enabling policy environment

For Latin America to remain competitive in world markets, agricultural productivity needs to grow further, in a sustainable manner. This will require an appropriate channelling of resources into agricultural research, complementary investments in the sector, well-functioning credit and insurance markets, and improved coordination across policies.

Agricultural research

Agricultural research spending in Latin American countries has grown steadily over the past decades. The region was able to achieve the minimum UN target of investment at least 1% of agricultural GDP in agricultural R&D. However, there are considerable differences across countries: while Brazil, Uruguay, Argentina and Chile spend well above 1% of their agricultural GDP on agricultural R&D, Nicaragua, Peru, Venezuela, Dominican Republic, Paraguay, Ecuador, Honduras and Guatemala spend 0.4% or less (Stads et al., 2016[7]).

Increasing investment in agricultural R&D is a prerequisite but may still be insufficient to increase productivity while facing future climate and food security challenges. It may be necessary to look at how current available resources for agricultural R&D are being invested. Are LA countries investing in the “right” type of research? To what extent do climate smart agriculture (CSA) technologies comprise part of their agricultural research agenda? Is combatting antimicrobial resistance (AMR) sufficiently high in the crop and livestock research agenda? In order to tackle AMR, research is needed on the economic costs of transitioning to lower levels of antibiotic use in farming, the potential of alternative products, and ways of improving the hygiene of animal husbandry (O’Neill, 2016[34]).

Three additional challenges also need to be confronted. First, countries will need to identify succession strategies for their ageing scientists, as 40% of the region’s agricultural researches were in their 50s and 60s in 2012/13 (Stads et al., 2016[7]). Second, effective ways of coordinating and strengthening synergies will need to be identified in order to overcome the complex institutional arrangements in which agricultural research is conducted (federal government agencies, local government institutions, universities, private sector, farmers organisations, NGOs). Third, financing mechanisms need to be assured. Regarding the latter, competitive government funds, and taxes on production/exports, already used in some LA countries, are financing options that governments could explore building on country experiences in Latin America and elsewhere.

Investment in agriculture

Productivity growth and competitiveness in world markets will demand, in addition to increased and better targeted investment in agricultural research, continued investments in infrastructure, extension services, and smallholder targeted initiatives, while ensuring an enabling environment to foster private investment.

Public investment in infrastructure is not only subject to economic cycles but also depend on priorities set by governments. In general terms, investment in infrastructure tends to be a low priority in total public expenditure. In the case of the agricultural sector, over the past two decades investment in infrastructure (including maintenance) increased modestly in Chile (7.2% annual average growth), Colombia (8.5%) and Mexico (7.0%), and substantially in Argentina (14.0%) and Costa Rica (10.9%). In Brazil, agriculture related infrastructure investment has been quite erratic and suffered greatly the effects of the country’s recent economic crisis. When adding up the resources invested in infrastructure for all these six countries, there is a significant net decline between 1997-99 and 2015-2017. This is explained by the large sums Brazil invested in the 1990s, which represented 82.6% of total investment in infrastructure in 1997-99 in these six countries. In 2015-17, Brazil’s share had fallen to 11.9%.

Poor irrigation, rural road, logistics and port facility infrastructure represent, in several cases, key bottlenecks to agricultural development. Poor roads, for instance, reduce the competitiveness of the lowest-cost producing region in Brazil, Mato Grosso, and make logistic costs account for 32% of total soybean export costs. Soybean transport costs in Brazil are estimated to be seven times larger than those in the United States (Arias et al., 2017[2]). Nevertheless, Brazil increased exports of soybeans much faster than the United States over the past decade.

The World Economic Forum’s Competitiveness Report captures competitiveness issues related to infrastructure. According to the 2017-18 issue, out of a total of 137 countries, most Latin American countries fell below the mean score for infrastructure, except for Chile and Uruguay, which ranked 41 and 45, respectively. Brazil for instance ranked 73, Argentina, 81, Colombia, 87, and Honduras, 104.

The public sector is far from being the largest investment source in the agricultural sector. It is farmers that invest the most, exceeding government investment in a proportion of 4 to 1 (FAO, 2012). However, public investment has a catalytic role, not only through infrastructure development, but also when supporting smallholder family farmer initiatives. The low adoption rate of CSA practices mentioned above, for instance, may be explained by weak extension services directed to smallholder farmers and lack of appropriate approaches for this type of farmers such as Farmers Field Schools.

Governments have also the responsibility of assuring an enabling environment to encourage private investment in agriculture. Infrastructure certainly plays a key role, but so do property rights, contract enforcement, improving regulation and taxation, well-functioning labour markets, and financial market institutions (Food and Agriculture Organization of the UN (FAO), 2012[35]). A policy framework for investment in agriculture was developed by OECD (2014[36]), which could serve as an important reference for countries in Latin America.

Agricultural credit and insurance

Competitive credit and insurance schemes need to be available for the various types of farmers for the private sector to invest in agriculture. Latin American rural financial markets have undergone important structural changes as governments have greatly reduced their participation as direct providers of credit services or through the elimination of interest rate subsidies and commercial bank operating cost subsidies. Smallholders’ access to financial services has suffered particularly because of their perceived higher risk, lack of insurance schemes, relatively higher operating costs for banks (client dispersion, poor communication systems, inadequate legal systems, etc.), and lack of information regarding the productive sector in which they operate. However, both long-term and short-term credit and insurance schemes become essential if Latin American agricultural productivity is to grow in a sustainable way.