Chapter 24. Ukraine

Support to agriculture

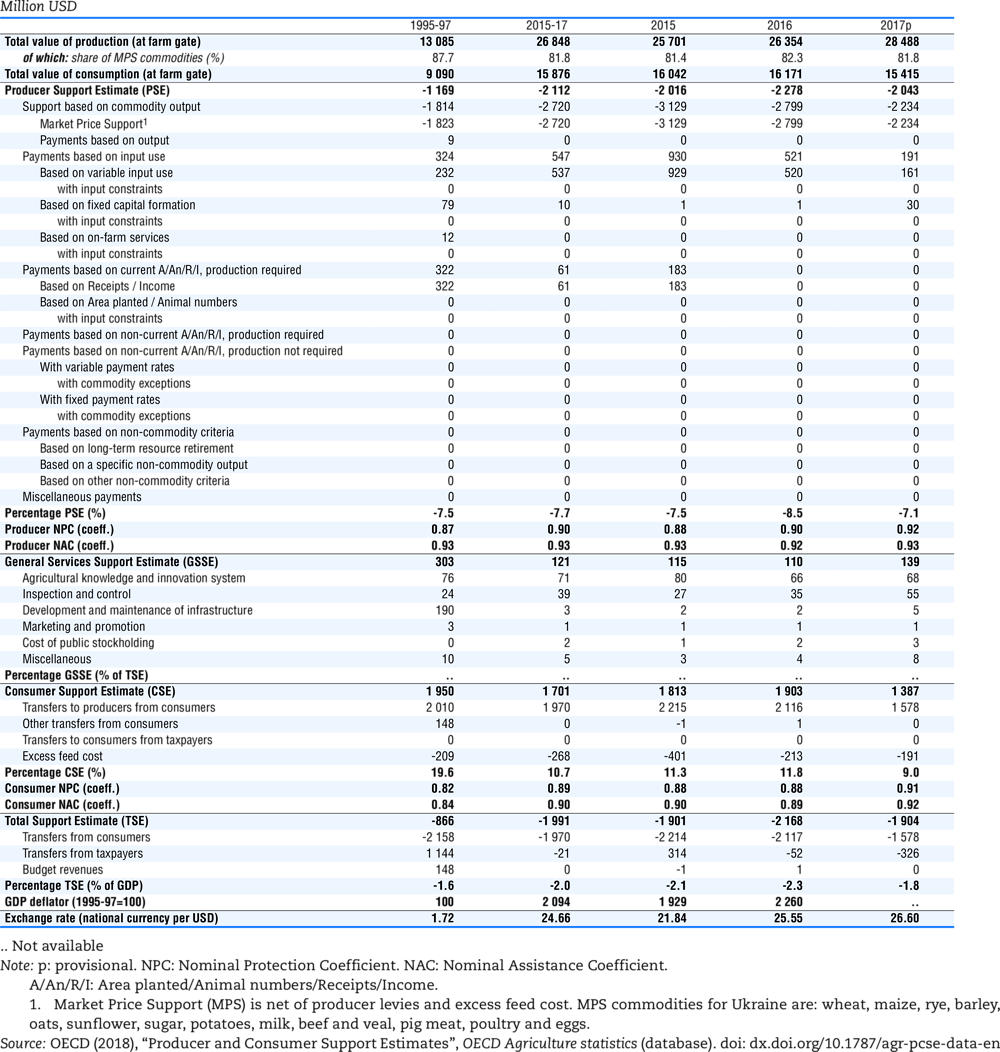

Support to agriculture has been quite variable over the past three decades, largely reflecting changes in market price support (MPS). Since 2013, support to farmers has been negative as budgetary payments in the form of tax benefits and input support, and price protection for imported commodities, only partly offset the implicit taxation through negative MPS on exported ones. On average, producer prices are below world price levels, but price protection differs significantly across commodities, with prices for most meat commodities, and until recently for sugar, above reference price levels.

Since 2012, Ukraine has significantly cut its expenditures on general services both in absolute terms and relative to the size of the sector; general services expenditures are now equivalent to 1.1% of agricultural value added, less than a quarter of the level during the mid-1990s. Support to general services is mainly used for agricultural schools and for inspection and control services.

Main policy changes

Most of Ukraine’s domestic policies have remained unchanged in 2017, but a major shift was undertaken by abolishing the VAT accumulation system. This system had allowed agricultural producers to accumulate a share of VAT from product sales for the purpose of purchasing agricultural inputs. In 2017, it was temporarily replaced by a “development subsidy” proportional to the VAT for a subset of agricultural commodities, which also could be used for the purchase of agricultural production inputs. However, the amount of support provided through the development subsidy was much smaller than that provided through the previous system.

Specific support was also provided to the livestock and fruits, wine and berry sectors. These subsidies were given for breeding animals, planting material, machinery, equipment and storage capacity, but also as debt repayments under different programmes of previous years.

The budget of the new State Service for Food Safety and Consumer Protection, established and operational since 2016, was increased by more than half, but funding for the country’s veterinary and phytosanitary services remains low compared to expenditures before 2015.

In the context of the European Union-Ukraine Deep and Comprehensive Free Trade Area, additional EU autonomous trade preferences for Ukraine came into effect in 2017. For a duration of up to three years, these preferences increase duty-free import quotas for agricultural products from Ukraine to the European Union. The Canada-Ukraine Free Trade Agreement came into force in 2017 and provides for an eventual elimination of import tariffs on the vast majority of bilateral trade, including agro-food trade.

Assessment and recommendations

-

Producer prices in most of Ukraine’s export oriented crop sectors, as well as for milk, are maintained substantially below world price levels. While formal export restrictions and levies are no longer applied, Memoranda of Understandings between the Government and main associations of grain exporters on maximum export volumes continue to reduce domestic producers’ opportunities to participate in international markets. Such restrictions are trade distorting and reduce the profitability and international competitiveness of the country’s most efficient agricultural sectors. While the EU-Ukraine DCFTA should reduce the resulting negative market price support to some degree, Ukraine should take additional steps to facilitate exports, including continued investments into the logistics and transportation system in line with growing export volumes.

-

Abolishing the VAT accumulation system, which indirectly supported the purchase of production inputs, should increase the efficiency in the sector. While its temporary replacement by the “development subsidy” is little more efficient than its predecessor as it is equally linked to VAT receipts and also used by farmers for various production inputs, it is limited in the sectoral coverage and smaller in size. Ensuring well-functioning input markets, including for agricultural credits, remains key for improving farmers’ access to agricultural inputs.

-

Land market rigidities continue to be in place with the extension of the moratorium on the sale of agricultural land. Overcoming these rigidities will be important for improving the economic viability and efficiency of the sector.

-

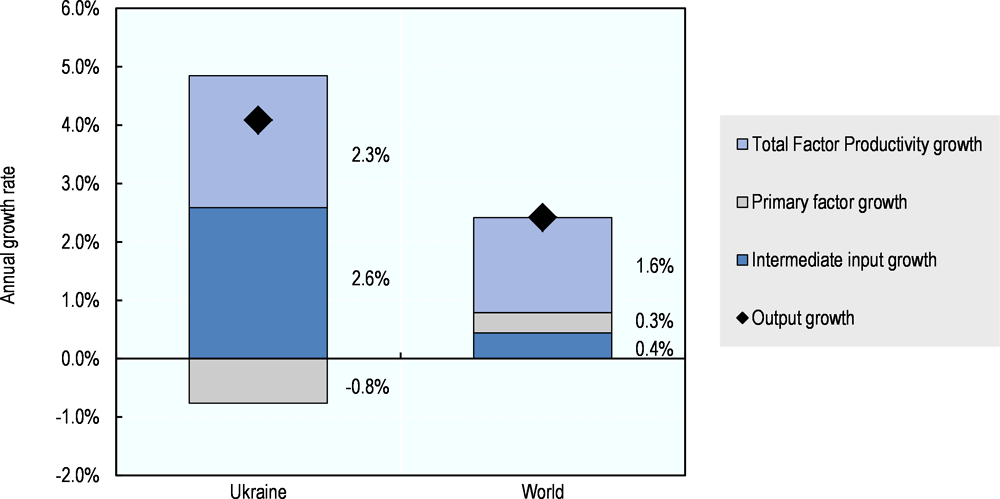

Over the last decade, Ukrainian agriculture has benefited from an impressive growth in total productivity, but capital stocks continue to deteriorate, likely caused by economic and political uncertainties. A return to macroeconomic and political stability will be critically important for maintaining and developing a productive agricultural sector.

-

Signatory to the 2015 Paris Agreement on Climate Change, Ukraine’s Nationally-Determined Contribution (NDC) commits the country to GHG emissions in 2030 not exceeding 60% of its 1990 levels, including from agriculture and other land use sectors. No specific net-emission target has yet been set for the agricultural sector. With agriculture responsible for 12% of national GHG emissions, specific targets and related policy action will be important for achieving the overall target.

-

Financial constraints following the economic depression of 2014-15 continue to limit Ukraine’s expenditures for general services, which are among the lowest across the set of countries covered by this report. Sanitary and phytosanitary inspection and control is a key service to the export-oriented sector, and progress towards compliance with EU SPS requirements remains a priority.

-

Ukraine’s exposure to high weather variability is likely to be exacerbated by climate change. The sector therefore also requires both a well-functioning and sufficiently funded knowledge and innovation system, including an extension service providing location-specific information and advice, and an effective risk management system which should involve all relevant stakeholders.

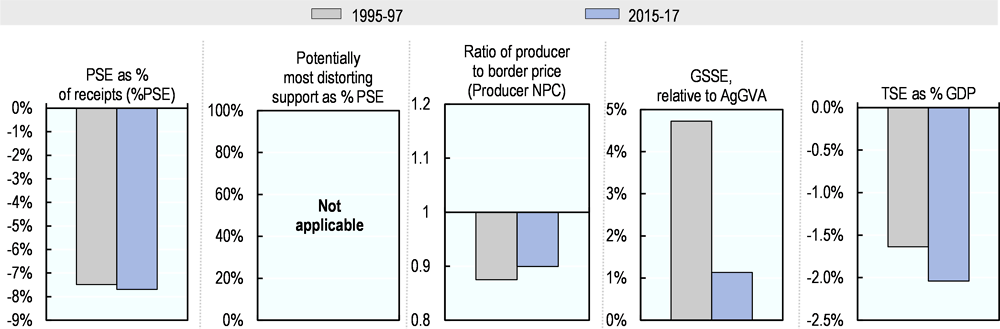

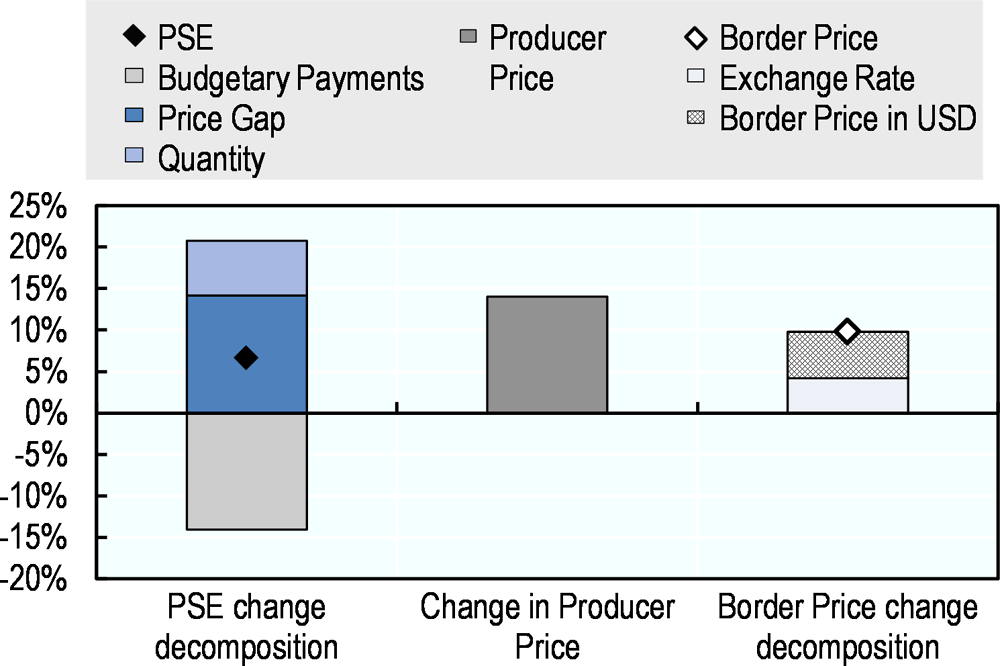

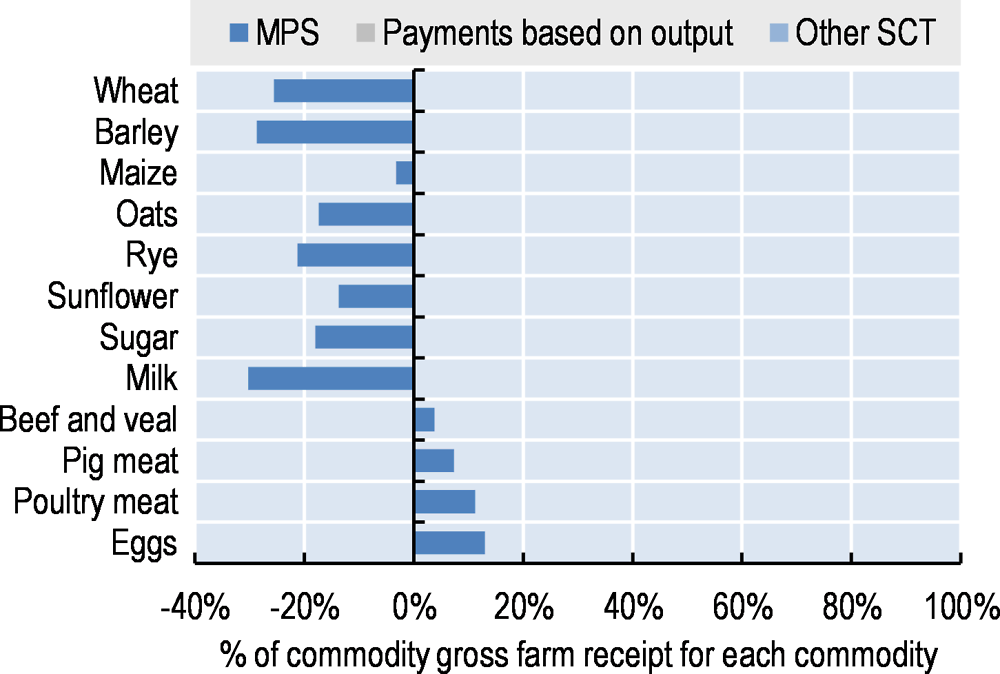

Support to farmers (%PSE) has been continuously negative for five years at levels similar to those observed on average during the 1995-97 period. This implicit taxation of the sector is caused by negative market price support for most exported products. As a consequence, the average level of producer prices is almost 10% below that of the reference prices: the Nominal Rate of Protection (NRP) was 0.9 for the 2015-17 average (Figure 24.1). The level of support has increased (i.e. has become less negative) in 2017 despite lower budgetary support: on average, prices received by farmers have come closer to the reference prices due to both higher world market prices and the continued devaluation of the Hryvnya, even though producer prices have increased as well (Figure 24.2). Single Commodity Transfers mirror the MPS across commodities, with grains, sunflower seed, sugar and milk being implicitly taxed while meat and eggs show SCTs of between 4% and 13% of their commodity gross farm receipts (Figure 24.3). The expenditures for general services (GSSE) have significantly fallen and represented a mere 1.1% of agriculture value added, well below the values of most other countries represented in this report and much lower than two decades earlier. Consequently, total support to agriculture is dominated by the negative PSE and was worth -2% of GDP during 2015-17.

Contextual information

Ukraine is classified as an upper middle income country. Thanks to its large area of fertile arable land, agriculture continues to play a major role in the economy and counts for 14% of the country’s GDP, 15% of its employment and close to 40% of its total exports. Crops represent some three-quarters of agricultural output, a share that has increased significantly from the mid-1990s.

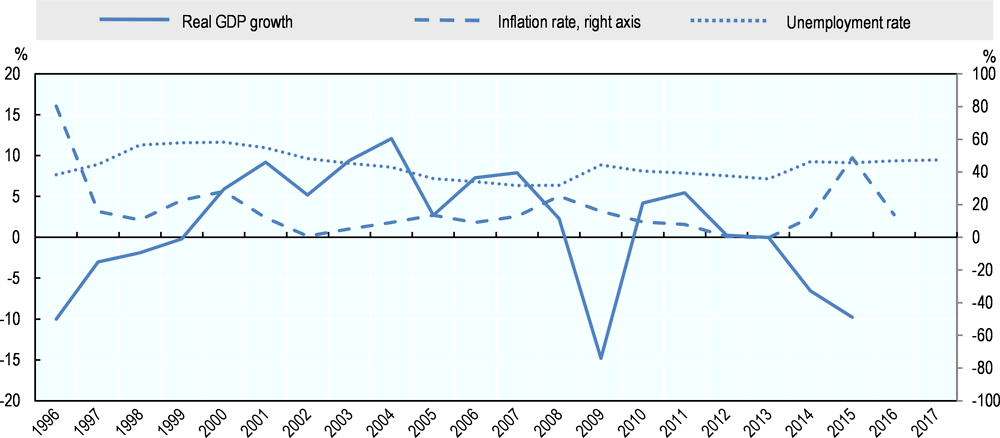

Real GDP in Ukraine has fallen by 16% between 2013 and 2015 while inflation rates have risen to almost 50%, due to adverse political circumstances. The economy has recovered since, and grown in both 2016 and 2017. Still, unemployment has continued to rise in these years.

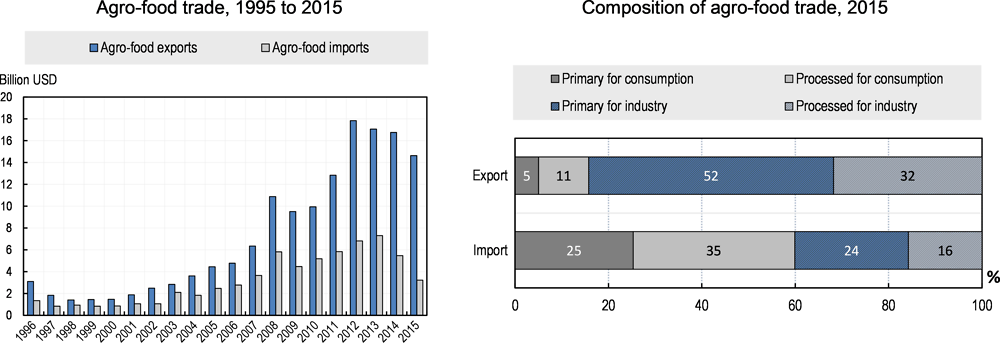

Ukraine is one of the world’s leading exporters of grains and vegetable oils and has seen rapid growth in its agro-food exports between the late 1990s and 2012. Most of the country’s agro-food exports are intermediary, mostly primary products for further processing. Imports are more mixed, with primary and processed products for final consumption representing 60% of imports.

Agricultural output growth, as well as its growth in total factor productivity (TFP), significantly outpaced global averages. Production grew by an average 4% p.a. in the decade ending 2014, with more than half of that coming from TFP, while the use of primary factors, notably of capital, shrank – a reduction that could threaten continued high productivity growth in the future.

Consistent with the importance of agriculture in the economy, agriculture’s shares in the country’s energy use and GHG emissions are comparatively high; while the economic importance of agriculture has declined, both its shares in energy use and emissions have increased over the last two decades.

Description of policy developments

Main policy instruments

Ukraine’s agricultural policy measures are formulated in a number of major laws and decisions. The law “On State Support of Agriculture in Ukraine” defines priorities and measures of agricultural policy. The “Concept of Rural Development in Ukraine”, approved in 2015, provides priorities for the development of rural areas in Ukraine until 2025. Ukraine’s policies are also influenced by the Association Agreement with the European Union, ratified by Ukraine in 2014. Finally, the financial scope of agricultural policies is defined in the annual law “On State Budget of Ukraine”.

The “Comprehensive Strategy of Implementing Legislation on Sanitary and Phytosanitary Measures” was approved in 2016 and provides for a process of harmonization of Ukraine’s SPS legislation with EU requirements, and stipulates the objective to recreate in Ukraine a system of food quality control similar to the European one by 2019.

Ukraine uses a range of market price support instruments. These include tariff protection, non-tariff trade regulation, and various forms of domestic price measures. The state agency Agrarian Fund implements domestic price interventions through the operation of a state intervention fund. Initially dealing only with grain, the Agrarian Fund has become progressively involved in other activities, such as sugar commodity interventions, state purchases and sales of a broad range of agricultural and food products, forward-contracting, flour processing and wholesaling.

For purchases by the Agrarian Fund, official minimum and maximum intervention prices are set and cover commodities that are “objects of state regulation”. The exact list of such products and the periods during which these administered prices will be in effect are defined by specific government decrees. Minimum prices do not play a role of guaranteed prices but are regarded as a floor-price reference for private market operators. Minimum intervention prices should not exceed domestic market price levels to comply with the Ukraine’s WTO domestic support commitment.

The sugar quota regime was developed as another element of price support policy. Reflecting domestic beet production, a national marketing quota for sugar produced from sugar beet and sold on the domestic market is set annually, together with the minimum in-quota prices for sugar beet and sugar. This quota, allocated to individual sugar plants, does not account for sugar processed from imported raw cane sugar, which is subject to a Tariff Rate Quota (TRQ).

Since 1999, and until 1 January 2017, significant support to farms was provided through unpaid VAT by agricultural producers, which was accumulated on special accounts and used for input purchases (see domestic policy developments below). In contrast, budget-based forms of input subsidies were gradually reduced in recent years due to the country’s budgetary deficits. In 2017, the abolishment of the VAT accumulation and the payment of a Development Subsidy reversed both trends.

Agricultural producers are eligible for a Single Tax (the Fixed Agricultural Tax before 2015), which is set as a percentage of agricultural land value, established on 1 July 1995 and adjusted with the general price index. Introduced in 1998, the Single Tax originally replaced twelve taxes for which agricultural enterprises were liable as business entities. The preferences incorporated in this tax have been narrowing since then. At present, the Single Tax replaces only three taxes – profit tax, land tax (for land used in agricultural production), and special water use fee – with agricultural producers liable to all other taxes due on agricultural businesses.

On 27 June 2014, the European Union and Ukraine signed the Deep and Comprehensive Free Trade Area (DCFTA) as part of their Association Agreement. It became provisionally applied from 1 January 2016 and formally entered into force on 1 September 2017. The liberalisation of trade between the European Union and Ukraine is to be implemented within a transition period of seven to ten years. The European Union opens zero-tariff rate quotas for Ukraine’s principal agro-food products, such as grain, meat and milk products, and sugar, and grants free access for the others. Ukraine reduced import duties for a number of goods imported from the European Union. About 40% of agriculture-related import duties were reduced to zero immediately after the Agreement entered into force, and around a half of import duties will be eliminated during the transition period. However, about 10% of tariff lines covering selected products in such product categories as dairy and eggs, sugar, miscellaneous edible products, animal oils and fats, feeding stuff for animals will preserve non-zero tariffs. Since 1 January 2016, Ukraine applies three TRQs with zero in-quota tariffs for EU exports of pig meat, poultry meat and poultry meat preparations, and sugar, respectively. Ukraine has secured the right to use safeguard measures and additional trading conditions (e.g. to apply entry prices for a certain number of tariff lines). The parties committed to apply no export subsidies for mutually traded agricultural goods.

The DCFTA incorporates fundamental WTO rules on non-tariff barriers, such as prohibition of import and export restrictions, disciplines on state trading etc. The main barrier for trade integration remains Ukraine’s ability to comply with EU food safety, veterinary and phytosanitary requirements. Thus, the DCFTA contains provisions for technical regulations, standards and conformity assessments to harmonise with those of the European Union, as well as for technical co-operation in the field of technical regulations, standards and related issues between Ukraine and the European Union.

Ukraine signed the Paris Agreement of the United Nations Framework Convention on Climate Change in April 2016, and ratified it in September 2016. Through its Nationally Determined Contribution, Ukraine committed to total emissions across sectors, including agriculture, not exceeding 60% of those in 1990 (equivalent to 140% of those in 2012). In December 2016, the Cabinet of Ministers of Ukraine (CMU) adopted the National Concept of State Policy in the Field of Climate Change Up To 2030. A draft agriculture part of the Action Plan for the implementation of this Concept is currently under review with the CMU. Ukraine is currently working towards its Strategy for Low Carbon Development. The country still needs to create a national system for monitoring, reporting and verification of greenhouse gases with a view to develop and implement a national carbon market.

Public extension to farmers for information and advice specific to local conditions on the risks related to climate change are pending the adoption of the National Action Plan for the implementation of the above-mentioned Concept and a corresponding allocation of state budget funds.

In addition to an action plan for implementing this Concept, the Ministry of Agrarian Policy and Food is developing measures to improve environmental practices in line with the obligations under the Association Agreement with the European Union.

Domestic policy developments in 2017-18

After substantial reductions in the scope and the extent of budget-based government support to agriculture in recent years due to the growing debt burden of the public sector, direct support to Ukrainian agriculture from the government’s budget increased in 2017. Based on the Law of Ukraine No. 1800 “On the State Budget of Ukraine for 2017” of 21 December 2016, the total budget allocation for all budget lines of the Ministry of Agrarian Policy and Food of Ukraine was UAH 9.04 billion (USD 340 million), more than quadrupling the allocation in the previous year.

In contrast to the preceding years, no public grain intervention purchases were carried out in 2016/17 and 2017/18. However, in 2017 the Agrarian Fund sold 67 400 tonnes of sugar stored as part of the state intervention fund.

The domestic sugar quota continued to be reduced, from 1.72 million tonnes in 2015/16 and 1.67 million tonnes in 2016/17 to 1.64 million tonnes in 2017/18. At the same time, the (indicative) minimum sugar price was changed from UAH 6 455 per tonne in 2015/16 and UAH 9 079 per tonne in 2016/17 to UAH 9 173 per tonne in 2017/18 (USD 295, USD 355 and USD 345 per tonne, respectively).

The programme “Partial compensation of interest on commercial bank credit”, re-activated in 2015, continued to be applied. Funds allocated to interest rate concessions on commercial bank credit to agricultural producers had declined from UAH 291 million (USD 13.3 million) in 2015 to UAH 280 million (USD 11.0 million) in 2016; for 2017, UAH 295 million (USD 11.1 million) were allocated from the general state budget. Priority was to be given to small agricultural enterprises (with annual revenues not exceeding UAH 10 million or USD 376 000) and enterprises engaged in cattle husbandry and breeding.

No support was provided for the purchases of variable inputs such as fertilisers, other chemicals, or electricity. However, in 2016 and 2017, UAH 30 million and UAH 11.7 million were allocated to partially (up to 50%) compensate the costs of purchasing high breeding animals, respectively (USD 1.2 million and USD 0.44 million). In addition, UAH 158 million (USD 5.9 million) were spent in 2017 on debt repayment under the “State support of animal husbandry” programme of previous years.

UAH 134 million (USD 5.0 million) were allocated in 2017 to partially compensate the costs of purchasing agricultural machinery and equipment.

The purchasing of production inputs, including planting material, machinery, equipment, and storage, for orchards, vineyards and berry fields was supported with UAH 299 million (USD 11.2 million) in 2017. In addition, UAH 183 million (USD 6.9 million) were spent on debt repayment under horticultural programmes of previous years.

With effect from 1 January 2017, Ukraine abolished its special VAT regime for agricultural producers. The so-called VAT accumulation mechanism allowed agricultural producers to accumulate the VAT due on their sales of primary and processed products on special accounts, and to use the funds for purchasing inputs. In spite of earlier intentions to end it, the mechanism has remained in effect in 2016; however, the shares of VAT that can be accumulated were reduced to 15% for grains, oil seeds and fibre crops, 80% for milk and beef meat, and 50% for all other agricultural products. As a consequence, VAT amounts accumulated under the mechanism have declined from UAH 20 billion (USD 916 million) in 2015 to UAH 13 billion (USD 509 million) in 2016. For 2017, the state budget included a specific “development subsidy” which effectively replaced the VAT accumulation mechanism to the tune of UAH 4 billion (USD 150 million). This subsidy was distributed proportionally to the amount of value-added tax paid based on the sale of certain agricultural products, including animal products, grapes, fruits, berries, nuts, vegetables, tobacco and sugar beet. Recipients used the subsidy for purchases of different production inputs. The “development subsidy” is planned to be discontinued in 2018.

In May 2017, the Verkhovna Rada of Ukraine (the Ukrainian Parliament) adopted the Law of Ukraine No. 2042 “On the state control for conformity with legislations on the safety and quality of food and feed, animal health and wellbeing”, which will be in force from April 2018. The Law regulates the general organisation and management of state control at the national and sub-national levels, the exercise of state control of certain production facilities, which aims at contributing to ensuring a high level of protection of human health and consumer interests.

The Law provides for reduction of physical inspections of these products imported into the customs territory of Ukraine if they meet the following requirements: (1) they originate from the country/capacity entered in the register of countries/capacities for that are allowed to import/transfer goods to the customs territory of Ukraine; (2) goods are accompanied by originals of the international certificate and other documents required by the Law. The Article 45 of the Law stipulates that laboratory test of samples taken during physical inspection of cargo are carried out in exceptional cases.

The Parliament of Ukraine has extended by another year, to 1 January 2019, the moratorium on the sale of agricultural land which was introduced in 2002. The lift of the moratorium is conditioned by the coming into force of a law on agricultural land markets. Development of a modern land cadaster has been viewed as a necessary condition to reform the agricultural land market.

In 2017, steps were undertaken by the Government of Ukraine towards simplicity and transparency of land services. These steps include a simplified land registration procedure; the provision of an electronic system to obtain extracts from the land cadaster; electronic requests for land parcel valuations; and open and public access to cadastral records, including for notaries. In March 2017, different agencies of the Government have jointly presented an updated State Land Cadaster which uses the Blockchain technology, in order to fight fraud and enhance transparency. The budget of the “land reform” programme was increased from UAH 44 million in 2016 to UAH 105 million in 2017 (USD 1.7 million and USD 3.9 million, respectively).

A draft of Law No 2845 On Feed and On Feed Safety and Hygiene was adopted after the first reading by the Parliament on 4 November 2017. It sets legal and organisational principles for production, circulation, labelling and presentation of feedstuff, and regulates the relations between executive authorities and feed market operators.

In 2017, the budget for the State Service for Food Safety and Consumer Protection was increased to UAH 1.45 billion in 2017, compared to UAH 0.9 billion in 2016 (USD 55 million and USD 35 million, respectively). Most of the additional funds were used for pest and disease inspection and control. Among others, improved inspection and control is expected to contribute to improving the exportability of Ukraine’s agro-food products. For instance, in 2017, a number of poultry and dairy plants and other enterprises of the Ukrainian food industry received permission from the EU veterinary services to ship agricultural products to the European Union.

Trade policy developments in 2017-18

During 2016/17, the Ministry of Agrarian Policy and Food and main associations of grain exporters agreed, by way of a non-binding Memorandum of Understanding, to exports of wheat and meslin not to exceed 16.5 million tonnes. This is similar to memoranda agreed for 2015/16 and for 2017/18, and quantities are subject to revisions during the respective marketing years (July-June). In contrast to 2015/16, no such agreements were signed on maize for the 2016/17 and 2017/18 seasons.

In response to a suspension by the Russian Federation of its free trade regime with Ukraine under the Agreement on Free Trade in the Commonwealth of Independent States (CIS) Area and the implementation of a ban on imports by the Russian Federation of agro-food products from Ukraine, Ukraine abolished zero-tariff import preferences for goods from the Russian Federation, effective until the end of 2018. Ukraine also maintains an import ban for agricultural goods from the Russian Federation.

Anti-dumping duties for chocolate and other cocoa-based food products produced in the Russian Federation were introduced for five years, effective from 20 June 2017.

As a result of further negotiations within the DCFTA, the EU autonomous trade preferences for Ukraine came into effect on 1 October 2017. These preferences increase the volume of zero-tariff import tariff rate quotas for agricultural products from Ukraine to the European Union and are applied for a duration of up to three years.

The Canada-Ukraine Free Trade Agreement (CUFTA), signed in 2016, came into force on 1 August 2017. As a consequence, Ukrainian import duties on agricultural goods are either eliminated immediately, phased out over seven years, or subject to reductions (to reach between 20% and 50% of their MFN rates). In addition, a duty-free tariff quota was established for frozen pork, certain pork offal and pork fat, set to reach 20 000 tonnes after the seven-year transition period. In turn, upon entry into force of the agreement, Canada has lifted its import duties for all fish and other marine products, and for most agricultural goods imported from Ukraine. Agricultural goods subject to Canada’s supply management system (i.e. dairy, poultry and eggs) are excluded from CUFTA.